Investment Thesis

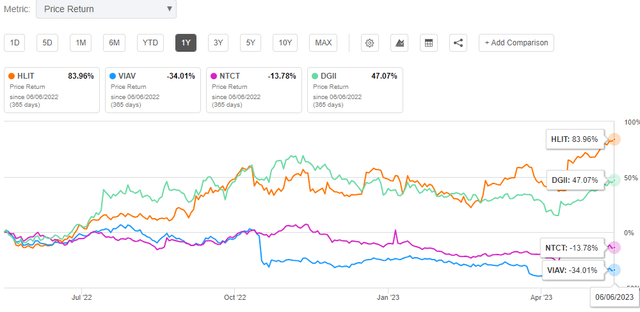

Harmonic Inc. (NASDAQ:HLIT) produces and sells software, hardware, system solutions, and services for delivering video. The company is split into two segments: video and cable access. Over the last five years, its shares have been on a solid upward trajectory, gaining more than 323%. Over the last year alone, HLIT stock has gained about 84%, outpacing its peers.

Seeking Alpha

To the company’s innovative products, which I believe are best suited and offer consumers a wonderful experience, I attribute this robust growth or, more accurately, this superb performance. It takes ongoing innovation to meet the demands of modern video delivery. Harmonic has relied on Plexus to help them stay ahead of the curve in product development, which is a partnership I believe has helped them provide excellent service to their customers and will continue to do so even with the complexity of the market and the speed with which technology advances.

I have a bullish outlook on the stock because the video market is expected to increase by double digits by 2029, and the firm is well-positioned to take advantage of this trend due to its focus on innovation. Investors should be ecstatic about this company’s prospects, as seen by the robust market growth and current ROE, which is higher than that of the company’s competitors. In my opinion, they have a lot of potential for future success with their investments.

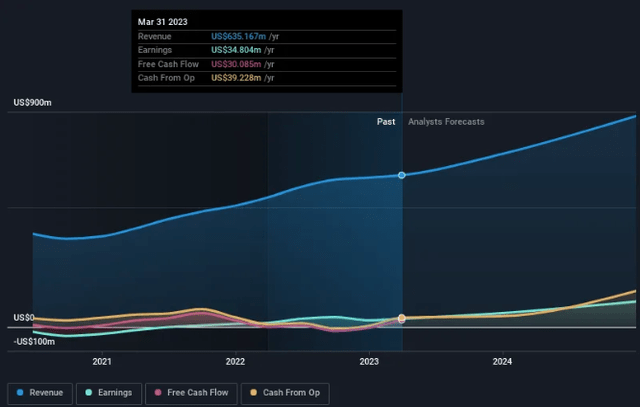

Financial Performance: Strong Future Momentum Builds From Solid Past Growth

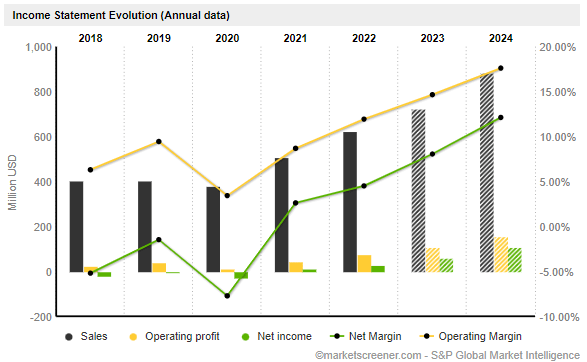

Since 2020, the company’s top and bottom financials have been growing significantly. To begin with, its revenues have grown from $379M in 2020 to $625 in 2022 and are projected to hit $885M by 2024. Moving to its operating margin, it has grown from 3.43% in 2020 to 11.94% in 2022 and is projected to reach 17.62% in 2024. The company’s net margin has grown from -7.73% in 2020 to 4.51% in 2022 and is projected to reach 12.13% in 2024.

Market Screener

The figures demonstrate the company’s past success and its optimistic future. Estimates show that the company will expand rapidly between now and 2024; this is realistic, especially considering its forward-thinking partnership with Plexus.

The MRQ reflected the company’s continued strong financial growth. Adjusted EBITDA margin was 14%, EPS was $0.12, and revenue was $157.6 million. The Broadband division saw a 23% increase in revenue year over year, while the Video SaaS division saw a 72% increase. Book-to-bill ratios greater than 1 were recorded in both segments. The company’s first-quarter gross margin of 53.9% was higher sequentially (120 basis points) and annually (660 basis points).

To further support my assertion that the company’s products offer the best experience to its clients courtesy of their innovative nature to improve customer satisfaction by meeting the dynamic needs is the increasing demand for the products as reported during Q1 2023 transcript call.

Patrick Harshman,

Strong demand for our products and services was further evidenced by strategic multi-year contracts signed for both CableOS and Video SaaS during the quarter. These new contracts, overall demand trends, and the competitive success we’re seeing gives us continued confidence in our ability to deliver on our full year 2023 and previously stated multi-year growth objectives.

