More than two years ago, I stated that California Water Service (NYSE:CWT) was richly valued and hence investors should have waited for a correction of at least 20% before purchasing the stock. Since my article, the stock has remained flat, whereas the S&P 500 has gained 5%. After such a long period of flat performance, some investors may be tempted to conclude that the utility stock is ready for its next leg up. However, in this article I will analyze why the stock remains fully valued.

Business overview

California Water Service was founded in 1926 and is the third-largest publicly-owned water utility in the U.S. The utility has six subsidiaries, which provide water to approximately two million consumers, primarily in California, but also in Washington, New Mexico, and Hawaii.

California Water Service has one of the strongest business models an investor can hope for. Even under the most adverse economic conditions, people and companies do not reduce their consumption of water, which is the most essential component of life. Thanks to its rock-solid business model, California Water Service has proved immune to recessions. In 2020, which was marked by the fierce recession caused by the pandemic, the utility posted all-time high earnings per share of $1.97.

The robust business model has enabled the company to grow its dividend for 55 consecutive years. Therefore, California Water Service is a Dividend King, with one of the longest dividend growth streaks in the investing universe.

California Water Service has grown its earnings per share by 6.3% per year on average over the last nine years. This is certainly a satisfactory growth rate for a utility. The company has grown its earnings at this pace thanks to the approval of rate hikes by regulatory authorities as well as decent growth of the number of customers.

While California Water Service is on a reliable growth trajectory in the long run, it has had a negative start to this year. In the first quarter, the company incurred a 24% decrease in operating revenue and a net loss of $22.2 million or $0.40 per share, compared to net income of $1.1 million or $0.02 per share in the same quarter of the previous year.

The main factor behind the poor results was the severe weather, namely wet and cold conditions in California, which caused a 12% decrease in sales. The extremely wet winter also affected unbilled revenue accrual, reducing it by $5.8 million compared to the previous year. In addition, the regulatory mechanisms that were previously in place to offset such revenue losses are no longer active in 2023. If these mechanisms were valid this year, they would have mitigated the decrease in revenues and earnings.

Moreover, in reference to regulatory updates, there has been another extension of the deadline for the cost of the pending capital case until August 2023. The California General Rate Case had no significant updates during the first quarter while management stated that it cannot predict the outcome of this case. Overall, California Water Service has had a poor start to the year.

On the other hand, it is only natural that the utility is sensitive to adverse weather conditions. As the effect of deviations of weather from normal tends to diminish in the long run, investors should not be concerned over the losses of the company in the first quarter. Instead, they should rest assured that California Water Service will keep growing its earnings in the long run thanks to material rate hikes year after year.

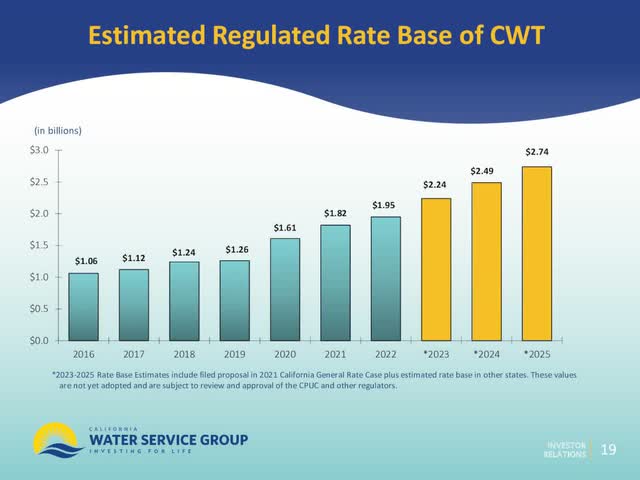

California Water Service Growth (Investor Presentation)

Source: Investor Presentation

Indeed, analysts expect the company to grow its earnings per share by 8.4% per year on average over the next five years, from $1.77 in 2022 to $2.65 in 2027. This is undoubtedly an attractive growth rate for a utility, as it is combined with minimal risk and resilience to almost any kind of downturn.

Valuation

California Water Service is currently trading at a forward price-to-earnings ratio of 31.7, which is much higher than its historical 10-year average price-to-earnings ratio of 26.3. The current earnings multiple of the stock is certainly extreme for a medium-growth company, such as a utility. Such a high price-to-earnings ratio would normally accommodate a high-growth tech stock, not a utility stock.

It is also worth noting that California Water Service is trading at 21.6 times its expected earnings in 2027. This means that the market has already priced many years of future growth in the stock. Moreover, investors should note that interest rates have surged to multi-year highs this year. High interest rates have rendered the dividend of California Water Service much less attractive than it was during periods of depressed interest rates. Therefore, it is somewhat surprising that the utility is trading at 31.7 times its earnings this year in the current environment of interest rates.

The rich valuation of the utility should be attributed, at least in part, to its immunity to recessions. The economy has remarkably slowed down due to the aggressive interest rate hikes implemented by the Fed and the risk of an upcoming recession has significantly increased. It is thus natural that investors may be looking for safe havens. Nevertheless, the nosebleed valuation level of California Water Service is likely to result in lackluster returns in the upcoming years. The essentially flat stock price over the last four years is just a reminder that investors should pay great attention on the valuation of the stock before purchasing it.

Dividend

As mentioned above, California Water Service has one of the longest dividend growth streaks in the investing universe, with 55 consecutive years of dividend growth. The company has grown its dividend by 4.9% per year on average over the last decade, roughly in line with the 5.1% median dividend growth rate of the utility sector. This growth rate renders California Water Service an attractive candidate for income-oriented investors.

On the other hand, the stock is currently offering a dividend yield of only 1.8%. Given its reasonable (for a utility) payout ratio of 76% and its decent growth prospects, California Water Service is likely to continue raising its dividend at a mid-single-digit rate for many more years. Nevertheless, the current dividend yield is too low to justify an investment in the stock right now, especially given the multi-year high prevailing interest rates. To provide a perspective, if California Water Service grows its dividend by 5% per year, it will reach the current yield of the 10-year U.S. treasuries in 15 years.

Final thoughts

California Water Service has many appealing characteristics for income-oriented investors. Thanks to the regulated nature of its business, it is on a reliable growth trajectory and has proved immune to recessions. It is thus safe to expect the company to keep growing its dividend for the next several years. On the other hand, the market seems to have noticed the attractive features of this stock. Due to the rich valuation of the stock, investors should probably wait for an approximate 20% correction, towards the technical support around $45, before purchasing the stock. Such a stock price corresponds to a more reasonable price-to-earnings ratio of 25.0 and a dividend yield of 2.3%.

Read the full article here