Magna International (NYSE:MGA) is a multinational automotive part manufacturer with a focus on OEM solutions across a host of consumer vehicle market parts.

Its activities have enabled $36.29bn in the past year, alongside a net income of $567.46mn. Magna has experienced steep declines in its profit margin- from 5.62% in 2018, to 1.56% today- due to a combination of supply chain difficulties, compressed demand, and overhead associated with the generational transitions- digital and electric- in the automotive sector.

Introduction

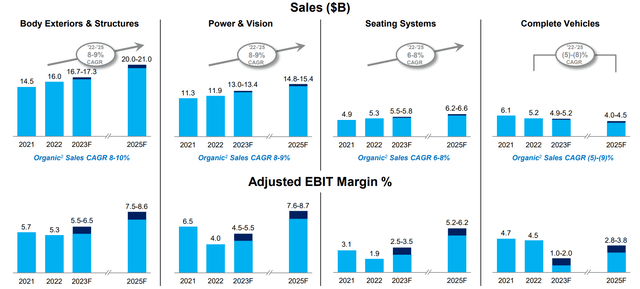

Magna’s activities are arranged along the following verticals; Body Exteriors & Structures, accounting for $16.0bn in sales for the year; Power & Vision, accounting for $11.9bn in revenues; Seating Systems, accounting for $5.3bn; and Complete Vehicles, accounting for $5.2bn.

Magna Annual Presentation

Of the four primary segments, only complete vehicles is experiencing negative CAGR, reflecting the increased complexity in manufacturing whole vehicles and a divestiture across the industry to doing so.

Valuation & Financials

General Overview

Relative to both the broad market (SPY) and the retail automotive industry (CARZ), Magna has experienced poorer price action.

Magna (Dark Blue) vs Market & Industry (TradingView)

Although this performance can be chalked up to macro issues- greatest of which being interest rate hikes, supply chain issues, and accelerating capex requirements- these issues are not unique to Magna.

In conjunction with market overreaction, I believe investors are of the mind that Magna’s focus on traditional powertrain and auto part systems is archaic; however, the company has made tangible investments and innovated in house to support up and coming driving technologies, such as through their micromobility ventures, Etelligent powertrains, and SmartAccess platforms to name a few.

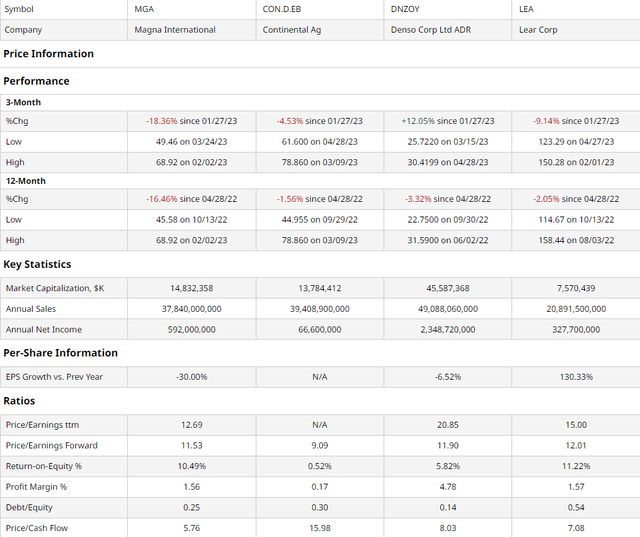

Comparable Companies

As with automakers, auto part OEMs are principally concentrated, mid-to-large cap companies across North America, Europe, and Japan. While Bosch is likely the largest competitor to Magna, their private status makes them difficult to assess. Continental Ag (CON.D.EB), principally known for their tires, is a German auto part manufacturer; Denso (OTCPK:DNZOY) is a Japanese auto part manufacturer, about 25% owned by Toyota; the Lear Corporation (LEA) is an American firm with specialties in seating and electrical components.

barchart.com

As illustrated above, even compared to peer manufacturers with the same stresses and duress, Magna has underperformed, both in the TTM and previous quarter.

Though this adequately reflects a steep EPS decline on the part of Magna, the market has overstated the impact of macro factors on the company’s financial health. Magna’s forward P/E, ROE, and Debt/Equity remains at parity- or better- than many of its peers. Furthermore, Magna’s TTM P/E and P/CF demonstrate superior value.

While Magna has not absorbed the impacts of macro factors as well as its peers, it has not been hit as hard as the market seems to suggest.

Additionally, I believe the market is underpricing the company’s operational growth capabilities.

