Author’s note: This article was released to CEF/ETF Income Laboratory members on May 25th.

I’ve written about the Saba Closed-End Funds ETF (BATS:CEFS), a diversified fund of CEFs, several times in the past. I’ve been bullish, due to the fund’s diversified holdings, strong 9.1% distribution yield and performance track-record. I’ve also been concerned about the fund’s large short treasury position, and feared it could lead to losses if treasuries were to rally. Treasuries have rallied, but the fund has continued to perform quite well, due to savvy trades and investments in its overall portfolio.

CEFS’s strong 9.12% dividend yield, strong long-term performance track-record, and recent gains, make the fund a buy. Due to the fund’s diversified holdings, it could function as a core portfolio holding.

CEFS Basics

- Investment Manager: Saba Capital

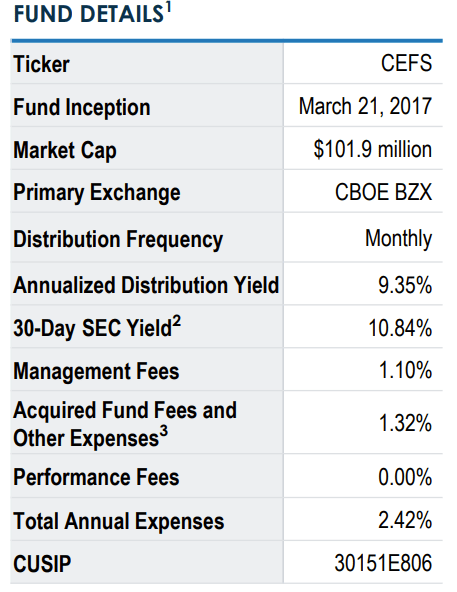

- Distribution Yield: 9.12%

- CEFS Management Fee: 1.10%

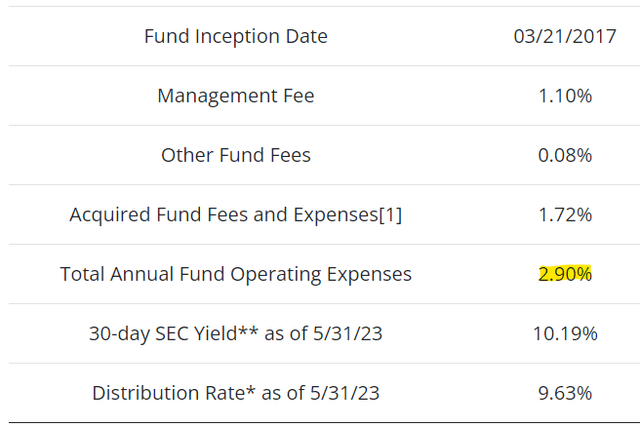

- Expense Ratio: 2.90%

- Underlying Funds Discount: 13.5%

- Holdings: 39

CEFS Overview and Investment Thesis

Diversified holdings

CEFS is an actively-managed ETF, investing in a diversified portfolio of fixed-income and equity CEFs. It is administered by Saba Capital, a small investment management firm, with experience investing, trading, creating, and operating CEFs. Saba is famous for launching activist campaigns on discounted CEFs, a strategy employed by / which benefits CEFS itself too.

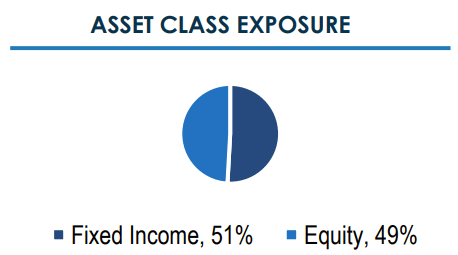

CEFS tends to focus on fixed-income CEFs, with these generally accounting for 60% – 66% of the fund. Right now, the fund is roughly evenly split between fixed-income and equity funds.

CEFS

The above is almost certainly due to a specific trade, investment, or position meant to boost portfolio returns. Specifically, it seems that the fund is holding a significant overweight position in the BlackRock ESG Capital Allocation Term Trust (ECAT), and equity fund. ECAT accounts for 21.2% of the fund’s portfolio, and increases the fund’s overall equity allocation. Once the ECAT trade or investment is completed, the fund’s fixed-income allocation should increase to average levels,

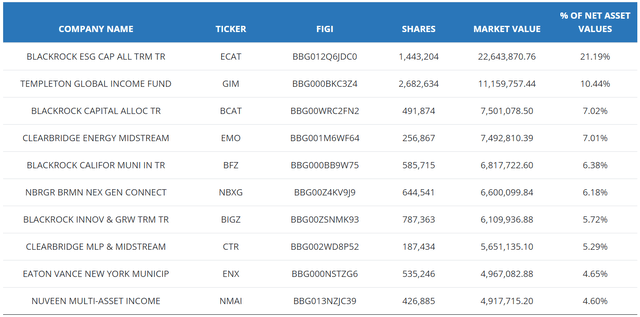

CEFS’s holdings are incredibly well-diversified, with investments in over 70 funds from several different asset classes, and with underlying exposure to thousands of securities. Some of these funds are nominal investments, but I’m seeing 40 funds with weights of at least 0.25%. The portfolio is generally quite concentrated; as the fund is overweight its activist positions.

