Investment Thesis

Sibanye Stillwater Limited (NYSE:SBSW) has had a truly difficult 2022, with operational processes having been hampered by both macroeconomic headwinds and surprise negative operational events.

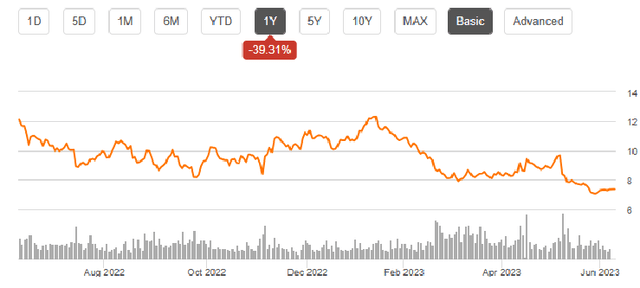

This has left SBSW shares trading at a 52-week low, with the overall market sentiment being undoubtedly negative towards the company.

Fundamentally, Sibanye’s profitability is unharmed despite the difficult year the company has battled. When combined with management’s desire to increase the operational efficiency of the company, I believe the future could be very bright for Sibanye.

I believe the 74% undervaluation (54% when factoring a safety margin relative to the risks associated with the stock) in the company leaves tangible space for value investors to become engaged.

Company Background

SS Homepage

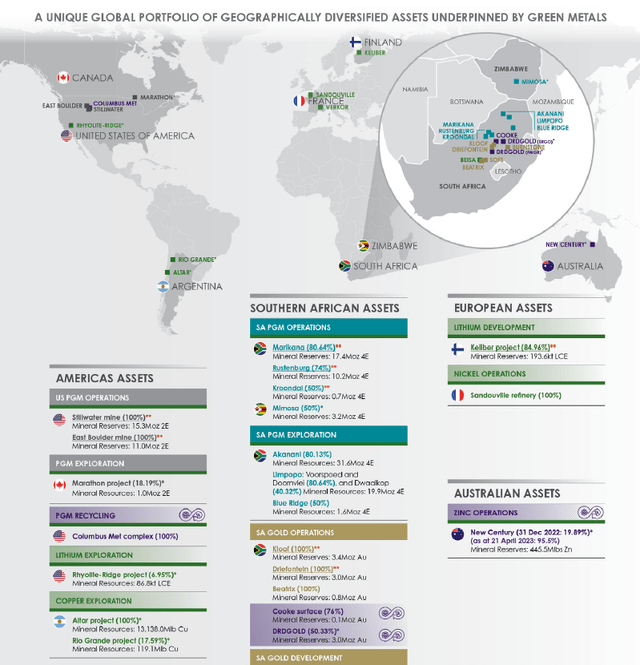

Sibanye Stillwater is a South African based mining and metals processing group with diverse portfolio of projects covering five-continents. The company is one of the world’s largest recyclers of PGM (Platinum Group Metals) auto-catalysts and has controlling interests in leading mine tailings retreatment operations.

As a leading producer of platinum, palladium, rhodium and gold, as well as recent diversification into ruthenium, nickel, chrome, copper and cobalt, Sibanye has secured themselves a wide breadth of revenue streams.

Recent macroeconomic headwinds combined with political unrest and contracting margins has led to a large deterioration in share prices. However, given the diverse nature of Sibanye’s operations along with management’s objective to return the company to significant profitability, the potential exists that the market has mispriced this mining group.

Therefore, a fundamental company analysis combined with an intrinsic and absolute valuation is necessary to better understand what value may lie for value-oriented investors in Sibanye’s shares.

Economic Moat – In Depth Analysis

Sibanye’s economic moat is primarily driven by their hugely diverse set of mining and processing operations along with recent diversifications into battery metals mining and processing. Significant moatiness is also derived from the geographic spread the company has developed for their various business operations.

While the company originally began in 2013 as a purely South African based gold mining company, a desire to diversify their revenue streams both in terms of geography and product type has helped the company evolve into the global-scale organization they are today.

