Preamble

There is not much coverage of this company on Seeking Alpha, just two articles and the last one was in January 2021. Put simply, Nanobiotix (NASDAQ:NBTX) is not a popular company, with just 541 Seeking Alpha followers expressing interest in NBTX versus 1.07 million for Tesla (NASDAQ: TSLA) so it is very likely that there will be very few SA subscribers reading this article. However, something Chuck Carnevale, co-founder of Fast Graph, shared with me came to mind:

It is interesting how analysts disappear when investors need them the most, just as the going gets rough for a company.

Other than writing about companies that I care about, and about companies that many SA readers care about, I hope to analyze and share updates on the less popular companies because I can understand the frustrations of not being able to find recent coverage on smaller cap companies that I like.

If you find my article helpful, do let me know in the comments section below. It took me three days to research and write this article. It is not perfect but as always, I appreciate all your honest and constructive feedback.

With that, let’s get started.

Introduction to NBTX

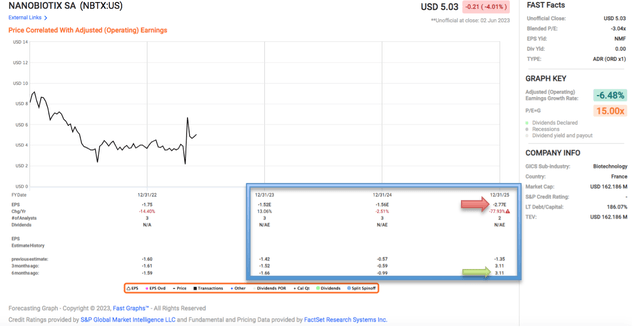

Nanobiotix first IPO’d on the Euronext Paris stock exchange in 2012. Then in 2020, it had its second IPO on the Nasdaq stock exchange. NBTX’s ADS (American depositary shares) started trading at $13.50 per share and went up to as high as $19; it is now trading at $5.03 as of close on 2 June 2023, a price collapse of more than 72% in just two and a half years.

Fast Graph

What does Nanobiotix want to achieve?

According to the company’s investor relations website:

Nanobiotix is a clinical-stage biotechnology company focused on developing first-in-class product candidates that use proprietary nanotechnology to transform cancer treatment.

The company has one product candidate, the NBTXR3, that is undergoing four clinical trials for four different treatments.

NBTX IR Website

The CEO Laurent Levy, who is also the co-founder of NBTX, shared his vision for radiation therapy for solid tumors:

Our company designs and manufactures nanoparticles that safely enhance the efficacy of radiation therapy in the treatment of cancer. With this approach, our ambition is to benefit millions of patients who receive radiation therapy by improving the efficiency of radiation in tumor cells without increasing the dose received by surrounding healthy tissues. We believe that radiotherapy combined with NBTXR3 can become a new standard of care in the treatment of cancer.

NBTXR3 is a sterile, nano object that is injected directly into the tumor just once. This non-toxic substance called hafnium oxide is small enough to enter the cell, and it is able to absorb X-rays.

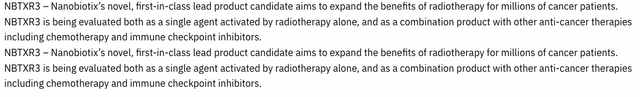

Slide from 2020 Webinar. Left shows tumor cell. Right shows tumor cell penetrated by NBTXR3

Value Proposition of NBTXR3

When X-rays are directed at an area, they cause random damage to both the tumor cells as well as healthy cells. The tumor cell on the right has NBTXR3 in it, and when these nano participles absorb X-rays, they are able to radiate energy into their immediate surrounding, delivering focused hotspots of energy in a targeted area like a tumor cell and leading to direct cell death, something that simply using X-ray cannot achieve, thus increasing the efficacy of the treatment without needing to increase the dose of radiation. More information about the treatment is available from the CEO’s 2020 webinar.

