Author’s note: This article was released to CEF/ETF Income Laboratory members on June 6th.

Federal Reserve rate hikes have led to higher coupon rates on most bonds, and higher dividend yields on most bond funds. High-yield corporate bond ETFs offer particularly strong yields and have benefited from these trends too. Looking at the larger of these, three funds stand out.

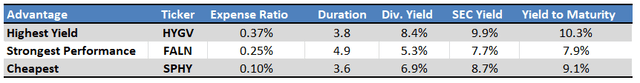

The FlexShares High Yield Value-Scored Bond Index Fund ETF (HYGV) offers the highest dividends, with a 9.9% SEC yield, due to focusing on bonds with particularly wide spreads. Although the fund’s strategy boosts risks too, the impact has been minimal in the past.

The iShares Fallen Angels USD Bond ETF (FALN) offers the strongest performance track-record, due to focusing on Fallen Angels, or recently downgraded non-investment grade corporate bonds. Fallen Angels tend to outperform, as forced selling from institutional investors causes these securities to trade at comparatively low prices, leading to outsized capital gains.

The SPDR Portfolio High Yield Bond ETF (SPHY) is the cheapest, with a 0.10% expense ratio. Lower expenses directly increase (reduce by less) dividends and total returns, with SPHY performing quite well on both metrics.

HYGV, FALN, and SPHY are all strong high-yield corporate bond funds, and buys. Select information for these three funds is as follows.

Fund Filings – Chart by Author

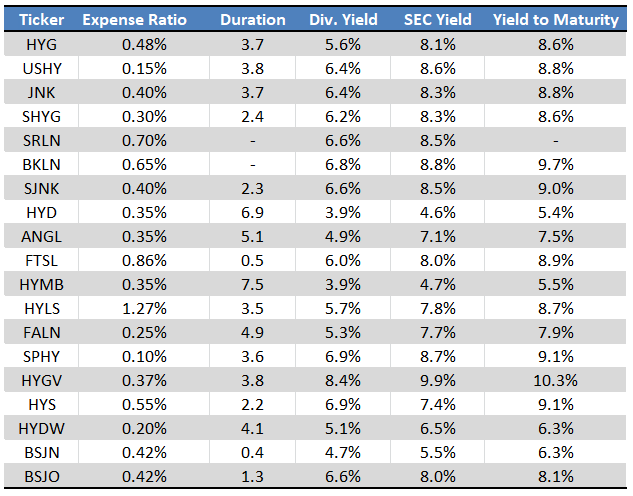

Select information for some of the larger high-yield corporate bond ETFs is as follows.

Fund Filings – Chart by Author

High-Yield Corporate Bond ETFs – Advantages

A quick look at some of the advantages of high-yield corporate bonds and bond ETFs, before looking at HYGV, FALN, and SPHY.

Strong Dividends

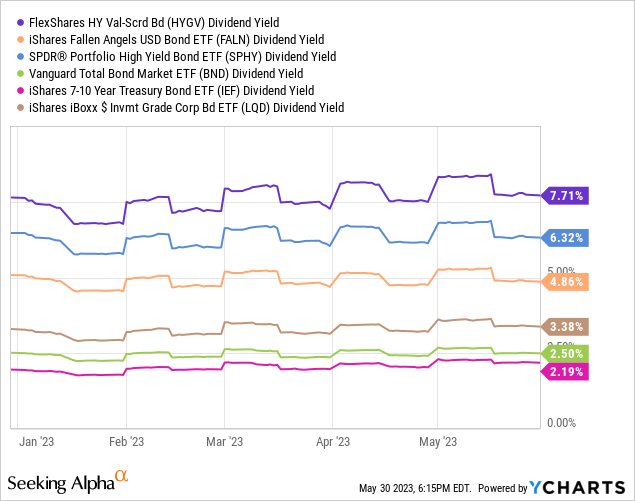

High-yield corporate bond ETFs have higher yields than broader bond ETFs, and than most other bond sub-asset class ETFs. Dividend yield spreads vary, but most tend to be in the 2.0% – 6.0% range.