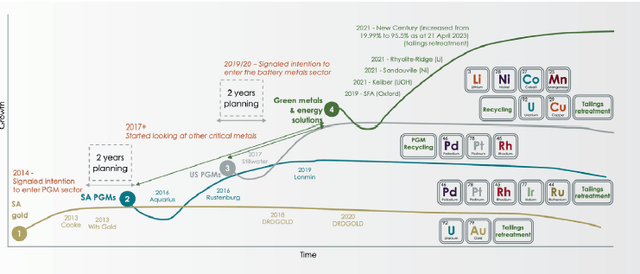

SS Integrated 2022 Report

The sigmoid curve above depicts the strategic evolution the group has undertaken which was primarily achieved through various acquisitions and mergers with company already operating in the desired business segments.

By diversifying away from being a pure gold mining company, Sibanye has managed to weaken the correlational relationship they previously held between gold prices and overall profitability.

The acquisition of U.S. PGM business Stillwater in 2017 was crucial to Sibanye being able to expand the geographic outreach of their operations. Given the turbulent political situation currently present in the Kingdom, this step outside of South Africa has proven to be an invaluable asset for the company.

Sibanye’s current largest business segment by revenue stream is undoubtedly their South African underground PGM operations. This primarily involves the mining of PGM’s through their Rustenburg and Marikana facilities in the Kingdom.

Recent operational struggles along with industry action by their workforce have led to total output and sales of SA PGM’s to fall slightly, but core business efficiency should be unharmed.

SS Integrated 2022 Report

Secondary to their SA PGM operations is their lucrative US PGM recycling and mining operations headed by the Stillwater side of the firm. Revenues in their U.S. segment have historically been very strong with significant growth being achieved YoY.

However, once more Sibanye has faced significant headwinds with regards to mine closures and flooding which has directly affected their U.S. PGM mining in particular with overall output dropping by 24% in FY22.

While these closures and unforeseeable natural events have caused significant lost revenues in FY22, their core business and solid margins should not be harmed in the long run which suggests the return to significant profitability of this segment is imminent.

Finally, Sibanye’s various gold operations including mining which is primarily accomplished by DRDGOLD (acquired in 2020), Cooke surface and managed South African gold businesses represent approximately a fifth of their total revenue.

Revenue from these segments has been hit particularly hard in 2022 due to a sizable 52% decline in gold volumes sold. This occurred mainly due to industry action performed by Sibanye’s miners in protest of unfair wages and corresponding working conditions.

While this is regrettable in the short-term, it is difficult to see any evidence to suggest that their fundamental business has been harmed in any tangible manner.

SS Integrated 2022 Report

Sibanye also has controlling stakes in multiple international mining and processing operations. Recent diversification towards “green metals” so dubbed due to their common usage in energy and infrastructural projects aimed at decarbonizing economies have been achieved in the form of obtaining a majority 88% stake in Finnish lithium development project Keliber.

Sibanye has also entered into positions in U.S. lithium miners Rhoylle-Ridge along with some minority stakes in Argentinian copper mining operations.

Finally, a diversification into nickel operations by acquiring the French refinery Sandouville has expanded Sibanye further into being a company with operation spanning across the rare metals and metallurgical commodities markets.

Overall, it is clear that Sibanye operates a hugely diversified portfolio of business across a massive geographical scale. This diversification helps mitigate the risks associated with reliance on a single commodity of product for their revenue streams.

Their geographical diversity in particular also mitigates some of the risks associated with operations in South Africa due to the difficult and complex political environment currently surrounding the nation.

I believe Sibanye Stillwater thus harbors a wide-economic moat which provides the company with a difficult to replicate and operationally robust footing for future success.

Financial Situation

Sibanye has had a relatively solid fiscal history since 2013 with the last couple years having been slightly less optimal. Their 5Y average ROIC is a healthy 16.31% while their ROE for the same period has been 18.51%. Their 5Y gross, operating and net margins for the same period have been 19.17%, 17.20% and 7.30% respectively.

