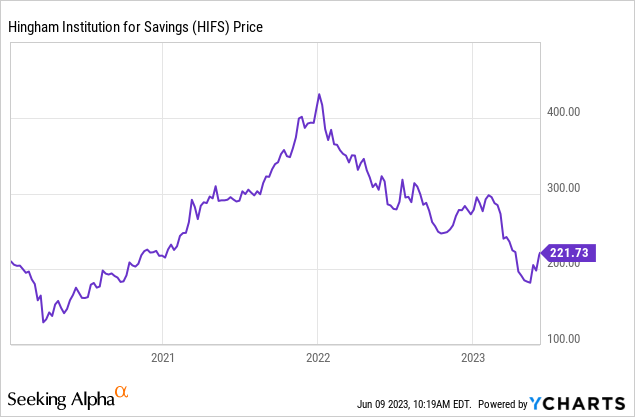

Boston-area regional bank Hingham Institution for Savings (NASDAQ:HIFS) has had an eventful few years. I started investing in the company in 2020 after shares tumbled following the onset of the pandemic. Shares went on to triple from that point, but have subsequently given back half of their value with the recent regional banking crisis:

With the large decline, and the particularly abrupt move earlier in 2023, it’s a good time to check in on the outlook for Hingham.

Why Shares Have Declined

Given the concerns around regional banks in general and Hingham in particular, let’s run through the negatives before getting to the potential upside.

The big overhang on Hingham shares is that it has a weak deposit base. Throughout the 2010s, the cost of bank deposits was essentially zero thanks to the Fed’s dovish monetary policy. As a result, Hingham did not invest heavily in gathering its own deposits. It was easier and cheaper to obtain funds from outside sources at a slight premium. After all, a cost of money at slightly over zero is still exceptionally cheap.

Hingham’s management team has long focused on playing into its strengths. The firm is good at keeping operating costs low and making a lot of safe loans at moderate yields. The bank’s strength is in its unmatched efficiency; Hingham has been the single most efficient multi-bank branch in the United States for several years recently.

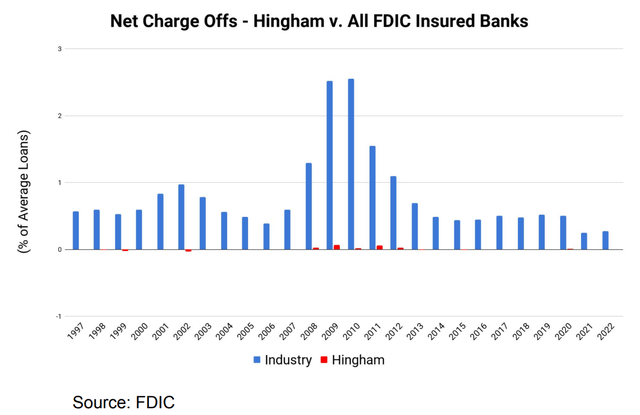

The other part of that is in avoiding ever writing bad loans. Hingham’s non-performing assets are at 0.01% currently. Even in the 2008 financial crisis, Hingham remained strongly profitable and had almost no loans that would turn into net charge-offs.

Hingham net charge-offs vs. industry (Corporate Presentation)

Hingham’s business is simple; make lots of good loans as efficiently as possible and try to avoid anything else where the bank doesn’t have as large of an operational advantage.

Unfortunately, deposits have suddenly become expensive. Instead of paying sub-1% for outside money, now Hingham is having to pay rates as high as 5% for some borrowed funds.

In aggregate, Hingham’s loan book is yielding 4.0%, whereas it is paying 2.4% on average for deposits and 4.4% for borrowed funds. Overall, Hingham’s net interest margin “NIM” plunged from 2.1% in Q4 of 2022 to 1.5% this quarter. By contrast, Hingham has run a median 3.2% NIM over the past decade. There’s no beating around the bush, this is a huge short-term decline in profitability. And given the additional rate hikes and unfavorable developments in the yield curve, we should expect Hingham’s NIM to further decline in Q2 and probably Q3 before things stabilize.

Unless the Fed immediately pivots to rate cuts, Hingham’s profitability is unlikely to start trending back up until 2024.

Some people are also worried about Hingham’s exposure to offices. However, I believe the bears do not appreciate what Hingham has lent against. Hingham’s “office” lending, as per the annual meeting, is primarily against small offices for individuals such as accountants and doctors. Anyone thinking of hulking office towers here has the wrong impression.

Why Hingham Isn’t Susceptible To The Bank Crisis

Hingham has a near-term issue with profitability, there’s no disputing that. However, bulls such as myself would say that isn’t particularly important as long as there are no concerns to the bank’s solvency.

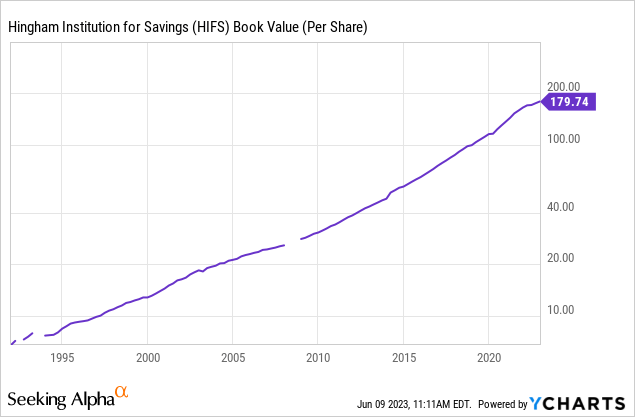

After all, Hingham has been one of the most tremendous performers in the regional bank space since the Gaughen family took over in the early 1990s.

