Nomura Holdings, Inc. (NYSE:NMR) has benefited from somewhat of a revival in equity markets, particularly in the Japanese markets, a standout performer this year. Other products for speculators also drew volumes, and the AM and retail businesses did well on more favorable market activity. The IB segment was the letdown in terms of net income, but on a relative basis, the segment performed rather well thanks to its Japanese positioning, highlighting the importance of liquidity on the IB business model.

Overall, Nomura has a cost problem, but its relative revenue performance in its segments wasn’t bad considering the struggles of peers in IB in particular. The problem is that it is a full service bank in the end, and you can get better large scale banks elsewhere.

Q4 Results

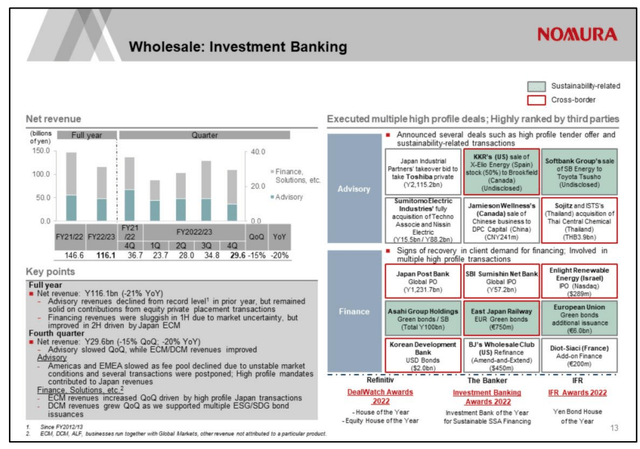

The results mirror somewhat the Q3 results we’ve covered in the last article, except there has been a turnaround in some of the proprietary capital results and equity products have done better than some risk hedging products in global markets. But investment banking continues to be an issue. Advisory is shot across markets. The only really resilient parts of private placement transactions, but also idiosyncratic Japanese exposures to DCM and ECM, which do well when liquidity is more solid.

IB Results (Q4 2023 Pres)

The Greentech exposures have also been important in being an anchor for the IB results, providing green deal flow throughout this latest cycle. There continues to be growth thanks to Greentech’s contribution. In addition to the Japan exposures, one of the only liquidity-flush markets left in the developed world, IB saw sequential strength and relatively limited YoY declines, as seen in the chart above.

Most other segments performed as expected, but we do point out that in the wholesale businesses Japan did well, APAC did okay, the U.S. didn’t do too badly, while EMEA was quite a bit of a disaster. This is yet another data point to show the hierarchy of economic health and performance in terms of inflation exposure and options across the globe. However, we note that most other European franchises for advisors performed better than average, usually outperforming other segments. So NMR stands out in a negative way here.

Bottom Line

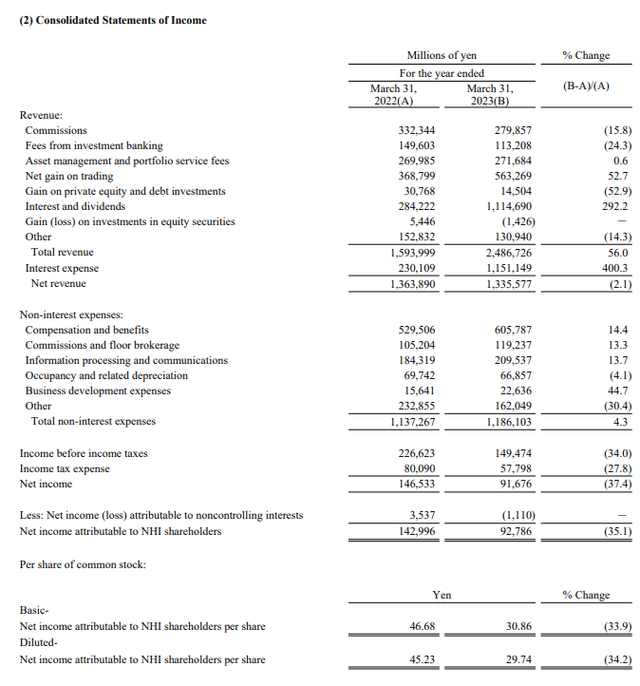

The results on the revenue level were all right, they were down 5%. But the profits tanked, which brings us to the concerns around the cost structure.

IS (Q4 2023 PR)

Expenses actually crept up, and with substantial operating leverage and pretty thin margins, net income saw quite a big hit. A weaker Yen and dollar-denominated exposures that produced smaller profits due to weaker liquidity in those markets didn’t help as well. Compensation expenses were stubborn, even rising, despite worse performance in segments like IB. The global markets’ results deserved some more compensation given results, but margins were primed to fall.

While better proprietary capital results, decent global markets results and alright retail performance helped provide some better results, continued pressures on advisory and general failure to control costs really hurt Nomura’s profits. Ultimately, its peers are the other full-service banks. Other exposures are less exposed to Japan like Morgan Stanley (MS) and JPMorgan Chase (JPM), but better management has meant equivalent or even better net income evolutions than NMR despite less help in those markets. For the same multiple as its peers, we’d rather take a bank with a more solid track record, that hasn’t had to back out of markets in the West where it on occasion couldn’t compete, and manages to control costs better in an industry where cost and headcount control is essential.

While there are tailwinds from a recovering Western advisory environment (not yet but eventually) while the Yen remains relatively weak, there really has to be a demonstration of cost reversals by Nomura management to create competitive results in the peer group. While management acknowledges the cost issue, we generally find that Japanese companies tend to be less aggressive on this front than American peers, and would in this rare instance prefer American picks over Nomura Holdings, Inc. stock.

Read the full article here