Investment Thesis

The iShares MSCI USA Minimum Volatility Factor ETF (BATS:USMV) is poised to outperform in a recession because it has a low 0.70 five-year beta, has proven resilient in the last three major recessions, and trades at a discount to the SPDR S&P 500 ETF (SPY), a reversal from five months ago. It’s also well-diversified, a key attribute because every recession is different, and we don’t know which industries will primarily be affected. This article will take you through its historical performance, including Index data to 1988, and evaluates in detail its fundamentals at the industry level. After reading, I hope to convince you why USMV is an excellent choice you can rely on if recession concerns grow.

USMV Overview

Strategy Discussion and Key Exposures

USMV tracks the MSCI USA Minimum Volatility Index, selecting stocks based on four criteria relative to the MSCI USA Index:

- Low beta

- Low volatility

- Low cap bias

- Bias towards stocks with low idiosyncratic risk

The Index is optimized each May and November to achieve the lowest estimated volatility, though sector exposures can’t deviate more than 5% from the MSCI USA Index. This constraint means USMV still has 16% exposure to Technology stocks, a red flag for some. However, USMV’s current selections have a history of outperforming in recessions. Also, we only need to go back three years to see how the Technology sector can even outperform. The key is selecting resilient businesses consumers rely on with relatively little competition, regulatory risk, or management concerns. That’s the purpose of the fourth screen.

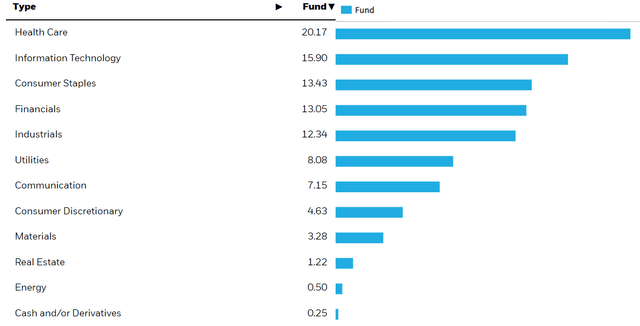

USMV’s sector exposures are listed below. Health Care is at 20%, followed by Technology (16%), Consumer Staples (13%), and Financials (13%). Energy stocks traditionally decline in recessions, so I’m pleased to see almost no exposure here. Real Estate might also come under pressure, as it did in the Subprime Crisis when VNQ lost 65% between November 2007 and March 2009. Finally, Materials exposure is limited to eight stocks totaling 3%. One-third is Newmont (NEM), a gold producer that produced a flat return when SPY declined by 19% in Q1 2020.

iShares

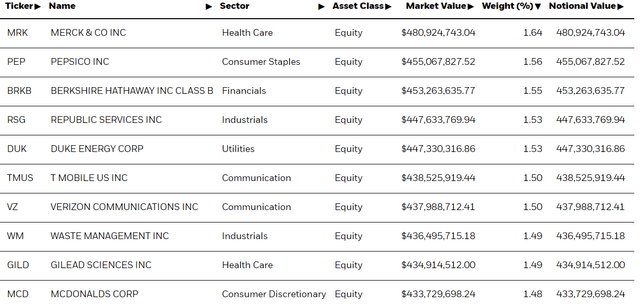

USMV’s top ten holdings are below. They include Merck (MRK), PepsiCo (PEP), Berkshire Hathaway (BRK.B), Republic Services (RSG), and Duke Energy (DUK). Berkshire has the highest five-year beta (0.87), but the average of the remaining nine is 0.52. There are 37/164 stocks with a beta above 1, indicating higher than market volatility, but their weight totals only 16%.

