Thesis

I believe that Global-e Online Ltd. (NASDAQ:GLBE) provides a unique investment opportunity in the rapidly growing sub-sector of e-commerce, specifically cross-border direct-to-consumer (D2C) transactions. I anticipate that D2C cross-border sales will become a significant portion of the global e-commerce market, which is projected to reach $7 trillion by 2025. Global-e only has a fraction of the market share, highlighting its potential for substantial growth. I view the stock as a buy and base my end-of-year price target of $45 on an EV/revenue multiple of 11x on the FY24 estimate.

Company Overview

Global-e Online provides a complete, end-to-end platform to enable and accelerate global, direct consumer cross-border ecommerce to merchants of all sizes across the globe. The company was founded in 2013 in Israel by Amir Schlachet, Shahar Tamari, and Nir Debbi, who currently serve as CEO, COO and President, respectively. The company operates out of seven global offices across the U.K., the U.S., the E.U. Israel and Japan.

Better than Expected Quarter on the Back of Higher Consumer Spending

Global-e reported better-than-anticipated financial results for the first quarter, as consumer spending exceeded management’s conservative estimate in the current economic climate. The company’s gross merchandise value (GMV) growth of 54% year-on-year demonstrates the effectiveness of Global-e’s value proposition in attracting new customers and driving revenue visibility through expansions. Despite macro uncertainties regarding consumer spending, Global-e’s ability to achieve an 800-basis point increase in adjusted EBITDA leverage to 12.3% while maintaining over 50% revenue growth is commendable. Looking ahead, I expect cross-border sales and the forthcoming release of SHOP Markets Pro to sustain high revenue growth rates in the medium term.

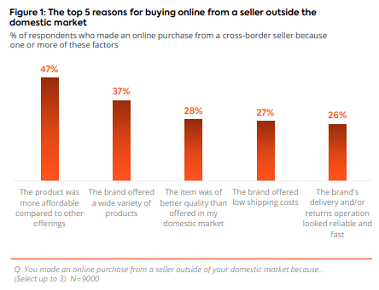

Demand for GLBE’s Platform Continue to Accelerate

While a key topic for e-commerce companies and technologies over the past two quarters has been the normalization of e-commerce growth post-pandemic, however, this has not been a headwind for Global-e given the penetration of cross-border as a mix of total e-commerce sales remains low at about 20%. Cross-border also continues to grow at a faster rate than the overall market, as larger and larger brands are increasingly prioritizing cross-border in their strategic growth plans. Given the complexity of building out and maintaining this infrastructure internally, merchants are increasingly turning to Global-e’s best-of-breed solution to facilitate these processes for them. This was represented in Global-e’s recent 1Q22 earnings report, where the company noted merchant bookings in the quarter were roughly double the previous year’s 1Q, while these bookings are comprised of larger and larger merchants. An example of this is GLBE’s recently announced deal with Adidas, where the company signed a deal to roll out GLBE’s platform across 16 global markets initially.

Company Report

Merchants Increasingly Prefer Global-e

Even if large merchants have sufficient sales volume to justify establishing local infrastructure for conducting foreign sales, maintaining and operating such infrastructure at an optimal level requires ongoing effort and expertise. The challenges of scalability become even more pronounced when expanding to numerous countries, each with its own unique requirements, especially when the revenue contribution from each additional country is relatively small. While merchants may initially believe that an in-house solution could be better for profitability, the continuous complexities, opportunity costs, and lack of extensive global domain knowledge often outweigh potential savings. Instead, merchants could allocate their time and capital more effectively by focusing on increasing website traffic while entrusting Global-e with handling all other aspects. Although large merchants may already have some localized infrastructure in certain markets, they still rely on Global-e’s multi-local offering to facilitate localization in those markets and manage the end-to-end process in others. It is worth noting that the company has observed an increasing number of these large brands recognizing the value provided by Global-e and subsequently deciding to dismantle their own localized infrastructure and transition all operations to Global-e.

Valuation

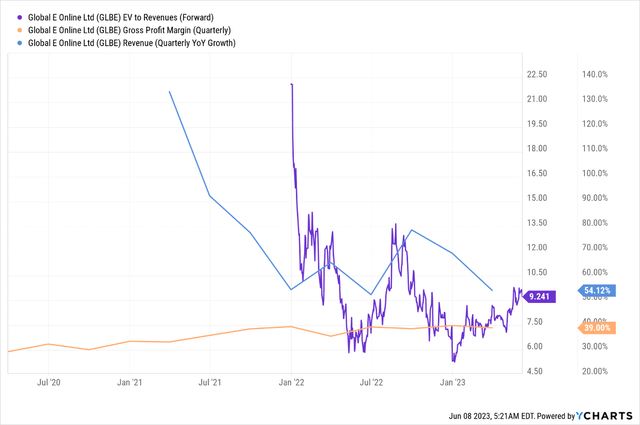

Since the company has not yet achieved profitability, my primary valuation method for GLBE is EV/sales. My price target is based on an EV/revenue valuation methodology. GLBE trades at an EV/revenue multiple of 9.2x. Recently, similar growth software companies that appear to have durable revenue growth above the 40% level, like Shopify Inc. (SHOP) and EngageSmart, Inc. (ESMT), have traded at 10x-15x revenue.

Global-e’s strong revenue growth over the last two years has driven significant leverage in its operating model as it has attained a level of scale to properly digest recent growth investments. However, although the company has achieved positive EBITDA, I expect the company to keep its focus on growth and continue to post GAAP net losses in the medium term.

Although I do not expect Global-e to sustain its pandemic-boosted 50%+ revenue growth, I do believe the company can drive 40%+ growth for several years with proper execution. I base my end-of-year price target of $45 on an EV/revenue multiple of 11x on the consensus analysts’ FY24 revenue estimate of $581 million.

Ycharts

Risks

E-commerce has seen rapid expansion in recent times, particularly fueled by the surge in online shopping during the COVID-19 pandemic. However, the macro-slowdown has had an impact on the industry, and the growth of e-commerce will decelerate in the upcoming years. According to the Global Retail E-commerce Forecast 2023 published by Insider Intelligence, the sales growth of retail e-commerce is projected to increase by 8.9% this year. This marks a significant decrease compared to the double-digit growth rates of 26.7% in 2020 and 16.8% in 2021. The slowdown in e-commerce growth hence poses a risk to topline growth of Global-e.

The slowdown in spending also poses a risk to the path to profitability of the company. Although GLBE is EBITDA profitable, the company has continued to post losses on a net income basis, and a slowdown in spending would cause further headwinds in achieving profitability in the near-term. Moreover, Global-e’s product and pricing structure have relatively low barriers to switching, making it comparatively simple for customers to transition away from the platform if they perceive a decline in Global-e’s services.

Conclusion

Global-e has not been affected by the normalization of e-commerce growth post-pandemic, as the company continues to grow at a 50%+ rate. Global-e’s best-of-breed solution is preferred by merchants due to the complexity and maintenance required to build and operate cross-border infrastructure internally. The global e-commerce market is projected to reach $7 trillion by 2025, and I view GLBE as well positioned to benefit from the growth of the overall market. I view the stock as a buy and base my end-of-year price target of $45 on an EV/revenue multiple of 11x on the FY24 estimate.

Read the full article here