Its valuation has fallen by nearly half, but Stripe, at $50 billion, remains the most valuable fintech. Last year’s No. 2, Klarna, is off the list, while No. 3 FTX is not only off, but in bankruptcy, with its founder accused of fraud.

W

hen did your fintech company last raise money? That, it turns out, is one key factor in our annual ranking of the 10 most “valuable” private fintech companies, which this year should come with a big disclaimer.

With the stocks of publicly traded fintech companies off 60% from their fall 2021 peak, the largest private fintechs are wildly overvalued—unless, that is, they’ve gone out for fundraising recently. Witness the experience of fintech poster child Stripe, a thriving business that recently saw its valuation slashed to $50 billion, a 47% decline from the $95 billion valuation it received two years ago. Despite the valuation drop off, Stripe still holds the top spot when it comes to most valuable private fintechs. By contrast, buy now, pay later company Klarna, which was #2 on our 2022 list with a $46 billion valuation, suffered a dramatic 85% valuation drop, to $6.7 billion, during a funding round in July 2022. That pushed it off of this list entirely.

Bottom line: our top 10 list is, as it has been in past years, based on a fintech’s last public fundraising value and every company appearing on this year’s list, other than Stripe, was last valued more than a year ago. Most of this year’s other top 10 would likely have to take a big haircut if they went out to raise more funds today. One notable example of this is OpenSea, which was valued at $13.3 billion when it closed its last round in December 2021. Back then, nonfungible tokens were hot and OpenSea was the leading NFT marketplace. Now it’s no longer the leader and the NFT bubble has burst–OpenSea’s monthly transaction volume collapsed from $4.81 billion in January 2022 to $191 million last month.

While a valuation cut may be a hard pill to swallow, at least the companies taking the plunge are still up and running. Last year, cryptocurrency exchange FTX held the No.3 spot on the most valuable fintech list. Today, after a stunning fraud-fueled implosion, the exchange is bankrupt and has secured a spot in the business hall of shame, alongside Enron and Bernie Madoff’s investment company.

Like other fintechs, most of the companies on our list are aggressively cutting costs, often by downsizing their teams. Chime, which is No. 2 on the list at $25 billion, up from No. 4 last year (due to Klarna’s and FTX’s disappearance), laid off 12% of its workers last November. Stripe laid off 14% of its staff the same month. (It says the $6.5 billion it raised in March will be used to offer liquidity to employees and to pay associated taxes, and not for ongoing business operations.) Plaid, Brex, Bolt, Blockchain.com, OpenSea and GoodLeap have also done layoffs since the start of 2022. The host of staff cuts across the industry earned 2022 the title of ‘Year of the Layoffs’ and the outlook for startups with low cash reserves or broken business models is bleak.

As fintech valuations and funding has fallen, the minting of new “unicorns”— companies worth $1 billion or more–has ground to a near halt. In the first quarter of this year, only one new fintech unicorn was minted, down from 31 in the first quarter of 2022, according to CB Insights. Total fintech funding in the quarter was $15 billion worldwide, down from $28 billion a year before, and more than 40% of that $15 billion went to Stripe.

Replacing Klarna and FTX on this year’s most valuable list are one-click checkout company Bolt (ninth at $11 billion) and development platform for blockchain-based applications Alchemy (tenth at $10.2 billion). Both are valued the same as they were last year, but the cutoff for making the list has declined from $12 billion.

Ironically, because of fintech’s woes, turnover on the most valuable list was actually lower in 2023 than in previous years—none of last year’s honorees went public and no new companies had huge funding rounds that vaulted them onto the list. Stripe, which had been widely expected to go public before the market took a downturn, has opted instead to allow employees to sell shares in the private market — the purpose of its $6.5 billion fundraise.

Here are the 10 most valuable private fintechs in the U.S.:

