Summary

As a New Jersey area native, Prudential Financial (NYSE:PRU) is one of the iconic brands based in my home state, and I still remember the “solid as a rock” TV commercials from the 1990s, coupled with the firm’s memorable rock logo, representing strength and stability over the decades. In fact, I recall one of my first temp jobs was at one of their divisions back in the early 2000s.

Today in 2023, however, I look at this firm from the point of view of a Seeking Alpha analyst and investor of financial and technology stocks, posing the question.. is it worth buying, selling, or holding right now?

Based on my scoring system below, today I am rating PRU stock a Strong Buy. Its positives include reasonable valuation ratios, a diversified revenue base across multiple segments, a price chart showing a buying opportunity, a very competitive dividend yield among its sector, and a rock solid capital / liquidity position along with industry leading AUM levels.

Below I present evidence to support this rating:

Rating Methodology

I will rate this stock using a 5-step methodology as follows, which has been updated from prior articles to now also include the P/E ratio, based on reader feedback. Here are the 5 questions I ask:

- Is the stock undervalued based on P/B ratio and P/E ratio? (10 points each)

- Is their revenue diversified enough across multiple segments? (20 points)

- Does their price chart present a buying opportunity? (20 points)

- Is their dividend yield competitive among its sector? (20 points)

- Is the firm in a strong position in terms of capital, liquidity, AUM, cashflow? (20 points)

After totaling the score, I assign a rating:

- 100 Points: Strong Buy

- 80 to 90 Points: Buy

- 30 to 70 Points: Hold

- 10 to 20 Points: Sell

- 0 Points: Strong Sell

The Stock is Reasonably Valued

For the valuation, I will be using two metrics, the forward P/E Ratio (GAAP) and the forward P/B Ratio, with data from Seeking Alpha.

As in a prior article, the standard used for P/E ratio is the S&P 500’s median P/E ratio of 14.93 as of May 2023, according to Investopedia.

For the P/B, I am using the Corporate Finance Institute interpretation: a low ratio (less than 1) could indicate that the stock is undervalued (i.e. a bad investment), and a higher ratio (greater than 1) could mean the stock is overvalued.

In the case of Prudential, Seeking Alpha gave it a grade of A for its forward P/E, which is 6.38, or 28% less than the sector average.

Its forward P/B of 0.92 is over 2% lower than the sector average.

So, in both metrics, this stock is appearing undervalued at this time.

By comparison, one of its peers, MetLife (MET), has a forward P/E of 9.28, and a forward P/B of 1.33.

Their Revenue Stream is Diversified Well

Prudential as a business model shows strong diversification across its portfolio of insurance products, retirement solutions, and funds it manages… as well as global penetration beyond just the US market.

The following is from the company’s official Q1 2023 earnings results.

Their portfolio consists of retirement strategies, group and individual insurance, and international insurance.

In addition, the firm through its subsidiaries is also a fund manager that manages mutual funds, ETFs, and target date funds, for example.

Essentially, it is a blend of asset manager, retirement advisor, and insurance company rolled into one brand. As such, its revenue comes from multiple sources.. insurance premiums, asset management fees, as well as the interest earned on all the cash that gets “invested” to generate a return, which is common with similar firms such as MetLife, a stock I also covered several weeks ago.

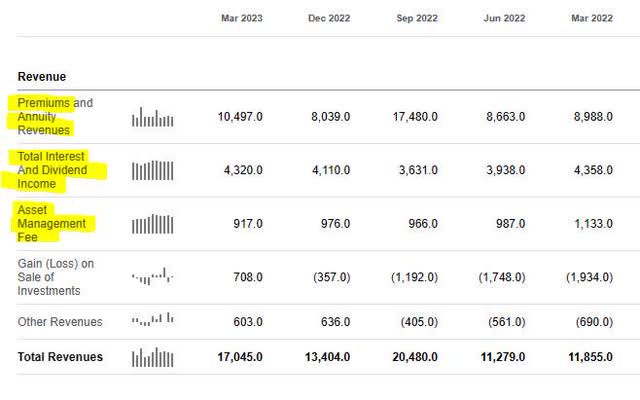

From Prudential’s Q1 income statement below, around 61% of revenue came from premiums and annuities, 25% from interest and dividends earned, and 5% from asset management fees:

Prudential Financial – Q1 revenue (Seeking Alpha)

This is also evidence that at its core it is an insurance company, but there is still enough diversification among its other segments.

