In recent years, the cannabis industry has gained rapid growth and popularity. In the United States, an increasing number of states are legalizing marijuana, leading to the emergence of Multi-State Operators that allow a cannabis business to operate in a variety of states. However, cannabis remains federally illegal, and its legalization will not be underway at least for another couple of years. With this uncertainty surrounding federal legalization alongside increasing regulation, I do not anticipate the cannabis industry to experience growth and development in the near term.

I rate AdvisorShares Pure US Cannabis ETF (NYSEARCA:MSOS) a Sell. The fund has been underperforming since its inception, and has been continuously declining since the middle of 2020. Being one of the first and one of the largest ETFs in the cannabis industry, one would expect a fund like this to provide a higher level of security and lower risk, but MSOS unfortunately does not meet this expectation.

The fund’s strategy in entering swap agreements as well as focus on micro and small-cap companies make this ETF especially volatile and risky. The fund’s portfolio will be extremely sensitive to the performance of a few small companies that are especially prone to market fluctuations. Combine this with already declining market sentiments as well as unfavorable market conditions, I expect that MSOS will continue to underperform alongside a declining cannabis industry.

Strategy

Launched and managed by AdvisorShares Investments, LLC., MSOS is primarily focused on using derivatives to invest in the US cannabis industry. The fund enters into total return swap contracts with various cannabis companies, where MSOS essentially exchanges the return on a pool of assets for the performance of the company’s equity. With an AUM of $333B, MSOS is the first US ETF that solely focuses on equities in the cannabis sector. The fund’s strategy seeks to accumulate long-term growth through investing in legal US cannabis equity securities. MSOS is an active fund that employs a manager to constantly adjust the portfolio, making changes based on predictions that create higher growth.

MSOS primarily invests in small-cap companies, with a smaller portion in micro-cap, that are indirectly tied to the US cannabis industry. Its portfolio is very concentrated, with a significant portion of their AUM in the top 10 holdings. With that being said, the fund also invests a large amount, 25% of its portfolio, in various spaces in the health care sector, including pharmaceuticals, biotechnology, and life sciences. With the fund’s niche focus in the cannabis sector, it is generally not very diversified, ultimately exposing it to industry-specific risks. However, the fund’s portfolio is constantly changing, so the weights of the top 10 holdings are prone to change in the future.

Below is an illustration of the top 10 stocks that take up the most weight in the portfolio.

AdvisorShares

Actively-managed portfolio

The fund’s core strength is that its investment strategy employs a manager that is constantly monitoring and adjusting the portfolio, making decisions about which companies to buy or sell based on relevant market factors and their potential for growth. The fund’s ability to adapt to dynamic market and regulatory environments gives MSOS a competitive advantage over other stagnant cannabis ETFs that pose a potential competitor.

MSOS’s portfolio manager, Dan Ahrens, also has deep experience in the capital markets, especially in highly-regulated sectors. With over two decades of experience in the financial services industry, Ahrens is portfolio manager of both MSOS and the fund’s main competitor, YOLO. MSOS’s assets are also held by a very respected financial holding company in the US, BNY Mellon.

Historical poor performance

MSOS has a multitude of weaknesses that make this fund undesirable to cannabis investors. The fund has not experienced an uptrend since February of 2021, and it continues to drop relentlessly each day. It maintains a negative Market Price Return for both 1 Month, 3 Months, YTD, 1 Year, and Since Inception. Also, MSOS has a relatively high expense ratio of 0.80%, making the fund less attractive to investors. However, this higher expense ratio could also be due to the fact that the fund employs an active management strategy, increasing the management expense. MSOS’s portfolio is also relatively small (56 total holdings), which could also contribute to a high expense ratio. This is not to mention that the fund’s portfolio is also very concentrated among very few stocks (distribution can be seen in the chart above), where many of these companies are micro-cap and small-cap companies. These types of companies are all very sensitive to market trends, and will have poor performance amid a declining cannabis industry.