| 1 |

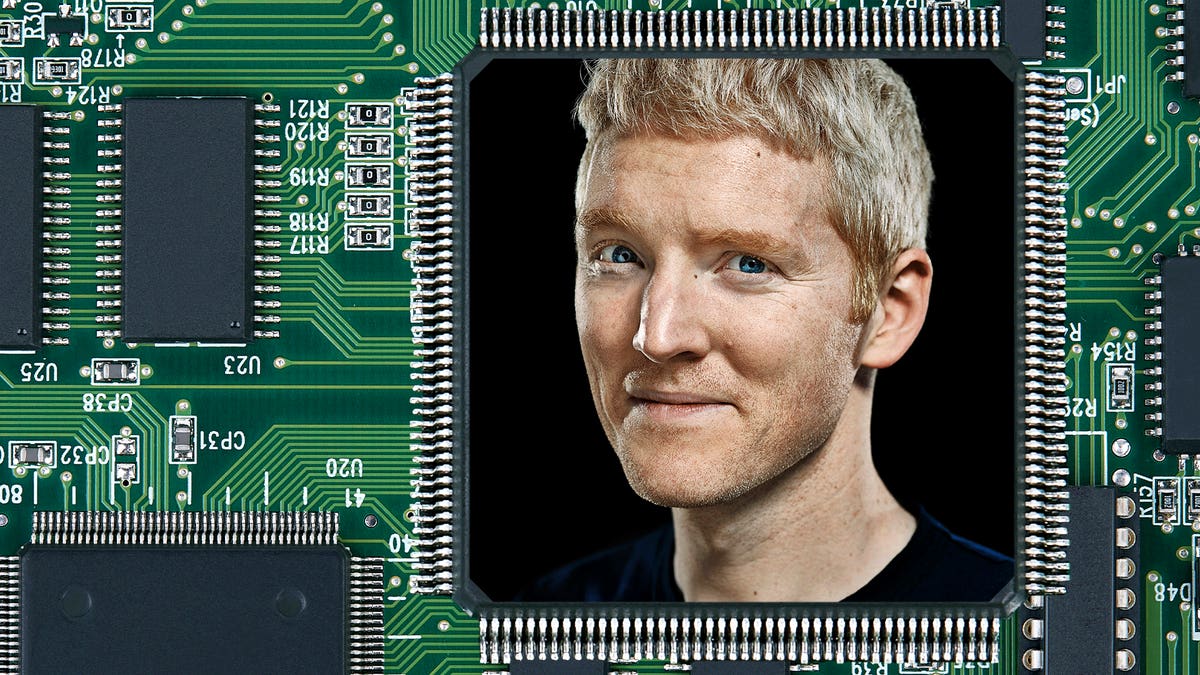

Stripe: $50 billion

Last raise: March 2023

13-year-old Stripe processes payments for online businesses. It rode the pandemic’s ecommerce boom to a $95 billion valuation in March 2021, though its valuation dropped to $50 billion in March 2023. In 2022, the company processed $817 billion worth of transactions for customers including OpenAI, Microsoft and Ford.

Cofounders: Irish brothers Patrick and John Collison, 34 and 32, respectively, sold their first startup, an auction-management system for ecommerce sellers called Auctomatic, for $5 million in 2008 before starting Stripe in 2010.

| 2 |

Chime: $25 billion

Last raise: August 2021

Chime rose to prominence by offering free checking accounts with no overdraft fees and cash advances to customers. Today, Chime is the largest digital bank in the United States. In 2021, the digital bank was reportedly planning an initial public offering, but those plans have been delayed. In 2022, it had 13.8 million app downloads compared with 13.2 million in 2021, according to Apptopia. It has raised a total of $2.3 billion from investors including Sequoia Capital and Menlo Ventures.

Cofounders: CEO Chris Britt, 50, who did previous stints at Green Dot and Visa; CTO Ryan King, 46.

| 3 |

Ripple: $15 billion

Last publicly valued raise: January 2022, in a private stock buyback.

California-based Ripple aims to arm enterprise clients with tools to integrate cryptocurrencies with their existing operations. It promises to enable cross-border payments, facilitate instant payments and help manage crypto holdings. Its liquidity hub platform is designed to connect businesses with market makers, exchanges and over-the-counter desks in cryptocurrency markets. The Securities and Exchange Commission is suing Ripple alleging that the sale of its native token, XRP, constitutes an unregistered securities offering. (Note: According to Pitchbook, Ripple raised funds in January 2023, but the valuation hasn’t been publicly disclosed.)

Cofounders: Executive chairman Chris Larsen, 63; Jed McCaleb, 50; Arthur Britto, CEO: Brad Garlinghouse, 50, a former AOL president.

| 4 |

Blockchain.com: $14 billion

Last raise: March 2022

U.K.-based Blockchain.com is a cryptocurrency exchange, data hub and provider of one of the world’s most popular cryptocurrency wallets allowing users to self-custody their crypto holdings by providing tools to manage their private keys. In March, the company evolved its wallet into the Blockchain.com app, which allows users to access their custodial exchange accounts and their non-custodial crypto wallets from the same place. Blockchain.com’s wallet is available in 25 languages and supports customers in more than 200 countries.

