Introduction

The first time I did my research on ETSY (NASDAQ:ETSY) was in April 2022. I posted my findings in the private Discord community (Fired Up Wealth) that I am a part of, led by Motley Fool contributor Eric Cuka. At that time, I was pretty bullish, and why shouldn’t I be?

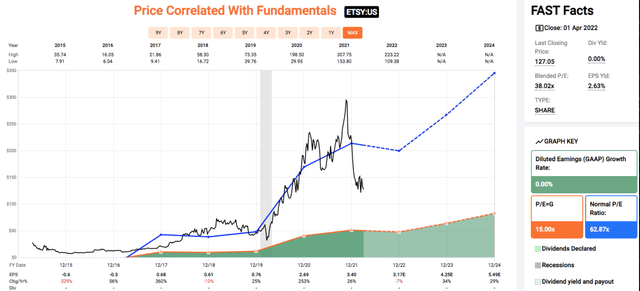

Fast Graph Etsy April 2022

Back then, the company was expected to see a 7% decline in earnings growth in 2022 before bouncing back with a vengeance in 2023 with 34% in earnings growth, followed by 29% earnings growth in 2024. That averages out to be 18.7% in adjusted operating earnings growth over three years. Sure, any fall in earnings would not be good, but that certainly did not justify a 56% plunge in stock price from $291 in November 2021 to $127 by April 1, 2022.

Morningstar analyst Sean Dunlop write a note in February 2022 with the following title:

Morningstar

In that article, he described Etsy as a “wide-moat” company that has “carved out an enduring niche in a quickly evolving e-commerce space, with two-year stacked GMV growth of 154% for the quarter (down just 4 percentage points sequentially), suggesting to us that the firm’s market share gains should prove enduring“, ending off his note by keeping intact his $221 fair value estimate for Etsy.

Not one to base my buy or sell decision on analysts’ fair value estimates blindly, I proceeded to model my own valuation estimate for Etsy (see table below), throwing in a worst-case scenario of a 10% chance of a 10% decline in earnings in 2022 (compared to FactSet analysts’ forecast of a 7% decline in earnings) followed by just 10% earnings growth per year for the subsequent nine years (compared to the 34% and 29% of positive earnings growth that were forecast for 2023 and 2024 respectively).

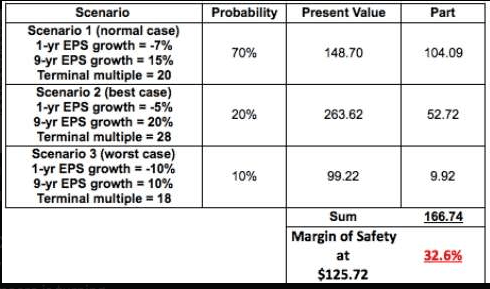

Author’s fair value estimate in April 2022

In my fair value estimate, I derived a much lower $166.74 per share fair value for Etsy shares in April 2022; Etsy’s shares were priced at $125.72 a piece at that time which meant that I could own Etsy shares with a 32.6% margin of safety according to my valuation. Even if my worst-case scenario happens and Etsy’s share price falls to $99, comparing a possible 21% decline to a potential 32% upside to my fair value calculation, or the even higher 75% gain if the stock price moves towards Sean Dunlop’s fair value for Etsy, the risk and reward seemed to be in my favor, and I bought some shares of Etsy for around $126 per share that same month in April 2022.

The bear market of 2022 crushed Etsy’s stock price, alongside other pandemic darlings. However, I doubt anyone expected a 70% collapse in the share price by 70% from its all-time high to the most recently transacted price, especially not for a profitable company.

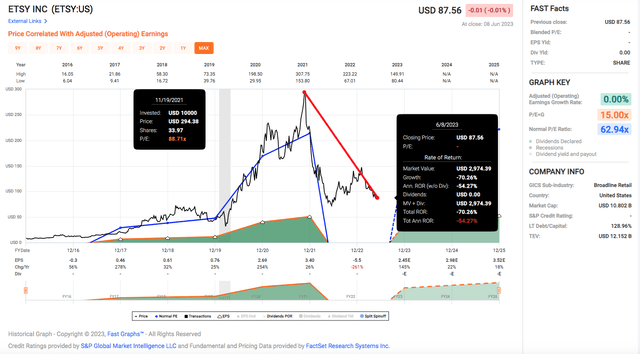

Fast Graph Etsy on 8 June 2023

I was lucky to have sold all my Etsy shares in December 2022 for $140 apiece. My decision to sell was based on my short-term outlook for the industry as well as to increase my cash position in preparation for better-valued buys.