iShares

USMV Performance In Drawdowns

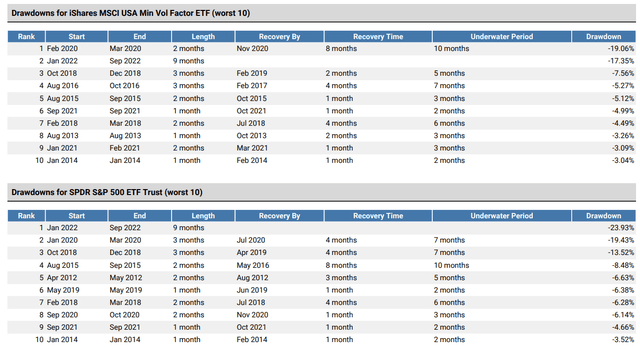

USMV launched in October 2011 after the Great Financial Crisis, so its history is limited. However, the drawdown tables below highlight how it outperforms SPY in bear markets. From January to September 2022, USMV declined by 17.35% compared to 23.93% for SPY, a 6.58% beat. USMV also outperformed SPY in Q4 2018 by 5.96%. Except for the COVID-19 decline, which matched SPY, USMV experienced no other significant losses.

Portfolio Visualizer

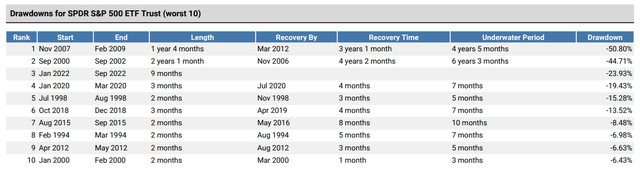

The Index page provides additional performance information, noting how it launched on June 2, 2008. There were two other significant drawdowns not included in the table above since SPY’s 1993 launch. The first was between September 2000 and September 2002, when SPY declined by 44.71%. The Index fell 25.16% during this period, a 19.56% fee-adjusted outperformance. The second was SPY’s 50.80% decline between November 2007 and February 2009. USMV declined by 41.10%, a 9.70% beat.

Portfolio Visualizer

The tech crash occurred before the Index launched, so these backtested results are less reliable than the actual ones. However, when the Index launched in June 2008, its results were 9.05% better than SPY through February 2009. The Index also experienced a lower 13.00% annualized standard deviation through March 2023 compared to 16.08% for SPY.

USMV Analysis

Fundamentals By Industry

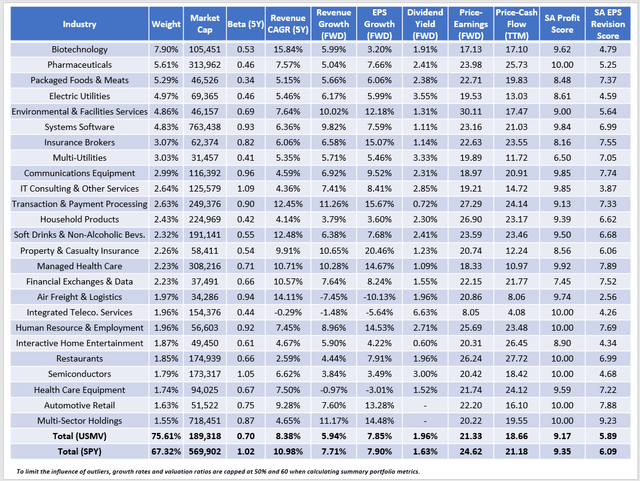

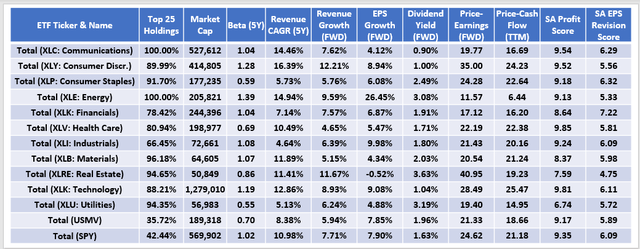

The following table highlights selected fundamental metrics for USMV’s top 25 industries. They total 76% of the portfolio, and this view touches on several critical factors, including USMV’s lower beta, a slight lean towards dividend-paying stocks, and solid profitability and earnings revision scores.