Valuation

According to my discounted cash flow model, at its base case, Magna is undervalued by 40%, with its fair value being $86.63, up from its current price of $52.14.

The model assumes a discount rate of 8%- although rates continue to be high, Magna demonstrates one of the lowest debt/equity in the industry- in line with the company WACC.

To best calculate the future value, I estimated a net margin from 3.5-5%, with growth in line with historic figures- and conservative, with CAGR being 4-5% rather than the 6-8% estimated by Magna itself, smoothed over for black swan events such as COVID-19. This is in conjunction with assumed increased net capex ratios.

I calculated the model over 5 years without growth in perpetuity.

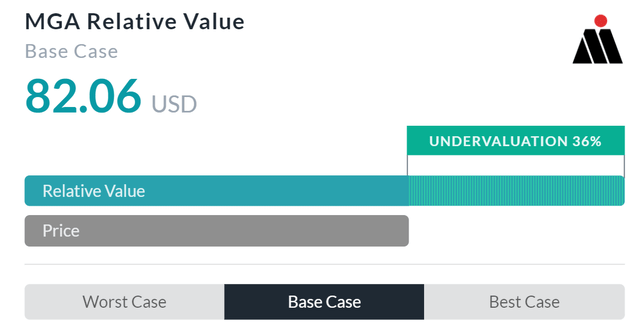

AlphaSpread

My idea of undervaluation is in line with AlphaSpread’s multiples-based relative valuation tool, which projects Magna’s fair value to be $82.06, meaning that Magna is currently undervalued by 36%.

Using an average, Magna’s actual price should thus be $84.35, or up 38% from today.

Twofold Investor Advantage with Income & Growth Baked-In

As I’ve discussed earlier, Magna’s long-term operational strategy impels confidence in its ability to sidestep current macro headwinds; investments in megatrend arenas such as Etelligent power train systems- an improved electrified powertrain, SmartAccess- a reimagined vehicular power door system, and the Mezzo Plus morphing surface products are only a few of these hyper-promising technologies and investments.

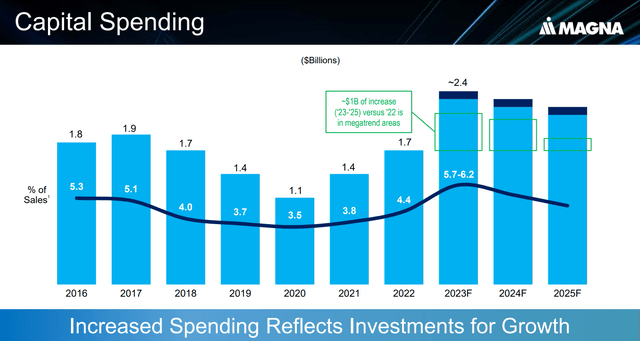

Magna Annual Presentation

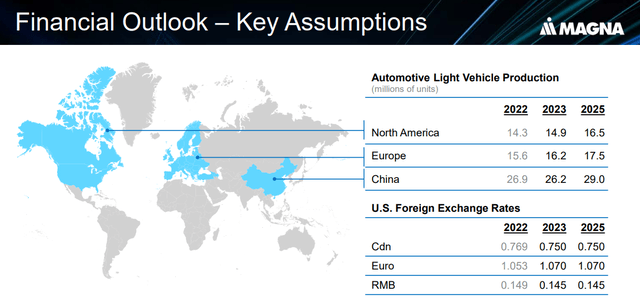

Moreover, the growth of Magna’s core line of legacy products is expected to coincide with the resurgence of global light vehicle production. The combination of novel investments and stable income from the current portfolio is expected to drive 6-8% organic growth per year, alongside a 230bps EBIT margin improvement through till 2025.

Magna Annual Presentation

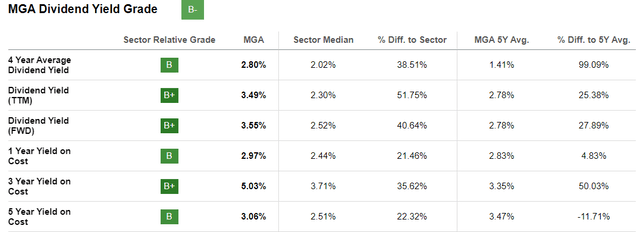

However, the historic share price performance of the company may not foster a sense of reliability. As such, Magna has committed to expanding its dividend offerings, with an 88.16% payout ratio for the year. Therefore, for the company presents an opportunity for both steady-growth oriented investors as well as conservative income-centric investors alike, driven by the growth of generational investments and the stable cash flows of Magna’s existing portfolio of products.

