I was recently asked to write a Dogecoin (DOGE-USD) article. My initial reaction was, in my opinion, a rather predictable and conformist response. I viewed Dogecoin largely as a joke with no chance of long-term price appreciation or widespread adoption. It is simply a digital asset created as a joke and pumped up by celebrities like Elon Musk via social media. This mainstream viewpoint looks at Dogecoin and all “memecoins” as something to ignore for serious investors. Though I still maintain this perspective in spirit and practice, as I do not own any DOGE nor plan to in the foreseeable future, I think there are certain merits to Dogecoin which detractors should be aware of. This article summarizes those findings.

What is Dogecoin and DOGE tokenomics?

The doge meme comes from a 2010 picture of a Shiba Inu dog. It is meant to be an adorable dog whose internal thoughts are written in broken English. The thoughts seem very scatterbrained and sometimes affectionately sarcastic. Doge was a very popular meme and was even named the Know Your Meme “top meme” in 2013. Dogecoin was created that same year.

Doge Meme (Wikipedia)

DOGE is the native cryptocurrency of the Dogecoin blockchain. This chain was a fork of Litecoin (LTC-USD), which itself was modeled after Bitcoin (BTC-USD). Litecoin is sometimes referred to as the “silver to Bitcoin’s gold.” This metaphor alludes to the history of bi-metallic monetary standards where gold was the solid, large-transaction medium of exchange while silver was used for more day-to-day purchases like buying a loaf of bread. Litecoin’s ~2.5 minute block time is about 4x faster than Bitcoin’s 10 minute block time, which theoretically makes it more user-friendly in everyday transactions. Dogecoin’s block time is even faster: 1 minute.

Dogecoin uses proof-of-work consensus, where miners have to solve mathematical puzzles to add the next block to the blockchain. By doing so, they help settle DOGE transactions and are compensated with fees (paid in DOGE by users) and block rewards (brand new DOGE created with each new block). This is how all proof-of-work chains function.

Dogecoin’s creation was admittedly a joke. However, this does not preclude the technology from working as intended. Dogecoin is a functioning, decentralized network which can facilitate value transfers. It is secured by a sizeable hash rate.

One initially off-putting feature of DOGE was its uncapped supply. Upon closer examination, I found that Dogecoin simply has a fixed tail-emission. Each new block provides a 10,000 DOGE block reward and 1 block is added every minute. This means about 5.2 billion DOGE is added to the token supply annually. Because there are currently around 140 billion DOGE, this works out to an annual supply inflation rate of 3.7%. And, since the denominator (token supply) increases each year but the numerator (5.2 billion new DOGE) stays the same, the annual inflation rate will asymptotically approach 0. However, it will be higher than 3.5% for many, many years. Other coins such as Monero (XMR-USD) have a similar kind of tail emission with a decreasing inflation rate. There is a case to be made that tail emissions incentivize continuous block creation, and thus preserves security, even when network activity lulls.

New Transaction Volume Highs

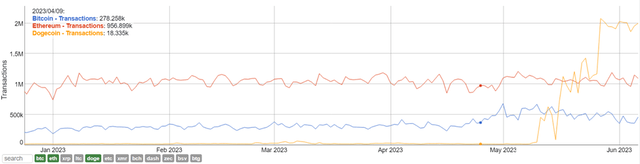

Dogecoin’s transaction volume has recently increased to new highs, prompting a few headlines to call attention to this development. Notably, Dogecoin managed to exceed the daily transactions of Bitcoin and Ethereum (ETH-USD).

Transaction Volumes BTC, ETH, DOGE (BitInfoCharts)

First, it’s good to put this headline into context. Because Dogecoin is forked from Litecoin, it is already designed to handle more transactions than Bitcoin. The fact that it hasn’t done so until very recently just means that there hasn’t been much interest in using DOGE as a medium of exchange. This brings us to the second point, which is the reason for the recent surge in transactions on Dogecoin.

If you are watching the crypto space, you might have heard about Ordinal theory and adding inscriptions to individual satoshis on Bitcoin. The idea is that because there is a finite amount of satoshis, one could assign numbers to each one and inscribe data on them. This movement has prompted an increase in the Bitcoin transactions, mainly to mint NFTs on Bitcoin by inscribing images or video data to satoshis. The same process can be done on Dogecoin. The scramble to create these inscriptions on the biggest memecoin was basically what triggered the recent surge in Dogecoin transaction volume. A similar increase in transaction volume and fees has been happening on Bitcoin.

As the hype around Ordinals inscriptions dies down, this spike should dissipate. For now, inscriptions on both Dogecoin and Bitcoin have been used on relatively meaningless things like images and JSON text. Although there is a decent case that inscriptions can be useful, it is highly doubtful that a useful implementation of inscriptions will materialize on Dogecoin.

The main value of inscriptions is that data will be permanently etched into a blockchain. There is potentially tremendous value in this. However, Bitcoin has much more security and immutability than Dogecoin owing to its much higher hash rate. Economically serious usage of inscriptions are likely to dismiss non-Bitcoin chains. Lacking new developments, there is no reason for Dogecoin’s transaction volume to stay elevated.

Where Things Turn Bearish

No blockchain can serve as payments infrastructure totally by itself. The current monetary system relies on layers, and a monetary system using digital asset payments must also scale via higher layers. This is why Bitcoin’s Lightning Network and Ethereum’s rollups are getting more attention nowadays.

