Summary.

Some of us are old enough to remember the era when the Motorola brand was known for its huge mobile phones, and its “batwing” logo we grew up with, possibly even being the very first cellphone in the 1990s for a few of us.

Today, an often undercovered stock, in my opinion, is that of Motorola Solutions (NYSE:MSI), one of the companies that was formed after the original firm’s spinoff in 2011 into two separate companies.

You may see the name on police and first-responder communications equipment, but it turns out that this brand does a lot more than just that.

The question today is whether an investor or analyst can currently consider it a buy, hold, or sell.

This stock scored a 60 in my analysis, giving it a Hold Rating at this time.

Its three positives are having diversified revenue across a large portfolio of products and services revenue streams, having a competitive dividend yield within its sector and proven dividend growth, and a healthy capital position. Its two negatives are being overvalued based on P/B and P/E ratios, and its current price chart not showing a great buying opportunity right now.

Rating Methodology.

I will rate MSI stock using a 5 step methodology as follows, which has been updated from prior articles to now also include the P/E ratio, based on reader feedback. Here are the questions I ask:

- Is the stock undervalued based on P/B ratio and P/E ratio? (10 points each)

- Is their revenue diversified enough across multiple segments? (20 points)

- Does their price chart present a buying opportunity? (20 points)

- Is their dividend yield competitive among its sector? (20 points)

- Is the firm in a strong capital position? (20 points)

After totaling the score, I assign a rating:

- 100 Points: Strong Buy

- 80 to 90 Points: Buy

- 30 to 70 Points: Hold

- 10 to 20 Points: Sell

- 0 Points: Strong Sell

The Stock Remains Overvalued.

Let’s start out by talking about valuation. For the purposes of this analysis, we will use both the P/B ratio and the P/E ratio, each scoring 10 points in my rating system.

The standard we will use for the P/B ratio is a range of 0 to 3.0, with anything over 3 considered overvalued, and under 0 being undervalued.

When looking at this stock’s P/B ratio from Seeking Alpha, as shown below, it has a forward P/B of 68.78 and a Seeking Alpha assigned grade of F:

Motorola Solutions – P/B Ratio (Seeking Alpha)

In this case, the P/B for this stock is overvalued, so score is 0.

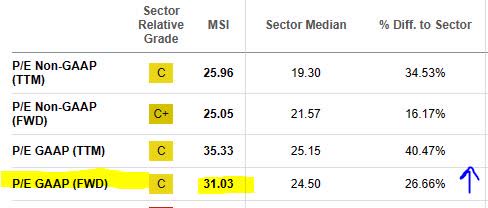

Besides P/B ratio, we can take a look at this stock’s P/E ratio below. The standard we are using is the S&P 500’s median P/E ratio of 14.93 as of May 2023, according to Investopedia. In other words, a P/E above that amount could be considered overvalued.

Based on its GAAP forward P/E, also from Seeking Alpha, as shown below, this stock has a grade of C for this valuation, as its forward P/E of 31.03 is around 26% higher than its sector average, its price trading at 31x earnings.

Motorola Solutions – P/E Ratio (Seeking Alpha)

Based on this, I would say the P/E makes this stock overvalued, so score is 0.

When comparing to its listed peers, a company like Nokia (NOK) has a P/E of 11.06, with a P/B of 0.93. Juniper Networks’ (JNPR) has a P/E of 20.66 and a P/B of 2.17.

Hence, two of its known peers have much better valuation at this time than it does.

A Diversified Solutions Portfolio.

As mentioned earlier, this brand is more than just police radios.

Let’s take a deeper dive into its revenue streams, as one of my rating criteria is whether a firm is well diversified across business segments and regions, not overly dependent on a single revenue source or product line.

Incidentally, I have used their products before, while working in the federal government sector, but it was only recently I found out just how broad their portfolio is.

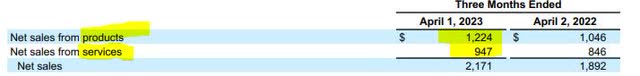

At a high-level overview, according to their Q1 2023 earnings results, their revenue is split among products and services sales:

Motorola Solutions – Q1 2023 results – by category (Motorola Solutions)

As the table shows, sales from products make up about 56% of total and services make up about 44%, a relatively balanced distribution in my opinion.

I often like to hear a company’s leadership set a positive forward-looking tone after earnings results, and I got just that from CEO Greg Brown in his earnings results commentary released May 4th:

Record first-quarter sales, orders and ending backlog positions us very well for continued growth. As a result, we’re raising our revenue and earnings guidance for the full year.

From its solutions website, one can see that the firm’s client penetration is diversified across multiple sectors including law enforcement and rescue, government, healthcare, and utilities, to name a few.