With the current share price of $87.56 as of the close on June 8, 2023, which is close to the 6-month low of $81, I am wondering if the risk and reward for Etsy has turned favorable again.

In this article, I will examine Etsy from a value investor’s point of view to determine if it is worth owning. I want to know is the stock broken or is it just the price that is broken.

Let’s go.

ETSY’s Business In A Nutshell

According to Etsy’s 2022 10K,

Etsy operates two-sided online marketplaces that connect millions of passionate and creative buyers and sellers around the world. These marketplaces – which collectively create a “House of Brands” – share our mission, common levers for growth, similar business models, and a strong commitment to use business and technology to strengthen communities and empower people. Our primary marketplace, Etsy.com, is the global destination for unique and creative goods made by independent sellers.

The Etsy marketplace connects creative artisans and entrepreneurs with thoughtful consumers looking for items that are a joyful expression of their taste and values…

We have a seller-aligned business model: we make money when our sellers make money. We offer Etsy.com sellers a marketplace with tens of millions of buyers along with a range of seller tools and services that are specifically designed to help our creative entrepreneurs generate more sales and scale their businesses.

In addition to our core Etsy marketplace, our “House of Brands” consists of Reverb Holdings, Inc. (“Reverb”), our musical instrument marketplace acquired in 2019, Depop Limited (“Depop”), our fashion resale marketplace, and Elo7 Serviços de Informática S.A. (“Elo7”), our Brazil-based marketplace for handmade and unique items. Both Depop and Elo7 were acquired in July 2021.

Is The Business Broken Or The Stock Broken?

Let’s examine this from the following perspectives.

Is the company profitable?

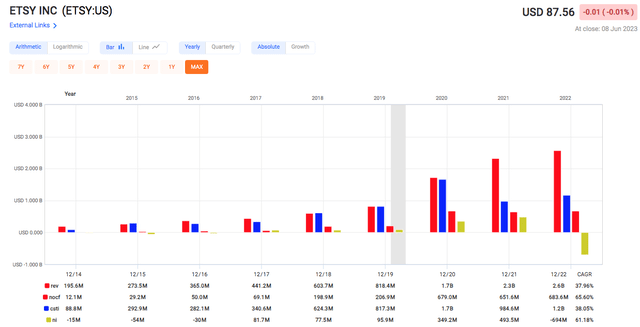

Etsy has had positive revenue and operating cash flow right from the beginning in 2014. From 2014 to 2022, revenue increased 12.2 times to $2.6 billion, net operating cash flow increased by 55.5 times to $683.6 million, and the amount of cash and cash equivalents increased by 12.5 times to $1.2 billion. The company has also been reporting positive net income since 2017 (more on the negative net income for 2022 later).

Fast Graph

This is a profitable business, no doubt. Due to the pandemic and stay-in-home directives globally that led many to shop online, Etsy’s revenue doubled from $818 million in 2019 to $1.7 billion in 2020. Such rapid revenue growth was definitely unsustainable especially when the world returned to normalcy. Revenue growth slowed to 35% from 2020 to 2021 and further declined to just 12% from 2021 to 2022. Things got worst for companies lumped into this bucket (such as Zoom and Sea Limited) when a confluence of bad things happened in 2022; the sudden and rapid increase in interest rates to 40-year highs, the war in Ukraine, supply chain issues that persisted to delay shipments and increase costs, etc. The bear market that tore investor confidence to shreds did not help.

Yet, let me be crystal clear: Etsy was profitable and remains so.

If it were profitable, why did the company report a negative earning per share of $5.48 for the fiscal year 2022? The recorded negative earning in 2022 was due to the company writing down the value of their acquisitions of Depop and Elo7. The following is from the Q3 2022 earnings call,

Before moving to the balance sheet, I’ll comment on the non-cash impairment charge of about $1 billion we recorded on the goodwill of Depop and Elo7, eliminating the full amount of goodwill we were carrying for each brand. We purchased these businesses when technology and consumer company valuations were at much higher levels. For instance, many peers have seen enterprise values decline by 70% or more…

Without this $1 billion impairment cost, instead of $694 million in net income loss, Etsy should have reported a net income of $351 million, which would be slightly higher than the 2020 reported net income.

Will the company remain profitable?