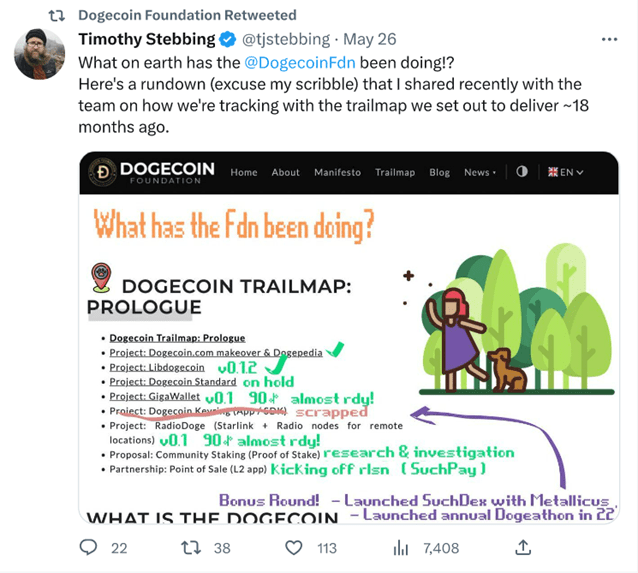

Dogecoin will not be ready to handle serious payments without a L2 solution. The current development roadmap pushed out by the Dogecoin Foundation focuses on platform integrations and wallets, rather than L2-based scaling. It also doesn’t focus on scaling the base layer.

What’s more concerning is that the progress updates are put on Twitter by the Foundation’s project lead, but not written into the Foundation’s website.

Dogecoin Trailmap Update (Twitter)

Also, both the Foundation’s blog and announcements page have been untouched since the year began. If there is less interest in developing on Dogecoin, the network will stagnate over time.

The most bearish aspect is that DOGE is attempting to be currency. There indeed isn’t an economic use case for the blockchain besides currency and inscriptions. The same can be said for Bitcoin and BTC. Trying to be currency means an object must engage in the competition for liquidity. There isn’t a reason why DOGE could beat the biggest digital asset, BTC, at this competition. In the long term, people converge on a single money. Today, it is the U.S. Dollar. In the realm of digital assets, the king is undeniably BTC.

The Bull Case for DOGE

The meme and humorous context behind Dogecoin is likely the best path to DOGE maintaining its relevance. As long as people find the concept behind DOGE amusing and desire to use it for transactions, it will remain. Amusement is value, even if it is not in the textbook sense of generating a yield or being a financial store of value. Thus, the bull case is rather fickle, and based on what can be described as a niche sentiment at best.

Despite this, DOGE is not a scam. It is not a pump-and-dump scheme even though people may have used it as such in the past. The blockchain is sufficiently active and functional. The underappreciated fact is that DOGE’s brand is certainly more approachable than most crypto today. That gives it potential to stick around and grow.

I have often thought that Bitcoin is a good product with awful public relations. The very outspoken Bitcoin bulls, labelled “Bitcoin maxis,” tend to appear cultish and off-putting, even to the crypto industry. Extremism and ignorant biases are nearly always bad for investing. Contrast that with Dogecoin’s lighthearted, easy-going, and wholesome brand image and there is a non-zero chance that it could hold its own as a bright image of positivity in an otherwise cutthroat world.

Wholesome Message of Dogecoin (Dogecoin Foundation) Do Only Good Everyday = DOGE (Dogecoin Foundation)

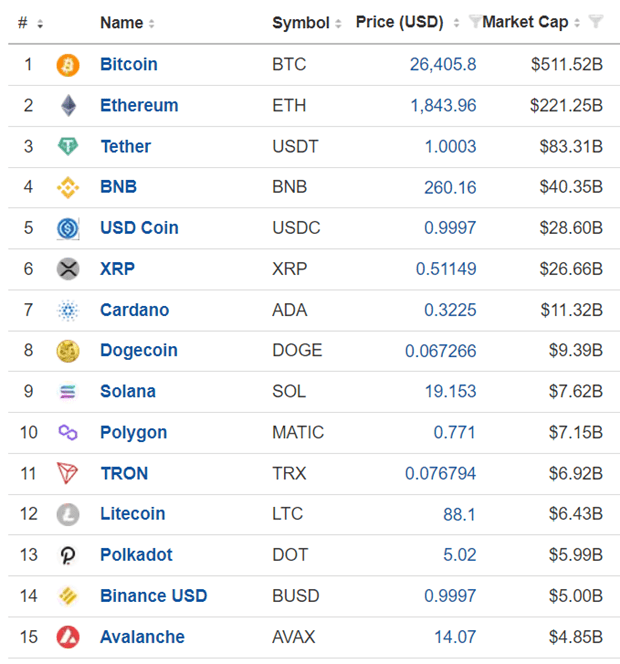

DOGE is the biggest memecoin in the market and the fact that it has remained in the top 10 cryptocurrencies by market cap is quite impressive. What’s more is that it is actually the second largest payments coin that is not a stablecoin. Not bad for this friendly Japanese canine.

Crypto Ranking By Market Cap (Investing.com)

Conclusion

I rate DOGE a hold. It doesn’t make financial sense to invest in a money-candidate that has very little chance of winning a liquidity competition within its own category (digital assets). Development seems to be slowing and the roadmap is focused on things which are unhelpful or inadequate for providing utility as a payment system. But it doesn’t make sense to short sell this either! The borrowing fees are high and it is not worth the risk of a FOMO-induced melt-up.

Despite its apparent lack of utility, DOGE has proved quite resilient in holding its position as a big player in crypto. It isn’t one of those highly inflationary smart contract tokens which mercilessly dilute investors. And it has clear potential to stick around based on its own merits, no matter how uneconomic this merit might seem. As the doge meme would say “much wow!”

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here