These strong 5Y operating indicators illustrate the fundamental profitability and expansive margins upon which Sibanye is clearly able to operate their business. Unfortunately, over the TTM, Sibanye has been battered by headwinds and surprise operational events which have hampered their overall FY22 performance.

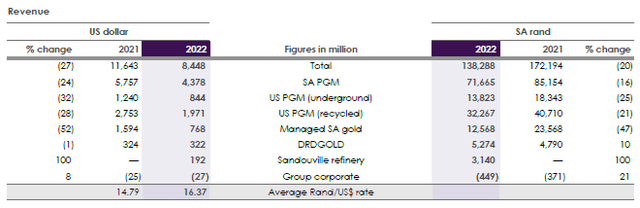

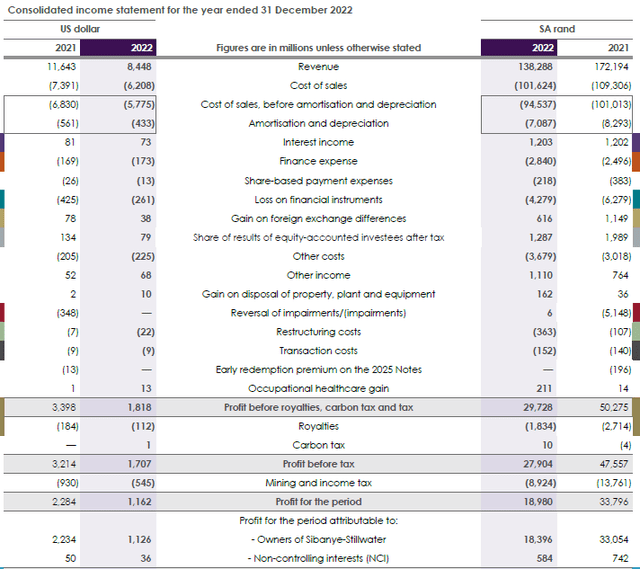

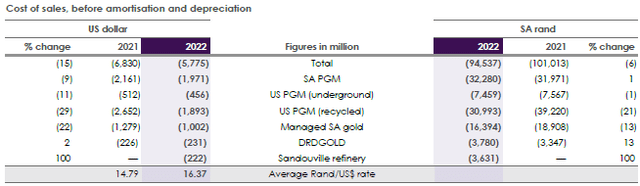

SS Integrated 2022 Report

2022 saw total revenues decrease 20% compared to 2021 falling to just over $8.4B. This was caused by lower volumes across all operations along with an average drop in PGM basket prices which impacted SA PGM, U.S. PGM and U.S. Recycling PGM operations.

Managed SA gold operations saw revenues drop 47% due to the aforementioned strikes during 2022.

EBITDA for 2022 fell by 46% compared to 2021 primarily due to the lower PGM basket prices and lost production volume (due to the flooding at U.S. PGM mining sites).

The decreased output from SA managed gold also impacted this value significantly with the business segment seeing a 169% drop in EBITDA. This was caused by key fixed costs remaining while variable output fell short of expectations. PGM operations as a whole saw a combined average EBITDA drop of 38%.

Overall, it is clear to see from an income perspective 2022 was a bleak year for Sibanye.

SS Integrated 2022 Report

It is still important to note that management’s newfound desire to achieve operation excellence through reducing the company’s operational footprint along with achieving new operational synergies seems to be working.

The company’s COGS for 2022 saw a 16% drop compared to 2021. SA small portion of these decreases may be associated with the drop in variable costs associated with the lost output at key PGM and SA managed gold facilities.

However, the significant size of this decrease, especially during the highly inflationary environment currently impacting economies across the globe suggests the push for operational excellence is paying-off.

Management has highlighted a focus on improving employee training and further enhancing a safety culture at the firm as being some of the key steps required to achieve operational excellence.

Equally, Sibanye has identified that U.S. PGM operations must be repositioned for long-term sustainability to ensure operational flexibility and cost competitiveness remains on a longer horizon.

