Investment summary

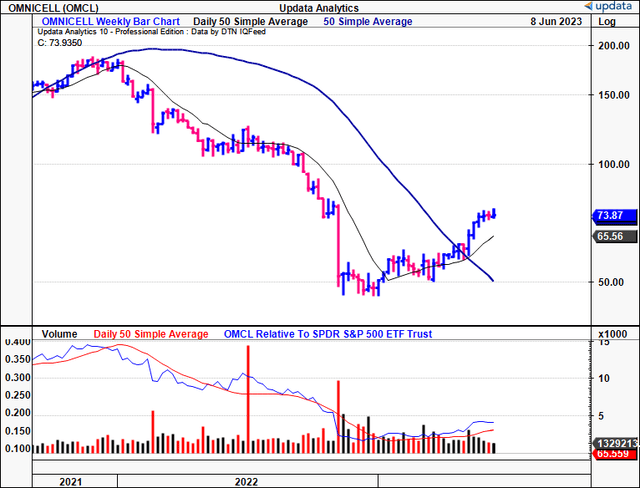

Investors scouring through the market’s depths may be forgiven for overlooking Omnicell, Inc. (NASDAQ:OMCL) amid the latest broad-market rally. The company’s stock price is up 43% this year to date. It is now at a critical juncture, with the 50DMA crossing the 200DMA in April, prior to repricing higher for 6-consecutive weeks.

For the consilient investor, education of the firm’s economic characteristics is telling. Earnings growth comes at the cost of shareholders, and the firm is unable to throw off more cash for its shareholders without jeopardizing its growth route, and vice-versa. Forward revenue and return on equity projections aren’t conducive to today’s buyer, even on conservative estimations. Despite doing another c.$350mm in business over the last 2-years (trailing figures), this hasn’t pulled-through to gross or operating leverage, for these reasons. With the abundance of selective opportunities available elsewhere, OMCL fits in as a hold in my coverage universe. Reiterate hold.

Figure 1.

Data: Updata

Critical facts – Q1 numbers

OMCL pulled Q1 revenues of $291mm, 9% YoY decline on core EBITDA of just $7.7mm. It reported in May, thus absent is the post-earnings drift or bullish convergence required to attract investment, now that we are in June, nearly 2-months later. At odds with my own investment criteria, the sequential and YoY downsides result from 1) capital budget constraints, and 2) fewer point-of-care (“POC”) revenues.

Point of care is a necessity within the primary health and medicinal care markets. Clinicians work in multidisciplinary teams to provide diagnostic markets across a range of disease segments. The Covid-19 pandemic, in all its calamity, was kind to the POC industry. OMCL included. It opened a new window for specialist diagnostics firms to expand their POC offerings. The downside- it has saturated the treatment market, such that growth looks lumpy going forward. Estimates point to 5.1% annual compounding rate to 2030, well behind more lucrative avenues. Plus, the market is filled with lifesciences giants, such as Thermo Fisher (TMO), Becton, Dickinson (BDX), Nova Biomedical, Hoffman-La Roche, and others- hardly the competition you’d want to be up against in an already choppy macro-landscape.

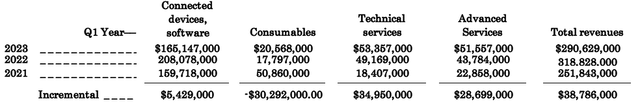

One might look to forgive the declines on the back of management’s transparency. That would be acceptable, if not for the fact such unfavorable financial trends have been in situ since Q1 FY’20 across the bulk of OMCL’s operating segments, as observed below:

Data: Author, OMCL SEC Filings

However, it is crucial to note that the company’s services revenues for the first quarter of 2023 increased by 12% since FY’21, indicating the effectiveness of OMCL’s digital transformation strategy. Since Q1 FY’21, the firm has added another $39.7mm in incremental turnover, even with the $28mm pullback from Q1 last year. Inventory has been well managed nonetheless, with $6mm in value written down in Q1 to reduce NWC intensity by that amount. Whilst not intended too, this frees up additional cash with the firm’s cost containment strategy, begun in November FY’22. Since the plan was implemented, OMCL reports a 21% reduction in office space square footage, and is progressing to reduce headcount where able.

The importance of OMCL’s decision to pare back asset intensity cannot be understated. Consider the following:

- Total savings to operating expenditures are expected to amount to ~$50mm in 2023.

- That would bring the firm’s pre-tax earnings back above the paltry $21.1mm in the TTM.

- Had these been realized in FY’22 you’d be looking at OMCL doing $158mm in annual operating income vs. $6.9mm recorded (excluding R&D investment).

