This article was first released to Systematic Income subscribers and free trials on June 2.

In this article we take a look at the recently announced proposed merger between Ellington Financial (EFC) and Arlington Asset Investment (NYSE:AAIC).

Our approach in this article is to avoid focusing on the press release bullet points, most of which are useful only for lawyers and cheerleaders. We also avoid the merger arbitrage details which is less “arbitrage” and more of a directional bet on the outcome of the merger and, which, while interesting to traders, is less so for income investors.

Rather, we think through some of the implications of the merger (whether it is approved or not) on AAIC senior securities (i.e. preferreds and baby bonds), their valuations and possible future performance.

The Gist

The merger transaction was approved by the boards of the two companies and now needs to be approved by Arlington shareholders. The offer price represents an implied 73% premium to the AAIC stock price on 26-May and a 15% discount to book value as of Q1. EFC will assume AAIC preferreds and bonds.

The obvious question is why is this happening?

The deal is an obvious one for EFC for many reasons. One, they get to grow their asset base which helps with the economies of scale, credibility and issuance costs. From the manager perspective managing more assets is always better than managing fewer assets.

Two, the sizable net operating loss carryforwards at AAIC may be useful for EFC.

Three, as would be the case with almost any other mREIT, AAIC senior securities are attractive given their relatively low level of interest expense (for the simple fact that most mREIT senior securities were issued in a period of lower yields). The baby bonds feature coupons of 6-6.75% while the public preferreds are at 7-8.25%. This is in the context of significantly higher yields on these types of securities at present across the sector.

Four, the 15% discount to book value looks to be at the larger end of the mortgage REIT merger transactions that we have seen.

The deal is fairly obvious for AAIC as well. In short, and to be very blunt, AAIC doesn’t have a clear reason to exist. As we discussed in our last update, AAIC is not taking much risk at all. Its long Agency MBS position of $461m is hedged out with TBAs by 80%.

Hedging Agencies is par for the course for mortgage REITs, however, nearly all hedging is done with non-Agency instruments such as Treasury futures, interest rate swaps and swaptions. The reason is simple – hedging Agencies with Agencies pretty much destroys the point of holding Agencies to begin with. It’s like a hedge fund that holds all the S&P 500 stocks in the right market cap amounts and then holds a short position in S&P futures for 80% of the position.

Yes, spec pools and TBAs do not co-move identically, having to do with various reasons such as that not all spec pools are deliverable into TBAs, differences in liquidity and Fed holdings.

An argument can be made that trading the spec pool / TBA basis can make sense for a sophisticated trading organization but not for a tiny one like AAIC. Moreover, with Agency spreads at extremely elevated levels, a hedged approach to Agencies overall makes less sense at the moment. And finally, the leverage applied to this strategy is too small to generate much volatility and returns, so the clear answer here is that the Agency position is there to avoid losing money.

It would probably raise too many questions if the company simply held an unleveraged position in Agencies which would also deliver little volatility, so a lightly leveraged but mostly hedged position looks like there is still something going on even though there really isn’t.

Outside of the Agency portfolio, the story is pretty similar. There is very little if any leverage applied and a big chunk of the remaining portfolio is in a AAA-rated CMBS position which is marked at $99.

Clearly, if the company is not in the business of actually taking much risk at all (i.e. generating much yield), an exit is the only other reasonable choice. This is supported by the fact that the company has been buying back its own shares at a steady clip, in fact, slowly unwinding itself. A merger achieves much the same thing but faster.

In thinking about outcomes from here on, the key question is whether this is a good deal for AAIC shareholders.

To gauge this question we need to consider what alternatives AAIC shareholders have. Perhaps some investors truly believe in the company and think it can deliver strong results and alpha going forward and these investors will probably vote no. There are probably very few of these investors since it’s clear that, apart from the pretty good recent REO venture, AAIC has not been doing much of anything, so its prospect for delivering strong alpha in the future is small.

The other alternative for investors is for the company to keep buying back shares and unwind itself slowly over time. The advantage here is that investors don’t have to accept a discount to book value however the disadvantage is that this unwind process can take a very long time, all the while paying management handsomely for not very much.

Which brings us to the liquidation scenario. Investors who follow AAIC may recall a liquidation proposal which was defeated with management recommending a vote against liquidation. It’s hard to gauge the costs of liquidating all of the company’s assets including operational aspects such as leases, however, it’s unlikely to be anywhere close to the 15% discount to book value. This suggests that a liquidation would likely be the best outcome for shareholders so there is some risk of them voting no here.

We also need to ask whether the merger is a good deal for AAIC management, since, it is they, after all, who got it to this stage.