This will be primarily achieved through increasing training of employees along with revised shift rosters (seven on/off) being trialed in an effort to reduce fatigue levels and increase productivity.

A more robust training of skilled staff is key for Stillwater to succeed in the U.S. PGM market due to the current shortage of these valuable workers. This has resulted in Stillwater relying on contractors to fulfill output demands which increases the COGS for the segment.

Furthermore, the highly energy intensive nature of all of Sibanye’s mining, processing and refining operations means the highly inflationary energy market impacts COGS significantly. This places increased pressure on all elements of the supply chain which negatively impacts the profitability of all of Sibanye’s operations.

Sibanye’s Q1 update (quarter ended March 2023) highlights a decline in group EBITDA YoY of 23%. This was primarily the result of further difficulties associated with the U.S. PGM operations where a Stillwater West mine suffered structural shaft damage limiting access to deeper levels of the mine.

The suspension of operations below 50 level during remediation of the shaft has delayed Sibanye’s overarching repositioning plan for the business segment. This resulted in 18% lower production volumes for the segment compared to Q1 2022.

Luckily, SA PGM production was only 4% lower YoY despite a significantly more challenging operational environment. Lower underground production volumes were offset by higher third-party purchases of concentrate which helped reduce the impact on results.

The SA managed gold segment has benefited significantly from the inflation linked wage agreement settled in 2022. Production from SA gold operation was 46% higher YoY following the resumption of operations post-industry action.

Sibanye’s partnered operation in Finland with Keliber regarding their lithium refinery has commenced with earthworks for refinery being laid on 11 May 2023. I see this new business segment as potentially providing the firm with a lucrative future set of revenue streams which should bolster the company’s economic moat for at least 20 years post-completion.

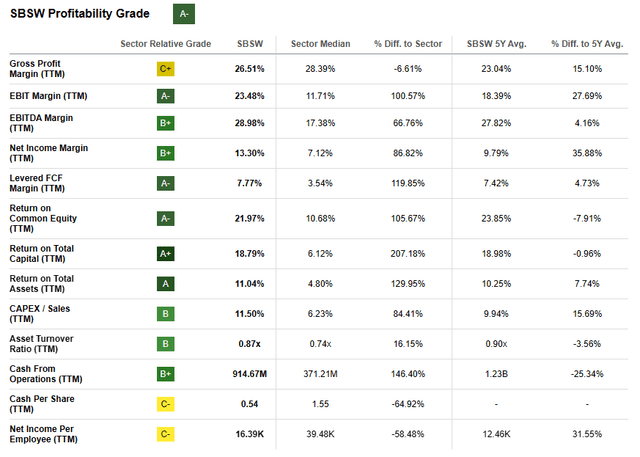

Seeking Alpha | SBSW | Profitability

Seeking Alpha’s quant assigns Sibanye with an “A-“ profitability rating. I believe that this rating is a representative snapshot illustration of the company’s overall current profit generating abilities.

While the future should see margins return to pre-2022 levels once all current surprise headwinds reside, the difficult political environment and sticky inflationary market environment makes forecasting the time-scale of this return difficult.

Sibanye’s balance sheet looks to be in healthy shape too. The company currently has $3.57B in total current assets while total current liabilities only amount to just $1.20B. This illustrates the relatively conservative fiscal strategy being pursued by management with regards to their expansion and acquisitions which is welcomed news for investors.

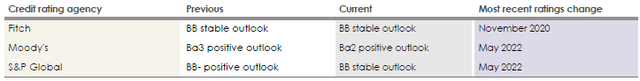

SS FY22 Integrated Report

Fitch and Moody’s provide Sibanye with a BB and Ba2 credit rating respectively: the outlook is stable.

Sibanye’s excellent liquidity is further supported by the $1.54B the company has in cash. For investors, such a well-managed cash-rich and liquid company is excellent news and illustrates the fundamental strengths Sibanye has in their business operations.