Finishing up with the quarter, management project Q2 turnover of $288mm at the upper end of range, that could pull down to adj. earnings of $0.25-$0.35 ($1.01 annualized). At the present price of more than 45x forward earnings, the payback on this couldn’t be justified without the most exceptional of growth rates to lie ahead of OMCL. As it would turn out, my estimates don’t place the company in with this category.

Economic losses on accounting profits

For the equity investor, the fundamental role a company is to compound its intrinsic valuation over time. For investors in public equities, one thought is market is an accurate judge of intrinsic value over time. That is to say, it will reward companies that demonstrate their ability to grow earnings whilst still spinning off piles of cash to its owners. Oftentimes, this combination is not feasible, nullifying the company’s status as investment grade. But what evidence exists of this success in the first place?

Ideally, you’d look to see one or both of a) the firm’s rotation of capital retained/invested into additional market valuation, and b) high returns on existing and new capital above the required rate of return (in this instance, 12%).

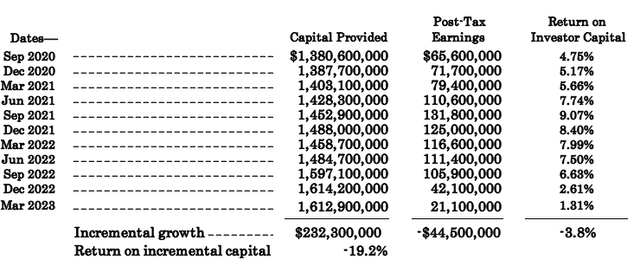

Much effort is devoted by analysts in the showcasing of financial results, things like sales and earnings growth, earnings multiples, and so forth. Not so much is dedicated to understanding the economic characteristics of a business. A more thoughtful analysis is needed on the ability to create value. To this point, OMCL has eroded shareholder value over the last 2-years, evidenced in the below record:

Data: Author, OMCL SEC Filings

For their capital provided to the business (debt, equity), investors have been treated to sub-6% returns on the firm’s incremental investments each period. Across the entire time, post-tax earnings decreased by $55.5mm despite a further $232mm capital investment at work in the field. This equates to a negative 3.8% return on owner’s capital as a shareholder of the business (presuming one own’s the stock, if not, there’s no opportunity missed). In the meantime, you could have simply ridden the benchmark for 12-15% compounding returns over this same period.

Alas, investors who bought the stock during the pandemic were in the hope of being treated to dinner and a show, except the show was one of negative economic earnings, sub-standard returns on investment, and ultimately, an erosion in quoted market value.

Economic earnings, those profits/losses above or below the opportunity cost of capital, are paramount in creating shareholder value and attract equity investment. Buyers are happy to bid a higher price in expectation of returns above what’s generally available, whereas investors are happy to sell at the higher price ranges.

The implications of this are telling. One way to visualize it is to track the value of $1 over time in the company’s hands versus a hypothetical investor. Here, we presume the investor can achieve a 12% return into perpetuity (not far off the long-term market averages), and OMCL invests at its recorded rates. Note the value of $1 compound from 2020-date:

Data: Author, OMCL SEC Filings

At the hurdle rate, the investor enjoyed an additional $1.20 in investment value given the compounding at 12% each period. Comparatively, OMCL investors enjoyed $0.62 – around 50% or $0.58 discrepancy. Such critical thinking reveals a great deal on the market’s psychology. Investors are in search of the most efficient use of capital- efficient fancied as reward to risk in this instance. Capital must be valuable in any agent’s hands in order for it to increase in value over time. For it to increase in value, it must be invested at a positive return, one that is above the hurdle rate. Otherwise, no value has been created, given the opportunity cost. Hence, if you’re going to leave even $1 against a company’s market valuation, capital must be valuable in said company’s hands. It must be investing at rates above the benchmark.

It goes without saying OMCL’s economic statistics don’t stack up in this regard. Would you be happy accepting a 4-6% range on capital when the market is paying you 10-12% just to ride the S&P 500 over the long-run (presuming history rhymes with itself)? Most likely not, and, typically, neither is the market. Hence the lackluster stock-price performance OMCL has exhibited over the last 3-years to date.

What this means for factors of growth and valuation? Not much positive in my view, especially now that investors are commanding a higher equity risk premium in the walk-through FY’23. What is certain, the market won’t be piling into OMCL’s equity any time soon if these trends persist.