Book value has gone up nearly 30-fold in three decades under their leadership. And in terms of stock performance, a $10,000 investment thirty years ago today would be worth more than $725,000 now. As long as Hingham’s superior efficient lending model keeps working, the compounding will return to normal as the yield curve moves out of inversion.

Sure, Hingham is currently paying too much for borrowed funds as opposed to its loan yields, which will temporarily depress earnings and book value growth. But as long as the loans keep performing, there’s no longer-term issue. Either loan yields go up as Hingham puts fresh capital to work or the cost of deposits will go back down.

And Hingham is taking aggressive strides on the deposit front. As per the Q1 earnings release:

“Retail and business deposits increased to $1.988 billion at March 31, 2023, representing 20% annualized growth year-to-date and 11% growth from March 31, 2022.”

There’s no deposit run here. Quite the contrary, Hingham is pulling in a huge chunk of new deposits. How has it pulled this off?

Recall that First Republic and Silicon Valley Bancorp went bust this year. Both banks were active in Hingham markets such as Boston and San Francisco.

Specifically, Silicon Valley had bought out Boston Private, a large relationship lending bank in the Boston area. With the failure of SVB, this put Boston Private’s banking customers and its employees on the market. As per the Hingham annual meeting, it was able to hire away employees from Boston Private and it is also gaining traction in getting clients and deposits from that institution as the landscape shifts.

More broadly, Hingham’s management spoke to how there are senior level commercial bankers now on the market that are open to taking a job at Hingham. This simply wouldn’t have happened prior to the current crisis, but with the changing landscape, Hingham is capable of attracting senior-level bankers — who in turn can bring a ton of deposits with them — that simply weren’t in play prior to this year’s problems in the industry.

All this to say that Hingham sees the current downturn not as an obstacle but rather as an opportunity. The firm clearly can’t rely on borrowed funds to fuel its loan book expansion anymore given the dramatic change in the macroeconomic landscape. But, because Hingham is prudent and has a sturdy balance sheet, it is in position to expand now, adding senior bankers and new clients at a time when the industry is in retrenchment. This should lead to Hingham being significantly more profitable once the yield curve works itself out.

Short Sellers Aggressively Bet Against Hingham

As you can see below, an amazing 9.37% of Hingham’s float has been sold short as of the latest available data:

Hingham chart (Seeking Alpha)

I find this to be a remarkable sum. That’s doubly true since the stock was down more than 50% from its peak when shares went under $200 recently. And second, volume on Hingham is tiny, often coming in at just a few thousand shares per day. Just from a tactical point of view, it seems quite dangerous to short into such a big hole on valuation and a short-term drop in earnings.

As Hingham’s management said in its recent annual meeting, there is no “silver bullet” that will fix the firm’s net interest margin in a quarter or two. The way forward is simply by doing what the bank has always done; keep making more attractive loans with sterling credit quality. Thanks to the disruption of other firms such as Boston Private, Hingham now has a golden opportunity to gain market share and expand its customer relationships. Ultimately, as long as a bank’s loans don’t go bad and it keeps costs at rock bottom, everything else tends to sort itself out sooner or later.

Perhaps short sellers can make the most of the current downturn in earnings. However, I’d be nervous to bet against this management team given its prudence, conservativism, strong track record, and pragmatic approach to dealing with the current interest rate landscape.

Hingham Stock’s Bottom Line

Hingham is turning into quite the fascinating stand-off. On the one side, short-term traders are rightly pointing to a huge drop in Hingham’s projected 2023 earnings. The company’s business model isn’t built to outperform in an inverted yield curve. There’s no denying that.

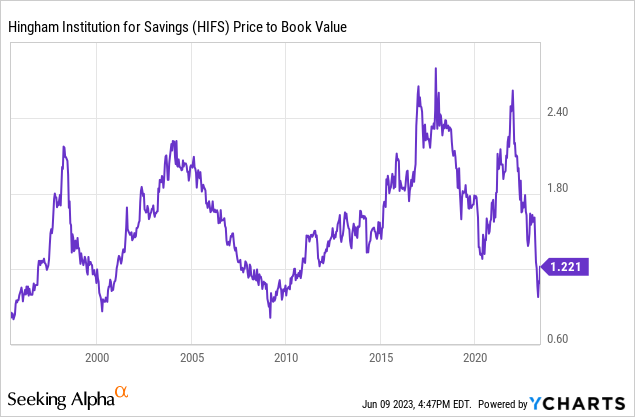

On the other hand, Hingham has a tiny float, a loyal shareholder base, and a great management team. Shares already fell to the bottom of their historical price-to-book range with the recent dip to $174 per share.

Historically, buying Hingham shares around book value has been a profitable move.

It’s not just that shares are cheap now, either. Don’t forget that Hingham has compounded said book value at a double-digit annualized rate for decades. And there’s no reason to expect anything different once the interest rate curve normalizes.

Hingham is not going to earn all that much money in 2023. Shares will trade at a seemingly high P/E ratio as a result. Will that cause a mass exodus out of the stock (beyond the 50% drop we’ve already seen)? I think not, given the firm’s tremendous track record and attractive valuation on a price-to-book value basis. But many bears apparently disagree judging by the elevated short interest in HIFS stock today.

And I’ll concede there’s a chance the naysayers will be right in the short-term. Fundamentally, I believe Hingham shares will be traded based off book value but if folks use P/E as the metric, the stock could easily end up back below $200 again in 2023. That said, I have little doubt that both earnings and book value will be a lot higher in two or three years, and thus investors with a reasonable time horizon shouldn’t be nervous with their Hingham holdings.

Read the full article here