Investment Thesis

With what seems like a good turnaround story post-scandal and aggressive expansion domestically and slowly outside of China, I wanted to take a look at Luckin Coffee (OTCPK:LKNCY) to see how the company managed to turn around so quickly and become one of the top coffee chains in China. Focus on tech, which expanded operating margins quite considerably, and shifting focus from affluent cities is what seems to be fueling the growth of the franchise. If the company can sustain such an expansion over the next decade, the company fairly priced. I will hold off for now and wait for the next report to see how the international expansion is going to develop.

Outlook- Very Strong Business Model

Since the fraud scandal, the company has changed its top management completely and taken it on the chin. The company has been aggressively expanding its operations in China and has well passed the king of coffee, Starbucks (SBUX) as the top franchise. They are not stopping anytime soon. Margins have improved quite considerably due to the use of cashier-less coffee shops where people can place their order online and pick it up at their nearest store whether that is a self-operated store or a partnership store. The reason the company can expand so aggressively is because its stores are very small. The company focuses primarily on “Pick-up Stores” that range anywhere from 20-60 square meters with very limited seating. Around 98% of all stores are Pick-up Stores.

The Retail Partnership

This model has finally turned into a profitable business with decent margins. I think what allows the company to have such aggressive growth is that it will no longer focus on affluent cities like Beijing or Shanghai. The Retail Partnership model is basically a contract with a local store that already has a presence in what they call a “lower tier” city, for example, a bubble tea shop or some fast-food chain in a mall. This has complemented its main business quite favorably and these stores grew from 874 stores in ’20 to 2,562 in ’22, covering around a third of total operated stores.

Other coffee chains like Starbucks or McCafé (MCD) primarily operate within the top-tier, affluent cities where coffee consumption is higher, however, Luckin decided to shift gears and started to penetrate the 2nd, 3rd, 4th, and even 5th-tier cities in China, and it seems to be working rather well.

The Retail Partnership model is very cost-efficient and one of the reasons is that it’s easier for the company to expand and keep very good margins going forward. I could see this revenue segment becoming as large or even larger than the Self-Operated Store model.

Growth Outside of China

The company has taken its first steps toward global expansion with the opening of 2 stores in Singapore. This is a very important step because if it can succeed in this market, which judging from what I saw on YouTube Shorts has seen quite a turnout. Maybe it was because it offered 99c coffees. We’ll have to wait a little longer to see how it is going to work out in that region.

Back in July of ’19, the company announced that it signed a memorandum of understanding with the Kuwait Food Company Americana because it would like to expand its business into the Middle East, North Africa Region, and India. I couldn’t find any info if the signed contract is invalid since the fraud scandal, so it seems like it is still on. Now that the company is not retrained domestically, the company could continue to see aggressive growth over the next 5 years or so, but it’ll all depend on the demand for its products and cost efficiencies. We will have to wait for the next earnings report to see how aggressively it is going to expand outside of China going forward.

Competition

China has very healthy competition in coffee. The big competition I see right now is two coffee chains that seem to adopt a similar business model to Luckin, which is catering to lower-tier cities. Cotti Coffee and Lucky Coffee. These two chains sell their coffees cheaper than Luckin, McCafé, and Starbucks so it is going to be tough competition for Luckin in these cities.

