Back in mid-March, I wrote an article on Pool Corporation (NASDAQ:POOL), saying that it was a great company but that it was facing some temporary headwinds. The stock hasn’t moved much since my article, while the S&P is up about 9%. Let’s catch-up on the name with the swimming season in full swing.

Company Profile

As a quick reminder, POOL is a wholesale distributor of pool supplies and equipment in the U.S. and Europe. However, the majority of its sales come from California, Texas, Florida, and Arizona.

The bulk of its business is serving contractors. About 60% of its sales come from service & maintenance, while a quarter is from replacement & repair and the rest from new pool construction.

Headwinds Show Up in Q1

In my original write-up I noted several headwinds that POOL was currently dealing with. The first was over-ordering in the wholesale channel due to previous supply chain issues. Now this is a headwind that has impacted a lot of different companies I’ve looked at in my writings. Apparel and footwear has been one big area that was impacted by this issue, but even a company like Generac (GNRC) saw it in its generator business. In other words, this is an issue that has impacted a wide swath of consumer-facing businesses that sell into the wholesale channel, so it happening with POOL isn’t a company specific or even industry specific issue.

This showed up when the company reported its Q1 results, with its base business sales to the retail channel down -16%. The company said the decline was due to a return to normal buying patterns as well as cooler weather. On that front, the company said its business in California and Arizona were hit by well above average rain fall and cooler weather. This resulted in overall sales declines in those markets of -9% and -14%, respectively.

In my article I also noted the potential for delays and deferment in the pool repair & replacement market. The company said the poor weather in particular hurts the repair market, as the pools go unused and repairs are postponed. Meanwhile, chemical usage during these periods are lost.

In addition, I noted that POOL was seeing a slowdown in new pool construction due to a weakening macro-environment, higher interest rates, and tough comps, as numerous households rushed to add pools during Covid when leaving the house was discouraged. In Q1, the company said it estimated that its sales into the new pool construction segment were down about -25%. Permitting activity, meanwhile, is a mixed bag.

On its Q1 call, CEO Peter Arvan said:

After assessing initial permit data, demand for new pool construction is clearly down. The decline ranges from a high negative teens percent to over 50% in some markets. In total, we believe the overall pool permit number is down approximately 30% so far. This is worse than we had contemplated in our previous guide that’s driven mostly by the weather and some additional economic headwinds. However, when comparing 4Q 2022 levels to the first quarter of 2023, we see permits up 4%, which is encouraging. Weather, interest rates, consumer spending and the end of COVID tailwinds all contributed to lower pool construction activity on a year-over-year basis, but we are encouraged that the sequential quarterly permit level is up. We continue to see lower end pools that typically are financed under the most pressure as consumers grapple with the higher cost of borrowing and higher pool construction costs.”

Overall, POOL’s Q1 was quite bad versus analyst expectations, with adjusted EPS of $2.46 missing analyst estimates by 73 cents and sales of $1.2 billion missing the consensus by $90 million.

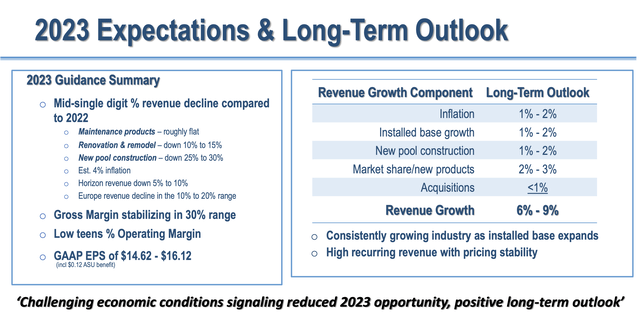

Because of its weaker-than-expected first quarter and current trends, POOL had to lower its full-year guidance.

The company now expects revenue to be down mid-single digits versus prior guidance for sales to be flat to down -3%. It’s expecting maintenance revenue to edge lower by -1%, while new pool construction could decline -30%. Adjusted EPS is now projected to be between $14.62-16.12. The company initial guided for EPS of between $16.03-$17.03.

Company Presentation

Missing results in part due to weather can sound like a convenient excuse, but it can certainly play a part in company’s operating results, and it certainly makes sense for a more seasonable business like pool maintenance and construction. At the same time, California and Arizona are considered year-round markets, so there is likely more at play than just weather. The pool market is clearly cooling, and the headwinds I discussed in March look like they still persist. Even with the guidance cut, it doesn’t seem like POOL kitchen-sinked guidance, so if trends do worsen, there could be downside in the stock.

Valuation

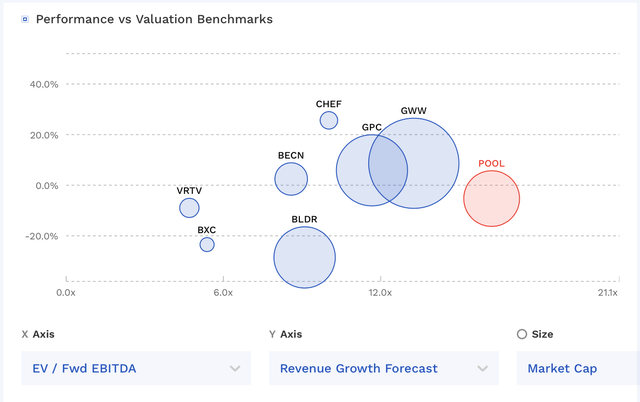

POOL stock trades at a 16.5x EV/EBITDA multiple based on the 2023 EBITDA consensus of $908.1 million. Based off of the 2024 EBITDA consensus of $978.5 million, it trades at around 15.3x.

It trades at 22.4x forward EPS, with analysts projecting 2023 EPS of $15.15.

It’s projected to see revenue fall -5.3% in 2023, returning to 4.9% growth in 2024.

The stock trades at one the highest valuations among its distributor peers.

POOL Valuation Vs Peers (FinBox)

Conclusion

I still think that POOL is a great company with a nice business. I’m a fan of the distributor business model in general, but POOL is one of the most expensive stocks in that group. That is likely because of the perceived steadiness of its business, but as the last couple of quarters have shown, the company can certainly experience its ups and downs.

The estimates for POOL are down considerably since I last looked at the stock, while its stock price has hung in there. There haven’t been much signs of pool trends improving, so I see no reason to adjust my rating at this point. I also don’t think guidance is ultra conservative, either. As such, I’m surprised the stock has held in as well as it has.

Longer term, I continue to like the POOL story, but I’d prefer to be a buyer at a lower valuation.

Read the full article here