Investment Thesis

DocuSign, Inc. (NASDAQ:DOCU) delivered a very strong revenue beat for Q1 FY 2024. As you’d expect, DocuSign didn’t waste a few lines of its press release before emphasizing how AI (artificial intelligence) is one of the company’s competitive advantages.

Moving on, I believe one of the most striking aspects of this earnings result is not so much that DocuSign slightly upwards revised its revenue outlook for the full fiscal 2023, but rather that DocuSign reached breakeven profitability on a GAAP basis. This, I believe is astounding.

What a remarkable improvement from the same period a year ago. It’s difficult not to be bullish on this stock now.

Why DocuSign? Why Now?

DocuSign seeks to be more than just an e-signature company that allows customers to digitally transact services, such as document workflows. DocuSign’s value proposition seeks to reduce risk, save time, and cut costs for customers with its digital transformation products.

Even though it’s clear that e-signing is the core of what DocuSign offers, the company has aggressively sought to expand its offering beyond this core vertical.

In actuality, when Allan Thygesen took the reigns as DocuSign’s CEO, there were great hopes that he would succeed in reinvigorating DocuSign’s prospects. And yet, what has actually transpired is that in the past year, DocuSign’s stock has been very stably stuck at around the $60 per share mark.

Accordingly, with the shares up significantly on the back of these results, what should investors think now?

Revenue Growth Rates Are Fizzling Out, So, What’s Next?

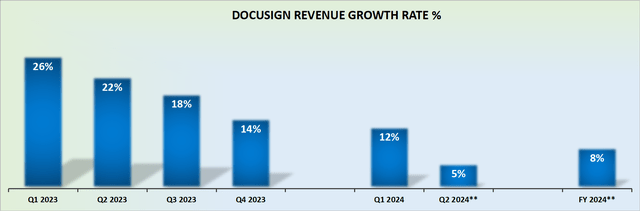

DOCU revenue growth rates

The graphic above is a painful reminder to shareholders that DocuSign is no longer a rapidly growing business. In fact, today, DocuSign is barely squeezing out double-digit growth rates.

DocuSign’s previous CEO Dan Springer, lead the company through its meteoric rise and rapid fall. Springer lasted 5 years. How long will Thygesen have if DocuSign doesn’t manage to reignite its revenue growth rates?

All that being said, where I believe Thygesen has left his mark is not on its growth prospects, but his focus on improving DocuSign’s profitability.

Compromised Profitability: The Compensation Conundrum

DocuSign has no issues in reporting very high gross margins. Indeed, for many investors, that was the appeal behind backing this company.

The problem here is that if we were to assume that management’s SBC is an actual cost, then we are left with a business that’s just about breaking even on a GAAP basis.

Nonetheless, DocuSign doesn’t overly stress this consideration and swiftly turns investors’ attention to its high non-GAAP operating margins.

But before we too turn out attention to DocuSign’s non-GAAP operating figures, I believe it’s worthwhile to consider this:

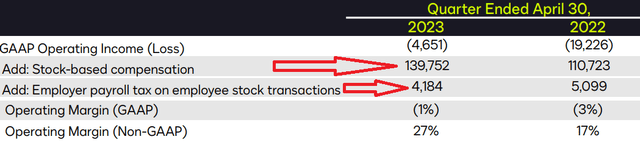

DOCU Q1 2024

Stock-based compensation (not including the taxes on the SBC), was up 24% y/y, approximately twice the pace that revenues grew by. In fact, as you can see above, the gap between GAAP and non-GAAP has widened to 28% this year, compared with 20% in the prior year.

That being said, we have to note that DocuSign is making substantial progress in getting its GAAP operating margins to break even.

Meanwhile, with the passage of time, DocuSign’s total shares outstanding continue to increase. Case in point, since last year, DocuSign’s total number of shares is up 4% y/y, which is close to half the revenue growth rate that DocuSign has guided to grow this fiscal year.

At a very rough estimate, DocuSign is priced at approximately 24x forward EPS. Typically, I would not have said this was a cheap valuation. However, given the pace that DocuSign is increasing its underlying profitability on both GAAP and non-GAAP measures, I’m inclined to believe that this is a very attractive entry point to get involved with DocuSign.

The Bottom Line

In this analysis, I examined DocuSign’s recent earnings report and highlighted some key points.

The company reported an attractive revenue beat. Further, DocuSign reached breakeven profitability on a GAAP basis, which is impressive compared to the previous year.

Despite hopes for growth under CEO Allan Thygesen, the DocuSign, Inc. stock price has remained stable. While revenue growth rates have slowed down, Thygesen has focused on improving profitability.

However, stock-based compensation has increased at a faster pace than revenue, widening the gap between GAAP and non-GAAP figures.

Nevertheless, DocuSign’s progress in achieving break-even operating margins is commendable. Considering the company’s increasing profitability and a relatively attractive valuation, this could be an opportune time to invest in DocuSign, Inc.

Read the full article here