Investment Thesis

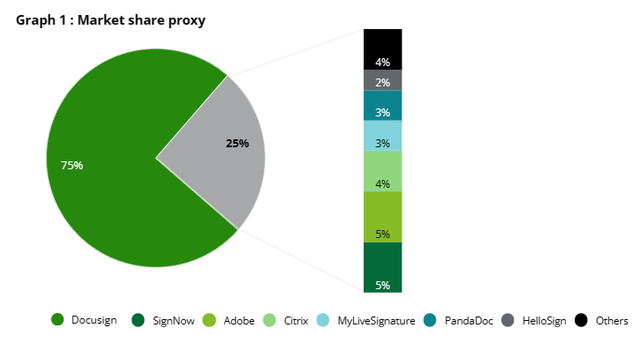

DocuSign (NASDAQ:DOCU) has experienced an initial reaction of 14% rally but reversed its gains and closed at 5% before market closed. DOCU provides an eSignature solution, capturing over 75% market share, which helps businesses manage contracts digitally. The company significantly benefited from the pandemic as more enterprises adopted electronic signatures in a decentralized working environment, leading to a substantial growth in their customer base and total revenue.

Deloitte

However, DOCU is not a high growth company anymore. As the pandemic’s tailwind faded, the company is facing many challenges in maintaining growth. The revenue growth dramatically dropped from 45% YoY in FY2021 to 19% YoY in FY2023. According to Deloitte, the eSignature industry is projected to grow 28%-30% CAGR from CY2023 to CY2026. However, the company only guided a single digit growth of 8.1% in FY2024. This divergence from the industry growth projections indicates structural headwinds ahead. While leadership changes and ongoing restructuring efforts may contribute to the company’s short-term growth slowdown, I’m more concerned about a deterioration of its long-term growth trajectory.

Despite DOCU’s decent 1Q FY2024 earnings results and better-than-expected forward guidance, I believe DocuSign is losing market share due to its single-digit revenue growth outlook. Although the stock is cheaper than the software industry average, without a significant catalyst, it’s possible that the stock will maintain a value trap. Therefore, I’m neutral on DOCU.

1Q24 Takeaway

1Q24 Presentation

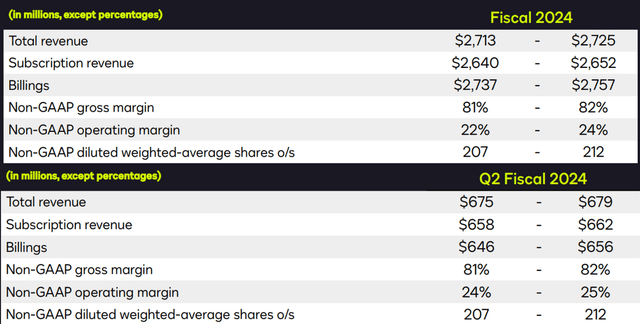

As I mentioned, DOCU reported decent earnings results in 1Q FY2024, beating expectations in both revenue and non-GAAP EPS. The company demonstrated its commitment to cost savings by achieving a 200 bps YoY improvement in non-GAAP gross margin. Particularly, it’s encouraging to see a 23% YoY growth in FCF, especially considering that its top-line growth came in at 12.3% YoY.

Looking forward, the company has raised its revenue and non-GAAP EPS forecasts for 2Q FY2024 and FY2024, which exceeded the upper end of the street estimates. However, it’s worth noting that the company often provides conservative guidance, setting achievable growth targets. We should keep in mind that the projected 8.1% revenue growth for FY2024 suggests a declining growth outlook, potentially impacted by intensified competition in the eSignature industry.

Intensified Competition

DocuSign Website

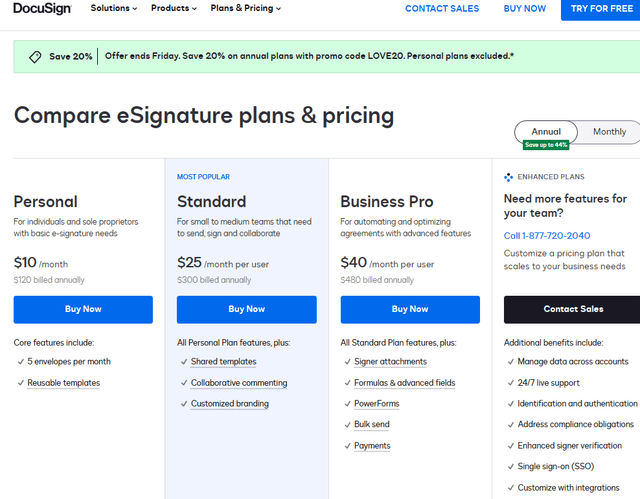

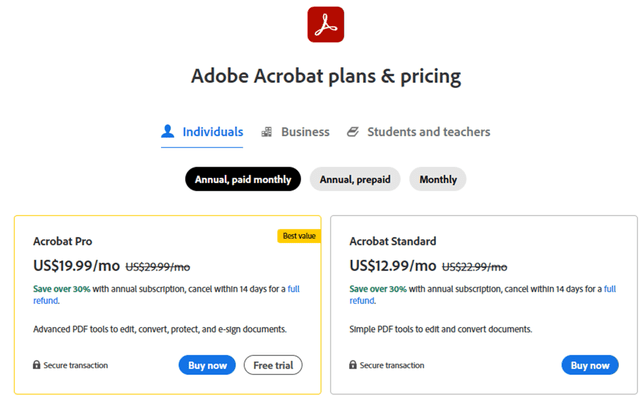

In this increasingly undifferentiated industry, despite a 75% market share, it’s possible that some of DOCU’s customers may express interest in switching to competitors like Adobe (ADBE) due to more favorable pricing. This is especially true for customers who believe they signed unnecessarily large and expensive contracts with DocuSign during the pandemic. Furthermore, there is a trend that customers who perceive basic eSignature as less unique and are less willing to pay a premium for advanced features they may not require. For example, Adobe’s Acrobat Pro is priced at only $19.99 per month, while DocuSign’s Standard plan costs $25 per month, making it 25% more expensive than Adobe’s Professional plan. Moreover, I also can speculate that although Microsoft (MSFT) currently partners with DocuSign, it’s possible that they may develop their own solution for this market in the future.

