Overview

Carvana (NYSE:CVNA) stock is back on the move nearly an entire month after the company’s latest earnings report. The immediate catalyst here is materially upgraded unit gross profitability guidance issued by the firm at a recent conference, with appreciation likely catalyzing shorts to cover their positions in addition to this first order effect.

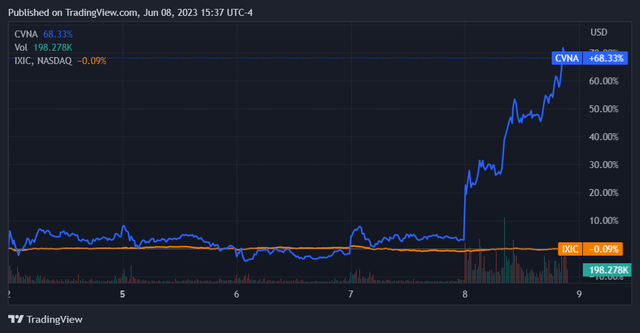

The stock has ticked up a remarkable 59% in today’s trading, posting volatility well into its 2-sigma 20 day rolling range.

Seeking Alpha

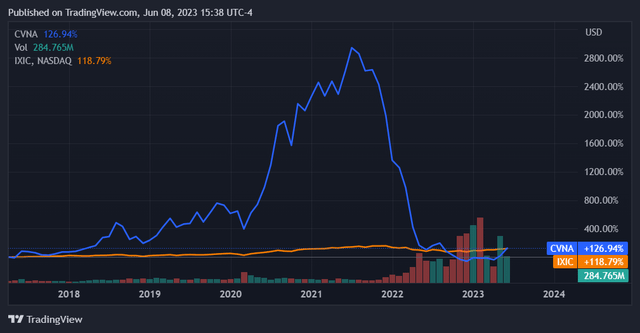

This has materially expanded Carvana’s YTD price return premium over the NASDAQ Composite, with the stock yielding roughly 400% more in appreciation than the index so far this year.

Seeking Alpha

This recent price action has seen Carvana stock cross an important threshold. It now marginally exceeds the NASDAQ Composite’s price return since its Q2 2017 initial public offering.

Seeking Alpha

These charts indicate that Carvana shares could very well be in the early stages of a comeback. While previous, relatively minor, upticks from its trading lows could have been interpreted as a ‘dead cat bounce’, it seems that we are now seeing something much more fundamentally indicative.

Of course, the market could very well be getting ahead of itself. Carvana’s struggles and consistent flirtation with bankruptcy have been well documented. In this article I’ll review what’s changed, where things stand as to the firm’s fundamentals, and if Carvana has the foundations in place to extend this rally into the second half of the year.

Q1 2023 Earnings and Unit Economics

While this price action for Carvana stock is coming in the wake of upgraded guidance recently issued by the firm, it makes sense to quickly review its latest earnings report to see how well it’s positioned to match these newly-heightened expectations. The context, of course, has been one of Carvana cutting costs and improving unit economics as it worked through a slowdown in used car sales and overall lower prices for its inventory throughout 2022.

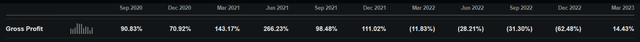

While the company is still experiencing declining revenue y/y, it has made notable progress on improving unit economics as well as its cost structure overall. The company improved gross profit per unit sold to over $5,000, in line with its goal heading into the quarter. This has resulted in Carvana posting its first positive gross profit margin in a year, albeit one that is still well below its previous trendline.

Seeking Alpha

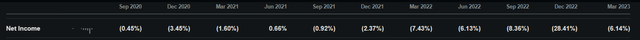

Net income remained negative and in line with the quarterly trendline, discounting the significant inventory write-offs we saw in Q4 2022.

Seeking Alpha

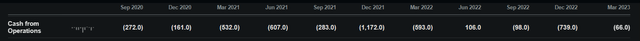

Cash from operations also remained negative in the most recent quarter, although noticeably closer to break-even than what we’ve seen for some time.

Seeking Alpha

The digest here is that Carvana has made progress but has not yet crossed the threshold into profitability or cash-flow generation. As such, it still has something to prove as to its unit economics. Given the material improvements in its margins, however, it appears quite feasible that the company gets to break-even in one or two quarters.

Investors should also note that the company’s cost profile, while leaner, is still at the higher end of where it has been over the most recent 10 quarters; there is definitely still room for improvement here.

