Investment Thesis

Palo Alto Networks (NASDAQ:PANW) has several catalysts afoot. In the near-term, the catalyst here is that PANW is about to be added to the S&P 500 index. This will provide the stock with significant near-term momentum.

Then, medium term, the most important consideration stems from its recently reported quarter where PANW now sees its 23% non-GAAP operating margins as the baseline from which Palo Alto will continue to grow into fiscal 2024.

The stock has never been cheap and continues to trade at a rich premium of approximately 39x next year’s fiscal 2024 (starting August 2023). There’s a lot to like here.

Inclusion into the S&P 500

I’d been making the case to Deep Value Returns members that they should buy PANW given that it was likely to be admitted into the S&P 500 soon, see below.

Deep Value Returns PANW

Then, news on Friday came out that PANW is set to be inclined in the coveted index.

This is important because many indexes will have to buy Palo Alto Networks’ stock in the coming few months providing it support.

But there’s a lot more to this story too.

Palo Alto Networks is Not SentinelOne

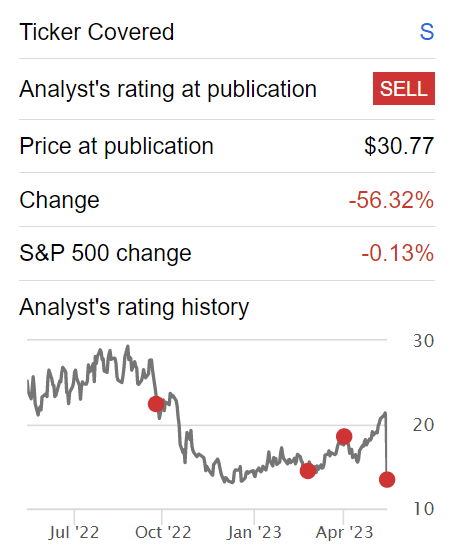

I’ve been publicly bearish on SentinelOne (S) for more than a year.

Author’s rating on S

Indeed, I want to be clear, that it makes a tremendous difference buying into the right company.

Nobody contests the fact that cybersecurity services are in high demand. But at the same time, it’s important to go beyond just an alluring narrative.

Accordingly, in the analysis that follows, I’ll provide both context and a discussion of the fundamentals as it pertains to the one cybersecurity stock that I believe makes sense to invest in.

Saying this, please be aware that PANW is a stock that I already own, so I’m prone to be biased here.

Why Palo Alto Networks? Why Buy Now?

Here’s the reason why I recommend Palo Alto Network.

Because I want to invest in the future. Within my Future Energy portfolio through to the commodity business I recommend, I’m seeking to participate in future profitability.

I’m an inflection investor. I’m seeking to buy stock today, in businesses that will be earning more per share in two years. And I don’t want to overpay for my investments.

Critically, I don’t want all my investments in the same theme. That’s why I’m diversified into different markets. Because I strongly believe that diversification isn’t about the number of stocks you own, but the exposure you have to different trends.

Palo Alto fits this criterion. I want to buy into a growing sector, but I didn’t want to pay up for the hype. That’s why I’ve been urging readers to stay clear of SentinelOne. Going so far as being a lone bearish voice.

The way to invest is to position myself in a business that is growing at a steady state and that’s already GAAP profitable or on the cusp of being breakeven within 18 months.

Near-Term Prospects Discussed

On the back of its recently reported results, we see Palo Alto yet again continue to benefit from the downturn in the tech sector.

Anyone that follows tech business will know that there’s a lot of purse tightening. Across IT, the time for expansion has come and gone during the pandemic period. Today, IT budgets are more constrained. Companies no longer want to own countless different product solutions that operate in a silo. While you can read recent examples of this in Snowflake (SNOW) and Salesforce (CRM), the best example I can find is this:

Author’s work: SentinelOne Why I’m A Lone Bearish Voice

Echoing this point, this is what Palo Alto Network’s CEO Nikesh Arora said on the earnings call:

The overall macro trends of cautious spending, deal scrutiny, and cost and value consciousness persist. Moreover, the behavior continues to be more widespread across a larger swath of our customers.

Companies have become very mindful of their cost structure and are seeking more value from their IT spending. They demand clear and high ROIs. And an easy way to get a high ROI, is to spend fewer dollars, rather than purchasing from cybersecurity companies that have it as part of their growth strategy to consistently upsell you more products over time. Again, be sure to read my SentinelOne analysis to see the contrast.

Fundamentally, the commentary I hear from cyber companies is about vendor consolidation. Companies want to simplify their cyber security architectures. On this note, here’s a quote from the earnings call:

On the macro front, customers anticipate that global growth may slow. Some are grappling with rising capital costs and are watching their bottom lines more closely. This means looking for efficiencies in their business. Within cyber security, complex architectures, and long vendor rosters have come into focus, and many customers see this as an opportunity to simplify and drive consolidation.

