With the aerospace industry looking to recover from supply chain challenges, it is interesting to assess which companies might be worthy of investment. Big aerospace companies might enjoy a bit too much interest from investors, making their current price point less attractive while small aerospace companies might be underexposed leading to more rewarding investment opportunities. However, just putting your money in the smaller companies against a positive demand backdrop for commercial airplanes and defense products does not equate to certain profits as some smaller companies are carrying significant debt that will pressure the stock prices for years, as I recently discussed on Triumph Group (TGI). In this report, I will be discussing the prospects of Curtiss-Wright Corporation (NYSE:CW).

About Curtiss-Wright Corporation

Curtiss-Wright Corporation

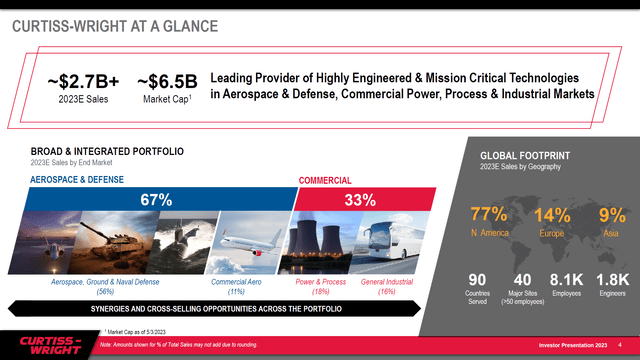

Curtiss-Wright Corporation is a global integrated business that provides engineered products, solutions, and services mainly to aerospace and defense markets, as well as critical technologies in commercial power, process, and industrial markets. The Company’s segments include: the Aerospace & Industrial segment, which is comprised of businesses that provide a diversified offering of engineered products and services supporting critical applications primarily across the commercial aerospace and general industrial markets; the Defense Electronics segment is comprised of businesses that primarily provide products to the defense markets and to a lesser extent the commercial aerospace market; and the Naval & Power segment is comprised of businesses that provide products to the naval defense market and to a lesser extent the power and process markets. Its product offerings include electronic throttle control devices and transmission shifters, turret aiming, and stabilization products, among others.

56% of its sales are derived from defense, while 11% is derived from commercial aerospace, bringing the share of aerospace & defense to 67%, with commercial industries providing the remaining 33% via 18% power & process sales and 16% general industrial sales. The distribution of the end-market sales provides an indication that Curtiss-Wright might be benefiting from commercial aerospace sales growth, but growth in defense sales is what really moves the needle for the company. So, this looks like a name better positioned to benefit from defense sales growth than commercial OEM growth.

Double-Digit Growth For Curtiss-Wright

Curtiss-Wright Corporation

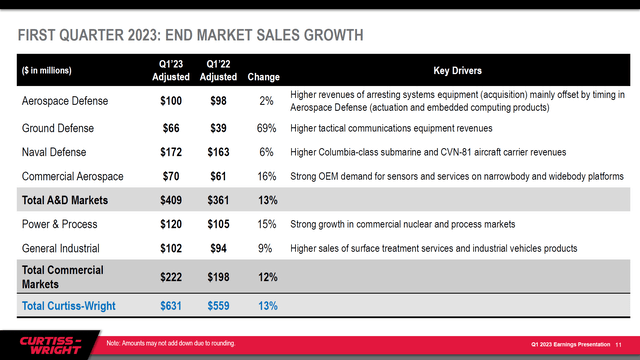

In the first quarter, Curtiss-Wright saw its sales increase by 13% with commercial markets and aerospace & defense showing similar growth rates. Aerospace defense sales growth was the softest of all segments with 2% growth driven by a negative timing mix offset by integration of the arresting business that the company acquired from Safran SA (OTCPK:SAFRF). Ground defense sales grew by nearly 70% on higher communications hardware sales while Naval Defense sales grew by 6% on aircraft carrier and Columbia-class submarine sales. Commercial aerospace growth was driven by services and sensor demand from original equipment manufacturers.

In the Commercial Markets, the growth was driven by high demand in commercial nuclear markets and services for general industries. On 13% sales growth, the company achieved 15% operating income growth, which is strong and represented a 20 bps margin expansion. Its earnings per share grew 17%, while free cash flow grew 18% and order inflow grew 17%.