The company has a debt/equity ratio of just 0.24x which again is fantastic to see from an investor perspective. Their quick ratio (current assets minus inventory divided by current liabilities) is 1.92x.

Net debt as a ratio of adjusted EBITDA has also fallen significantly since highs of 2.5x in 2018 to -0.14. Sibanye operates with a financial leverage of 1.91x which is excellent to see.

Overall, it is clear that the management at Sibanye focusing heavily on returning the business to significant levels of profitability in the near future. While short-term headwinds have been relentless and unforgiving, the core profitability of Sibanye along with the company’s dedication to further improving their business economics suggests the long-term outlook remains positive.

Valuation

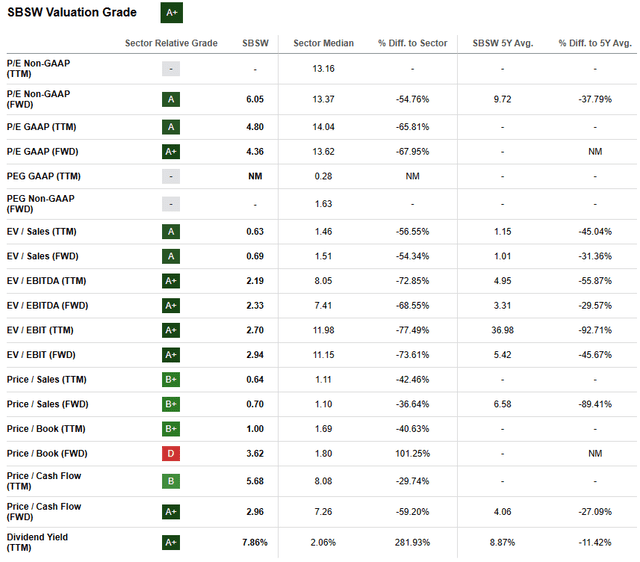

Seeking Alpha | SBSW | Valuation

Seeking Alpha’s Quant has assigned Sibanye with an “A+“ Valuation rating. I find this valuation to be an accurate overview of Sibanye’s current valuation. I believe shares are currently trading at a reasonable discount compared to their future cash generation abilities.

The firm is currently trading at P/E GAAP FWD ratio of just 4.35x and a P/CF TTM ratio of only 5.68x. Their FWD EV/EBITDA of 2.37x is very low in my opinion, along with their EV/Sales TTM of just 0.64x.

To emphasize, Sibanye is trading at only 2/3 the value of their significantly hampered 2022 sales.

I believe these figures alone suggest that Sibanye could be trading at a pronounced undervaluation compared to the intrinsic and future value present in the firm.

Seeking Alpha | SBSW | Summary Chart

From an absolute perspective, Sibanye shares are trading at their lowest price in years. Current prices of around $7.50 represent a 52-week low.

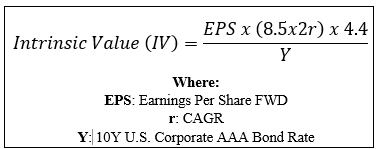

By accomplishing a simple financial valuation based on the calculation below and using the estimated 2023 EPS of $1.67 a conservative r value of 0.04 (4%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive a base-case IV for Sibanye of $27.00.

The Value Corner

Even when using this conservative CAGR value for r, Sibanye appears to be undervalued by huge 74%.

When using a more optimistic CAGR value of 0.06 (6%), shares are valued at around the $33 mark, which would represent a 78% undervaluation.

Therefore, I believe Sibanye as a company is currently trading safely in deep value territory. If the firm is able to put the difficult one-off events behind them and harness the expected growth in margins and the resulting net incomes, the potential for FY23-FY25 results to outperform even the current management expectations is real.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. Much depends on the prevailing macroeconomic conditions and how reluctant investor sentiment will be to realize the true fundamental profitability that lies at Sibanye.

In the long term (2-4 years), I expect their position as a key precious metals resource to become even stronger. Their extensive portfolio of business operations provides Sibanye a moat which is not only robust, but one which could be efficient at providing real margins for the company’s business operations.

