As the digital revolution peaks, mobile devices and computers have become a staple. Households and businesses globally rely on these gadgets. Their appeal increases as online business transactions and cashless payments dominate the world. With that, mobile phone manufacturers and internet providers enjoy a higher operating capacity. They remain a durable market amidst inflationary headwinds. Nokia Oyj (NYSE: NOK) also sees increased revenues. It has a well-grounded financial positioning, which is one of its sturdy foundations. It allows the company to sustain its current size and capital returns.

However, its growth remains lackluster as the fierce competition intensifies. From being an industry stalwart, it has lost its strength over the years and contracted. Today, it stays unappetizing for me despite the growth opportunities it has. It will have to transform itself to speed up its growth across regions. Unsurprisingly, the stock price has remained sluggish over the past decade. Investment returns are underwhelming. There is undervaluation but limited upside potential.

Recent Performance

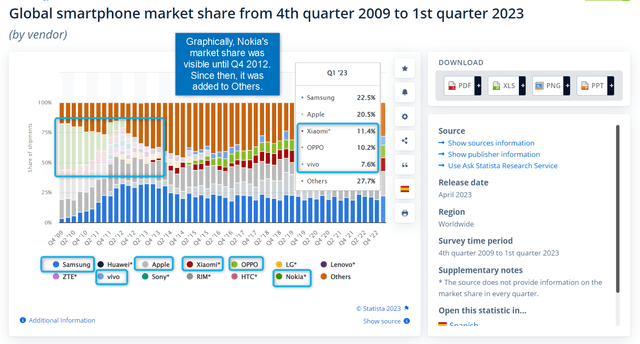

Nokia Oyj has been around us for a long time. Once upon a time, it was a giant that dominated the world of technology. However, it failed to keep up with the fast-paced market. Eventually, Apple (AAPL) and Samsung (OTCPK:SSNLF) prevailed. Nokia had to rethink its decisions and move to the mid-range market. It proved effective as NOK regained its footing. Sure, it is no longer the superstar it was twenty years ago, but it is doing fine today. It maintains stable core operations amidst macroeconomic volatility.

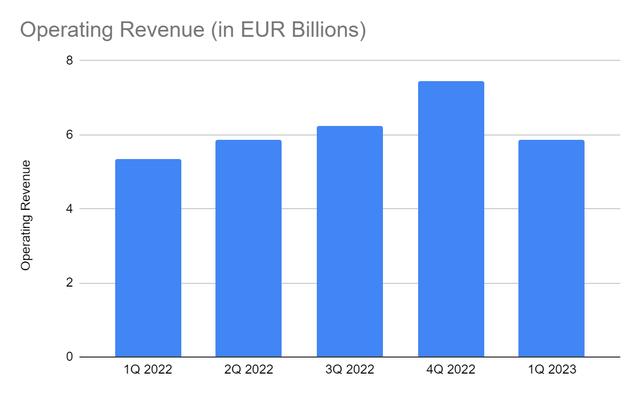

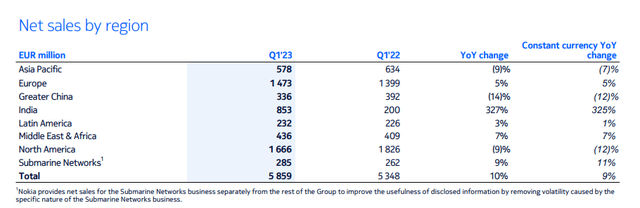

It started the year with a decent performance. Its operating revenue reached €5.86 billion, a 9% year-over-year increase. This double-digit growth was reassuring, given the economic uncertainties and tight competition. As such, NOK remained durable while sustaining its capacity and cushioning market blows. Its network infrastructure remained a primary driving force with a 14% year-over-year increase. It comprised 38% of the total sales. The increase was most visible in its IP Networks and Optical Networks, thanks to its newfound strength in India as a result of its geopolitical tension with China. Note that it has a lot of competitors in China, such as Huawei and ZTE. So, the company increased its market share in India. It is no surprise its revenues in the country rose by over 300%. Meanwhile, its mobile networks segment was the largest revenue component. It also remained healthy with a 13% year-over-year increase. We could attribute it to the increased appeal in the mid-range market in the EMEA region. On the other hand, The Cloud and Network Services Segment realized a 3% increase in revenues. Hence, they offset the noticeable decrease in the Nokia Technologies segment. We can also attribute its revenue growth to its pricing strategy. It helped stabilize its sales volume, which was crucial amidst inflation.