Its products segment includes an array of two-way radios, bodycams, and video products, while its services segment includes software, cybersec, and command center solutions, for example.

Having recently covered cybersecurity stocks like Fortinet (FTNT), it is interesting to note that Motorola Solutions happens to also be a managed security services provider, as this is a space I am keeping an eye on, and I think it will fuel their growth and diversification going forward into 2023 and 2024.

In fact, even renowned consulting firm McKinsey commented on the market potential in the cybersecurity segment, in an October 2022 study:

In the face of this cyber onslaught, organizations around the world spent around $150 billion in 2021 on cybersecurity growing by 12.4 percent annually.2 However, set against the scale of the problem, even this “security awakening” is probably insufficient.

Therefore, I think the answer to whether this firm’s revenue is well diversified is yes.

A Price Chart Waiting for a Dip.

Next, I am looking at the current price chart for this stock before market open on Monday June 5th, as shown below.

Motorola Solutions – Price Chart on June 5 (StreetSmart Edge trading platform)

What this 2 year period tells me, with use of the 50 day SMA (dark blue line) and 200 day SMA (dark red line) is that a so-called “death cross” occurred in March 2022, during a bearish trend, which reversed later as shown by the “golden cross” (blue circle) in September 2022.

However, since then this stock’s price has mostly remained above both averages and continues to have a bullish trend. In fact, while bank stocks saw major dips in March after a few regional bank failures, it seems investors flocked to tech, and we see in the chart that Motorola also saw a March and April price rally upwards.

In fact, a June 1st headline in the Wall Street Journal announced that “a tech mania is underway. Bullish bets are exploding.”

I think therefore that the bullish trend of this stock is tied to overall bullishness in tech, and not specific to this company.

Consider that, according to a June 1st article in Markets Insider, “tech stocks are outperforming broader benchmarks by the largest amount since the dot-com bubble burst in the early 2000s, according to one measure.”

As an investor looking for a buying opportunity with which to enter a position on this stock, I am hesitant at the current price trend, which may or may not continue upwards if the tech-focused trend reverses suddenly. Instead, I am looking for the next death cross so I can take advantage of a market dip in tech, to grab this one much cheaper, possibly after it dips below its 200 day SMA.

With that said, to answer the question of whether the price chart shows a buying opportunity right now, it is No.

Proven Dividend Growth and Competitiveness.

Now, I want to talk about dividends, since I tend to be a dividend-income investor myself.

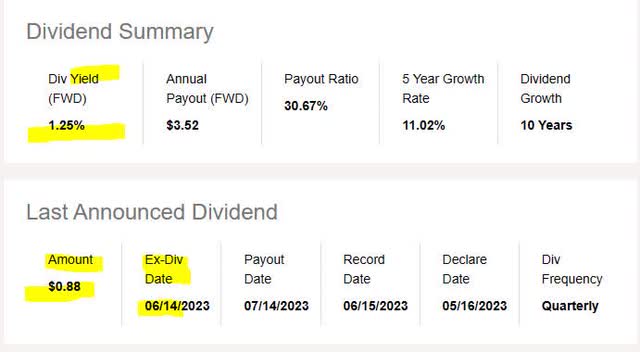

Based on dividend info from Seeking Alpha, as shown below, this stock offers a yield of 1.25%, and more importantly an upcoming ex date on June 14th:

Motorola Solutions – Dividends (Seeking Alpha)

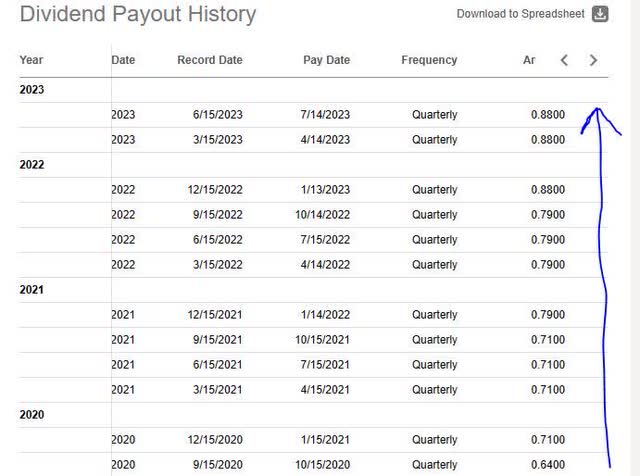

Further, the table below shows a consistent growth in dividends over the last few years:

Motorola Solutions – Dividends growth (Seeking Alpha)

In fact, the current dividend of $0.88 is over 11% higher than in the same quarter a year ago. In addition, they have made regular quarterly payments, which shows a commitment to return capital back to shareholders, an important metric I follow.