CEFS

As can be seen above, CEFS invests in an incredibly wide assortment of funds and asset classes. We have municipal bonds, through the BlackRock California Municipal Income Trust (BFZ) and the Eaton Vance New York Municipal Bond Fund (ENX). Midstream energy companies, through the ClearBridge Energy Midstream Opportunity Fund (EMO) and the ClearBridge MLP and Midstream TR Fund Inc. (CTR). Growth equities, through BlackRock Innovation & Growth Term Trust (BIGZ). Equities and bonds, with an ESG tilt, with ECAT. And more.

In general terms, CEFS is an incredibly well-diversified fund, with two caveats.

First, some fund of funds are even more diversified than CEFS, including the Invesco CEF Income Composite Portfolio ETF (PCEF). PCEF invests in over 100 funds, and has more balanced asset allocations too.

Second, CEFS’s portfolio and overall asset allocation are somewhat dependent on its active investment strategy and activist campaigns, so these might not necessarily provide investors with a balanced portfolio. As an example, the fund is currently massively overweight ESG investments, which isn’t wrong, but these might not provide sufficient diversification or balance. CEFS could choose to massively overweight other niche asset classes in the future too, such as MLPs or BDCs.

Notwithstanding the above, CEFS remains an incredibly well-diversified fund, a significant benefit for the fund and its shareholders.

Strong Performance Track-Record

CEFS is an actively-managed fund, and it is very actively managed. Large, aggressive bets are common, and turnover tends to be quite high. Investments and positioning are dependent on many factors, including discounts, yields, and quality. The fund sometimes take short positions in assorted securities, generally treasuries, and its parent company sometimes launches activist campaigns on some of its funds.

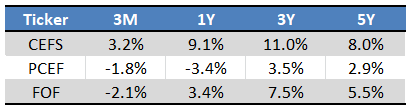

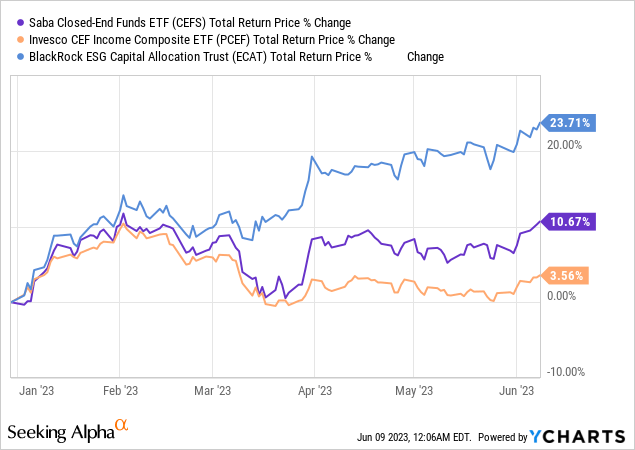

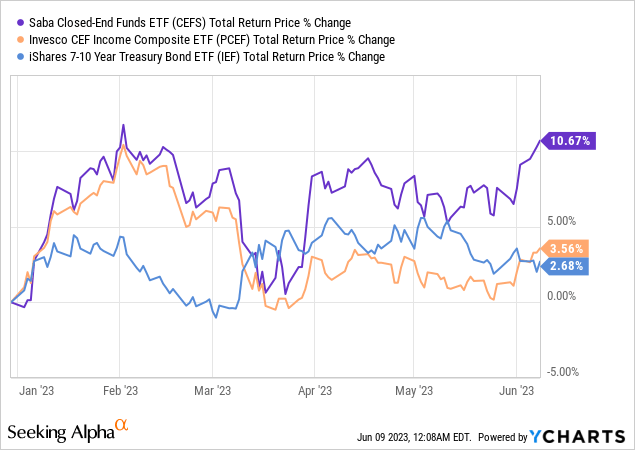

CEFS’s investment strategy is meant to deliver strong, industry-beating returns. The strategy has been incredibly successful in the past, with CEFS outperforming its closest peers since inception, and for most relevant time periods too.