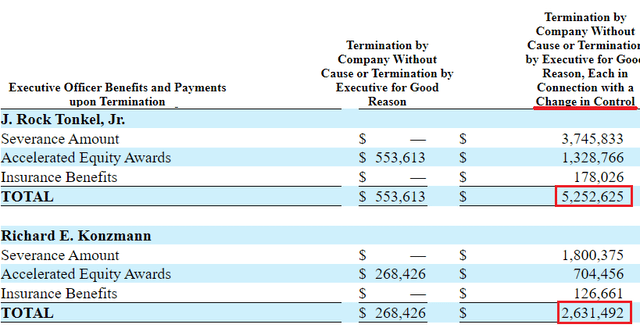

On the face of it, the liquidation scenario, which looks most appealing to the shareholders, should also appeal to management. However, the key difference appears to be the question of compensation. The table below shows there is a significant payout to management in case of a change of control. This table is from 2021 and likely understates the total compensation due to the CEO and CFO as it is dated and uses a lower level of stock price than the merger offer.

The key point here is that these are the rough numbers that get paid to management in an acquisition (i.e. a change of control scenario) while in a liquidation scenario these numbers are not paid out. Nuff said.

SEC

Implications For Senior Securities

There are four public AAIC senior securities:

- Series B Preferred (AAIC.PB)

- Series C Preferred (AAIC.PC)

- 2025 Bond (AIC)

- 2026 Bond (AAIN)

For senior security holders, there are four key factors at play: cost of capital, change in control, risk and management credibility.

As far as cost of capital, it is fair to say that the interest expense on the AAIC senior securities is attractive enough that EFC could very well keep them outstanding rather than redeem them, at least until yields move significantly lower.

For example, the AAIC bonds have coupons of 6-6.75% which is on par with investment-grade bonds and which looks to be roughly 1% below the yields on EFC senior notes. The story is similar with the preferreds.

As far as change of control, the bonds don’t have this feature but the preferreds do. Specifically, the issuer can redeem the preferreds at $25 or the shareholders can convert the preferred into the common at $25. The latter has the same economics as the former (if the common is then sold at the conversion price). Both preferreds rose after the announcement, which likely partly reflects the economics.

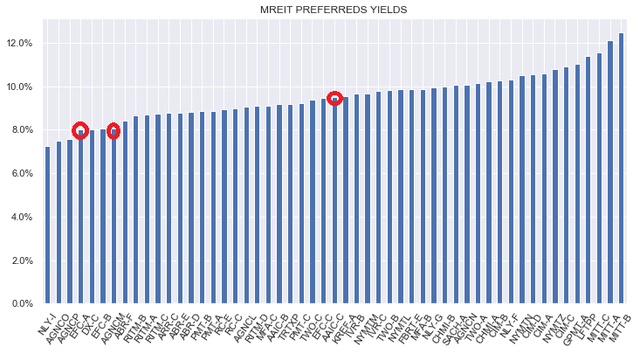

The quality of the new entity is also relevant. We view EFC as a higher-quality hybrid mortgage REIT. Its performance through the COVID period was very impressive which is reflected in its relatively low yields in the overall sector as shown in the chart below. Despite a hybrid stance, the yields on two of its preferreds are lower than many Agency-focused preferreds.

Systematic Income

In our view, the yields on AAIC senior securities should move lower if the merger goes through. From a pure risk perspective, this doesn’t make sense as AAIC takes much less risk than EFC. However, from a management credibility perspective, EFC is clearly ahead which we see in the yield differential between the two stocks (particularly before the merger proposal announcement).

However, it’s also important to keep in mind that while EFC management has higher credibility, AAIC takes much less risk in its portfolio than EFC. On balance, it’s not clear what’s better – a low risk portfolio run by less credible management or vice-versa. The market clearly weighs management more than risk in this case, however, if pressed, we would go with the lower risk option, particularly when evaluating relatively short-term securities (the risk to our view here is that AAIC then starts to take more risk).

Takeaways

In case of merger approval, AAIC senior securities could remain outstanding, and because they will now be associated with a more credible company, their yields would likely move lower (i.e. their price will move higher). There is some chance that the preferreds will be redeemed due to the change of control clause which will be a quick gain for shareholders. Between the preferreds, we would favor AAIC.PC as it has rallied much less than AAIC.PB and offers a more attractive yield, particularly in case of a reset to a floating-rate in 2024. Investors who are banking on the merger going through may prefer AAIC.PB as it trades at a lower price and would deliver a larger gain in case of a change of control redemption / conversion.

And if the merger is not approved then it’s very likely because shareholders know they can get a better deal by having the company terminated. That’s exactly what they tried to do recently but the move wasn’t approved. Now that people are paying attention to the mathematics, it might get a different result.

If the deal is not approved, it puts something else in play which is the restart of common dividends on the stock. Out of all the ways to sharply close the discount-to-book gap, this is it. So if the merger falls through, this might be on the cards. That would also be good for the AAIC securities as it would lift a cloud and make it more of a “normal” mREIT. This should also result in a drop in yields for AAIC senior securities.

We continue to favor the AIC bonds given their highly defensive posture and an attractive yield of not far from 9%. The bonds have not reacted to the announcement which also means they have little downside if the merger fails.

More tactical investors may find AAIC.PC more appealing given the potential change of control upside, less downside than AAIC.PB in case of merger failure and a higher yield. It also features a double digit reset yield or the yield expected on its first call date in 2024 (based on current forward rates) when it converts to a floating-rate preferred, unless it’s redeemed.

Read the full article here