Data by YCharts

High-yield corporate bond ETF dividends are higher than average across most relevant dividend metrics, including standard dividend yields, SEC yields, and yield to maturity. I have a closer look at how these metrics differ here.

Due to the above, high-yield corporate bond ETFs are enticing investment opportunities for most income investors.

Strong Dividend Growth, Realized and Expected

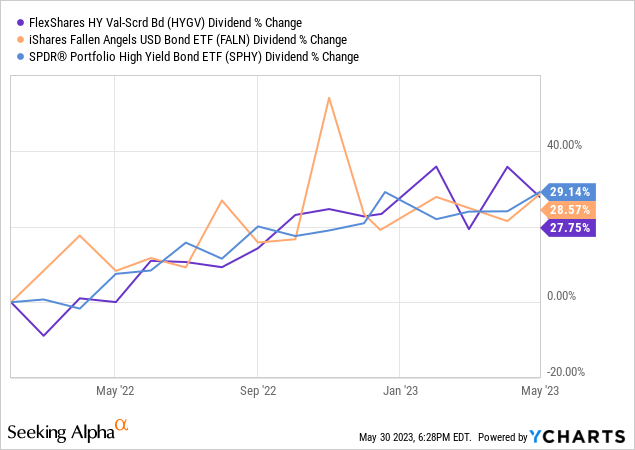

Bond ETFs have seen strong dividend growth since early 2021, courtesy of Federal Reserve rate hikes. High-yield corporate bond ETFs have seen strong dividend growth too, with some volatility.

Data by YCharts

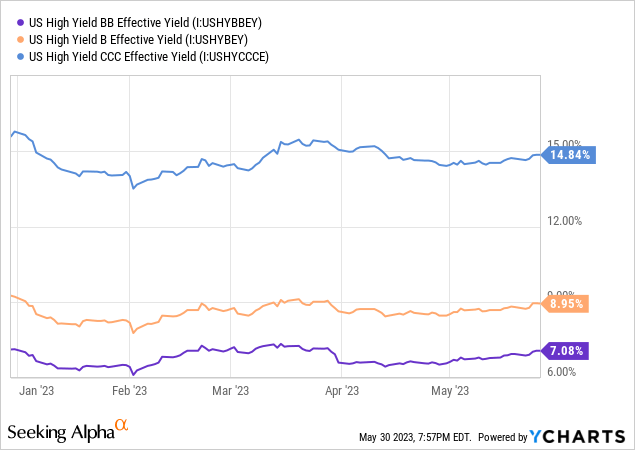

High-yield corporate bond ETFs should see strong growth moving forward as well, due to recent Federal Reserve hikes, considering these generally take a few months to impact investment markets / funds. At the same time, almost all high-yield corporate bond ETFs generate more in income than they are currently distributing to shareholders, as evidenced by their SEC yields and prevailing market interest rates.

High-yield bonds currently yield +7.0%, so funds focusing on these securities should yield +7.0% too, and their dividends should increase until that is the case.

Data by YCharts

Strong dividend growth, realized and expected, is a significant benefit for high-yield corporate bond funds and their investors.

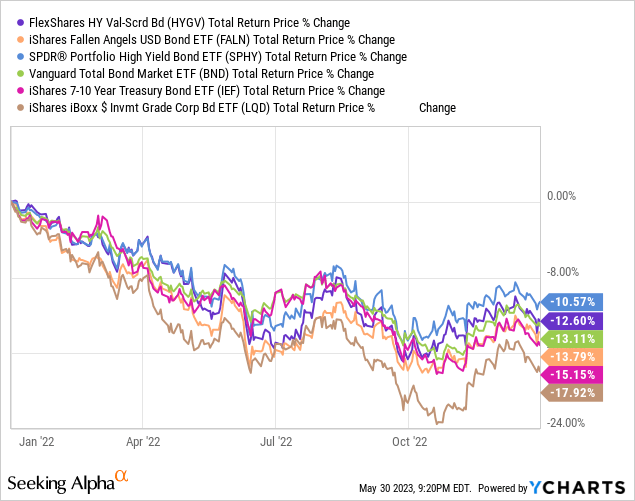

Low Duration and Interest Rate Risk

High-yield corporate bonds tend to have below-average maturities, as investors are generally loathe to extend long-term credit to weaker, riskier issuers. Bonds with below-average maturities have below-average duration and interest rate risk, leading to lower losses and outperformance when interest rates are rising. This was generally the case in 2022, with HYGV, FALN, and SPHY outperforming most other bond sub-asset classes.