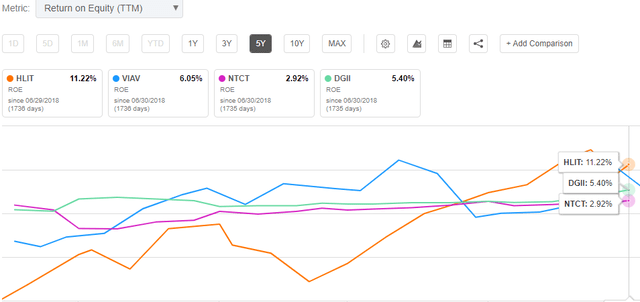

ROE, Quality Returns?

Return on Equity, or ROE, is a way to measure how well a company grows its value and manages its shareholders’ money. In other words, it shows how well the company could turn shareholder money into profits. First, Harmonic has a good return on equity [ROE], and compared to its peers, it has the best.

Seeking Alpha

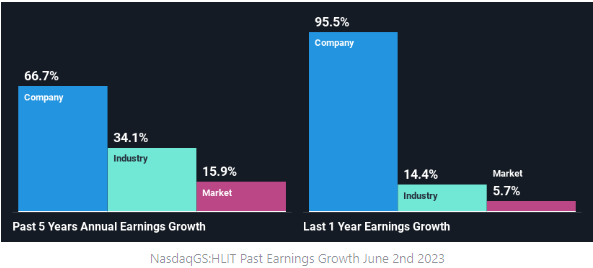

In light of this, likely, the net income growth of 67% over the past five years was made possible. When I compare the growth of Harmonic’s net income to the growth of the industry, I’m glad to see that the company’s growth rate is higher than the 34% growth rate during the same period.

Wall Street

This evaluation shows that this company has effectively turned shareholders’ money into profits and greater value, especially compared to its peers. I believe it is a good result for investors and the company.

The Video Market Analysis: Long-term Growth Opportunity To Be Leveraged

The video sector has substantial growth potential, supported by robust growth levers. This expansion represents a tremendous chance for HLIT, which it can seize by putting its inventive skills to good use. The world market for video on demand is expected to grow at a CAGR of 17.6%, from $82.77 billion in 2022 to $257.59 billion in 2029.

The industry is expanding due to rising demand for TV shows, movies, and documentaries via subscription and increasing mobile internet penetration. A 2020 GSMA intelligence assessment estimates that 4 billion people, or 51% of the world’s population, were using mobile internet. Comparing 2020 to the year before, 2019, it climbed by 225 million. This rise in mobile internet usage drives global demand for subscription-based on-demand videos. If HLIT can capitalize on this expanding market, I anticipate that its video division’s income will increase rapidly in the future.

Valuation: What’s The Opportunity Here?

Harmonic is currently overpriced when measured against relative valuation criteria, such as the price-to-earnings ratio, because the ratio is higher than the average for its industry. The company is selling at a premium since its PE ratio 61.05x is higher than its industry’s 24.82x median PE ratio. Also, Its share price seems to be relatively stable, which could suggest two things: first, it could take some time for the share price to go back down to an appealing buying range, and second, there might be less opportunities to purchase low in the future once the share price hits that value. This is because the stock’s low beta (0.83) makes it less volatile than the market as a whole.

When deciding whether or not to add a company’s stock to its portfolio, investors should consider the company’s prospects. Let’s also examine the firm’s future projections, as it is usually a fantastic investment to buy a wonderful company with a healthy outlook at a reasonable price. Earnings growth forecasts for Harmonic over the coming year point to an extremely bright future for the company. A higher share price is expected as a result of increased cash flows.

Wall Street

With this optimistic future in terms of earnings and cash flow growth, a time when the company appears to be trading at a premium, here are my thoughts on where the opportunity lies. Shares of HLIT are selling at a premium to industry price multiples, suggesting that investors are pricing in the company’s strong outlook for future growth. But this raises the question of whether or not this is a good moment to sell. If you think HLIT’s price is too high, you may make money by selling shares now and buying them back down to where they would be in relation to the industry’s PE ratio.

If you’re a potential investor, buying the stock might not be the best time. Since the price has already exceeded its competitors in the market, all further gains from mispricing are likely exhausted. Nevertheless, HLIT’s optimistic prognosis suggests further investigation into other aspects is warranted before jumping on the next price drop. To sum up, I believe current shareholders should take profits now because I see very little future upside. After all, the market appears to have priced the future upside in its current valuation, while I would advise potential investors to wait until the valuation falls below the industry median before buying in.

Conclusion

HLIT is a company with a bright future, but it’s time to cash out your gains and wait for a lower entry point from an investing standpoint, in my opinion.

Read the full article here