For an e-commerce company to keep growing, the number of active buyers (demand) and active sellers (supply) have to increase. If an e-commerce company has fewer and fewer customers buying from it, it is likely that it is experiencing a decline. This aspect is discussed in my article on another e-commerce company eBay Inc (NASDAQ:EBAY).

In Etsy’s case, the answer is not so straightforward.

When compared on a year-on-year basis (see table below), the number of active buyers has been on the decline, from 96.3 million in 2021 to 95.1 million in 2022, and in the most recent quarter, it was just 89.9 million.

Author’s compilation from 10Ks from 2019 to 2022 and 10Q from Q1 2023

But when compared to the pre-pandemic figure of 46 million active buyers in 2019, the current number of active buyers is still almost twice that in 2019. The pull-through expansion in demand in 2020 and 2021 has increased the adoption of e-commerce globally and brought in customers interested in the unique products available only on Etsy in greater numbers at a pace faster than previously anticipated, hence seeing a slight decline in the number of active buyers year-on-year from 2021 to 2022 is normal. Corroborating data will be the falling number of new buyers added each year, down from the peak of 38 million added in 2020 to 35 million in 2021, then a further decline to 29 million in 2022. It is too early to predict if the 6.7 million new buyers added in Q1 2023 is off to a good start or not, but it does represent a decline in new buyers compared to the 7 million added in the same quarter in 2022.

At the same time, while understanding that explosive growth in active buyers and new buyers in 2020 and 2021 is unsustainable, investors should not understate the risks that come with these declining numbers because the decline of more than 5 million active buyers from 2022 to Q1 of 2023 may suggest that Etsy has some difficulties in retaining existing buyers, and if that is a real problem and not a temporary blip, then the conversion of these active buyers to the much coveted habitual buyers (people who spend $200 or more in the last 12 months) will be harder, and it will also mean more effort and money has to be spent to reactivate the former active buyers.

Already, some of these issues have reared their head. As you can see from the table above, the number of habitual buyers has declined from 8.1 million in 2021 to 7.4 million in 2022 and to 7 million in Q1 of 2023. The loss of one million habitual buyers signifies a loss of at least $200 x 1 million = $200 million in net revenue, the equivalent of 7.8% of 2022’s full-year revenue.

And in spite of a 55% increase in SG&A expenses (excluding R&D) from $655 million in 2020 to $1.02 billion in 2022, the number of reactivated buyers increased by just 9% from 22 million to 24 million. In short, it is costing more and more advertising money just to keep the churn under control by reactivating buyers and keeping active buyers active.

Another set of figures that investors should be watchful of is the Gross Merchandise Sales (GMS). The GMS figures exclude revenue from services, so higher GMS numbers indicate that sellers are doing better, as well as the satisfaction of Etsy’s buyers, and the health, scale, and growth of Etsy’s business. Based on the total recorded GMS, it would seem that Etsy’s GMS has declined from $13.49 billion in 2021 to $13.31 billion in 2022. However, bearing in mind one category of item, face mask, was sold in huge quantities in the years 2020 to 2021, a feat that is unlikely to repeat anytime soon, revenue from the sale of face masks should be stripped out. After doing that, it becomes clear that GMV has been increasing year on year from 2018 to 2022 (see green arrow).

I think it is hard to say if Etsy is now at the start of a long-term decline (like eBay has been for years), or if the growth normalizing to a post-pandemic rate. What I can say is that pre-pandemic, the management had been outstanding, trouncing analysts’ 1-year and 2-year earnings and sales estimates handily (see table below).

Author’s compilation from Fast Graph

Valuation and Growth

From 2017 to 2019, investors were constantly paying in excess of 44x adjusted operating earnings for Etsy’s growth, which made sense as Etsy’s adjusted operating earnings were 278% in 2017, 32% in 2018, and 25% in 2019, an average rate of 111% per year. Etsy deserved that kind of premium back then.

Earlier in the article, I already mentioned that the recorded loss in net income in 2022 was due to an impairment charge rather than a deterioration in the business.

Fast Graph

Hence, for the purpose of my thinking about Etsy’s future growth rate and its valuation, I will imagine that the loss of 2022 is absent and skip that year. Etsy’s adjusted operating earnings of $3.40 per share in 2021 to $2.45 per share in 2023 (if analysts are right, and if Etsy did not outperform those estimates) represents a 28% decline. Together with the analysts’ expectations of a 22% gain in 2024 and 18% in 2025, the average adjusted earnings growth rate for these three years (2023, 2024, and 2025) works out to be a paltry 4%.