Cofounders: CEO Peter Smith, 33, an early bitcoin enthusiast; and Vice-Chairman Nicolas Cary.

| 5 |

Plaid: $13.4 billion

Last raise: April 2021

Plaid facilitates the sharing of consumers’ financial data between their bank accounts and financial service apps. Its network includes 12,000 banks, credit unions and financial institutions and counts fintechs including Venmo and Robinhood among its client base. In 2022, it launched a slate of new fraud-fighting features and Instant Payouts on Transfer, a service allowing businesses to disburse loan payments, insurance payouts and wages instantly. It has raised a total of $735 million from Altimeter Capital, Silverlake and Index Ventures.

Cofounders: CEO Zach Perret, 35, and former CTO William Hockey, 33, the cofounder of Fintech 50 member Column.

| 6 |

OpenSea: $13.3 billion

Last raise: December 2021

OpenSea is a peer-to-peer marketplace for NFTs, unique digital collectables which can represent real-world or online items. OpenSea allows customers to mint, buy and sell NFTs across multiple blockchains. In January 2022, OpenSea’s $13.3 billion valuation earned its founders, Devin Finzer and Alex Atallah, the title of first NFT billionaires. In 2022, OpenSea brought in $472 million in revenue by collecting a 2.5% transaction fee on the $18.8 billion in trading volume the platform saw over the year. Despite its success to-date, OpenSea will need to compete with rising challengers like Blur, which usurped OpenSea as the largest marketplace by trading volume for NFTs.

Cofounders: CEO Devin Finzer, 32, and CTO Alex Atallah, 31.

| 7 |

Brex: $12.3 billion

Last raise: January 2022

Business banking startup Brex offers a no-fee corporate charge card with travel rewards and expense tracking, bill pay and startup debt financing. Before the FDIC insured all deposits during the Silicon Valley Bank crisis, Brex helped other startups borrow more than $1 billion to meet potential payroll disruptions. Its cash management account helps clients spread their cash between different bank accounts to insure up to $6 million in deposits. Last summer, Brex announced it was cutting ties with small business clients in favor of larger enterprises and venture-backed startups.

Cofounders: Co-CEOs Henrique Dubugras, 27, and Pedro Franceschi, 26, launched Brex after dropping out of Stanford.

| 8 |

GoodLeap: $12 billion

Last raise: October 2021

GoodLeap is a marketplace for sustainable home upgrades including solar panel systems, energy-efficient windows, smart thermostats or HVAC systems. The company offers point-of-sale financing solutions in an effort to make environmentally-friendly home upgrades more accessible. GoodLeap has provided more than $20 billion in financing to about 700,000 homeowners, up from $13 billion disbursed to 380,000 homeowners one year ago.

Cofounders: Chair and CEO Hayes Barnard, 51, and Chief Revenue Officer Matt Dawson, 49, two longtime executives at SolarCity (now Tesla Energy); and Chief Risk Officer Jason Walker, 49, a veteran mortgage broker.

| 9 |

Bolt: $11 billion

Last raise: January 2022

Six-year-old Bolt offers one-click checkout for online merchants. With the goal of eliminating hassle-prone guest check-outs, Bolt promises to boost purchases and return shoppers for digital retailers. It counts Forever 21, Revolve, Casper and Fanatics among its clients.

Founder: Ryan Breslow, 29, Forbes’ 30 under 30 honoree who stepped down as CEO of Bolt in January 2022. Today, he is CEO and founder of health startup Love.

| 10 |

Alchemy: $10.2 billion

Last raise: February 2022

Alchemy is a platform designed to help developers build decentralized applications. The company connects developers’ applications to existing blockchains to help share data between them. Often referred to as the Amazon Web Services of crypto, Alchemy provides the data infrastructure behind blockchain-based players including NFT marketplace OpenSea, cryptocurrency exchange dydx or decentralized crypto lending platform Aave. It processes more than $150 billion in annualized crypto transactions and has secured $529 million in total funding from Andreessen Horowitz, Lightspeed Venture Partners and Coatue, among others.

Cofounders: Nikil Viswanathan, 35 and Joe Lau, 33, two Stanford grads whose first success was meetup app Down to Lunch.

MORE FROM FORBES

Read the full article here