Investment thesis

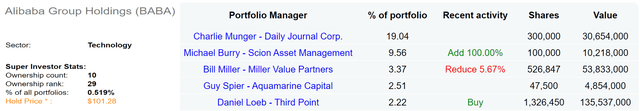

Recently, several high-profile investors have been buying shares of Alibaba Group Holding Limited (NYSE:BABA). As shown in the chart below, these investors include Charles Munger, the vice chairman of Berkshire Hathaway Inc. (BRK.A), and also “big short” Michael Burry, the hedge fund manager who famously predicted the housing market crash. Munger’s portfolio currently has the most concentrated bet on BABA, representing more than 19% of his overall portfolio size. Burry’s Scion Asset Management has also been buying shares in Alibaba. As seen, the hedge fund doubled down on its stake in the past quarters.

In the most recent quarter (Q1 of 2023), the hedge fund increased its BABA stake by 100%. In that quarter, the Alibaba stock price varied in a range of $81 to $120, with an average closing price of ~$100. After this increase, Burry’s portfolio now also has quite a concentrated exposure of close to 10% of its overall portfolio.

All told, BABA is now ranked the top 29th stock most held by super-investors tracked by Data Roma. And the average holding price for these super-investors is about $100 as shown ($101.28 to be precise).

Under this background, the thesis of this article is twofold:

- First, I will explain why I see the recent buying by these super-investors as a sign that some of the most successful investors in the world believe in Alibaba’s long-term prospects.

- Second, I will argue that the fact that the average buying/holding price for smart money is around $100 while the current market price of BABA stock is around $84 is a sign that the stock is undervalued substantially.

Source: Data Roma

Why the super-investors are buying/holding

As just mentioned, I believe that the primary reason for the above transactions is a bullish sign. More specifically, I believe they see an opportunity to purchase a great company that is experiencing temporary difficulties. There is no doubt that Alibaba has been experiencing strong headwinds recently on multiple fronts. And I assume all BABA investors are familiar with these issues, which include the competitive landscape, the regulatory environment (both in China and also globally), and also the macroeconomic outlook.

However, I see these issues as only temporary, and I assume that is what these super-investors see also. I am familiar with the style of several of the super-investors listed above and follow their writings closely (e.g., Munger, Burry, and also Guy Spier). They are all experienced investors with a long track record of success. Munger and Burry have both said that they believe in Alibaba’s long-term prospects.

Looking ahead, regulatory pressures seem to be waning as I see. BABA and other technology companies in China had been under intense scrutiny from Chinese regulatory authorities over the past 1~2 years. But recently I see signs that this relationship has markedly improved, as the country’s focus appears to be shifting back to supporting economic growth measures rather than cracking down on tech companies.

At the same time, BABA’s stock price and valuation remain extremely compressed. Furthermore, BABA recently announced plans to restructure the business into six distinct operating groups. And I anticipate this to be an effective approach to unlock shareholder value and also put each unit in a better and more focused competitive position.

And in the next two sections, I will elaborate on the implications of these factors.

The $85-$100 gap

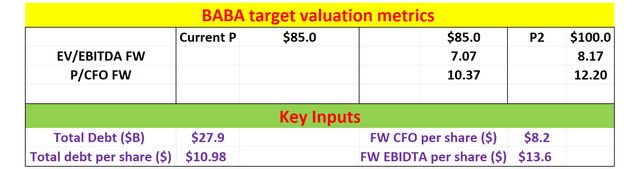

As aforementioned, the smart money’s average Alibaba holding price is around $100, while the market price is about $85 as of this writing. And I view the gap as a clear sign of undervaluation.

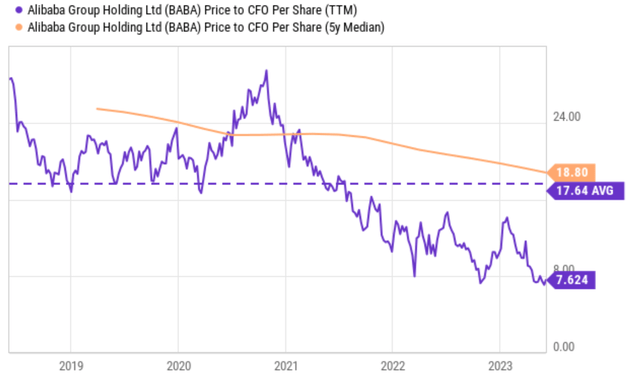

Besides the price gap, the stock valuation compressed can also be seen via other metrics. And the charts below show two more such metrics. The first chart shows that the stock is currently trading at a price-to-cash flow ratio (P/CFO ratio) of only 7.64x, which is extremely low either by horizontal or vertical comparison. As seen, its median P/CFO ratio over the past 5 years is 18.8x and the average is 17.6x.