Data by YCharts

High-yield corporate bond funds have relatively low interest rate risk, a straightforward positive for shareholders. As interest rates have mostly stabilized, this is unlikely to prove beneficial right now, but it should bring long-term benefits for shareholders.

High-Yield Corporate Bonds – Disadvantages

High Credit Risk

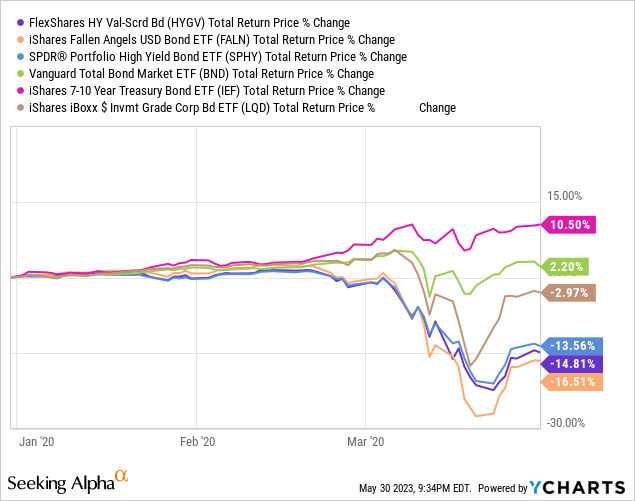

High-yield corporate bonds are riskier than average, with relatively weak credit ratings and above-average default rates. Expect above-average losses during downturns and recessions, as was the case in 1Q2020, the onset of the coronavirus pandemic.

Data by YCharts

As high-yield corporate bonds are relatively risky securities, funds focusing on these might be inappropriate for more conservative investors.

HYGV – Highest Yield

HYGV is a high-yield corporate bond ETF, and so shares the same overall characteristics of these securities: strong yields and dividend growth, low interest rate risk, high credit risk.

What sets HYGV apart is the fund’s dividends, which are highest in its peer group. The fund currently yields 8.4%, around 1.5% higher than average amongst its peers. HYGV’s 9.9% SEC yield and 10.3% yield to maturity are also both higher than those of its peers. These two metrics are more forward-looking dividend metrics, and indicate that HYGV is likely to see strong dividend growth and yields moving forward.

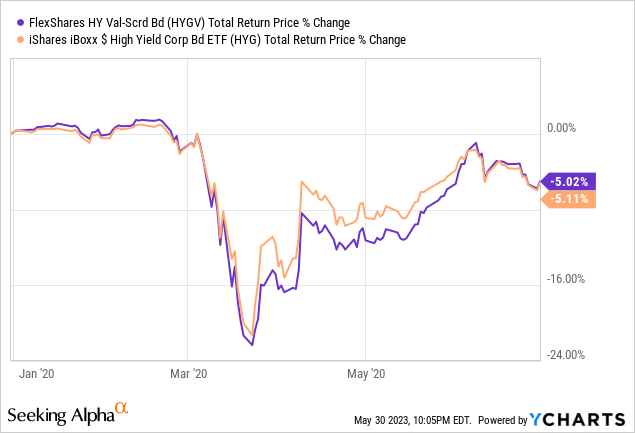

Besides the above, nothing much else stands out about HYGV. The fund is about as diversified as most high-yield corporate bond ETFs, less so than the largest, broadest ones. Interest rate risk is about average. Credit risk is a bit higher, with above-average allocations to CCC-rated securities, but this has not led to significant losses or underperformance during prior downturns. For reference, HYGV’s performance in 1Q2020 versus that of the industry benchmark.