I believe current share prices represent a classic lagging-sentiment mistake by Mr. Market. A base-case 74% undervaluation is simply too large to ignore.

Risks Facing Sibanye

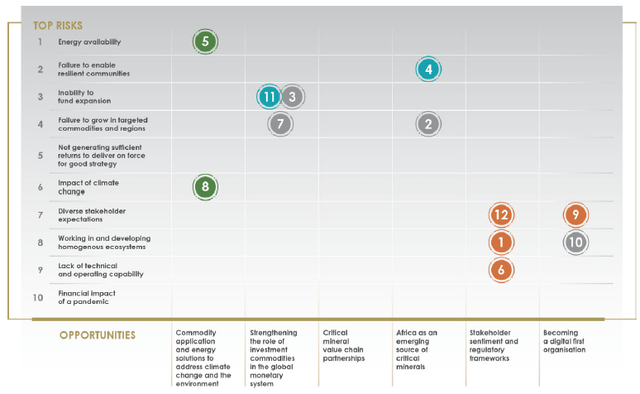

SS Integrated 2022 Report

Sibanye faces multiple tangible risks. The most influential are energy availability, a lack of demand development in key commodity areas and the potential for geopolitical issues arising from a complex political environment in South Africa.

The risk of energy supply shortages affecting Sibanye’s South African operations in particular is high. Since 2018, South Africa has faced an increasingly energy constrained market with frequent planned cut-offs affecting multiple industries including the mining and refining sector.

Without electricity and water, Sibanye cannot operate their extensive PGM and gold operations in the kingdom. This could manifest itself as an almost 1/3 reduction in revenues for the company.

Another key risk facing Sibanye is the potential for a lack of increase in long-term demand for many of their key commodities and sourced resources. Sibanye’s significant investment towards “green metals” is reliant on global megatrends such as decarbonization efforts and a switch towards EVs to produce the forecast increase in demand.

While these megatrends are very resilient and seem set to develop, uncertainty always surrounds a long-term forecast covering the global economy as a whole.

Finally, the unstable political environment in South Africa has the potential to significantly ward off FDI into the nation along with trust in the ability for businesses to navigate such a difficult environment.

This could see foreign (from the perspective of a South African company) investors become bearish on the overall value generation ability that the market holds. Sibanye could see significantly down-trod valuations (much as is the case with some Chinese company’s at the moment) despite their profitability which of course could harm investor returns.

From an ESG perspective, the risk of poor business ethics arise when discussing Sibanye’s extensive mining and processing procurement. While Sibanye’s management has devoted a paramount importance towards being a sustainable, socially beneficial and responsible corporation, the risk of unethical business practices leading to more strikes could exist.

Given the extensive set of real risks facing Sibanye, I will factor a 20% safety margin cut into my final valuation figure.

Summary

Sibanye Stillwater Limited is undoubtedly a global player in the PGM and gold industries. Their continued expansion into new business segments across a multitude of countries in Europe, the U.S. and South America has provided the company with an extensive economic moat that should provide tangible competitive advantages for years to come.

A difficult 2022 marred by complex headwinds and surprise operational events has turned-off investors from the stock. Given the overall softening demand for PGMs, market sentiment has truly soured against the South African company.

However, fundamentally the firm’s profit generation abilities are unharmed and the latent macroeconomic headwinds cannot last forever. When combined with the real intrinsic undervaluation present in the company, a real deep-value case is beginning to emerge.

While the list of threats facing the company are extensive, especially when considering the political landscape in South Africa, I believe Sibanye is well positioned to outperform the markets as a whole in the coming two years.

I award Sibanye with a Strong Buy rating thanks to the large 74% undervaluation currently present in shares and the company’s strong future profitability potential.

Even with a geopolitical risk safety margin of 20%, a 54% undervaluation sounds mighty fine to me.

I believe now is the time to get-in on a high-quality business at a great price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here