Investment thesis

Allegro MicroSystems (NASDAQ:ALGM) demonstrated solid stock price growth with a 31% year-to-date rally this year. On the other hand, the stock is currently far lower than its late March peaks. Some might be tempted to buy the dip, but my analysis suggests the stock is overvalued, and the recent strong revenue growth momentum is already priced. Concentration in the Chinese market is a major risk, and overall risks substantially outweigh potential benefits for potential new investors of ALGM stock.

Company information

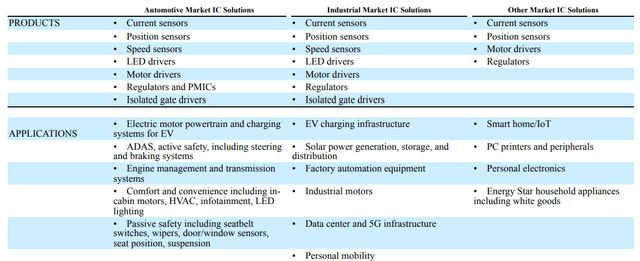

ALGM is a leading global designer, developer, fabless manufacturer, and marketer of sensor integrated circuits [ICs] and application-specific analog power ICs aimed at automotive and industrial markets. The company serves its customers via design and application centers in North America, South America, Asia, and Europe. Examples of IC products and their application for end markets are outlined in the below table.

ALGM’s latest 10-K report

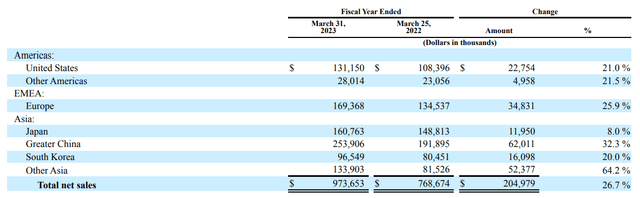

The company’s fiscal year ends on March 31. The company disaggregates its revenue in several dimensions: by market, by product, and by geographic location. About 67% of sales are attributable to the automotive market. Magnetic sensors integrated circuits [MS] is the leading product, with about 61% of total sales. I would also like to emphasize that a significant part of revenue geographically relates to Asia, with Greater China accounting for more than a quarter of the company’s sales.

ALGM’s latest 10-K report

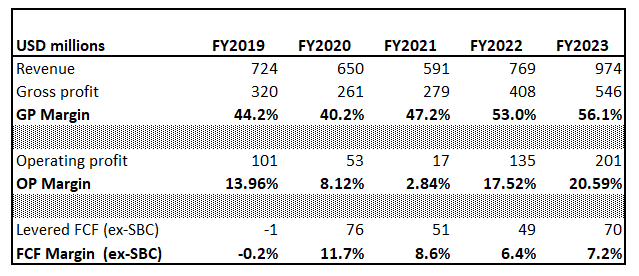

Financials

The company went public in late 2020, so only financials are available from FY 2019. Over the last five years, the company delivered a modest 6.1% revenue CAGR. For me, a mid-single-digit revenue increase pace does not look attractive for a growth stock. On the other hand, despite a relatively slow scaling-up pace, the company managed to improve profitability metrics significantly. I also like that the company consistently delivers positive levered free cash flow [FCF] even after the stock-based compensation [SBC] deduction.

Author’s calculations

The company fuels its growth with the help of innovation. ALGM’s R&D expenses were stable at about 15% of revenue, which is a good sign for me. Innovations are crucial for the company because it operates in a very intense semiconductor industry, where technologies become obsolete rapidly. If the company can maintain its technological advantage, it will likely remain on a stable revenue growth trajectory. The company aims for the automotive market, primarily electric vehicles [EVs]. According to statista.com, the EV market is expected to grow at a ten percent CAGR over the next five years. Allegro is well-positioned to benefit from this secular trend. The second crucial addressable market for the company, solar energy, is also expected to demonstrate solid growth over the following years. For example, world-energy.org projects the solar power equipment market to compound at 11.5% over multiple years.

ALGM’s balance sheet is strong thanks to the company’s ability to generate FCF at a solid margin. Current assets are about five times higher than current liabilities, meaning a stable liquidity position. The company is in a net cash position that has been expanded consistently yearly.

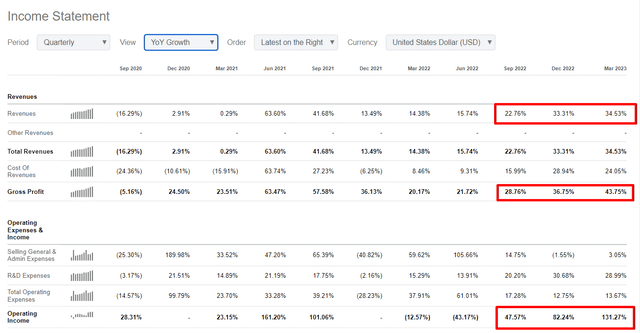

If we narrow our analysis down to reportable quarters, the business is experiencing strong momentum, with revenue increasing over 20% YoY during the last three quarters. I also like very much that margins are growing at a more rapid pace than the top line. Levered FCF also has been consistently positive over these quarters.

