By Liqian Ren

In an emerging markets portfolio, Taiwan typically represents around 15% of the total allocation, with mainland China accounting for approximately 33%.

But if we exclude mainland China, Taiwan’s weight in the portfolio increases to roughly 25%.

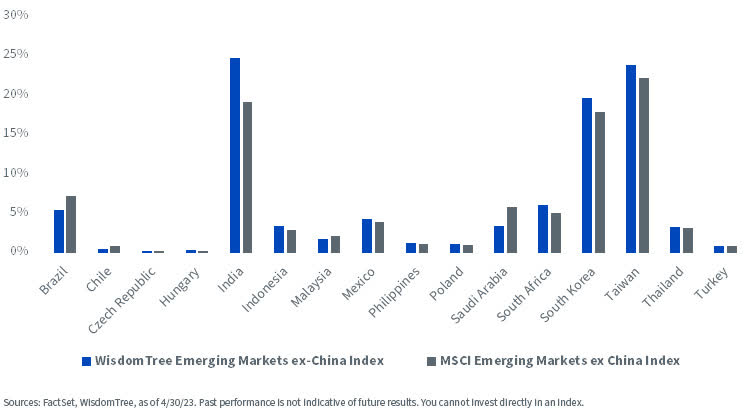

To address the growing interest in tracking the weight of mainland China separately, we at WisdomTree have introduced an ex-state-owned ex-China Index that specifically excludes it.

As of May 19, 2023, this Index allocates 24.65% to Taiwan equities.

Exposures to Emerging Markets ex-China Indexes

When it comes to political risk, U.S. concerns are directed toward mainland Chinese companies. Taiwanese companies, on the other hand, primarily face geopolitical risk related to a potential conflict in the Taiwan Strait.

About 20% of Taiwanese equity is TSMC (TSM), which is a world-leading semiconductor company facing increasing competition as every major country ramps up investments in this critical industry.

We believe the actual risk of a military conflict in the short to medium term (next five years) is very low. However, the perception of military risk remains high due to Taiwan’s role as a wedge issue in the U.S. containment strategy against China. Consequently, there is a greater media focus on Taiwan, which unfortunately leads to some investors being less inclined to invest in mainland China or Taiwan.

Let’s delve into the main reasons behind this assessment.

First, despite reports suggesting an imminent Chinese attack, there is no set timetable for such an event. China’s stance is rooted in the belief time is on its side if Taiwan is acknowledged as part of One China.

Domestically, there is approximately 55% support for a military solution in mainland China, with 20% accepting the current situation and being open to it continuing indefinitely. Often, China’s aggressive diplomatic posturing on Taiwan stems from its extreme reluctance to use force while having limited alternative options.

Secondly, it is crucial to consider the official messages conveyed by key figures, such as during Speaker Pelosi’s visit to Taiwan in 2022. The official statements from China and the U.S. exhibit a greater level of cooperation and communication than is portrayed on social media in either country.

It is essential to give more weight to the viewpoints expressed by those in positions of power, such as U.S. military communication channels or China’s own spokespersons, rather than relying on media narratives.

Third, in the very near term, the likelihood of a serious military conflict is close to zero. Taiwan is currently in a heated presidential election that will be resolved in January 2024. Both mainland China and the U.S. will closely observe the election outcome and recalibrate their Taiwan policies accordingly.

Most polls indicate a dead heat between the top two candidates. Therefore, mainland China has little interest in taking action that could disrupt the status quo, opting instead to emphasize increased cross-Strait human contacts to bolster its case that both sides belong to One China.

It is crucial to emphasize that Taiwan is not comparable to Ukraine. Taiwan’s democratic processes and vibrant economy could suffer if it excessively models itself after Ukraine. The perception of military risk may deter both individuals and investments away from Taiwan.

It is important to recognize that the main battleground between the U.S. and China lies in economic and technological competition, rather than being centered on Taiwan. The U.S./China relationship will be challenged but could see a slight thaw as both sides find a way to move beyond Speaker Pelosi’s visit to Taiwan and the spy balloons, and into other more contentious issues.

By considering these factors, investors can gain a more nuanced understanding of the risks associated with China and Taiwan equities in an emerging markets portfolio.

Liqian Ren, Director of Modern Alpha

Liqian Ren, Ph.D., joined WisdomTree as Director of Modern Alpha in 2018. She leads WisdomTree’s quantitative investment capabilities and serves as a thought leader for WisdomTree’s Modern Alpha® approach. Liqian was previously at Vanguard, where she worked for 12 years, most recently as a portfolio manager in the Quantitative Equity Group managing Vanguard’s active funds and conducting research on factor strategies. Prior to joining Vanguard, she was an associate economist at the Federal Reserve Bank of Chicago. Liqian received her bachelor’s degree in Computer Science from Peking University in Beijing, her master’s in Economics from Indiana University—Purdue University Indianapolis, and her MBA and Ph.D. in Economics from the University of Chicago Booth School of Business. Liqian co-hosts a podcast on China and Asian markets with Jeremy Schwartz, WisdomTree’s Global Head of Research, and she is a co-host on the Wharton Business Radio program Behind the Markets on SiriusXM 132.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here