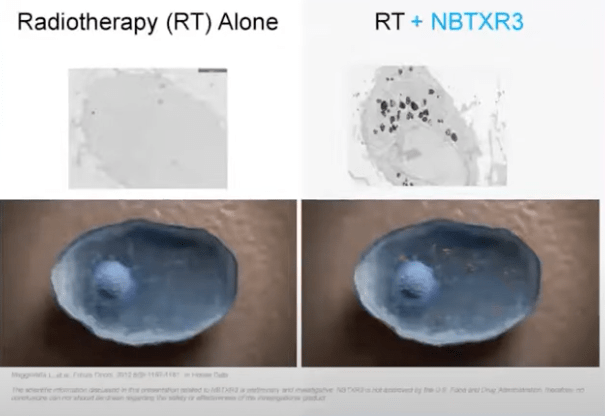

Clinical trial results so far have been positive. NBTX has been trialing the use of NBTXR3 in combination with radiation therapy in the treatment of a number of tumors, including soft tissue sarcoma, head and neck, liver, prostate, pancreas, and other tumors. In particular, in phase 2/3 randomized treatments of soft tissue sarcoma, the use of NBTXR3 in combination with radiation therapy is more effective than using radiation therapy alone as it was able to demonstrate an increase by four times the rate of complete response even in the most advance stage. The research is published in Lancet.

From 2020 Webinar by CEO

During Q4 2022 conference call, the CEO said:

Each year, since initiating development of our lead candidate NBTXR3, we have seen evidence continue to mount suggesting NBTXR3 has the potential to change the way solid tumors are treated and improve outcomes for patients… successfully first initiate NANORAY-312, our global Phase 3 trial in head and neck cancer in the US, Asia, and Europe, complete enrollment in Study 102, also in head and neck, generate new compelling data from our IO combination program, and early, but very encouraging data on pancreatic cancer, and significantly reduce our operating expenses, secure future access to capital through an equity line, and restructure of debt obligations.

It is definitely a positive sign to have drugs in Phase 3 clinical trials because that represents the final stage of drug development before a drug can be submitted to the Food and Drug Administration (FDA) for approval.

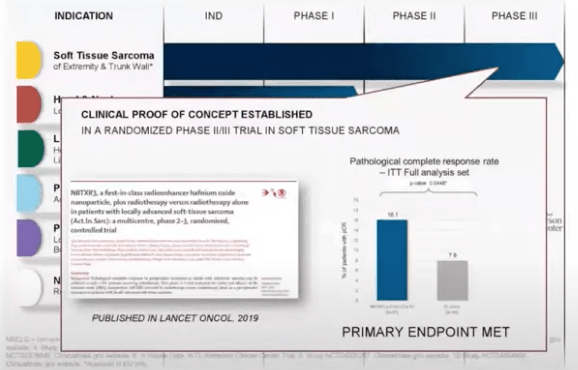

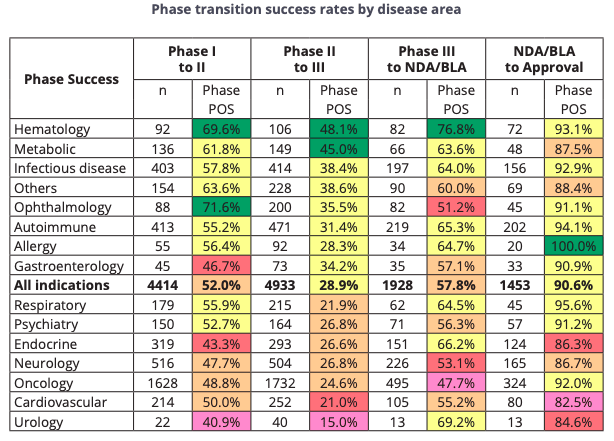

Based on this report by Biotechnology Innovation Organization, Informa Pharma Intelligence and QLS Advisors, Phase Two trials have the lowest success rate of all at 28.9%, and it is even lower at 24.6% for oncology. This is the stage where companies need to determine if they should pursue large, expensive Phase Three studies, or just terminate. Therefore, for NBTXR3 to clear Phase Two and move into Phase Three is not insignificant.

Phase 2 Success Rate

Phase 3 clinical trials have to be conducted to confirm the safety and efficacy of a drug for use in humans, and are conducted in a large sample size of people across different nationalities and geographical sites with a particular disease that the drug is meant to treat, and these trials typically last for several years. According to the same report mentioned (see table below), the success rate of oncology drugs in Phase Three trials being approved by the FDA is around 47.7%.