Adobe Website

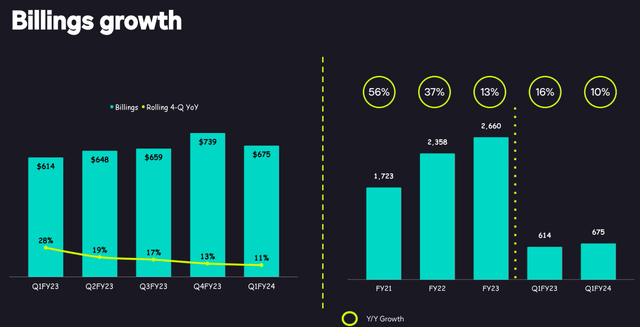

Slowed Billings Growth

1Q24 Presentation

In the software industry, billings are a crucial metric for driving growth. Unlike revenue, which represents the amount of income recognized in a given period, billings reflect the actual cash inflow received by a company. It’s important to note that revenue doesn’t directly represent the cash received from customers.

Billings are calculated by adding revenue to the positive change in deferred revenue (liability side of balance sheet). Deferred revenue represents cash received in advance from customers, which will be recognized as revenue once the company provides the corresponding services.

It’s evident that DOCU has experienced a significant slowdown in billing growth, dropping from 56% in FY2021 to only 13% in FY2023. The company has guided for billings growth of 2.1% YoY in FY2024. However, if we factor in the billings guidance for 2Q FY2024, it indicates a growth of 0.46% YoY. This suggests that despite the current market dominance of 75%, the company may be losing its market share.

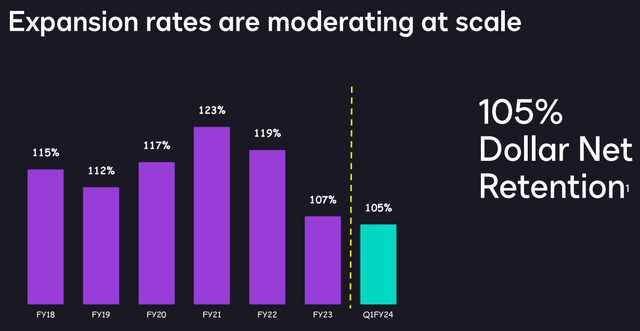

Downtrend In Net Dollar Retention

1Q24 Presentation

Additionally, DOCU had historically maintained a Net Dollar Retention (NDR) over 110%, demonstrating a steady flow of cash generated from its recurring revenue. Sustaining a high NDR is typically associated with an increase in a company’s valuation. According to Stats For Startups, a NDR exceeding 110% is considered best in class. However, in FY2023, we saw the NDR dropped below 110%, suggesting a decline in customer engagement. This decline could be seen as another signal of the company potentially losing market share. Basically, a strong and consistent NDR history can justify a premium valuation for a company. Considering the 105% Net Revenue Retention (NRR) reported in 1Q FY2024, I believe this prolonged deterioration in NRR further supports a lower valuation for DOCU. The diminishing NRR indicates challenges in retaining and expanding customer relationships, which could impact the company’s overall growth and market position.

Valuation

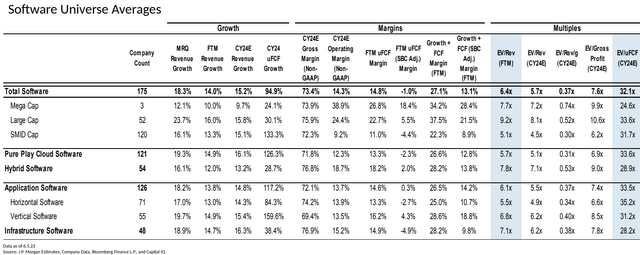

Source: J.P. Morgan Estimates, Company Data, Bloomberg Finance L.P., and Capital IQ

DOCU is currently trading at 4.38x EV/Sales FTM, which is lower than the software average of 6.4x. This lower valuation may lead some investors to argue that DOCU is undervalued and presents a long-term buying opportunity. However, I believe this could be a classic example of value trap. We should keep in mind that the company’s growth potential has significantly decelerated, with a projected growth rate of 8.1% in FY2024, which is lower than any software subcategory presented in the table. This explains that the stock is cheap for a reason. I believe the primary reason behind this is the continued loss of market share by DocuSign.

Conclusion

In sum, while DOCU experienced growth and gained customers due to the increased use of electronic signatures during the pandemic, its growth has since slowed down, mainly because of intensified competition and customers looking for better prices. This raises concerns about DocuSign’s market share and ability to keep customers. It’s important to note that the company’s billing growth is projected to be almost flat in the current quarter, which suggests it may have difficulty maintaining its past growth rate. Furthermore, its NDR dropped below 110% in FY2023 and is expected to be 105% in 1Q FY2024, indicating a decrease in customer engagement and a potential loss of market share. Given the projected growth rate of 8.1% in FY2024, which is significantly lower than the industry’s long-term forecast, it’s possible that the stock has fallen into a value trap. This means that while the stock may look cheap, the weak growth potential suggests there may be a structural headwind impacting the company’s performance. Therefore, I’m neutral on DOCU.

Read the full article here