Keep in mind that the interest-income component of revenue will benefit from the rising interest rate environment of the last year.

This point was reiterated also by the US Treasury Dept’s Office of Financial Research, in a July 2022 article:

Modestly rising interest rates are generally positive for the insurance industry. When rates rise at a reasonable pace, portfolio yields also rise. With these new, higher-yielding corporate and other bond purchases, insurers’ investment earnings also increase. Life insurers, in particular, benefit from a rising interest rate environment as they’re likely to earn improved spreads over the cost of funding liabilities.

So, with this diverse blend of interest income, insurance premium income, and income from managing funds. I would say yes, they have a diversified enough portfolio of revenue streams.

The Stock Price Chart Shows Buying Potential

Next, we will discuss the price chart as of market open on June 5th, shown below:

Prudential Financial – price chart on June 5 (StreetSmart Edge trading platform)

As in previous analyses I’ve done, I have simplified this step down to a 2-year chart with the 50-day and 200-day SMA overlaying each other, to spot any golden cross or death cross lagging indicators of bullish and bearish price trends.

I am looking for buying opportunities after a death cross appears. We see one in June 2022 (red circle), and another one in March 2023, followed by the current downward price trend.

The March freefall in the stock price seems to correlate with the overall dip in financial stocks resulting from the regional bank failures this spring. An investor could take advantage of Prudential currently trading well below its 200 day SMA, to snatch up the stock before a trend reversal and another golden cross occurs.

So in this case, yes, I see buying potential at this time for this stock, based on the chart trend, to later on profit from potential upside down the road.

The Stock has a Very Competitive Dividend Yield

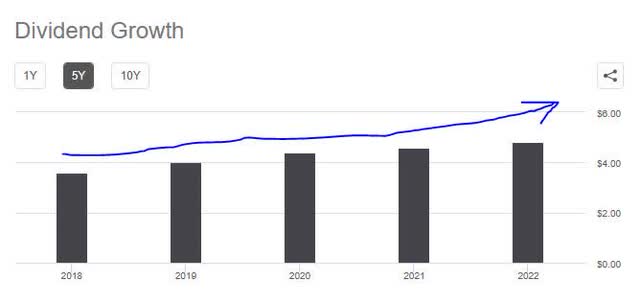

For dividend-income investors who want to generate a quarterly income from holding a stock in the financial or tech sector, and earn a competitive yield, this stock has a very compelling one… 6.02%, based on dividend info from Seeking Alpha.

The below chart shows a steady growth in the dividend over 5 years:

Prudential – 5 year dividend growth (Seeking Alpha)

This tells me the firm is committed to returning capital back to its shareholders, regularly.

However, how does their dividend yield compare with its peers?

For this case study, we will use two of its listed peers, MetLife and Sun Life Financial (SLF). These are good picks because like Prudential they crisscross the realm between investments and insurance, and provide a decent apples-to-apples comparison.

MetLife has a yield of 3.95%, while Sun Life has a yield of 4.29%.

So, in this case, yes, Prudential has a very competitive dividend yield among its sector.

Further, achieving a yield topping 6% from owning this stock actually beats out the yields from the 100 largest money market mutual funds, which are averaging 4.91%, according to a June 2nd article in Forbes.

From a forward looking perspective, taking advantage of this yield could be a good addition to an investor’s existing portfolio of financials stocks.

The Firm Sits on a Healthy Financial Footing

Although this stock is technically in the “financial” sector, unlike my recent ratings of firms that are clearly global banks, this one is a hybrid between insurance and funds manager, to put it plainly.

With that said, the discussion will not be on CET1 ratios as with banks but a holistic look at the firm’s AUM, capital, cashflow, and balance sheet… to gauge whether this firm faces risks of insolvency anytime soon.

From their own Q1 presentation, the firm boasts a strong capital position:

Prudential Financial – Q1 2023 – capital position (Prudential Financial)

In addition, their Q1 press release mentions “AUM of $1.417 trillion versus $1.620 trillion for the year-ago quarter.”