Operating Revenue (MarketWatch)

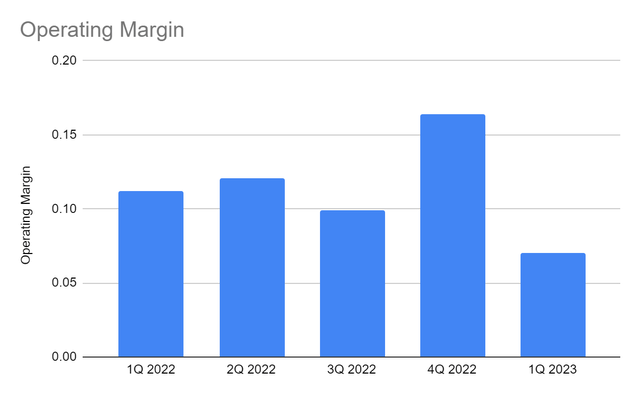

However, cost pressures got the better of it. Its operating cost rose by 14% while operating expenses had a 16% increment. They easily offset revenue growth and squeezed margins. The operating margin dropped from 11% to 7%. The actual operating income decreased as well from €600 million to €410 million. Nevertheless, Nokia stayed viable, giving it adequate returns.

Operating Margin (MarketWatch)

How Nokia Oyj May Stay Secure This Year

Nokia Oyj is not immune to the risks associated with the elevated prices. But thankfully, Finland appears to have stabilized inflation. After peaking at 9.1%, it started decreasing again, landing at 7.9%. Even so, it must not be complacent since the inflation rate is still high. It must also account for the competition, which we will discuss in the next section.

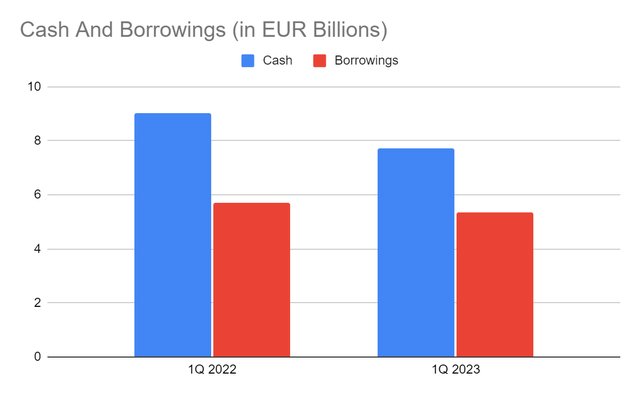

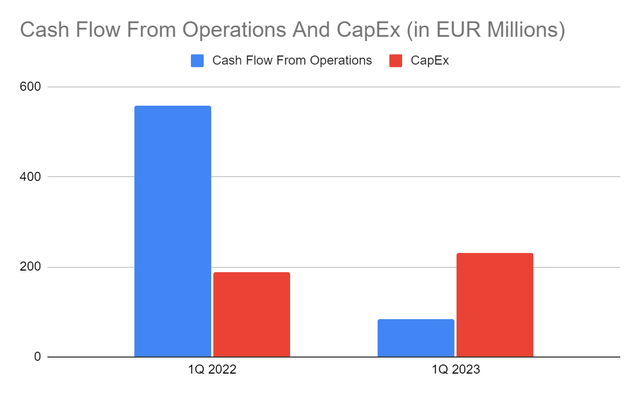

What holds Nokia together is its impeccable financial positioning. It has a healthy Balance Sheet, showing its high liquidity levels. Cash may have decreased by 15%, but it still comprises 18% of the total assets. Borrowings decreased by 7%, which is a good aspect in a high-inflation environment. Also, cash alone can cover all borrowings in a single payment. Even company earnings can cover borrowing repayments. We can confirm the changes in cash using the Cash Flow Statement. Cash Flow From Operations decreased substantially. We can attribute it to the higher cash outflows from working capital. It reduced its financial obligations by paying its accounts payable. It also had higher spending on investing activities through CapEx. With that, it had a negative FCF, showing a decrease in cash.

Cash And Equivalents And Borrowings (MarketWatch) Cash Flow From Operations And CapEx (Nokia 1Q)

By the looks of it, the company can sustain its operations for a long time even without earnings. Again, cash levels are high enough to cover its current capacity. More specifically, it has a monthly cash burn of €109 million, the cash movement from 1Q 2022 to 2Q 2023. It has 71 months to cover its operations and capital returns using cash. The company maintains the balance between viability and sustainability.

Why Nokia May Not Speed Up Its Growth Potential

I don’t doubt Nokia’s capabilities to maintain a decent performance and sustain its current size. But I don’t think it can stimulate its growth potential and make a massive expansion. Nokia maintains adequate cash levels with lower financial leverage. However, it has contracted its operations with several divestitures. It could help streamline its operations in a challenging macroeconomic landscape. But it decreased its size after selling its North America cable and antenna business. It also sold its VitalQIP business and exited TD Tech. But let’s see if these moves were strategic for its B2B technology platform.