Seeking Alpha – Chart by Author

CEFS’s strong performance track-record is due to the fund’s effective investment strategy, and consistent generation of alpha. In simple terms, CEFS consistently picks the right funds, industries, and positions. Let’s have a quick look through some of these.

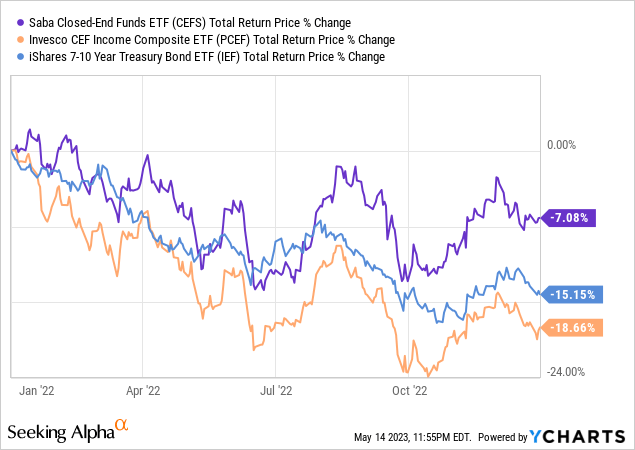

CEFS has held a massive short treasury position for years. Said position generally equals around 20% – 30% of the fund’s NAV, although it has ballooned to almost 50% as of today. Said position has been very profitable for the fund, as higher interest rates have led to lower treasury prices for years. Said position was particularly impactful in 2022, during which CEFS outperformed its benchmark by double-digits.

Data by YCharts

CEFS also focused on fixed-income asset classes with low duration last year, including senior loans, high-yield corporate bonds, and short-term bonds. These asset classes saw below-average losses in 2022, reducing fund losses during the year. CEFS is no longer focusing on these asset classes, almost certainly due to shifting management expectations. Interest rates have stabilized these past few months, so shifting to other asset classes seems to have been the right call.

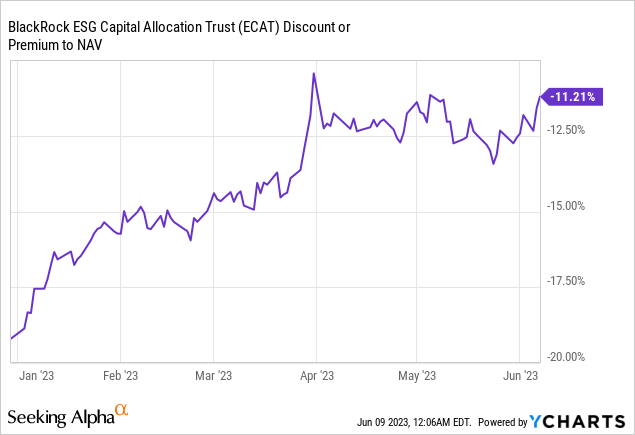

CEFS sometimes benefits from the effective activist campaigns of its parent company, Saba. These vary, but most tend to consist of Saba buying a large position in a heavily discounted CEF, and then pressuring the fund into (attempting to) narrow the discount. As an example, Saba initiated a position in the BlackRock ESG Capital Allocation Term Trust (ECAT) earlier in the year. Saba then announced its intention to ask ECAT’s board to initiate buybacks if the fund’s discount exceeds 10%. ECAT’s discount immediately decreased by around 4%, touching 10% in the days after the announcement. Fund discounts are as follows, Saba’s announcement preceded the very notable spike.

Said announcement led to significant gains for ECAT and its shareholders, including CEFS.

From what I’ve seen, and based on prior coverage, CEFS’s short treasury position has been particularly impactful since inception, less so these past few months.

CEFS’s strong performance track-record is due to the strength and effectiveness of the fund’s investment strategy, and a significant benefit for the fund and its shareholders.

Strong 9.1% Distribution Yield

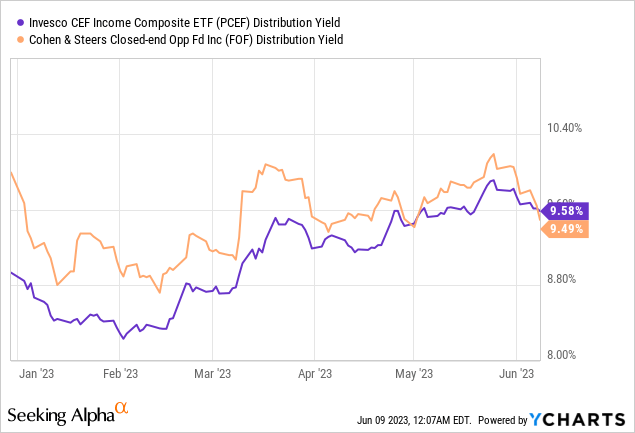

CEFS focuses on heavily discounted, high-yield CEFs, which boost the fund’s yield to 9.1%, excluding a special distribution in late 2022. It is an incredibly strong yield on an absolute basis, and much higher than that of most asset classes. It is, however, slightly lower than that of its closest peers.

