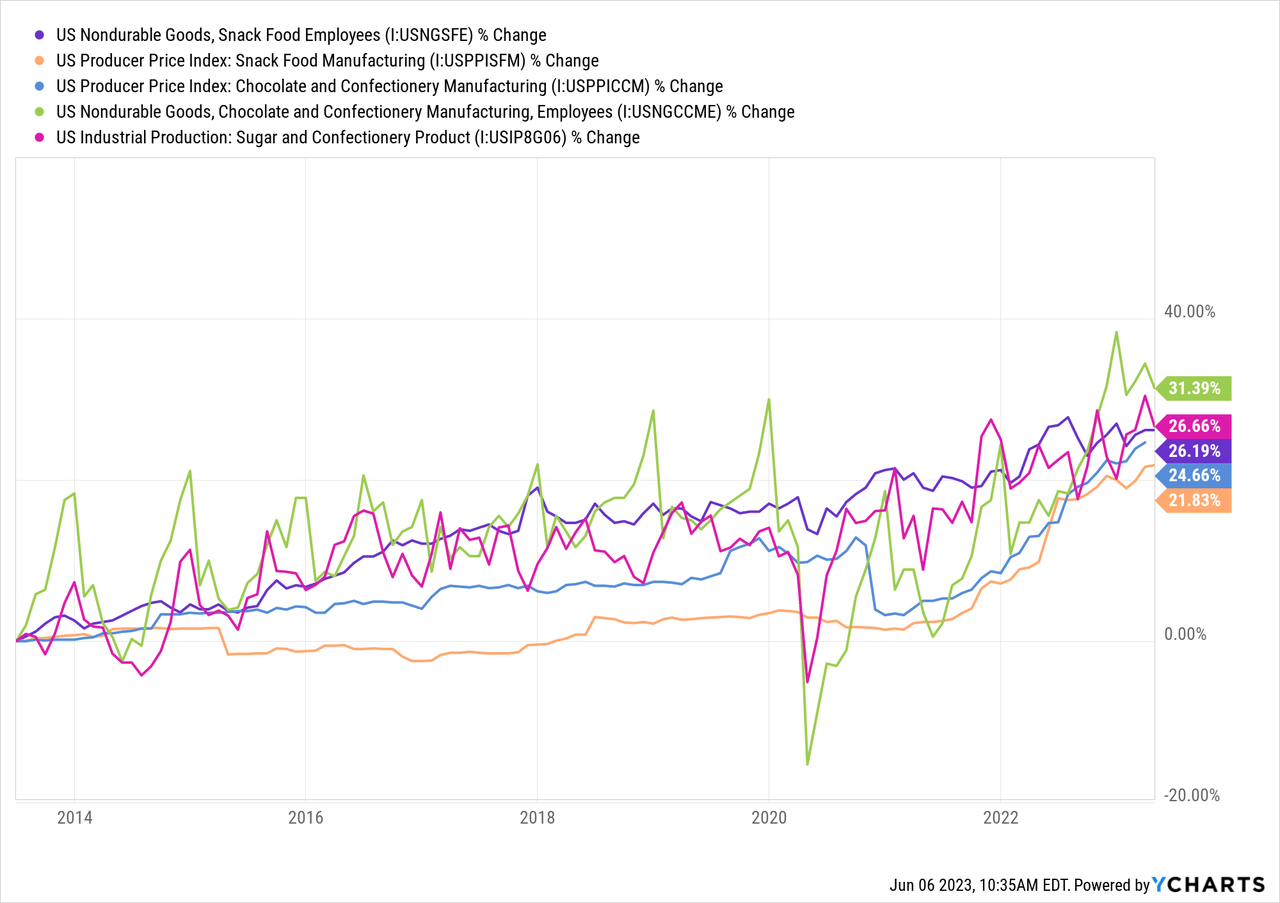

The past three years have led to dramatic changes in consumer purchasing habits. One interesting little-known trend is the general boom in spending on candy, chocolate, and snacks. For understandable reasons, sweet and salty items have been a primary coping mechanism for many worldwide. Prices of non-chocolate and chocolate confectionary items have risen by around 30% since then, with US industrial production of those items rising by about 15%. The number of employees in that industry has similarly increased to manufacturing output. See below:

This industry was performing decently before 2020 but has shown a substantial upward trend since then as demand for these products has risen despite the sharper increase in consumer prices. In my view, this trend is particularly notable because US industrial production of most goods has declined since 2020 amid rising costs and lackluster demand. Clearly, the “sweet and salty” snack industry is a significant benefactor of precarious environments, causing the industry to behave similarly to “sin stocks” by performing well during generally difficult social periods.