How much premium are investors willing to pay for each dollar in Etsy’s earnings in a post-pandemic, post-lockdown world where the assumed growth rates in 2024 and 2025 although still double-digits are significantly lower than the pre-COVID years?

I seriously doubt that investors will continue to pay 40x earnings for a company that is growing at an average rate of just 4%.

If we are generous and assume the 28% decline from 2021 to 2023 has been baked into the beaten-down stock price, and the average adjusted earnings growth rate for 2024 and 2025 should be 20% per year, I will still be doubtful that Etsy deserves the same premium it commanded from 2017 to 2019 when it was growing at an average rate of 111%.

Normal Case: Assuming that Etsy grows earnings at 20% per year and commands a premium of 20x earnings (using Peter Lynch’s PE = Growth rate), for $2.98 of earnings in 2024 the stock could be worth $2.98 x 20 = $59.60.

Good Case: If Etsy outperforms well as it did in the past, earnings grow by 30% per year to $3.185 in 2024 and it commands a premium of 30x earnings, the stock could be worth $3.185 x 30 = $95.55 in 2024.

Extraordinary Case: If Etsy outperforms superbly as it did in the past, earnings grow by 40% per year to $3.43 in 2024 and it commands a premium of 40x earnings, the stock could be worth $3.43 x 40 = $137.20 in 2024.

Assuming that each of these three scenarios has an equal chance of success, the average of these three results in $97.45. Based on the closing price on June 8 of $87.56, that will mean an 11.3% upside in 18 months.

Although I believe it is slightly undervalued at the price of $87.56 and could potentially return 11.3% by the end of 2024, I will consider Etsy a HOLD at this price as I deem the margin of safety insufficient. Although the potential for price appreciation is significant in my best-case scenario, and there is still a potential 11.3% price appreciation after considering the other two scenarios, I have yet to factor in a worst-case scenario. What if, due to a slow-growing economy where wages are not rising as fast as inflation of goods and services, where everything from food to rent costs more, and the average person finds themselves having to stretch every dollar to reach the next payday, demand for unique, handcrafted items on Etsy would likely fall.

There were around 46 million active buyers in 2019 and Etsy brought in $0.79 in adjusted operating earnings in that year. Let’s say everything normalizes in 2023, and let’s say the number of active buyers in 2023 grows to 92 million, double that of 2019 and higher than the recorded number in Q1 2023. Assuming a 153% increase in the adjusted operating earnings to $2 per share in 2023, even at a premium P/E of 40x earnings that will get to just $80 per share, lower than the price at close on June 8, 2023. And if earnings do grow by 20% to $2.40 in 2024, even at a P/E of 40 the stock price will only be $96. The risk and reward do not seem to be very favorable.

Conclusion

I believe that Etsy is a stock that is not broken. Etsy is definitely not the next eBay. Etsy remains profitable and based on GMS figures alone (excluding face mask sales of 2020 and 2021) revenue has actually been growing every year. Not to mention it has a cash hoard of $1.2 billion to deploy so it does not need to borrow money at the elevated rates currently. Flush with cash, and with the share price declining for the past many months, the company has been buying back shares over the past four quarters.

- Q2 2022 Repurchased $62.2 million in stock

- Q3 2022 Repurchased $151 million in stock

- Q4 2022 Repurchased $150 million in stock

- Q1 2023 Repurchased $148 million in stock

In the words of CEO Josh Silverman in the Q1 2023 earnings call,

… we effectively utilized a portion of our cash to repurchase shares to offset dilution resulting from stock-based compensation.

While it is disheartening to see that executives have been selling their own shares rather than buying them even at the depressed price levels, it is of some consolation that management has been buying back shares thus managing the impact of the dilution on the reported earnings per share.

Another point to mention is the increasingly growing piece of the revenue pie comes from the “Services” segment, which has been increasing nicely from $160 million in 2018 to $660 million in 2022. This segment currently makes up 25% of Etsy’s total revenue providing an additional source of revenue with levers that management can pull if there is a need to increase revenue, like it did in 2022 when it increased the sellers’ transaction fees by 30% from 5% to 6.5%.

Management has proven themselves to be great at leading and growing Etsy in the years pre-pandemic. Nobody is perfect, but based on their past performance, there is no reason to think otherwise of them.

If you are holding Etsy’s shares now, I recommend holding on to them.

If you are considering Etsy as a fresh investment now, I suggest holding off until there is a larger margin of safety, or until you see the number of active buyers and habitual buyers growing again.

Read the full article here