Simply put, Palo Alto Networks is well-placed to benefit from a secular demand for platformization. Arora continues:

We have the opportunity to do the security what we have seen done in financial software, HR software, or CRM where customers have adapted to platforms due to the inherently superior benefits from data integrity, integration, seamlessness, and outcome orientation.

Customers want ”one-true” source for their cybersecurity needs. Customers don’t want to spend money on many best-of-the-breed offerings, rather there’s a continued momentum towards vendor consolidation and platformization.

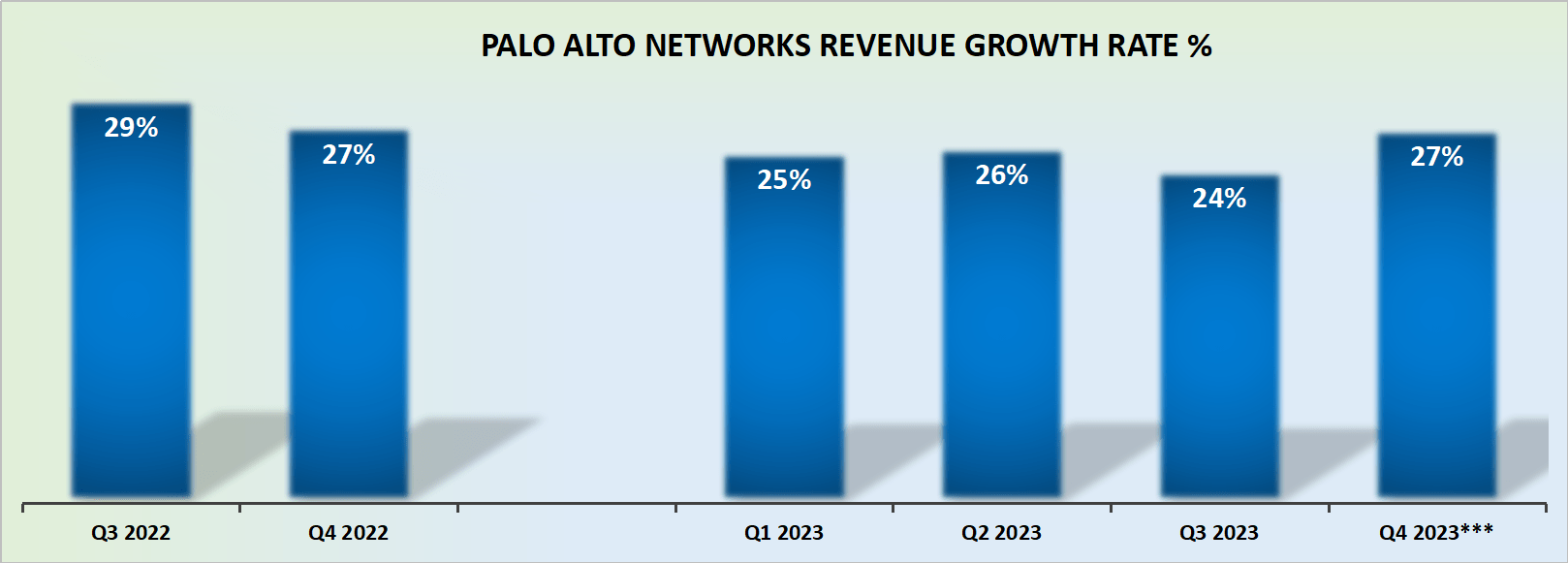

Revenue Growth Rates Ticking Along at 20% CAGR

PANW revenue growth rates

The guidance for fiscal Q4 2023, starting this quarter, points to around 25-27% CAGR.

This is less than the pace at which Palo Alto was growing in the prior full year. But given the overall macro environment, I believe that this pace of growth is compelling.

What’s more, Palo Alto’s future growth will come from its Next-Generation Security platform (”NGS”).