Clinical Trial Success Rate

Now, for the exciting bit. According to the report:

The second highest phase transition success rate was found in Phase III (57.8%, n=1,928). This is significant as most company-sponsored Phase III trials are the longest and most expensive trials to conduct. The probability of FDA approval after submitting an NDA or BLA, taking into account re-submissions, was 90.6% (n=1,453).

NDA means “new drug application” phase and BLA refers to “biologic license application” filing phase. Based on past success rates, NBTX has around a 50/50 chance of clearing the Phase Three trial to move on to the NDA/BLA phase, after which the approval has a 90.6% success rate.

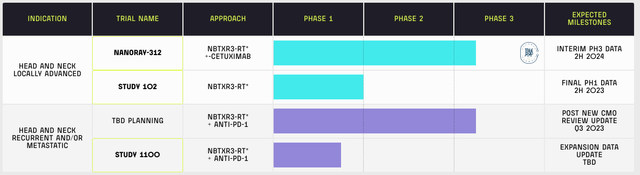

There were some delays in 2022. The initiation of NANORAY-312, the trial name for the approach in the Phase Three Clinical Trial to treat head and neck cancer that are ineligible for platinum-based chemotherapy, experienced some speed bumps in 2022 due to geopolitical factors like the war in Ukraine and the strict COVID measures in China but the pace is coming on track. The CEO explained in detail:

… after a slow start of this trial, as expected in such a complex time with the war in Ukraine and the end of the COVID period, we’re seeing a good ramping up of the patient recruitment right now and have been able, across the year, to get much more sites activated and also open new countries that were not initially planned in order to compensate the loss of Ukraine and Russia and also the slow start of the trial.

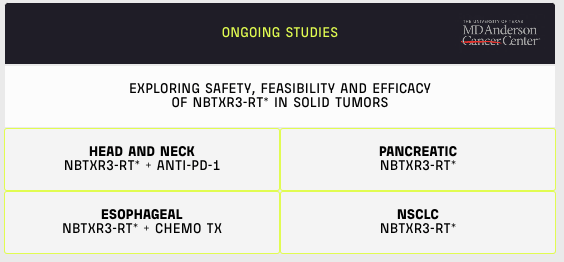

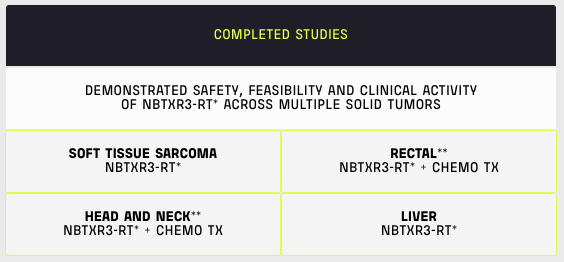

Besides this Phase Three trial, several more trials are ongoing to demonstrate the safety, feasibility, and efficacy of NBTXR3 in the treatment of solid tumors in other organs.

From 2020 Webinar – Ongoing Trials

These continuing trials are possible because of the success in earlier completed clinical trials that ended with positive results demonstrating the safety, feasibility, and clinical activity of the hafnium oxide NBTXR3 across solid tumors in soft tissue sarcoma, head and neck, live and rectal.

From 2020 Webinar on Completed Studies

Data from the various ongoing trials are expected to come in within the next 6-18 months, and if positive will provide further impetus for the company to continue its efforts and to raise more funds to continue their research and to bring their product – if approved – to the commercialization stage.

Risks

Despite the positive clinical trial results, the company is still a long way from getting Food and Drug Administration (FDA) approval, not to mention a long way from being able to monetize its product to generate any revenue. Data from the Phase Three trial is only expected to be out in the second half of 2024 barring any issues.

NBTX Website Shows Pipeline

And assuming the data shows that the treatment using NBTXR3 to treat head and neck cancer will significantly benefit patients and is safe for human use, the approval at FDA may take another year. According to this study on cancer treatment approval timings, it takes an average of 200 days for approval to be granted in the United States and 426 days for approval to be granted in Europe. And after approval is granted, the company still needs to set up manufacturing facilities, hire workers, buy machinery, hire and train the sales team, and develop sales and distribution channels. In short, NBTX is expected to burn cash for at least the next 3 years with no certainty of profitability.