Of course, companies like Hershey (NYSE:HSY) do not carry the valuation discount and regulatory risks of more common “sin stocks.” HSY has performed exceptionally well since 2020, rising by around 70% with little volatility. The stock’s forward “P/E” is very high today at 27X, a particularly significant figure considering rising interest rates have caused consumer staples stocks to see their valuations decline. On the one hand, Hershey has a strong track record of growth and profitability in recent years. On the other, its valuation is extremely high, its costs are growing, and the positive secular trend in sweet and salty snack demand may be starting to fade. Accordingly, Hershey is an interesting stock today that I believe could be on the cusp of a sharp reversal.

Will America’s “Sugar High” Continue?

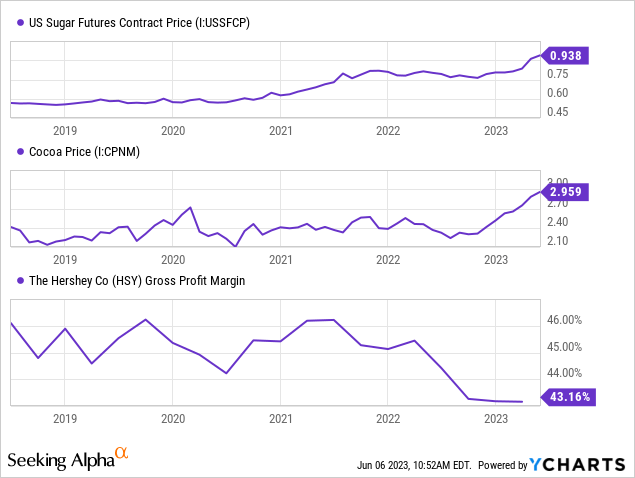

Before 2020, most Americans were cutting back on their intake of sugar and sugar products. During that year, there was a notable reversal in that trend, and consumption of sugar and sugar products has risen significantly since. This reversal has come with a noteworthy shift in people’s attitudes toward candy and chocolate, with the vast majority of consumers having a positive attitude toward such items in 2022. Hershey has struggled to keep up with demand, particularly considering it has been met with a decline in the global availability of cocoa and sugar. Indeed, although Hershey’s sales and income growth have been phenomenal since 2020, its gross margins may be beginning to slip due to rising commodity prices. See below:

Since last year, there has been a particularly significant increase in sugar and cocoa prices, with a notable decline in Hershey’s gross margins. Like the confectionery sector, Hershey has had to accelerate hiring, causing its total employee count to rise by 23% since 2020. As with virtually all manufacturing firms, widespread US labor shortages have caused some strain on Hershey’s efficiency and are likely a significant cost contributor today. Significantly, Hershey’s gross margin declines have been offset by a slightly more significant ~3% decline in operating costs-to-sales, so its operating margins are about 1-2% higher than before the pandemic. Its operating margins have been slipping YoY since 2021, meaning rising costs may be catching up with the firm.

In my view, Hershey’s profit margins are relatively likely to slip over the coming year and beyond. I do not expect the decline to be too significant yet; however, a continued increase in commodity, labor, and freight costs could cause a more substantial margin decline, particularly if sales do not continue to rise. Analysts expect Hershey to continue to grow faster than inflation over the coming years, with a slightly higher anticipated long-term increase in EPS. Even based on these relatively strong assumptions, Hershey’s long-term forward “P/E” based on its predicted 2029 EPS is 20X today, a very high figure compared to most firms having a ~15X or lower long-term forward valuation.