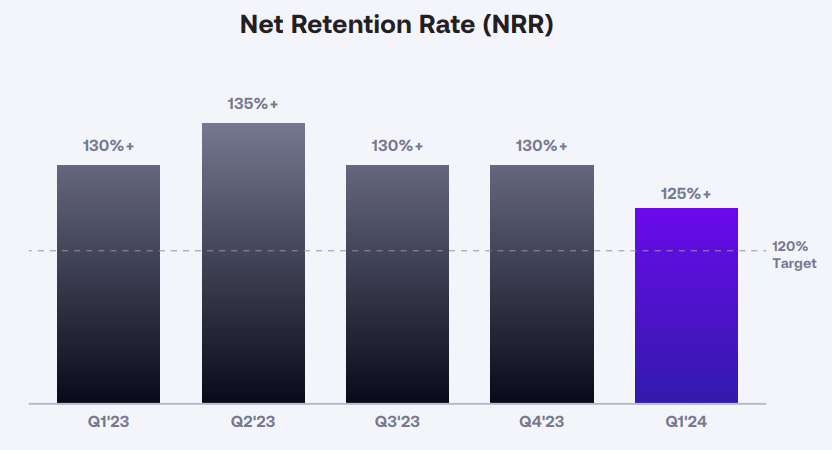

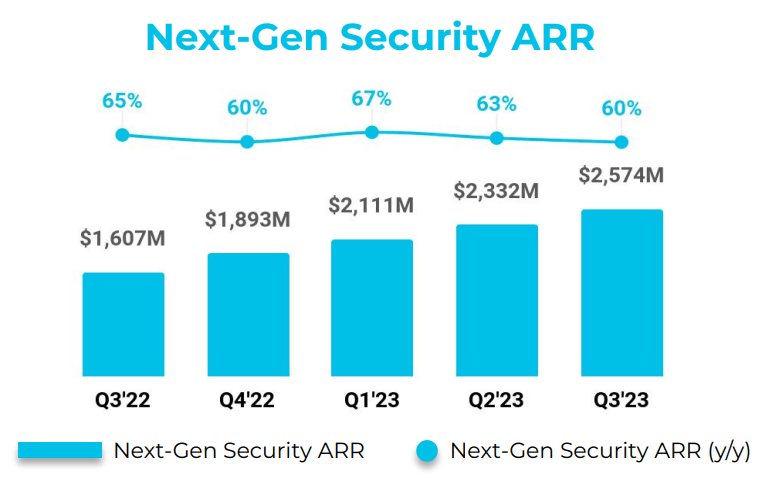

PANW presentation

Palo Alto Networks Next-Generation Security portfolio includes firewalls, endpoint protection, and cloud security.

As you see above, Palo Alto’s NGS portfolio continues to grow at 60% y/y and has annual recurring revenues of $2.6 billion. These are really not small numbers.

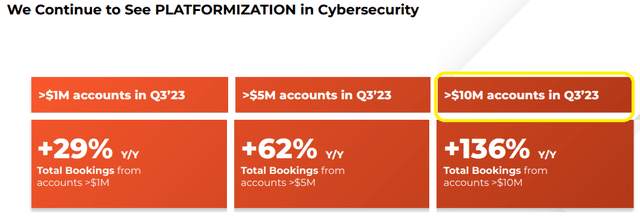

Case in point, growing to $2.6 billion in revenues at a very rapid rate shows the demand for Palo Alto’s NGS portfolio. And it’s clearly resonating with customers, as you can see here:

PANW presentation

Large enterprises spending several millions on Palo Alto continue to rapidly grow.

Focused on Free Cash Flows

A strong balance sheet allows us to accommodate customers, while we maximize our medium-term cash flow. (Palo Alto Networks CEO Nikesh Arora)

I’ve touched on this throughout, I wanted to invest in a cybersecurity company that is highly profitable.

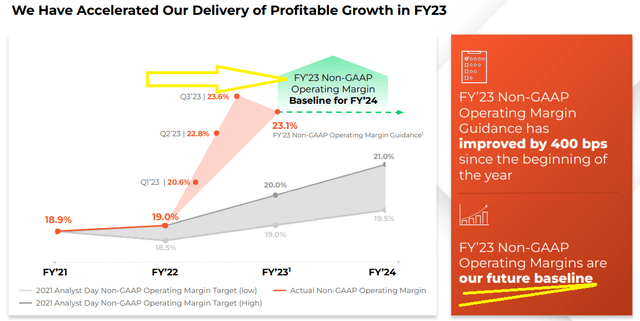

PANW presentation

During the earnings call, Palo Alto Networks updated investors that its fiscal 2023 operating margins of 23% are the baseline from which Palo Alto Networks will grow in fiscal 2024.

Meaning that profitability will continue to tick higher next fiscal year, starting August.

The Bottom Line

I won’t make the argument that absolutely everything is perfect within cybersecurity. Indeed, I hope I have given you plenty of food for thought and how nuance is required here.

There continues to be a restrictive environment for cyber security companies. While companies are keen to protect their operations from malware and cyberattacks, companies are also very price-conscious.

My argument is to think about Palo Alto Networks as a slow and steady compounder. The stock is not too expensive. Yes, I know that it’s not growing as fast as the other players in space, but again, you are not asked to pay up for the growth either.

Read the full article here