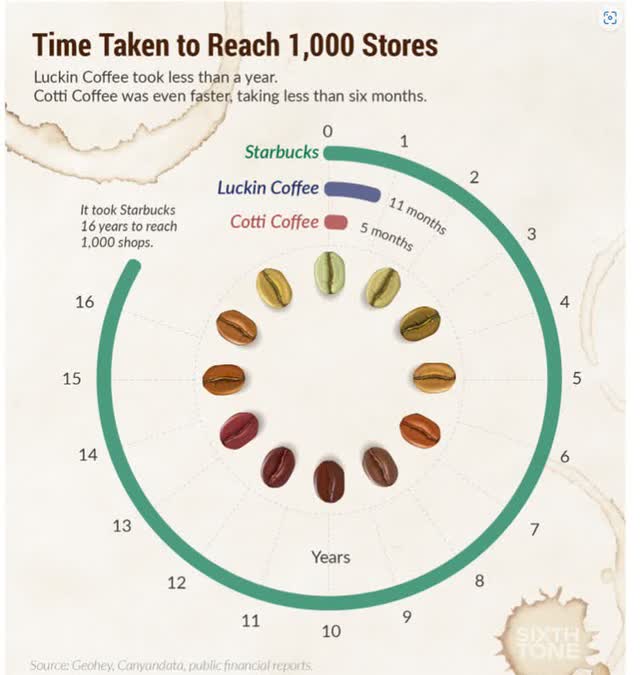

Prices of coffee comparison to Luckin (Sixth Tone)

Cotti Coffee is a company that came out of nowhere and started to expand even more aggressively than Luckin. It is still quite small, but at this rate, it can become 2nd in no time. Cotti is being run by the ousted management of Luckin Coffee during the fraud scandal. To be honest, I would be very skeptical of a company like Cotti due to how shady its management was in the past. I’m not sure how many people even know that the management is the one that almost bankrupted Luckin in the first place.

It took Luckin Coffee 11 months to reach 1,000 stores. For Cotti, it took barely 5 months. So, we can see the competition is going to be fierce domestically, but if international expansion is successful, Luckin should be in a strong position. In the latest quarter, Luckin opened 1,137 stores, so they are not standing still also.

Sixth Tone

Financials

Let’s have a look at the company’s financials to see how it has done since the fraud. At the end of Q1 ’23, the company had almost $600m in cash and no debt. That is a great position to be in. This gives the company a lot more flexibility and with a good amount of cash it can keep expanding further.

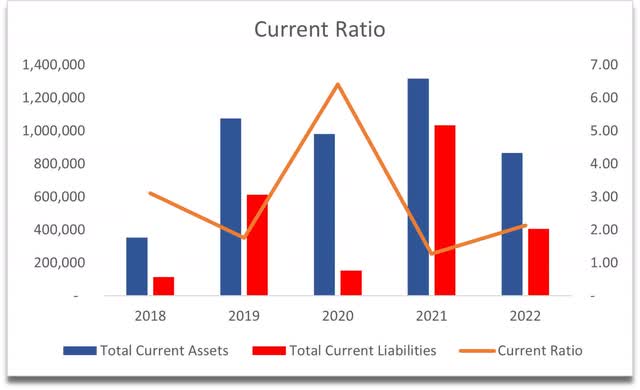

The company’s current ratio is fairly decent, standing at around 2, which means that it has no problem paying off short-term obligations. Luckin doesn’t have any liquidity issues.

Current Ratio (Own Calculations)

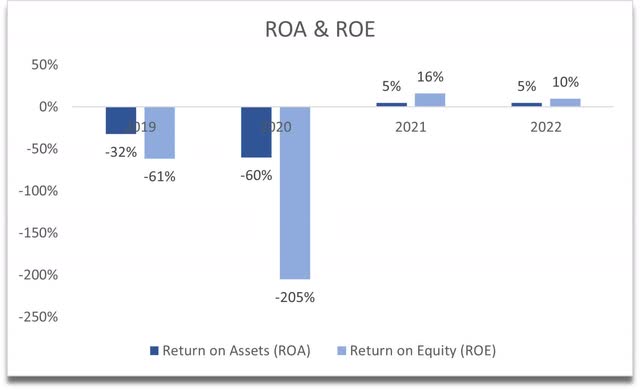

I can see a nice turnaround since the fraud scandal in recent years in terms of efficiency and profitability. The company’s ROA and ROE have been positive in the last 2 years, which is a good turnaround from when the company was still very unprofitable.