CEFS’s yield is currently fully covered by underlying generation of income, as evidenced by the fund’s 10.8% SEC yield.

CEFS

SEC yields measure a fund’s actual generation of income, specifically excluding capital gains, ROC distributions, and the like. CEFS generates 10.8% in income, which more than covers its 9.1% distribution yield.

CEFS’s strong, covered 9.1% distribution yield is a significant benefit for the fund and its shareholders, and a fantastic complement to the fund’s strong overall performance.

Notwithstanding the above, I would not characterize CEFS’s distribution as safe. As mentioned previously, the fund is aggressively actively managed, and its holdings are constantly changing. The fund generates a lot of income right now, but there are no guarantees that this will be the case moving forward. Based on prior coverage and relevant tax documents, the fund’s distribution is generally not fully covered too.

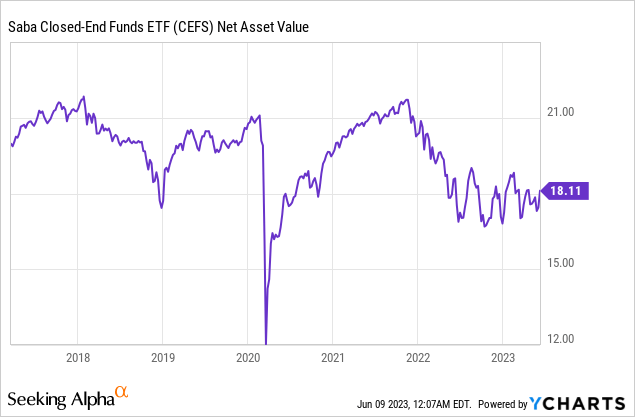

On a more positive note, the fund’s distributions have remained constant since inception, and these have not led to consistent, significant NAV erosion either. NAV are down, mostly due to losses in 2022.

In my opinion, CEFS will likely maintain their distributions in the near future, but changes in the fund’s positions could imperil these.

CEFS – Risks and Negatives

Short Treasury Position

In my opinion, CEFS’s most significant risk, by far, is the fund’s massive short treasury position. As mentioned previously, this generally equals around 20% – 30% of fund NAV, although weights have recently risen to almost 50%.

Such a massive position is incredibly risky, and could lead to significant losses if treasury prices were to increase. I was very concerned about this position in the past, less so right now, as treasury prices have increased YTD, and CEFS has performed quite well regardless.

CEFS’s strong performance was mostly due to strong trades and investments in its overall portfolio. The ECAT investment was particularly impactful. The fund’s short treasury position remains quite risky, but the fund has many other positions too, and as long as most of these are performing well, the fund as a whole should perform well too.

CEFS’s performance was also buoyed by the fact that the fund invests quite heavily in fixed-income funds, with some duration and interest rate risk, which act as a counter or hedge to the short treasury position. A short treasury / long bond trade is much less risky than a simple short treasury one.

In my opinion, CEFS’s massive short treasury position remains a risk, but I’m much less concerned about it than in the past.

Expenses

CEFS is a fund of funds, so investors are liable for two set of management fees. CEFS is a relatively expensive fund, with a 1.1% management fee. The fund invests in CEFs, which are generally expensive too, with an average expense ratio of 1.7%. Add in some smaller fees, and CEFS’s expenses rise to 2.9%, significantly higher than average for an ETF.

CEFS

CEFS’s expenses directly reduce shareholder returns, and are a significant negative for the fund and its shareholders. On the other hand, the fund’s overall performance track-record is quite strong, and this is net of fees. Meaning, investors would have seen strong returns even after paying these fees. In my opinion, considering the fund’s track-record, the fund’s fees are more than worth it.

Leverage

CEFS is a leveraged fund, with a 1.3x leverage ratio. Although leverage increases risk, volatility, and potential losses during bear markets, the fund’s short treasury position somewhat undercuts this. Specifically, even though the fund is leveraged, it is currently around 0.80x net long, lower than average. As such, and in my opinion, the fund’s leverage does not increase risks at a portfolio level.

Conclusion

CEFS’s strong 9.12% dividend yield, strong long-term performance track-record, and recent gains, make the fund a buy.

Read the full article here