An interesting comparison point to illustrate this is the company’s fiscal Q2 2021. Here Carvana had positive operating income at a 2.46% margin. As of last quarter’s margins, a subsequent reduction of 4.03% in operating expenses would bring its cost profile in line with that quarter.

Seeking Alpha

This would still yield a negative operating income for Carvana. Essentially, it has not reached its own recent levels of operating efficiency as of yet. This is likely constrained by ongoing fluctuations in used car prices as opposed to variability in other aspects of its cost profile.

Used Car Prices and Margin Profile

Used car prices have been clawing back lost ground recently, having increasing 4.73% overall during the last 90 days. Year/year, however, they are still down 4.01%. Assuming Carvana can capture roughly half of the trailing 90 days gain (due to inventory delay between buying and selling a vehicle), it should be able to generate an operating income of roughly 1% in this current quarter. Further gains in used car prices would then continue to filter through directly into increased operating margins for the firm.

Considering this further, Carvana could capture this entire price spread of 4.73% and still not have enough margin to make up its most recent 6% net income loss without additional cost reductions. A return to parity for used car prices this year would represent another increase of 4%, and if Carvana were to capture this spread this would result in a scenario allowing Carvana to hit break-even on net income at current expense metrics.

Assuming that the company’s cost profile stays constant and that it can generate improved economics in line with appreciating used car prices, near-term improvements in this macroeconomic factor alone do not appear quantitatively significant enough on their own to swing the firm into profitability for the upcoming quarter.

Forward Context, Valuation, and Risks

While a rising tide of used car prices could very well lift Carvana’s boat in the near-term, the math doesn’t work out too favorably if all else holds constant. Instead we must evaluate management’s most recent forward-looking scenario on its own: an estimated $6,000 gross profit per unit for the present quarter. At last quarter’s roughly $5,000 GPU this amounts to a gross margin gain of 20% and a resultant net income margin of roughly 14%.

This appears readily feasible in light of the company’s recent history and overall cost structure. The caveat here is that this guidance would amount to a record level of per-unit gross profitability for Carvana and a 63% increase y/y. These are aggressive targets, to say the least.

Implicit in this assumption is likely a portion of the used car appreciation effect detailed in the previous paragraph. Nonetheless, it is fair to believe that the market has continued to display positive signals as management has upgraded its guidance in the middle of the quarter. This is a risky play and demonstrates a level of confidence that makes me inclined to believe it will likely happen according to plan.

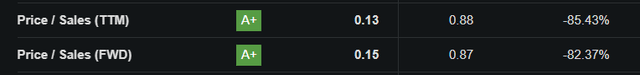

To that end we should then note that Carvana is still trading quite cheaply on a price/sales basis. The market is still heavily discounting any near-term profitability prospects.

Seeking Alpha

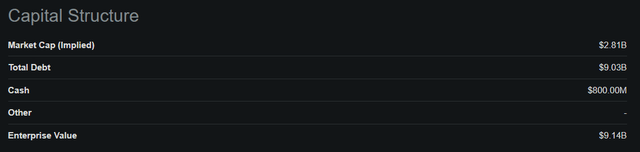

Of course, near-term profitability, if achieved, will still be weighed down by the company’s inferior capital structure. At present Carvana is still carrying $9.03B of debt on a market cap of less than $3B.

Seeking Alpha

As a forward-looking growth stock I think Carvana will end up trading more on its progress towards profitability this year rather than concerns around its capital structure. Its Altman z-score of 1.05 is quite low but has been holding steadily at this level, and – critically – financing has continued to flow. I would consider this a solid valuation to buy in at for long-term buy and hold investors.

The two core risks here are as follows. The first is that management is unable to hit their newly-established expectations for unit economics. This would see Carvana shares lose its recent gains and then some as of the next quarter. Continued traction in this regard will likely add more momentum to its share price.

The second risk is that used car prices do not move up any further. While the summer season is generally a busy one for car retailers, there are numerous indicators of consumer stress playing out across the economy. Sky-high consumer credit utilization and an ongoing high-rate environment could dampen the appeal for new car purchasers. While it is unclear what implicit macroeconomic assumptions management is baking in to its forward-looking view, underperformance in this regard could yield worse profitability than expected and a collapse in the share price. This risk is material in my opinion.

Conclusion

I am cautiously optimistic that Carvana will achieve its guidance in the upcoming quarter and see its share price buoyed further as a result. Given the degree of uncertainty around the consumer environment, however, I am far less optimistic thereafter. As such I think this stock is a good tactical buy through until next quarter’s results but will require reevaluation at that time.

Read the full article here