Fast Graph

Nine months ago, analysts previously thought that NBTX would be profitable on an adjusted operating earnings basis by 2025 but have most recently revised that down from $3.11 per share to a loss of -$2.77 per share in 2025. With 34.9 million shares as of 31 December 2022 and an expected loss of $1.52 per share in 2023, FactSet analysts expect NBTX to lose $1.52 x 34.9 million = $53.048 million in 2023, which works out to be EUR49.61 million in losses. According to the 6K filed on 24 April 2023:

As of December 31, 2022, Nanobiotix had €41.4 million in cash and cash equivalents, compared to €83.9 million as of December 31, 2021.

The weak balance sheet is definitely compounding the risk of owning shares in this late-stage biotechnology company. At the Q1 2022 earnings call, the CFO was confident that the company would have sufficient funds to allow the company to function till Q4 of 2023, saying:

We’ve taken steps that are in our control to extend our runway. And that includes both the actions that we’ve taken as well as the equity line that will get us to Q4 of 2023.

But the situation has worsened since then. The CFO shared in the Q4 2022 earnings call that instead of having sufficient funds to last till Q4 of 2023 as previously stated, the company could only fund operations into Q3 2023.

Why are Wall Street analysts bullish about NBTX?

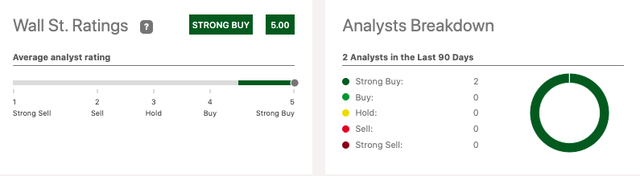

Despite concerns about the company’s very survival, two Wall Street analysts have been very bullish on NBTX, both issuing Strong Buy calls over the past three months.

Wall Street Analysts’ Strong Buy Calls on Seeking Alpha

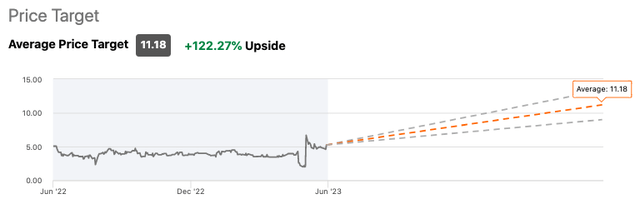

Their average price target is $11.18 by the end of the year, a return of 122% if that happens.

Wall Street Analysts Price Target on Seeking Alpha

That could be due to the ongoing discussion between NBTX and a global pharmaceutical company to develop and sell its lead cancer drug candidate NBTXR3. The details have yet to be announced as discussions are still underway but when news of this broke it was positively cheered on by investors, bumping the stock price up 111.81% from $2.03 to close at $4.30, with the inter-day high reaching $7.76.

This news portends a possible extension of the loan from the European Investment Bank (EIB). According to the CFO at the Q4 2022 earnings call:

The EIB has granted a temporary waiver of this requirement of EUR15 million until December 31. The temporary waiver will be automatically extended until January 31, 2024 before signing of a business development partnership, collaborative or strategic alliance. Because the company is not reporting such an event at this time, the waiver is assumed by us and our auditors to be expiring on July 31. And because our projected cash and cash equivalents balances are expected to decline below the EUR25.3 million level in Q3, we are reporting a cash runway that extends only to the time based on the conservative series of assumptions that include no business development deals, no new financing, and the assumption the EIB will exercise the covenants and seek repayment of the loan in full.

What this means is this: If NBTX does not reach any partnership or deals with other companies soon, EIB’s agreement to extend the repayment of EUR 15 million will be assumed to expire on 31 July 2023, less than two months from now. If this extension is not given, EIB has the right to “exercise the covenants and seek repayment of the loan in full“. This does not mean that the company will go into bankruptcy immediately. It depends on the kind of insolvency proceedings under French laws that the company enters into, be it an amicable restructuring where day-to-day business operations can continue (under certain conditions) or judicial restructuring which can involve either working out an installment plan or selling off of assets. The above discussions on possible insolvency proceedings may not happen, of course, as it depends on the decision by EIB if NBTX is unable to meet the condition set to extend the loan repayment. However, it does provide a glimpse into the possibilities.