Seeking Alpha Seeking Alpha

MSOS invests in cannabis stocks through swap contracts

I also am not particularly fond of the fund’s strategy in using derivatives to enter swap contracts with its portfolio companies. It is likely that MSOS is doing this in order to navigate complex legal hurdles, especially in an environment where there are still federal and state concerns with the legality of cannabis. This method allows MSOS to indirectly invest in various companies in the US cannabis industry without physically owning the company’s stock. There could be numerous risks associated with derivatives and entering a swap contract. One such risk is counterparty risk, where the other party involved in the contract does not uphold their obligations outlined in the contract. In my opinion, the main downside to a swap agreement strategy is simply its unconventional strategy in not directly investing in the stock of companies. This may be especially daunting to investors, deterring them from investing in the fund. Investors might find it challenging to gauge the true value of the portfolio’s performance due to the complex nature of derivatives.

Long-run growth in cannabis

Despite all of this ETF’s faults, the overall cannabis industry is still expected to grow 14% to $36.5B by the end of 2023. I believe this is a reasonable projection given inflation continues to fall after a peak 10 months ago and lowered interest rates in response to this. This fund invests 100% of its fund in US securities, where the US cannabis market is one of the largest in the world and are forecasted to remain so into the future. Additionally, MSOS’s cannabis securities can have useful applications in various industries including, agriculture, biotechnology, pharmaceutical, and other healthcare fields. This allows for diversification in a niche cannabis industry, where growing fields in health care such as ongoing research and other developments could lead to significant upside potential for this ETF and the cannabis industry.

Legalization hurdles slowing growth

With a recent slowdown of the legalization of marijuana on the federal level, the cannabis industry has been experiencing a downtrend for the latter half of 2022 and 2023. Most recently, the United States House of Representatives has blocked an amendment, sponsored by Representative Matt Gaetz, that would have removed marijuana as a Schedule 1 drug. The blocking of this amendment could negatively impact the cannabis industry. This can further increase barriers to entry in this market, as increasing risks and regulations can decrease opportunity for new businesses to gain traction. These regulations can include lifted taxes on cannabis businesses, which can make it a very difficult industry to make profit in.

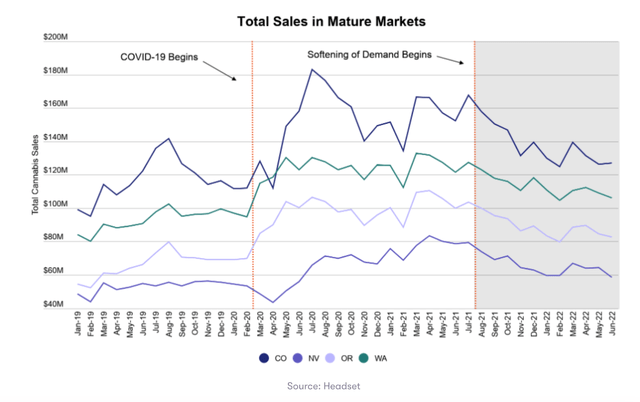

Even in a post-COVID industry environment, cannabis sales have still declined overall, especially in states with a mature cannabis market, including Colorado, Nevada, Oregon, and Washington. Again, I attribute this to growing competition in an industry with such high barriers to entry and high regulation. Below is a graph of the cannabis industry in a pre-COVID, during COVID, and post-COVID market environment.

Flowhub

ETF Quality Opinion

While MSOS does benefit from an actively managed portfolio, many other cannabis ETFs in the same bucket as MSOS also employ this same strategy. Given an overall negative market sentiment, I would not recommend investing in the cannabis space at this time. While I do not like the inherent structure of this ETF, a future investment in MSOS may prove profitable if the sector experiences more favorable changes to the regulatory environment or if it experiences positive developments in the industry. However, cannabis companies continue to underperform even in a Post-COVID environment, and the economic downturn in 2022 and 2023 has not helped it either.

ETF Investment Opinion

I rate MSOS a Sell because I do not have much faith in the cannabis market right now. MSOS is a top ETF in this space representing the cannabis industry, and it has continued to disappoint in the past few years. Furthermore, the fund’s strategy in entering swap agreements alongside its concentration in very few stocks makes it even more riskier and dependent on the performance of a few companies. Add these factors on to overall market volatility, and this ETF is poised to continue to underperform in coming years.

Read the full article here