However, is this firm’s dividend yield competitive to that of its peers? Let’s find out…

The yield for Nokia is 1.83%, for Juniper Networks it is 2.84%, so they are not astronomically higher than that of Motorola Solutions.

In this case, when looking at all factors, the answer to whether Motorola has a competitive dividend position within its sector is a Yes.

A Healthy Capital Position and Liquidity.

As an analyst in both the technology and financial space, I look at banks and tech companies differently obviously. For large banks, I am interested in their regulatory capital and ability to withstand financial shocks, which could have systemic economic effects across the markets and economy, due to the unique position of banks in the ecosystem, and their role in providing “liquidity” to the entire system.

For a technology and communications company like Motorola Solutions, I am interested in their cashflow situation, but also their balance sheet, which I believe to be an important metric.

The Harvard Business School had this to say about the importance of cashflow, in an April 2020 article:

Ideally, a company’s cash from operating income should routinely exceed its net income, because a positive cash flow speaks to a company’s ability to remain solvent and grow its operations.

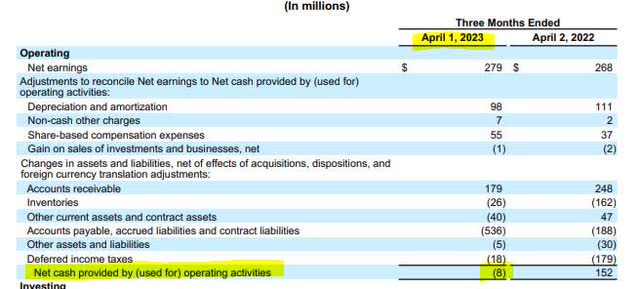

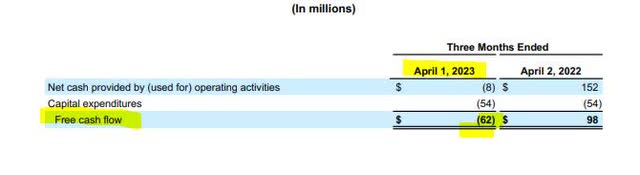

Below is both the statement of cash flows and free cash flow, from Q1 results:

Motorola Solutions – statement of cash flows (Motorola Solutions) Motorola Solutions – free cash flow (Motorola Solutions)

Although at first glance the cash flow in the most recent quarterly result seems of concern. However, to explain the YoY decrease in cash flow, the company’s earnings commentary stated:

Both the operating cash flow and free cash flow for the quarter decreased primarily due to an increase in working capital and higher cash taxes, partially offset by higher earnings, net of non-cash charges.

It is a known concept that working capital can affect free cash flow.

Further, its balance sheet shows $1.02B in cash and equivalents, total assets of $12.3B and $12.1B in total liabilities.

I think their most recent cashflow situation appears temporary and not a sign of any long term liquidity issues to be of concern.

So, I think that Yes, they have a healthy financial position at the moment, and it will be more important to keep an eye on the cashflow number in the next few quarterly results to look for any difference or any longer-term trends.

Risks to my Outlook.

Risks to my moderate outlook for this stock are that the tech rally continues well into the next few quarters, which would have made my rating overly cautious.

But this time around, I don’t think it will be a case of being late to the party.. because it seems the rally is now being overly fueled by the latest hype over “AI”, and how big tech is riding that wave, as touted by CNBC in late May.

Rather than chasing that hype over artificial intelligence, I would caution over being overly celebratory over that too quickly and instead look for the next dip opportunity in tech.

A similar sentiment was echoed by Morgan Stanley (MS) chief investment officer Michael Wilson, in an April 3rd article in Business Insider:

We advise waiting for a durable low in the broader market before adding to Tech more aggressively as the sector typically experiences a period of strong outperformance post trough—a time when its cyclicality works in its favor on the upside,” Wilson wrote.

Conclusion.

In conclusion, I reiterate my moderate view and Hold rating for Motorola Solutions, who is attractive in terms of the diversification of revenue across products and solutions as well as its cybersecurity potential, in addition to having a strong liquidity position and competitive dividend among its peers. At the same time, it appears to be overvalued in terms of both P/B and P/E ratios, and its overly bullish price chart seems more of a reflection of the larger bullish tech rally lately, which I am not sure will last a lot longer.

At the end of the day, this brand some of us remember from our youth in the 1990s and the first mobile phones, has truly matured into a more than just a brand, but an entire brand ecosystem of products and solutions critical to public safety, homeland security, emergency response, tackling cyber threats, and more.

This will be one of the tech / communications stocks I continue to keep an eye on in 2023.

Read the full article here