Magna Dividend Yield Report Card (Seeking Alpha)

Wall Street Consensus

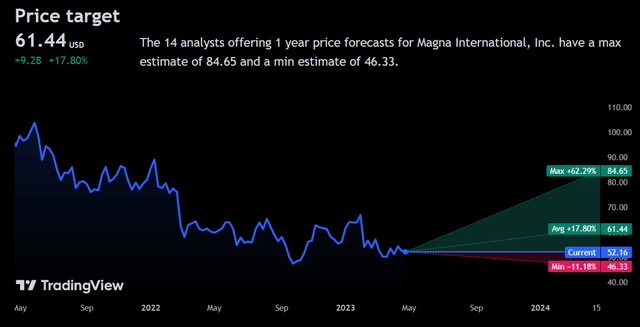

Analysts largely agree with my positive outlook on the company, projecting an average price increase of 17.80% to $61.44.

TradingView

Although a minimum price decline of -11.18% to $46.33 is forecasted by analysts, this is likely a product of the historic headwinds generated by COVID-19 and subsequent effects, rather than some forward-looking guidance or such.

Forward Outlook

With earnings coming out on May 5, it’s important to look at the potential immediate-term price action of the company.

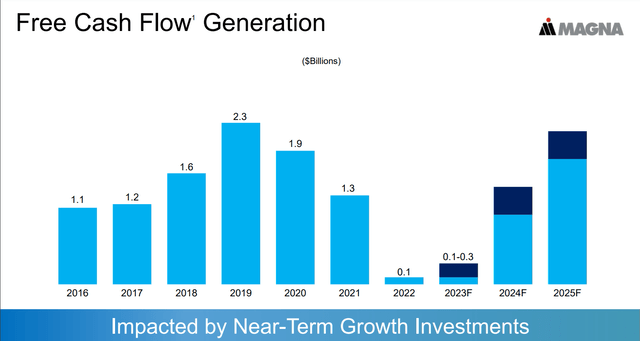

As aforementioned, the company has set forward guidance with the expectation of 6-8% annual growth, accelerated margin action, and improved cash flow and capex investments.

Magna Annual Presentation

Moreover, the company expects a global production rate of 14.9mn light vehicles, putting upwards pressure on scale.

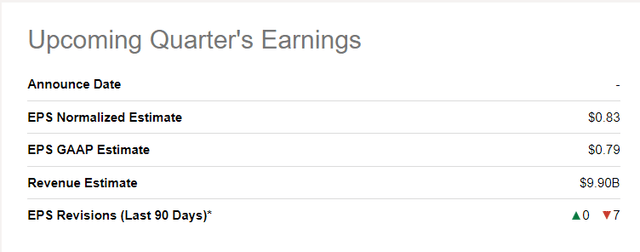

Seeking Alpha

As such, analysts are expecting an upwards price revision, with a GAAP EPS estimate of $0.79/share, up from $0.33/share from the previous quarter. Additionally, analysts project revenue of $9.90bn, up from $9.57bn, which itself was a surprise, further proving Magna’s operational excellence.

Risks

Macroeconomic Interest Risk

As previously described, interest rates present a material risk to the business and its ability to operate with larger margins. Over the past round of rate hikes, Magna has seen end-market demand fall on the consumer end, alongside incremental, inflationary price increases of base inputs. Compounded by the need for generational investments- which come at a cost requiring debt financing- and interest rates continue to pose a risk to the demand and supply of Magna products.

Continued Innovation May Put Upward Pressure on Capex

More than just the price tag of constant innovation and subsequent capex, any further reductions in free cash flow due to the demands of innovation may lead to reduced operational efficacy and a long-term inability to consistently invest. More so than that, the Magna is engaged by competitive intensity by deep-pocketed rivals; the automakers that traditionally purchase from Magna are attempting- to varying success- to backwards integrate, leading to a vicious cycle of increased investment and perhaps decreasing reward.

Increased Consumer Concentration Risk

With companies attempting to vertically integrate and/or consolidating horizontally, Magna’s number of consumers is dwindling. This increased concentration of consumers reduces the pricing power of Magna and may put downwards pressure on already declining net incomes.

Conclusion

In the short-term, I expect Magna will revert to the mean value of its peers and the income provided by it to attract skeptical investors.

In the long-term, the combined portfolio of novel products and stable income generated by its legacy products will ensure margin expansion and potential scale expansion and lead the company into steady price appreciation.

Read the full article here