Investment Thesis

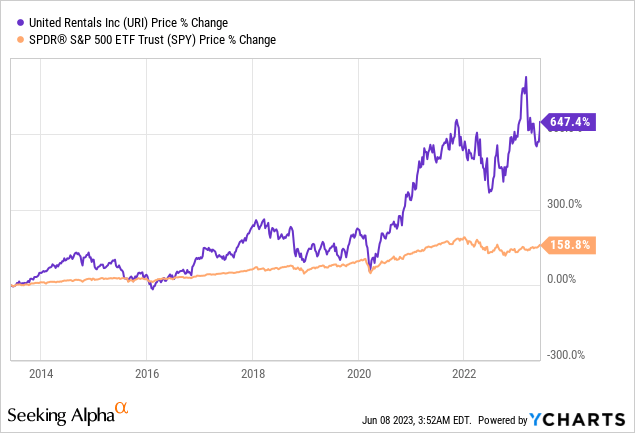

United Rentals (NYSE:URI) has been one of the best-performing industrial companies in the past decade, with shares up nearly 650% during the period, vastly outperforming the S&P 500 Index (SPY). I believe the company is poised to continue its strong run thanks to favorable tailwinds.

The shifting customer preference from buy to rent and the rising construction spending amid government bills should continue to help fuel demand and growth. While the company has already rebounded over 60% from its 52-week low, its current valuation remains attractive. I believe the current price should offer ample upside potential and I rate URI stock as a buy.

The Shift From Buy To Rent

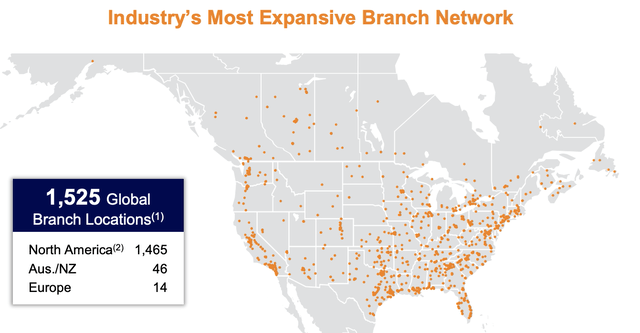

United Rentals is a Connecticut-based leading equipment rental company with a market share of 17%. The company currently has over 1,500 global branch locations covering 4,700 equipment categories, making it the one-stop shop for customers with different needs. It has also been expanding into more specialized categories such as trench safety and fluid solutions, in order to address the growing customer needs.

The construction equipment rental market is huge and growing. According to Fortune Business Insights, its market size is forecasted to grow from $116 billion in 2022 to $164.6 billion in 2029, representing a solid CAGR (compounded annual growth rate) of 5.1%.

United Rentals

The market expansion is mainly driven by the shifting customer preference from buying to renting equipment. Equipment (especially larger ones) is often very costly and requires ongoing maintenance, which weighs on the company’s financials. Through renting, customers can have a lot more flexibility and control over capital, expenses, and inventory.

Thanks to United Rentals’ growing product catalog, customers are now able to have the best-fitting equipment for each respective project, without having to spend extra for new equipment each time. Not to mention they also get to save on equipment storage costs and have 24/7 customer support from the United Rentals team. The incentives are compelling and I believe more companies will adopt this approach moving forward.

Favorable Industry Spending

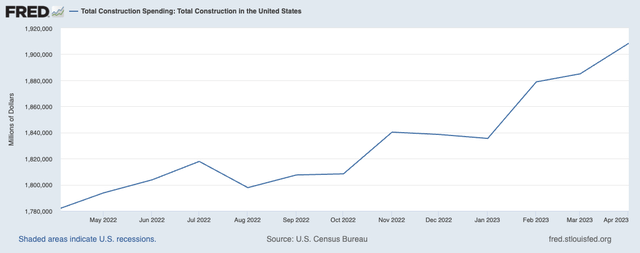

While the overall economy has been slowing amid higher interest rates and tighter credit conditions, the construction industry continues to be extremely strong. The ongoing momentum should provide meaningful tailwinds for United Rentals as the company generates 52% of its revenue from the construction industry. According to the FRED (Federal Reserve Economic Data), the US seasonally adjusted annual rate of total construction spending has continued to trend upwards and reached a historical high of $1,908 billion in April, up 7.1% YoY (year over year) compared to $1,781 billion.