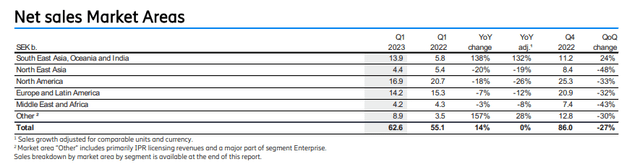

Aside from that, it faces fierce competition in the domestic and international markets. In the domestic market, it still lags behind Ericsson (ERIC). Ericsson posted a higher revenue increase of 14%. It has a much larger growth rate in India. But if we account for the whole Asia Pacific, including India and Greater China, its growth rate of 44% is lower than that of ERIC at 63%. Also, the actual amount of revenue increase in Nokia is €510 million versus SEK 7.5 billion or €640 million.

Net Sales By Region (Nokia 1Q) Net Sales By Region (Ericsson)

It may also have a hard time expanding in Asia, given the presence of multiple competitors. It averts the threat of Chinese competitors in India, but not in other Asian countries. Localization in Asia is one of the primary hurdles it must overcome. It may become harder this year since China has already reopened its borders. Shipments from China to neighboring countries may increase. It can capitalize in India, but it may be different in other parts of the continent, especially in East and Southeast Asia.

In the chart below, we can see how Nokia performed relative to its competitors. Note how Nokia’s market share shrank over the past decade. Also, note how Apple and Samsung sustained their market power. To be more precise, we will focus on its mid-range market competitors. We can see the uptrend in its Chinese competitors, mainly Xiaomi, vivo, and Oppo. Basically, Nokia and its Chinese mobile phones have similar features and price ranges. But its competitors have a competitive advantage over Nokia aside from localization. China is the largest supplier of raw materials for mobile phones. So, it is easier for these companies to manage their variable costs and make a cut-throat competition. They can easily set predatory pricing without sacrificing their operating income.

Global Market Share (Statista)

It must also consider inflation. Although it has slowed down recently, actual rates are still high. Prices remain elevated, which can make its raw materials and labor more expensive. It may also have to readjust its prices to cater to its customers amidst the lower purchasing power. It is logical since global recession fears persist, which may lead to lower discretionary spending.

Stock Price Assessment

The stock price of Nokia Oyj has been in a downtrend over the years. There were some uptrends, but price decreases were larger. At $3.9899, the stock price is 18% lower than last year’s value. Despite this, the PB Ratio shows undervaluation, given the current BVPS and PB Ratio of $3.83 and 1.04x. If we use the current BVPS and the average PB Ratio of 1.51x, the target price will be $5.78. Yet, the PE Ratio shows a potential downtrend. If we use the current PE multiple of 4.86x and NASDAQ EPS estimates of $0.44, the target price will decrease to $2.14. The EV/EBITDA Model shows that the stock price is fairly valued. It gives a target price of ($20.42 B EV – (-$2.54 B Net Debt)) / 5,579,816,000 shares = $4.11.

Meanwhile, it is an ideal dividend stock with consistent payouts and yields of 2.9%. It is way higher than the S&P 500 of 1.51%. Dividends are well-covered as the Dividend Payout Ratio remains decent at 65%. However, actual investment returns are unappetizing. We can compare the cumulative EPS and the average price changes since 2019. The cumulative EPS was $0.68 while the average stock price change was only $0.005. So, for every $1 increase in the EPS, the stock price had a $0.07 increment. In short, the stock price returns relative to company earnings were only 0.07%. To say price returns were measly was an understatement. To assess the stock price better, we will use the DCF Model.

FCFF €1,002,000,000

Cash €7,720,000,000

Borrowings €5,340,000,000

Perpetual Growth Rate 4.4%

WACC 9.2%

Shares Outstanding 5,579,816,000

Stock Price $3.9899

Derived Value €3.96 or $4.22

The derived value adheres to the supposition of an undervaluation. But the potential upside stays limited at 7% in the next 12-18 months. While the stock is still offered at a bargain, it does not appear enticing.

Bottom line

Nokia Oyj maintains a decent performance amidst macroeconomic volatility. It has an excellent financial positioning to ensure its sustainability. It can cover its operating capacity, borrowings, and capital returns. However, growth prospects remain limited and unappetizing due to fierce competition. It can hardly demonstrate price and product differentiation due to the competitive advantages of its peers. Most importantly, investment returns are very low relative to company earnings. The stock price remains divorced from the fundamentals. There may be undervaluation, but upside potential remains limited. The recommendation is that Nokia Oyj stock is a sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here