Data by YCharts

HYGV’s strong 8.4% is highest in its peer group, and the fund’s key benefit and advantage relative to peers. Although the fund offers few other significant benefits, it suffers from no significant downsides either. As such, HYGV is a strong investment opportunity, and a buy. I last covered HYGV here.

FALN – Strongest Performance Track-Record

Some context first.

Investment-grade bonds are those issued by stronger, more credit-worthy institutions. These bonds are rated from BBB to AAA, by relevant credit rating agencies.

Non-investment grade bonds are those issued by weaker, less credit-worthy institutions. These bonds are rated BB and lower, by relevant credit rating agencies.

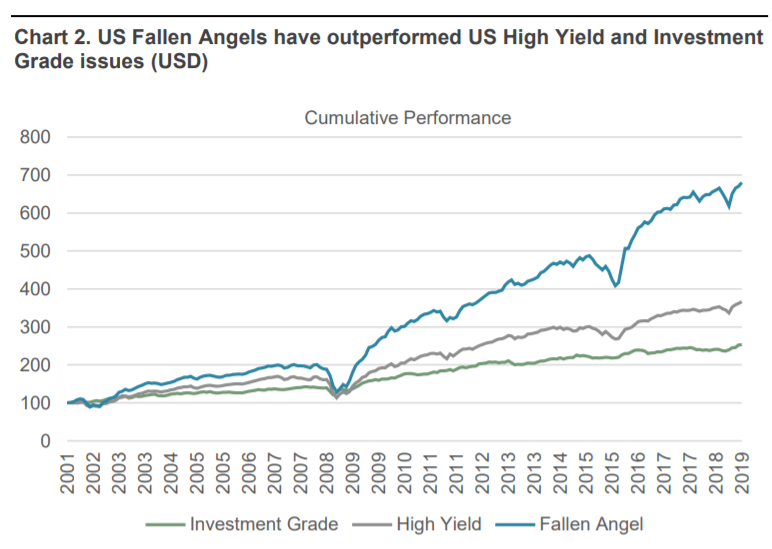

Some institutional investors, including some pension funds and insurers, are forbidden from investing in non-investment grade bonds, due to their greater credit risk. When bonds are downgraded from investment-grade to non-investment grade, these institutional investors are forced to sell, temporarily tanking their prices and boosting their yields. These bonds are called Fallen Angels, and tend to outperform in the months following their downgrade, as prices settle.

FTSE Russell

FALN itself is a high-yield corporate bond ETF, and so shares the same overall characteristics of these securities: strong yields and dividend growth, low interest rate risk, high credit risk.

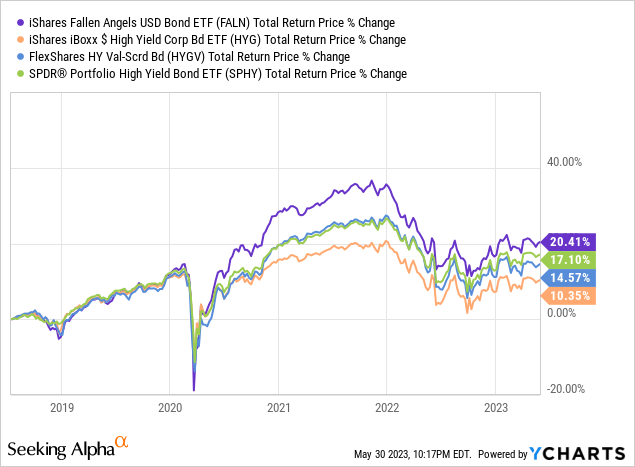

What sets FALN apart is the fund’s strong performance track-record, with FALN outperforming its benchmark and effectively all of its peers since inception.

Data by YCharts

FALN’s outperformance was entirely due to focusing on Fallen Angels, which tend to outperform other high-yield corporate bonds.

FALN’s strong performance track-record is its key benefit and differentiator, but the fund does have a few other important differences relative to peers.

