Business updates

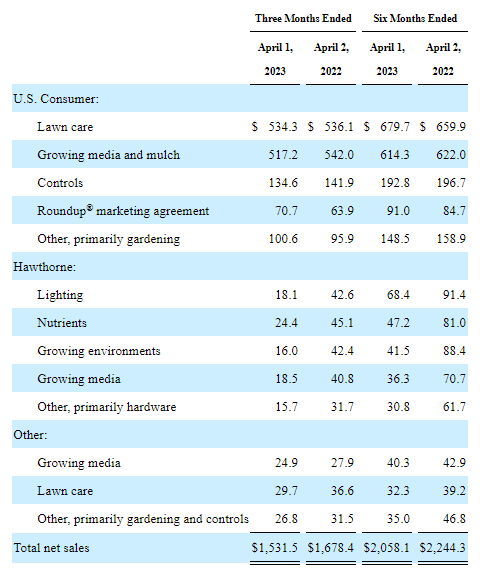

In fiscal 2023 Q2, The Scotts Miracle-Gro Company (NYSE:SMG) experienced a 9% decrease in company-wide sales to $1.53 billion. The US consumer segment (garden & lawn) saw an 11% decline in volume, coupled with a 9% increase in price, resulting in a 2% drop in sales to $1.36 billion. Additionally, the Hawthorne segment faced significant challenges in the hydroponic industry, with a 60% decrease in volume and a 54% decline in sales to $93 million, compared to $203 million during the same period last year. SMG reported a GAAP net income of $109.4 million, or $1.94 per diluted share, in contrast to prior year earnings of $276.5 million, or $4.94 per diluted share.

Overall, SMG has demonstrated resilience in maintaining relatively high levels of total revenue compared to the pre-pandemic period. As a company that benefited greatly from the pandemic, SMG is now facing pressure as society begins to return to normalcy. Given SMG’s historical reputation as a slower-growing business, there may be some skepticism regarding its ability to sustain sales levels during the post-pandemic period. Currently, the consumer business segment appears to be solid and in high demand. The main concern lies with the Hawthorne business segment, which has yet to show any early signs of recovery.

SMG segment performance (SMG fillings)

Cost saving and restructuring

SMG experienced a significant surge in demand during the pandemic, leading to an over-investment in capacity to meet customer needs. However, now that the pandemic has ended, SMG is left with an excess of its supply chain and headcount. Recognizing this, SMG has taken swift action to implement cost-reduction initiatives, which have been crucial in addressing this situation. In 2022, the company closed down four distribution centers and divested its Hurricane branded fans for the Hawthorne business. These measures have proven effective in controlling costs and optimizing operations, as evidenced by the reduction in operating expenses from 12.8% to 11.7% compared to the previous year.

Due to the reduced capacity, SMG is now anticipating achieving run-rate annualized savings of at least $200M, surpassing their initial target of $185M. However, the management also expects a 100 basis point decline in the gross margin rate, along with mid-single-digit declines in adjusted operating income and low single-digit declines in adjusted EBITDA. The good news is that the management has set an ambitious goal of generating $1 billion in free cash flow over the next two years. This is what shareholders will like, but it is possible that a portion of the cash flow may be derived from asset write-downs. Nonetheless, SMG’s financial performance has been stabilized since the management was looking at free cash flow of negative $1.2 billion just about a year ago.

Consumer business is still solid, but nothing exciting

SMG’s US consumer segment remains dominant and resilient, with their collection brands leading in products sold across various garden centers, including soils, grow media, mulches, fertilizers, seeds, live plants, weed killers, and more. The strong brand recognition and preference among gardeners contribute to its success. However, a significant portion of SMG’s sales relies on distribution through Home Depot and Lowe’s, accounting for 43% of total sales. This dependency limits SMG’s pricing power and requires significant investments in marketing and research and development (R&D) to maintain a competitive edge against other brands and private labels, thus preserving its brand image. These factors, along with limited control over distribution channels, pose challenges and may restrict the future growth potential of the consumer business. SMG foresees future growth of 2-4% or at least in line with GDP, which is not an amazing performance.

Hawthorne is the X factor that the market is worried about

As per the management’s assessment, the Hawthorne business within SMG operates in a Total Addressable Market (TAM) estimated at $5 billion. This market is primarily driven by the infrastructure needs of large and efficient cannabis growers, who are dependent on the legalization of the market. Currently, the majority of the market, approximately 75%, remains illegal, while only 25% is legal. This imbalance has resulted in an oversupply of cannabis products, as efficient and legal growers are not allowed to compete with illicit producers.

SMG’s product offerings are designed to tackle the specific challenges faced by cannabis growers, allowing them to produce cannabis that is dense, of high quality, and free from insects. The company’s management is optimistic about the future potential for growth as the cannabis market continues to undergo legalization. They believe that SMG could achieve a compound annual growth rate (CAGR) of 7-8%, which would be a substantial driver of future growth for the company. However, it is important to note that the pace of the legalization process remains uncertain and difficult to predict. The Hawthorne segment of SMG represents a significant unknown factor in the company’s future growth. The pace and extent of legalization remain uncertain, making it difficult to predict the segment’s potential. However, SMG acknowledges the challenges and has taken responsible measures to reduce shareholder risks by cutting capacity and scaling back operations. By doing so, the company aims to navigate the uncertainties moving forward.

Bottom line

In my opinion, SMG has shown promising signs of steering the business in the right direction. The company possesses strong and renowned brands, although the impact of the Hawthorne segment remains uncertain, raising questions about management focus. However, one of the standout aspects of SMG as a stock is its alignment of interests. With the Hagedorn family’s multi-generational involvement in the plants and lawn industry, CEO Jim and his son Chris are fully committed to the business’s success, reflecting a shared interest with public shareholders. Additionally, SMG has a track record of dividend payments and buybacks, further enhancing its appeal to investors.

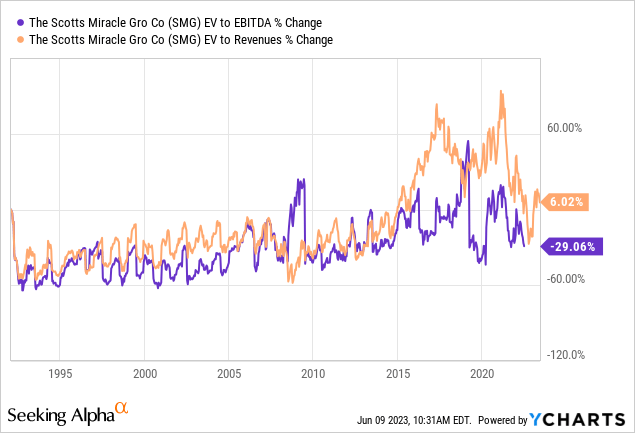

Regarding valuation, SMG is currently at the lower end of the historical spectrum (chart below), especially for EV to EBITDA (14x). EV/sales are not actually higher than levels between the 1990s to 2015. The stock overall is somewhat undervalued but not ridiculously cheap to me, even after the price dropped nearly 75%. Forgot to mention that growing debt levels could also be a drag for future growth.

Regarding valuation, SMG is currently positioned at the lower end of its historical range, particularly in terms of EV/EBITDA at 14x. Although EV/sales are currently higher than levels seen from the 1990s to 2015, I think the stock is still undervalued overall, even after experiencing a significant price drop of nearly 75%. However, it’s important to note that growing debt levels could potentially act as a drag on future growth prospects.

Read the full article here