FRED

The growth was particularly strong in the non-residential segments, as it benefited from the government’s Infrastructure Bill and Inflation Reduction Act. The segment increased 25.4% YoY from $840 billion to $1,053 billion. The residential segment was much weaker due to its sensitivity to the interest rate. The segment declined 9.1% YoY from $941 billion to $855 billion.

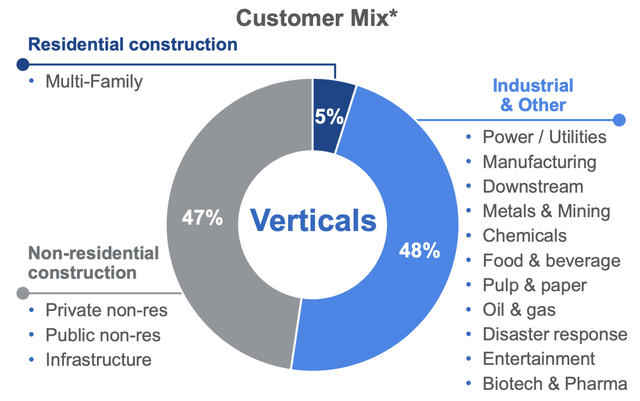

This trend highly favors United Rentals as non-residential construction accounts for 47% of its revenue, while residential construction only accounts for the remaining 5%, as shown in the chart below. The rise in spending should subsequently flow through to the company and help drive growth.

Matt Flannery, CEO, on spending trends

It remains early, but we continue to see a ramp in spending from the federal infrastructure bill across a variety of project types, including airports, bridges and road and highway. We’re also well positioned to support our customers as they undertake projects across clean energy and advanced manufacturing funded by the Inflation Reduction Act.

United Rentals

Improved Balance Sheet

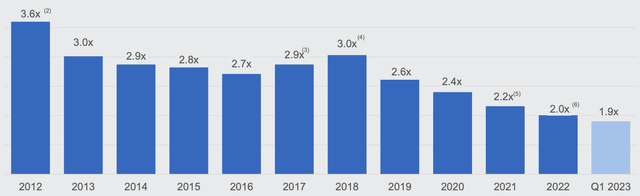

Despite the $2 billion acquisition of Ahern Rentals last year, United Rentals has substantially strengthened its balance sheet through ongoing deleveraging and thoughtful capital allocation. The company’s current leverage ratio is only 1.9x, down from 3x in 2018 and 2.4x in 2020, as shown in the chart below. While the company still has $12.5 billion in debt, no long-term notes are due until 2027. It also has $2.66 billion of liquidity available through cash and other facilities. This alongside the low leverage ratio should provide ample financial flexibility for further buybacks, dividend increases, or acquisitions.

United Rentals

Attractive Valuation

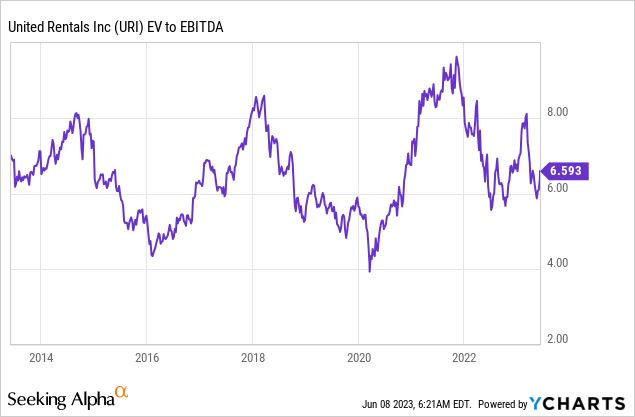

United Rentals is currently trading at an EV/EBITDA ratio of 6.6x, which is quite attractive in my opinion (I am using the EV/EBITDA ratio as it can take the company’s debt into account). As you can see from the chart below, the current multiple is still at the lower end of its 10-year historical range.

It is also trading at a significant discount of 43.1% compared to the sector’s average EV/EBITDA ratio of 11.6x. Considering its estimated EPS growth of roughly 7% for the coming few years, I believe there should be ample upside potential through multiple expansions.

Investor Takeaway

I believe United Rentals is trading at a bargain right now. The company should continue to see solid growth in the near term thanks to the rise in construction spending. The shift from buying to renting will also be a long-term tailwind that drives demand. While there are certainly risks regarding further economic deterioration, which would impact construction spending, I am not too worried at the moment. For instance, most of the recent increase in construction spending is funded by government bills, which are usually very stable.

Considering the favorable tailwinds, the strengthened balance sheet, and the estimated growth, the current valuation seems discounted. I like United Rentals at this price level and I rate it as a buy.

Read the full article here