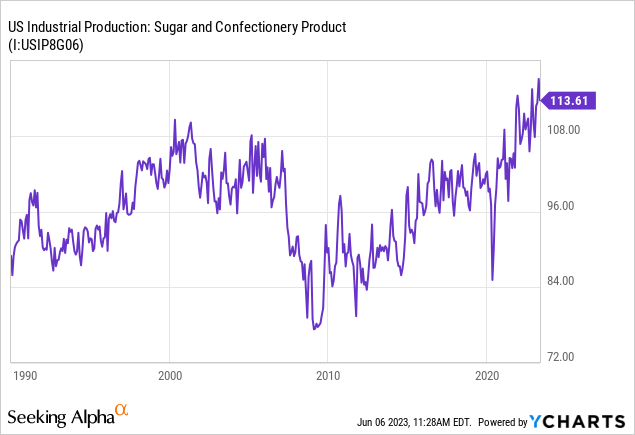

Even still, its EPS and sales may decline over the coming years if costs continue to grow and demand fades. The US sugar and confectionery product business is historically cyclical, with output currently at the high end of its thirty-year range. See below:

There may be an upper limit or constraint to the potential US demand for candy products. As we’ve seen since 2020, social and economic stress may be a positive factor that increases demand, but it is unclear if that growth is permanent. While Hershey’s products are certainly not the sole cause of obesity and diabetes in America, studies suggest that obesity rates in adults and children have risen dramatically since 2020 – with the average American gaining ~30 lbs of weight since then. The US military, which closely tracks its members’ health (and is, therefore, a means of approximating general US trends), has seen a sharp increase in diet-related health issues since the pandemic, forcing it to reduce health standards for new recruits.

Of course, the sharp increase in sugary food consumption since 2020 is not the only factor behind this trend. However, soaring diabetes death rates and the considerable relationship between diabetes and COVID mortality (40% of deaths having diabetes) indeed indicate that more Americans will need to improve dietary standards. Around 83% of Hershey’s sales and ~90% of its income comes from its North American Confectionary segment (with salty snacks and international being comparatively insignificant). Accordingly, much of the company’s income is directly exposed to the risk of Americans making healthier choices. The company sells “zero sugar” products, which may not be much more beneficial, but still offers some potential in case the anti-sugar trend eventually returns.

The Bottom Line

Overall, I am generally bearish on HSY today due to apparent overvaluation. The company has undoubtedly been great to own over recent years as its valuation has risen amid growing sales and EPS. However, I believe its primary fuel has been a temporary social shift away from health toward comfort foods, which I expect to reverse over the coming years inevitably. Importantly, I do not expect a massive reversal in the broader sales trend of chocolate and candy; however, even a stagnation at the current high level would be sufficient to make HSY considerably overvalued today. Put simply, investors are valuing the stock based on extrapolating its recent growth. In my view, it is doubtful that the secular trend for candy can continue to rise indefinitely, particularly in light of record health issues in the US.

In other words, a slightly negative shift in candy and chocolate demand will likely make HSY overvalued at a 27X forward “P/E.” Further, I believe Hershey’s margins could continue to slip as it braces for rising commodity, labor, and freight costs that will be more difficult to push onto customers. HSY’s TTM “P/E” is at 29X today, 53% higher than its sector and 15% greater than its average over the past five years. Of course, the past five years have seen great growth for the stock, which is unlikely to continue, so it should not be trading at such a valuation premium. Most of its other valuation metrics are 30-60% above sector norms and 10-20% higher than its five-year average, indicating HSY is overvalued based on essentially all measures.

The company may continue to see decent growth in 2023, but I do not expect it to continue, and I believe a slight decline in sales (adjusted for inflation) is likely after that. Accordingly, I would not buy HSY at a hefty premium to its sector, with a 20X “P/E” seeming far more reasonable, closer to that of its peer group. Thus, I believe HSY’s fair price is likely closer to $180, where it traded around late 2021. While I would not short the stock (since its bearish catalysts are too long-term), it seems to have reached its peak at $275 and is trending lower from a technical standpoint. As such, it may be a suitable time for bullish investors to profit from HSY.

Read the full article here