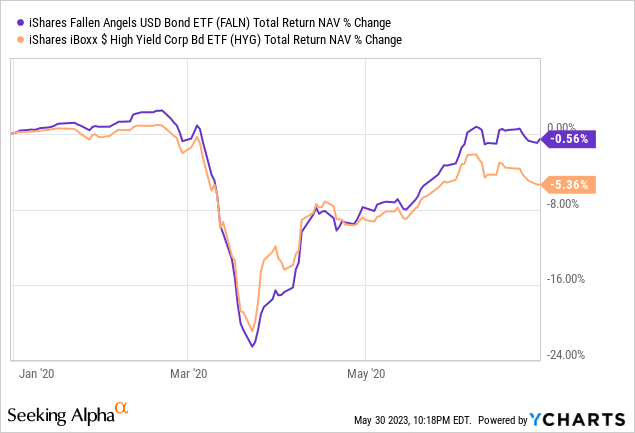

FALN’s credit risk is a bit lower than average, as Fallen Angels are a bit safer than average (they were investment-grade bonds before, after all). Lower credit risk should lead to lower losses during downturns and recessions. Although this was the case in early 2020, the onset of the coronavirus pandemic, there was some volatility, and some underperformance at first.

Data by YCharts

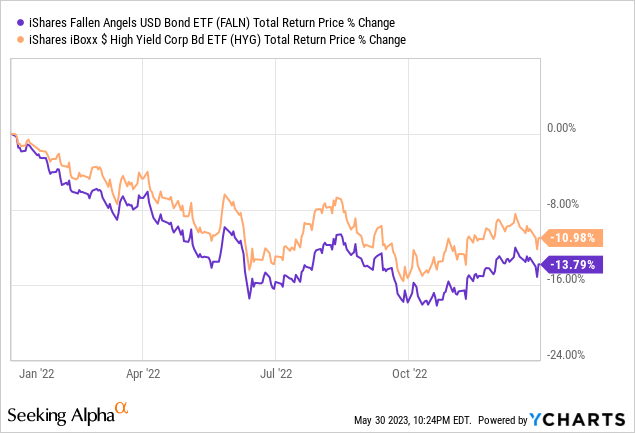

On the flipside, FALN’s interest rate risk is a bit higher than average, as the fund’s bonds have somewhat higher maturities (this is generally the case for investment-grade bonds, which the fund’s bonds originally were). Expect above-average losses when interest rates increase, as was the case in 2020.

Data by YCharts

Fallen Angels are a somewhat niche bond sub-asset class, which reduces portfolio diversification, boosting risk, volatility, and potential for underperformance. I’m not aware of any time period in which the reduced diversification actually led to losses, however.

FALN’s performance track-record is strongest in its peer group, and is the fund’s key benefit and advantage relative to peers. The fund is a strong investment opportunity, and a buy. I last covered FALN here.

SPHY – Cheapest

SPHY is a high-yield corporate bond ETF, and so shares the same overall characteristics of these securities: strong yields and dividend growth, low interest rate risk, high credit risk.

What sets SPHY apart is the fund’s 0.04% expense ratio, which is lowest in its peer group. Lower expenses directly increase (reduce by less) dividends and total returns, with SPHY performing quite well on both metrics. Importantly, SPHY’s lower expenses necessarily increase returns, while the same is not true for HYGV’s dividends, which might get cut, or FALN’s outperformance, which might fail to materialize in the future. Choosing cheap funds is always beneficial, while the same is not true for funds with strong yields or strong performance track-records.

Besides the above, nothing much else stands out about SPHY. It is an incredibly vanilla fund, with no important benefits or drawbacks besides its expenses.

SPHY’s expenses are lowest in its peer group, and is the fund’s key benefit and advantage relative to peers. The fund is a strong investment opportunity, and a buy. I last covered SPHY here.

Conclusion

High-yield corporate bond ETFs offer investors strong, growing dividends.

HYGV offers investors a particularly strong 8.4% yield.

FALN offers investors a particularly strong performance track-record, due to focusing on Fallen Angels.

SPHY offers investors the lowest 0.04% expense ratio, which boosts dividends and returns alike.

HYGV, FALN, and SPHY are all strong funds, investments opportunities, and buys.

Read the full article here