ROE and ROE (Own Calculations)

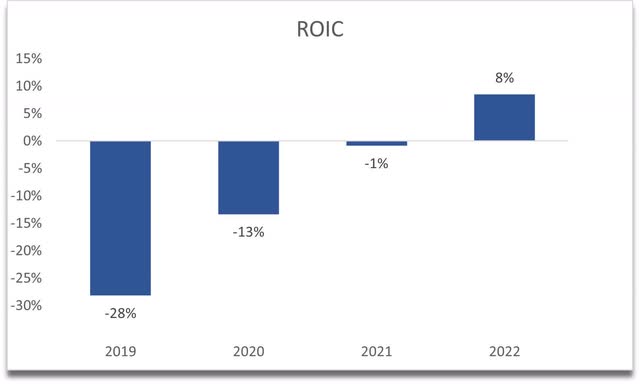

The same story can be seen in return on invested capital. It finally went positive, which means that the business model is working well, and the company is gaining a competitive advantage and a decent moat. I’d like to see this metric trending upwards in the future or at least stabilize around 10%.

ROIC (Own Calculations)

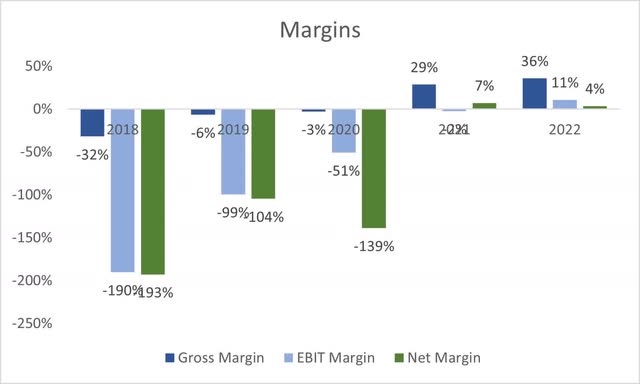

In terms of margins, we can see the management is doing a good job at operating all of these coffee shops. The company has become profitable in the last two years, and I’d like to see this continue in the future.

Margins (Own Calculations)

Overall, I can see a turnaround story unfolding here, but I would need a little bit more data in the next couple of quarters to see which direction it is heading. I wouldn’t want to hear that the margins are starting to contract again and that the revenue growth is slowing down considerably.

Valuation

The growth has been extraordinary, to say the least. In the last 5 years that it’s been around, the company averaged over 100% CAGR. The latest quarter showing around 85% tells me that the company is not stopping any time soon.

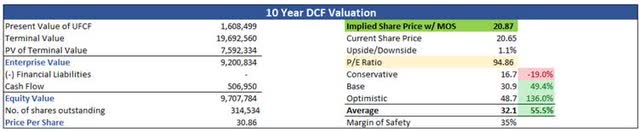

This is a growth company. For my base case, I decided to go with 24.5% CAGR over the next decade, with the largest growth frontloaded in ’23 and ’24. For the optimistic case, I went with 28% CAGR, while for the conservative case, I went with 17%.

For the margins, I went with conservative estimates of around 200bps or 2% improvements on gross and operating margins over the next decade, with slightly better improvements for optimistic and worse improvements for conservative.

On top of these assumptions, I decided to add a 35% margin of safety. I usually add 25% if the balance sheet has been spotless for a while now, which is not the case for Luckin since it is still a risky company. Riskier than I usually analyze.

With that said, the intrinsic value of Luckin Coffee is $20.87, implying the company is valued fairly.

Intrinsic Value (Own Calculations)

Closing Comments

It could be a good time to jump in to capture the future growth of the company if you believe that these estimates are reasonable. In the base case, the company’s revenue would be 8x the ’22 figures, which I think is possible given the global expansion opportunities and further expansion domestically. China has lifted its zero-covid policy, which will play some role in the further growth of Luckin; however, it seemed like it wasn’t affected by Covid that much.

I’m going to take a more cautious stance and wait for the next earnings report to see what kind of revenue growth we’re going to see and what kind of outlook the management is going to give if it’ll give any at all.

It’s a risky company, with a lot of negative sentiment, so, please do your due diligence. Don’t base your investment solely on this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here