The stock market is increasingly hard to analyze. A few stocks are leading the market higher, and that seems unhealthy.

Consider: The seven largest constituents in the

S&P 500 index

have surged 53% in 2023 versus 0% for the other 493 stocks, David Kostin, Goldman Sachs’ chief U.S. equity strategist, recently told clients.

Though the market often speaks loudly, it now seems to have more in common with a black hole than with the Oracle of Delphi. To overcome the lack of transparency, I sought guidance from a higher power—from something that has excited the entire financial world: artificial intelligence.

I asked ChatGPT to write my column, even though it felt adulterous and akin to cheating on my readers and editors. Surprisingly, the result was satisfying—in an unexpected way.

“As an AI language model,” ChatGPT told me, “I can generate text based on prompts and provide information on various topics, including finance and investing. However, I don’t have access to real-time data or the ability to write specific columns for Barron’s or any other publication. The Striking Price column in Barron’s is written by Steven M. Sears, a financial journalist and author. His expertise and insights are unique to him, and it would be best to refer to his articles directly for the Striking Price column in Barron’s.”

Undeterred, I asked ChatGPT other questions, but I never got any real insights.

It couldn’t tell me if the stock market was a buy or sell. It did say that stocks don’t rise forever, though they exhibit volatility and periods of decline or stagnation. When asked if it was normal for only a few stocks to advance while the rest of the market stayed flat, it generated another broad homily. The same happened when I asked ChatGPT if it was better to buy or sell options.

Question after question generated responses you would encounter from someone who had mastered the ability to speak without saying much of anything. At the end of my aborted attempt to have an intellectual exchange with ChatGPT, I found myself thinking that there was a bigger spread than most people likely realized between the excitement around AI and the reality of AI.

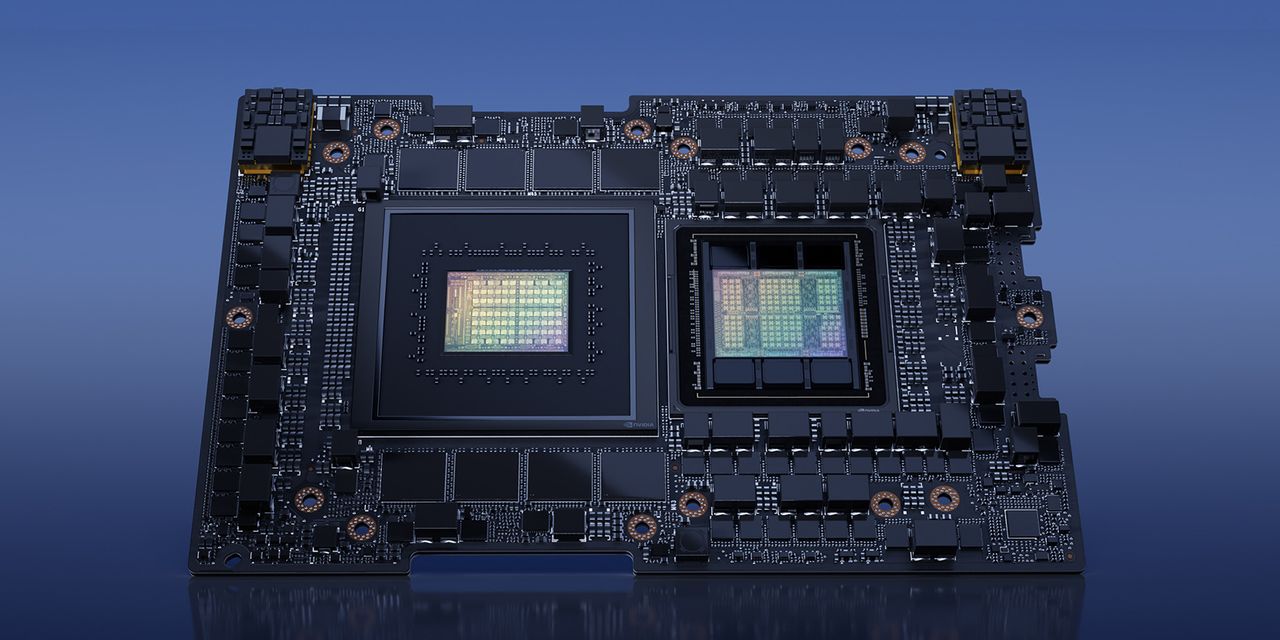

And while we focused last week on a way to bullishly trade

Nvidia

shares (ticker: NVDA), we now find ourselves wondering if it is only a matter of time before investors start asking harder questions about AI.

Investors who want to hedge the downside—Nvidia stock is up about 27% since late May, and up 165% this year—could consider a so-called bear spread. The strategy—which entails buying a put option and selling another with a lower strike price but a similar expiration—is designed to increase in value when stocks decline. It is used when a stock is unusually expensive, and its options are expensive and have high implied volatility. (Puts give the holder the right to sell an underlying asset at a specified price and time.)

With Nvidia at $386.54, investors who harbor some doubts that AI-related stocks won’t remain in an upward parabolic trend could consider buying the August $375 put and selling the August $320 put. The spread recently cost about $15.20.

Should the stock be at $320 or lower at the August expiration, the bear spread is worth a maximum of $55. Of course, if the stock continues to advance—or even if it doesn’t fall below $375 at expiration—the trade will fail.

Some might say that playing the bear side of last week’s idea lacks imagination, but there doesn’t seem to be much reward for imagination in the markets lately.

Steven M. Sears is the president and chief operating officer of Options Solutions, a specialized asset-management firm. Neither he nor the firm has a position in the options or underlying securities mentioned in this column.

Email: [email protected]

Read the full article here