Investment Thesis

Broadcom Inc. (NASDAQ:AVGO) is a stalwart that is priced as a stalwart. Expectations are rather muted, as the stock is priced at 19x this year’s free cash flows. And this fiscal year ends for Broadcom in 4 months.

Here I explain why an investment in Broadcom and why now. Beyond its cheap valuation, I’m attracted to this business for its rapidly growing exposure to AI demand.

Simply put, I want to participate in the need for AI infrastructure and energy efficiency that Broadcom’s chips provide. But I don’t wish to pay a silly multiple to invest in the semiconductor industry.

This is a balanced approach to invest in what is unquestionably the fastest-growing sector of the market.

Why Broadcom? Why Now?

Broadcom is a semiconductor company. Broadcom provides specialized hardware components, such as processors and chips, optimized for AI applications. These components deliver higher performance, energy efficiency, and processing capabilities required for AI workloads.

As the complexity for compute, storage, and communications workloads increases on the back of AI, so, too, does the need for workload-optimized silicon designs.

For Broadcom’s customers, AI and cloud hyperscalers such as Alphabet (GOOG), Meta (META), Microsoft (MSFT), and Amazon (AMZN), the key chips they require have better performance, lower power consumption, and lower overall silicon costs.

This means, as I’ve been making the case for some time, a key limiting factor for AI processing will be access to very cheap energy, as the chips are extremely power-hungry.

By working with Broadcom and Marvell Technology (MRVL), these titans purchase and develop application-specific integrated circuits (”ASICs”). These chips end up being cheaper compared with off-the-shelf merchant chips.

Don’t be put off by unfamiliar terms, simply understand that ASICs enhance the performance, speed, and efficiency of AI applications.

During the earnings call, Broadcom stated that AI will account for 15% of semiconductor revenues this fiscal year (ends October), up from 10% last year, and could approach $1 billion in the current quarter, with revenues expected to be up 100% y/y by fiscal Q4 2023.

Looking out to next year, Broadcom believes that its AI exposure will account for about 25% of its semiconductor revenues. Meaning about 20% of its total revenues next year will be exposed to the rapidly growing AI sector.

So, Why Did the Stock Not Take Off?

The messaging coming from Broadcom was consistent with the prior quarter. After Nvidia’s (NVDA) earnings and Marvell Technology’s earnings, investors wanted more.

But as you know from my thesis, while I’m looking to benefit from companies that reduce the energy required to drive AI applications and companies that are exposed to AI, I don’t want to pay for something that was going to be too ”jazzy.”

I was more than willing to get something that’s less subdued, with less upside, but less downside too. Not because I’m seeking the best upside. But because I want stocks that allow me to remain sane amidst all this market volatility.

Revenue Growth Rates Are Not Accelerating

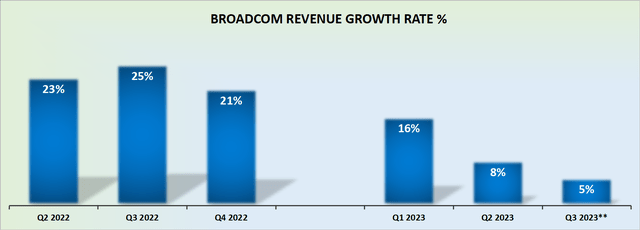

AVGO Revenue Growth Rates

Investors were hoping to be dazzled by Broadcom’s fiscal Q3 2023 guidance. Instead, the guidance points to 5% y/y revenue growth rates.

That being said, consider the following:

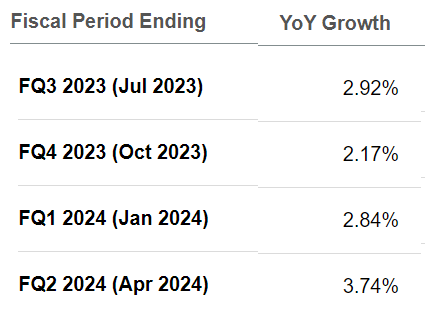

SA Premium

Presently, analysts are expecting very low single digits growth rates to come from Broadcom. Consequently, if Broadcom can continue to grow its AI exposure at a rapid rate, this will in time allow its overall revenues to tick higher.

Incidentally, this was my thinking behind Palo Alto Networks (PANW), too, and why I recommended that stock in the first place. I wanted a stock that wasn’t too jazzy and had a portion of their business that was rapidly growing (Palo Alto’s Next Generation Security).

Impressive Cash Flows

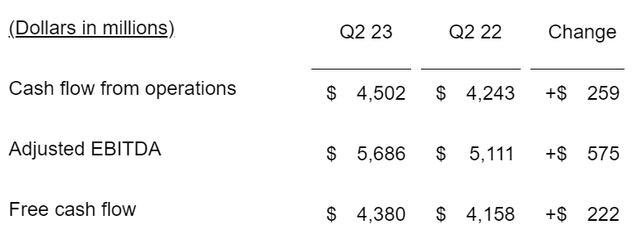

Broadcom reported $4.4 billion of free cash flow and guides that it expects its cash flows to remain strong next quarter.

AVGO Q2 2023

Above we can see that Broadcom has a very high EBITDA to free cash flow conversion rate. In Q2 2023, more than 75% of Broadcom’s EBITDA ended up as clean free cash flow. This was 400 basis points lower than the prior year, and undoubtedly investors would not have looked too enthusiastic toward this free cash flow margin contraction.

The other aspects that would have partially weighed on the stock would have been that Broadcom’s gross margin profile contracted by approximately 100% basis points y/y.

Objectively, these two matters taken together imply that Broadcom’s overall profitability in the quarter weakens. And if we were to continue weakening going forward, investors would pay a smaller premium (or multiple) for AVGO’s stock.

For now, if we include Broadcom’s guidance for fiscal 2023 and presume that Broadcom’s free cash flow conversion reverts ever so slightly higher, this would leave Broadcom on a path towards approximately $17.5 billion of free cash flow this year.

This figure would be about 14% lower than my previous forecast and something that I’m going to be extremely attentive to.

That being said, this would leave Broadcom priced at 19x this year’s free cash flow. But as I said last week, Broadcom is already now in fiscal Q3 2023. That means that this year actually finishes in October 2023.

Thus reinforcing that investors are truly not paying a significant multiple for a company that has significant optionality to reignite its growth rates on the back of supplying customers with custom-designed chips.

The Bottom Line

Broadcom Inc. has rapidly grown its exposure to the demand for AI infrastructure.

What weighed on the stock was that investors were hoping for stronger revenue growth rates and were concerned about margin contraction.

I strongly advocate for looking at this stock over a slightly longer time horizon than 1 quarter. There’s a compelling opportunity for upside over the next twelve months, as Broadcom’s AI exposure continues to grow by 100% y/y and could reach around 20% of total sales next year.

Read the full article here