Seeking Alpha

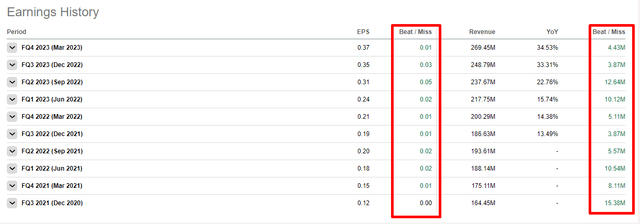

If we look forward to the upcoming quarter, consensus estimates forecast quarterly sales at $270 million. It indicates approximately 24% YoY growth and almost no growth sequentially. The forthcoming earnings release is expected on July 28, post-market. By the way, the company has never missed consensus estimates since it went public. The track record is relatively short, with a mere ten-quarter reporting history.

Seeking Alpha

Valuation

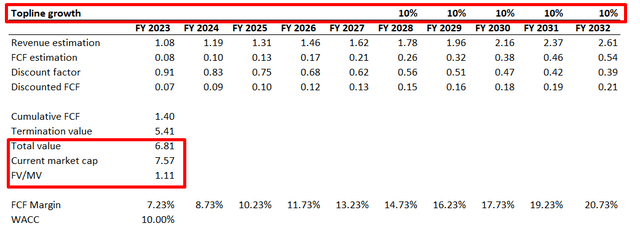

ALGM is a growth company. Therefore, I use discounted cash flow [DCF] approach for valuation. Valueinvesting.io suggests that the company’s WACC is 9.7%, but I prefer to be more conservative and round it up to 10%. I also have revenue consensus estimates up to FY 2027, and then I expect revenue to grow at 10% CAGR. ALGM’s FCF margin has been consistently positive over the last four years, so I expect it to be 7.2% in FY 2024 and expand 150 basis points each year.

Author’s calculations

Incorporating assumptions into my DCF template returns me the business’s fair value at about $6.8 billion, about 10% lower than the current market cap. This suggests the stock is slightly overvalued.

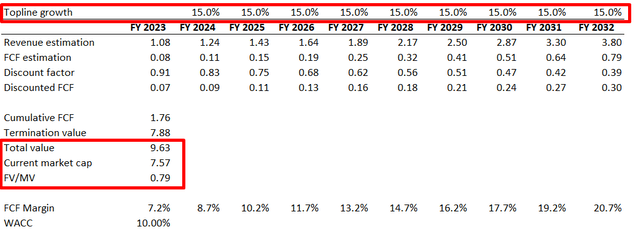

I have simulated a more optimistic scenario with revenue growing at 15% CAGR over the next decade. In this case, the stock might look attractive, but a 15% compound over such a long term is a very aggressive scenario, and not many companies can sustain this growth level.

Author’s calculations

ALGM has a “C-” Seeking Alpha Quant valuation grade, meaning the stock is fairly valued. I would like to underline that the stock trades at slightly above the 7 price-to-sales [P/S] ratio, while the historical 5-year average was substantially lower at 5.46. For me, it also adds evidence that the stock is overvalued.

Risks to consider

Weakness in the broader economy is a significant risk for any growth company at the moment. According to the latest manufacturing ISM report, the index dropped to 46.9, the seventh consecutive below-50 reading, which seems to be in the worst shape since 2009. A recession will significantly pressure the valuations of growth stocks. Apart from pressurized valuations, the recession will soften demand for ALGM’s end markets, ultimately hitting the company’s financials.

At the beginning of the article, I emphasized that revenue generated in Greater China represents more than a quarter of total sales. Intensifying geopolitical tensions between China and the developed world pose significant risks for ALGM’s business. The company might suffer from changes in international trade policies or even trade wars.

Foreign exchange risk is also substantial for the company. Only 13% of the company’s sales are generated within the U.S., meaning that the company is very vulnerable to unfavorable changes in foreign exchange rates.

Bottom line

To conclude, ALGM’s stock is not an attractive investment to me. Indeed, the company demonstrates strong momentum in sales and shows an impressive ability to expand profitability metrics even in the current harsh environment with high-interest rates and high inflation. But, my valuation analysis suggests that solid momentum and expanding margins are already priced into current levels. Moreover, I consider the company’s solid concentration on the Chinese market as a substantial risk. Therefore, I assign ALGM stock a neutral rating.

Read the full article here