The Sunday Investor

USMV’s standout metric is its 0.70 five-year beta, indicating it’s approximately 30% less volatile than SPY. Except for IT Consulting & Other Services and Semiconductors, all industries have betas below market. USMV accomplishes this low beta by underweighting or outright avoiding stocks like Apple (AAPL), NVIDIA (NVDA), Meta Platforms (META), and Tesla (TSLA).

USMV’s 7.85% estimated earnings growth rate aligns with SPY’s 7.90%. It’s impressive for a low-volatility defensive portfolio, especially considering the gap was 3.16% (10.28% vs. 13.44%) five months ago. Another benefit is that USMV trades at 21.33x forward earnings, virtually unchanged from December 2022, and represents a 3.29-point discount to SPY. In contrast, USMV previously sold at a 0.42-point premium despite lower earnings growth. I concluded that USMV wasn’t worth buying at the time, and it’s underperformed by 5.60% since. Since its relative fundamentals improved, USMV is an even more attractive ETF for investors seeking to lower risk.

Seeking Alpha

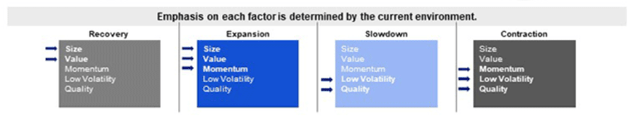

Quality is another factor that makes USMV appropriate for a recession. I measure it using Seeking Alpha Factor Grades normalized on a ten-point scale, and USMV scores a solid 9.17/10. Along with low volatility, quality is a factor the fund managers of the Invesco Russell 1000 Dynamic Multifactor ETF (OMFL) target for the slowdown and contraction business cycle phases.

Invesco

OMFL blends these two factors nicely, but its current 0.84 five-year beta suggests less downside protection than USMV, even as the quality remains excellent. I covered OMFL on April 3 and expressed concern that its model would return to the riskier expansion version at an inopportune time. That won’t happen with USMV. It’s passively managed and rebalances only twice yearly, consistently targeting the two factors OMFL’s managers rely on based on decades of research. In short, USMV’s advantage is that you know what factors it favors at all times, allowing you to set your portfolio up for success ahead of time.

Why Choose A Diversified Fund For A Recession?

The type of security you turn to for recession protection is crucial. You could choose one stock, a dedicated sector ETF, or a well-diversified fund like USMV. Here are my thoughts on each.

1. This month, you’ve likely seen dozens of articles on what stocks offer the most recession protection. Chances are all make compelling cases, but only some will prove correct. You might choose the ones that make the best arguments, but this approach ignores the critical objective of purchasing portfolio insurance. Ask yourself how confident you are that the particular security will outperform if markets decline substantially. Turn it into a question of probabilities and add up the chances of it not behaving as expected. The greater those chances, the more speculative it is, and that’s not the purpose of insurance. Instead, insurance protects you against low-probability events that can cause significant losses. You need high certainty that the strategy will work to some meaningful degree, and I don’t think most individual stocks offer that comfort.

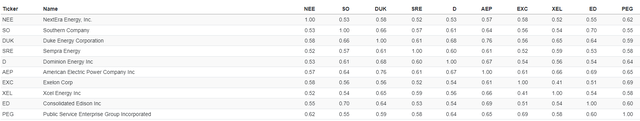

2. Sector ETFs are an improvement primarily because they hold more securities. However, most are highly correlated, diminishing any diversification benefits. To illustrate, consider the Utilities Select Sector SPDR ETF (XLU), a 30-stock fund with a 0.55 five-year beta. The table below is a correlation matrix for its top ten holdings based on 25 years of monthly returns. Most are at least moderately positively correlated (above 0.50).