Source: Seeking Alpha data

Similarly, the second chart shows that the stock is trading at a very compressed valuation too when its leverages are considered. For example, its enterprise value (EV) to earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio currently stands at 7.07x only (on a forward basis). Actually, even at the ~$100 holding prices from the super investors, its EV/EBITDA multiple is still only 8.17x and the P/CFO is only 12.2x.

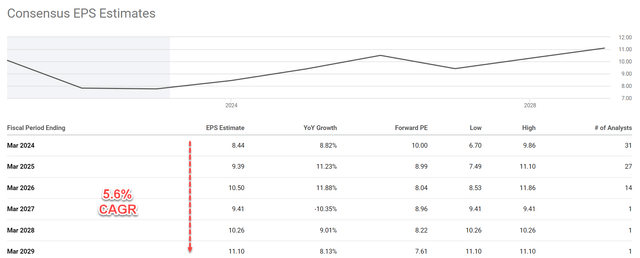

For a business that has no solvency issues, I view such multiples as reserved only for companies that are terminally stagnating. Yet, BABA is the opposite of a terminal stagnation stock in my mind. And consensus estimates are forecasting healthy growth in the next few years (5.6% CAGR as seen) too.

I will go a step further and argue that such consensus estimates are on the conservative side. I am optimistic that BABA can achieve higher growth rates in the years ahead both because of macroscopic and company-specific catalysts. Macroscopically, my opinion is that the Chinese domestic economy has moved past lingering COVID-19 headwinds and I expect a much-improved macroeconomic landscape. Specific to BABA, I expect the ongoing restructuring efforts to spur more creativity, efficiency, and also profitability in the near future.

Source: Author based on Seeking Alpha data Source: Author based on Seeking Alpha data

Other risks and final thoughts

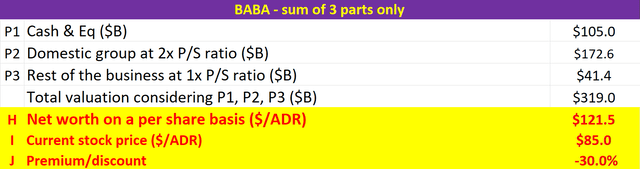

There are a few other upside risks to consider besides those mentioned above. And the top and most immediate one in my mind is the shareholder value unlocked due to its anticipated reconstruction efforts. The following charts show my sum-of-the-parts (“SOTP”) analysis of the current worth of the business (more details are provided in an earlier article). The gist is that two of the parts, its current cash position and domestic e-commerce, are already worth its current market price according to my results. When all six parts that it plans to separate out (and potentially IPO) are considered, I am seeing a 30% upside potential for Alibaba stock even under conservative assumptions.

Source: Author based on Seeking Alpha data

There are also downside risks to consider. Geopolitical risks are a major risk. Besides the crackdown from the Chinese government, the company is also often at the forefront of the U.S.-Sino trade tension. The company has been regularly under investigation by the U.S. government for various violations (i.e., antitrust, compliance, reporting irregularities, et al). In addition to these geopolitical challenges, BABA is also facing competition from other Chinese and also global e-commerce companies, such as JD.com (JD), PDD Holdings Inc. (PDD), and Amazon (AMZN). All these competitors are investing heavily in new technologies and marketing initiatives, and all of them directly compete with BABA and could pressure its margins.

Despite these challenges, Alibaba Group Holding Limited remains one of the largest and most successful e-commerce companies in the world. And the key consideration for my bullish thesis is that the current headwinds are temporary. I interpret the recent transactions from some of the most successful super-investors as a move to buy a great company that is experiencing temporary difficulties. And I see the price gap between their buying/holding prices and the market price of Alibaba Holdings as an indicator of the company’s undervaluation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here