A Look At The 2023 Guidance For Curtiss-Wright

Curtiss-Wright Corporation

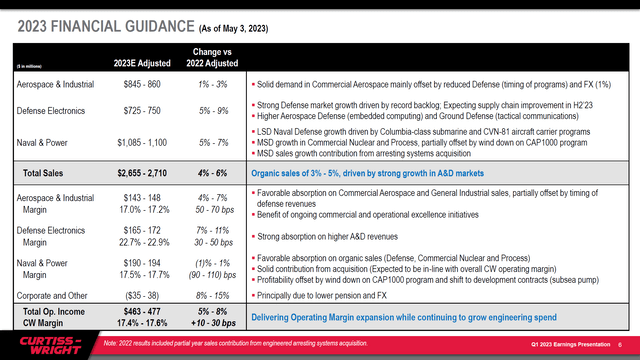

For the year, the company targeted 5% growth at the midpoint for sales and 4 to 6 percent growth in operating income, basically indicating that margin expansion is expected. Supply chain challenges should ease in H2 2023, which will drive Defense Electronics sales growth. Growth in commercial aerospace is partially offset by other defense programs, which might be somewhat surprising given that the overall defense budget environment is favorable. Naval defense sales continue with low-single-digit growth while nuclear and process sales will provide mid-single-digit growth.

Overall, the growth numbers look OK, perhaps somewhat soft given the strong results we saw in Q1 2023, but the company also said it maintained its guidance given the current macroeconomic outlook. This provides some evidence that this is a conservative outlook, and further into the year, the guidance could indeed be revised to reflect the strong start to the year.

Does Curtiss-Wright Corporation Pay A Dividend?

Curtiss-Wright recently increased its quarterly dividend from $0.19 per share to $0.20 per share providing a 5% bump, which is nice but given that its forward yield is 0.5% this most definitely is not a name you want to be holding for its dividend. Stock price growth is what you want to hold this name for, primarily because for the yield to be attractive many dividend increases need to be announced.

Curtiss-Wright Stock: A Buy, Sell Or Hold?

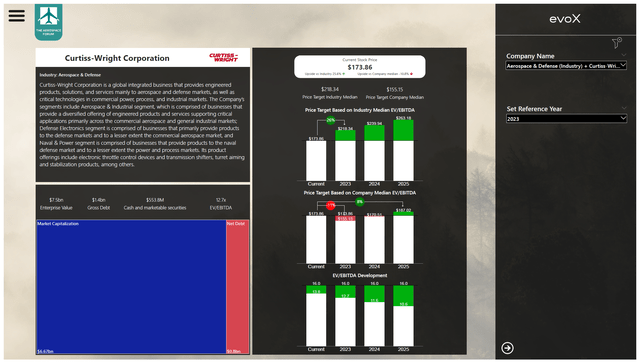

The Aerospace Forum

For stocks, it is always difficult to determine the stock prices because there are so many ways one can value a stock. I entered the numbers for Curtiss-Wright into the evoX Financial Analytics tool and based on the industry multiple there is a significant upside. However, this is not the typical multiple that the company trades on. If we look at the price targets implied when using the company median for EV/EBITDA, we see that the company is priced in for earnings two years ahead. Companies often do not trade according to their current year expectations. Curtiss-Wright seemingly trades with earnings of 2024 factored in. As the year progresses, 2025 should start being reflected in the share price, which I believe brings an 8% upside to the stock. Typically, I am looking for companies that have at least a 10% upside to consider it a buy.

Conclusion: Curtiss-Wright Stock A Better Hold Than Buy

Curtiss-Wright Corporation is certainly not a bad company. The company leans more towards defense than commercial aerospace, so investors should keep in mind that growth in defense is what predominantly will drive the company’s prospects. Q1 results were strong, but the company maintained guidance despite the strong start to the year. That is not a bearish sign, as management indicated that, given the current macroeconomic environment, they are maintaining the guidance. That might actually mean, that as the year unfolds, management will feel confident to raise the guidance. I mark shares of Curtiss-Wright a Hold, as the implied upside is less than 10%.

Read the full article here