Therefore, the news of the ongoing discussion between NBTX and this unnamed global pharmaceutical company is so important because if this deal does go through within the next two months before 31 July, it could mean two things. One, the EIB will extend the waiver of the requirement to repay the loan for another seven months till 31 January 2024, buying the necessary time needed for the company to raise funds. Two, depending on the kind of deal made, future profits from the successful development of cancer treatment using NBTX’s NBTXR3 could be shared with this global pharmaceutical company in return for a possible injection of funds now to complete their research well beyond 2024. A company like Royalty Pharma (NASDAQ: RPRX) has frequently structured deals with late-stage biotechnology companies to help them bring their products to market in return for royalties from future profits. I am not saying that RPRX is the company that NBTX is in discussion with but I will not be surprised, and RPRX is the only major company with this business model. I have researched RPRX previously and you can read about their business model in my article here.

Conclusion

I am rooting for a company like Nanobiotix to succeed. Any treatment that can provide hope, extend life span, and reduce suffering, and improve the efficacy of cancer treatment without increasing the toxicity of the radiation dose is definitely welcomed.

On the scientific side, studies and clinical trials on the feasibility of the nanoparticles of hafnium oxide in improving the efficacy of the treatment of solid tumors have been successful. The company even has an ongoing Phase Three trial and data is expected to be out by the second half of 2024. These are the positives.

On the finance side, the company is in dire straits. It is running out of money unless it can strike a deal of sorts. In the latest 6K filed on 17 May 2023, the company maintains a positive outlook that it can “fund its operations into the third quarter of 2023”. The reality is the company made similar assurances in Q1 of 2022 that it had sufficient funds to last till Q4 of 2023, only having to backtrack that since it now only has, based on the best knowledge by the management, sufficient funds to fund operations to Q3 of 2023.

If Nanobiotix’s negotiations with the unnamed global pharmaceutical company work out, the company will have a lifeline to continue its research, and if successfully approved by FDA, it can possibly commercialize its product in a few years. In this best-case scenario, investors will still need to be patient and wait for maybe four to five years before they can see the company producing a marketable product. In the short term, if the negotiation yields a positive outcome, the stock price will likely jump.

At the same time, investors need to be aware of the risks involved. If the negotiations break down and there is no new white knight to come to the rescue by the 31 July 2023 deadline, Nanobiotix will find itself with limited funding options. It can try to negotiate with the EIB for another extension but I do not imagine that it would go smoothly without NBTX giving further concessions. It can approach a different company, such as RPRX, to seek funding for a share of future profits. It can definitely sell more shares to raise funds from the capital markets but that will further dilute existing shareholders. The company can try to reduce expenses but it is already running a lean operation with fewer than 90 employees; there is not much fat to cut.

Management was candid in its 6K filing on 24 April 2023, regarding the state of its finances, and mentioned the alternative avenues of funding that it is actively considering.

The Company is also pursuing additional funding through one or more possible new partnerships, collaborative or strategic alliances; or from the use of the equity line (PACEO) signed with Kepler Cheuvreux, financing from institutional or strategic investors, from the capital markets, or a combination of the above. However, the Company cannot guarantee if or when any such transactions will occur or whether they will be on satisfactory terms.

While the Company has taken and will continue to take actions to obtain new funding and manage costs through operating expense reduction plans, as necessary, the above factors indicate substantial risk about the Company’s ability to continue as a going concern as there is no assurance that the Company will be successful in satisfying its future cash needs.

Whether Nanobiotix is a buy, sell, or hold will depend on your risk tolerance as none of us outside the negotiation room knows the chances of a successful outcome. To me, the success of the negotiation comes down to a 50-50 coin toss situation that will happen one way or another in the next two months. Your decision as an investor will also depend on your investment horizon. Even if the best scenario happens, the company will still need to get regulatory approval, and will still need to actually manufacture and sell the product. Management has to shift gears and change hats from being researchers to actually becoming businessmen and businesswomen, and not every management team can handle that change in their respective roles well.

In the worst-case scenario, if the company is unable to secure a positive outcome to the negotiations with the global pharmaceutical company, all is not lost as there are other funding alternatives that the company can pursue but it will have a much shorter runway to do so, and even if it succeeds it may not be on the most favorable terms.

Read the full article here