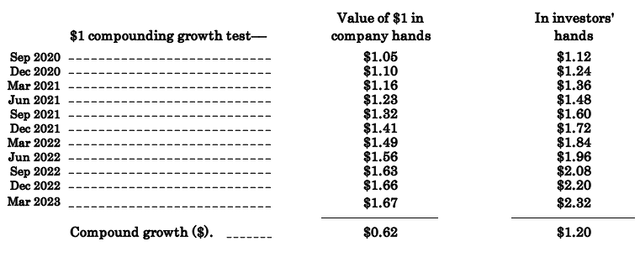

Growth estimates match sentiment

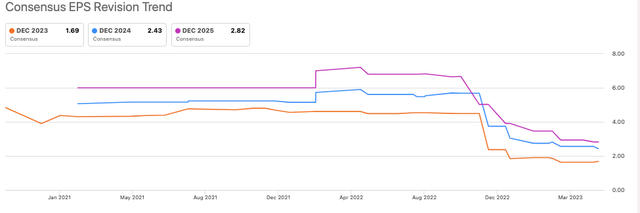

Consensus expectations are at 2-year lows following a large re-rating in April and again in December last year. The range is $1.69-$2.82 in FY’23-’25, quite the breadth. Subsequently analyst sentiment is poor on OMCL at this point in time in my view. In contrast, the stock has curled off 52-week lows in recent times and is trading above all moving averages. There is no in the money options chain for June expiry to suggest investors are aggressively positioning either way on the long or the short account.

Figure 2.

Data: Seeking Alpha

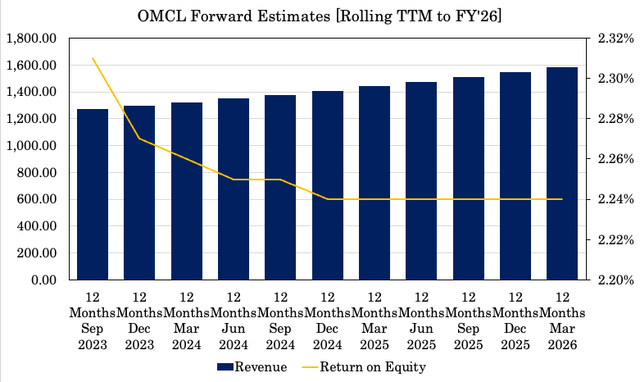

Looking out to FY’25, my growth assumptions have the company doing nearly $1.6Bn worth of business but the return on investor equity from this isn’t as appealing in my modelling. I’ve got this rolling off heavily into the coming periods as noted below. These findings support earlier analysis around the company’s ability to create value for its equity holders. It would appear further value-erosion could be expected should these assumptions come to fruition.

Figure 3.

Data: Author, OMCL SEC Filings

Valuation and conclusion

Forty-five times forward earnings or 45x P/E, that’s what investors are trying to sell OMCL at the time of writing. Just let that sink in for a second. That is $45 for every $1 in the company’s future earnings. Future earnings that are projected to decrease by 44% in FY’23 according to the sell-side. It also suggests that, assuming no earnings growth, and a hypothetical 100% payout of earnings to shareholders, it would take a swift 45 years before we receive payback on that multiple. Naturally, this is not acceptable.

Analysts are valuing the company on earnings and EBITDA factors and both are obscenely priced at 125% and 244% premium to the sector, respectively. Based on key findings in this report, I do not believe OMCL deserves this premium, not when you can pay 20x for the sector, and get a diversified basket of healthcare longs.

At the current market cap. of $3.36Bn and a 12% discount rate, the market expects $403.5mm in future cash flows from the company over a future horizon (403.5/0.12 = $3,360). To me this would suggest a return to long-term range, and calls for 23% annual compounding growth in pre-tax earnings to FY’28 from the company’s FY’19 numbers (145x(1+0.23)^5/0.12 = $3,400).

My estimates do not suggest there is reason to expect differently from the market in this instance. I am looking to the company hitting $80mm in FY’23 core EBITDA and clip $75-$80mm in free cash flow. Taking the sector multiple of 16x to this (OMCL’s market multiples are unusable) I’m getting to $70–$71 share over the coming 2-years, below the current market price and thus supporting a neutral view.

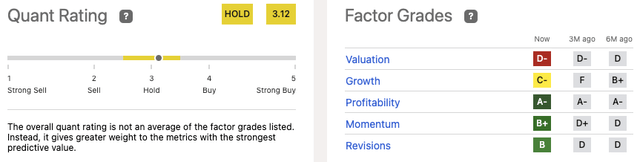

This is heavily supported by findings shown in the quant grading system which also indicate the firm is rated poorly on valuation and growth factors.

Figure 4.

Data: Seeking Alpha

Net-net, findings from this OMCL analysis corroborate a series of meaningful challenges that must be overcome in order to attract serious buyers. In particular, the lack of economic earnings makes it difficult to re-rate the stock higher on fundamental, sentiment of valuation-based reasons. In that vein, whilst there were positives in Q1, these don’t outweigh the uncertainties for mine, and therefore in my opinion the market has got OMCL marked correctly at its current levels. Reiterate hold.

Read the full article here