Next, its operating cashflow increased YoY:

Prudential Financial – Q1 – operating cashflow

The tone I got from the company CEO Charles Lowrey in his Q1 earnings comments was setting the right course for the rest of the year I think:

Our first quarter operating earnings reflect underlying business growth, including the benefits from a higher interest rate environment, offset by lower variable investment and fee income, and elevated seasonal mortality experience.

Further, its balance sheet shows total assets far exceeding total liabilities.

Although it seems that yes, this firm has a healthy financial position, I should also caution from a forward-looking view that the very nature of what is essentially an “insurance” business model relies on bringing in a lot more in premiums than having to pay out in claims, and making a return on investing all that cash brought in from premiums.

With that said, although an attractive stock, one should also take into account the unique liquidity risk that this sector can face.

For instance, a 2021 study by consulting firm Deloitte also reiterated that sentiment:

It has become evident that insurers, though solvent when assessed on the existing capital adequacy framework, may become financially distressed due to an idiosyncratic or systemic event, potentially leading to a material loss of value as a result of inadequate liquidity risk management practices. Based on this, there has recently been more focus on liquidity risk for insurers both internationally and locally.

Risks to my Outlook

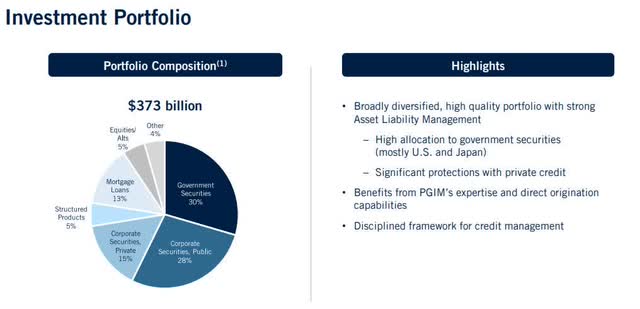

For this specific type of firm, besides the liquidity risk issues I mentioned earlier for all insurance firms, the two risks specific to this firm is the risk of its own investment portfolio doing badly and the other is the risk of excessive client outflows from the funds it manages.

Below is the investment portfolio for the firm:

Prudential Financial – Q1 2023 – investment portfolio (Prudential Financial)

The portfolio shows diversification across several asset classes.

Because Prudential is not a bank and therefore does not have a large number of uninsured depositors, but rather it deals with insurance policyholders retirement account participants, it does not face the issues that failed regional banks did this spring, of having to sell off their bonds portfolio at a realized loss in order to cover a bank run on deposits.

However, this does not mean that its investment portfolio is not prone to losses. If they were to occur at a larger scale, consider what fellow Seeking Alpha analyst Real Investments had to say in a May article about the potential scenario:

If the company’s investment portfolio were to suffer significant losses, its credit rating could be downgraded by rating agencies such as Moody’s or S&P. A credit downgrade could make it more expensive for the company to borrow money, as investors may perceive it to be a riskier investment.

Prudential’s Q1 press release sums it up well when it comes to their asset management arm, PGIM, and the risk of net outflows and other factors:

PGIM assets under management of $1.270 trillion were down 10% from the year-ago quarter, primarily resulting from higher interest rates, declines in equity markets, and net outflows. Third-party net outflows of $14.0 billion in the current quarter were driven primarily by redemptions from public fixed income strategies and reflect institutional outflows of $10.2 billion and retail outflows of $3.8 billion.

Conclusion

In conclusion, I reiterate my strong buy rating for this stock, which scored 100% in my rating methodology today. Its positives include attractive valuation, a healthy financial position, diversified revenue across segments and regions, a competitive dividend, and a price chart showing a buying range.

Risks include potential for declines in its investment portfolio, as well as potential for more net outflows from funds it manages. This could be countered by conservative risk management approaches taken by the firm.

To wrap up this presentation today, as an analyst I will continue to keep an eye on these financial hybrid firms that cross the line between insurance companies and asset managers, particularly since this subsector is sitting on literally trillions$ in AUM, and has such a major impact to the everyday life of individuals and institutions, as well as markets, while sometimes not getting the attention and coverage it deserves.

Read the full article here