Portfolio Visualizer

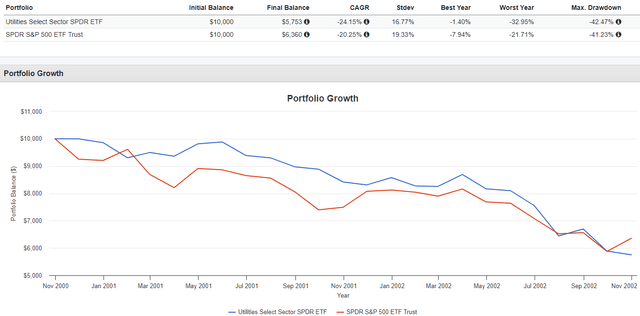

XLU is a suitable ETF to buy if you have confidence Utilities will perform well in a specific environment. I made that call one year ago, going against the consensus that the sector would struggle amid rising interest rates. XLU ended up a top-performing sector in 2022, but predicting it will excel again under opposite conditions (declining interest rates) would be strange. Also, let’s remember XLU fell 42% in the early 2000s. No sector is immune from all recessions, and this unknown makes preparation difficult.

Portfolio Visualizer

3. Instead, a diversified ETF like USMV scores well on numerous factors, thus increasing your chances of at least some success in a recession. I put together this table comparing USMV’s fundamentals with the 11 sector ETFs offered by State Street. Assuming you’re looking for a low-beta fund, XLP, XLV, and XLU are your main options. In addition to high concentration, all three have separate issues.

The Sunday Investor

XLP has a low 0.59 five-year beta but offers less earnings growth (6.08%) than USMV and trades at a higher 24.28x forward earnings. Costco (COST) trades at 34.51x forward earnings and is 8.70% of the portfolio. The retailer is generally regarded as recession-proof in part due to its recurring membership fees, but it’s not immune from valuation multiple contractions.

XLV offers a cheaper valuation than XLP but not USMV. However, the main issue is growth. Constituents grew sales by 10.49% over the last five years, but analysts estimate just 4.65% sales growth over the next year, with 5.47% EPS growth. All figures are lower than USMV. The best part is that nearly the entire fund has a perfect “A+” Seeking Alpha Profitability Grade. Quality matters in a recession, but I want to remind readers that Health Care is USMV’s largest sector exposure area.

Finally, XLU is among the cheapest sector ETFs, trading at 19.40x forward earnings. However, a weak 6.74/10 profitability score indicates it has quality problems. This metric explains why USMV’s exposure to the sector is only 8%. In addition, Public Utilities Commissions are less likely to approve a high return on equity for Utility companies when interest rates are lower, and consumers are hurting. I took the opposite view in last year’s bullish review of XLU, demonstrating that investing in the sector is complex and more complex than comparing XLU’s dividend yield to the yield on U.S. Treasuries.

Investment Recommendation

USMV is an excellent ETF to hold through a recession for three reasons:

1. It’s well-diversified at the sector, industry, and company level and optimized to favor low-beta, low-volatile companies with low idiosyncratic risk.

2. The strategy has demonstrated outperformance in prior recessions. It beat SPY by approximately 6% in the 2018 and 2022 drawdowns and saved investors 10% and 20% through the Great Financial Crisis and Dot Com Bubble crashes.

3. Its fundamentals significantly improved over the last five months. USMV now offers the same earnings growth as SPY but for a 3.29-point discount on forward earnings, all while featuring a 0.70 five-year beta that only a handful of sector ETFs can match.

Deciding how much recession insurance you must purchase and when is challenging. I don’t think the need is immediate, as I see market sentiment improving and a greater possibility of another bull market occurring in the short term. Still, keep USMV in your back pocket if recession concerns intensify because it’s a solid-all around ETF that scores well on many factors. Consider the risks of using individual securities as recession, and opt for the low-beta/high-quality combination USMV offers instead. Thank you for reading, and I look forward to the discussion in the comments below.

Read the full article here