Dear readers/followers,

My investment in Norsk Hydro ASA (OTCQX:NHYDY) (OTCQX:NHYKF) was possibly one of the better ones I’ve done over the past few years. The reason I say this is that this company was one of the very, very few “STRONG BUYS” I ever called for in the past 4 years. This call was made in February 2020, and at the time, the native ticker traded below 28 NOK. That was when I bought a massive stake in Hydro.

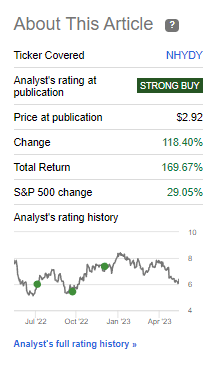

Since that time, even with the recent drop, this is the result.

Seeking Alpha NHYDY (Seeking Alpha)

You may argue with some of my picks and some of my timing – but the same strategies that I employed to find this 3-year outperformer with a TSR of almost 170% (or over 165% with dividends when I trimmed most of my stake), is the strategy that I employ for all my investments. I believe this to be a successful approach, and one to make you rich over time – or at least wealthier than you are before you started investing.

Let’s look over the recent results and let me show you why I am, at this time, more lukewarm on the company.

Norsk Hydro – Not the greatest valuation at this time

This is a volatile company – no secret here. Hydro is one of the more up-and-down businesses I invest in, entirely related to energy and commodity pricing volatility. This is not a problem – because we understand that this is the way.

It also isn’t a problem that the yield has the stability of a JoJo – even if the company has recently introduced dividend floors to try and garner some stability for shareholders here. Again, if we know what to expect, that’s not a problem. Why?

Because we can account, or discount for it if necessary.

Some basic recaps.

Norsk Hydro is one of the most profitable aluminum companies on the planet.

Why?

Because every single profit margin that matters, margins from the net, operating, and gross levels, as well as returns on assets, equity, invested capital, and capital employed, show us levels in the 85-93rd percentile, and that’s compared to the entire mining/metals sector. It has a very high current dividend yield, though that one is unlikely to remain longer-term, and a business model that is…not that hard to understand, shall we say.

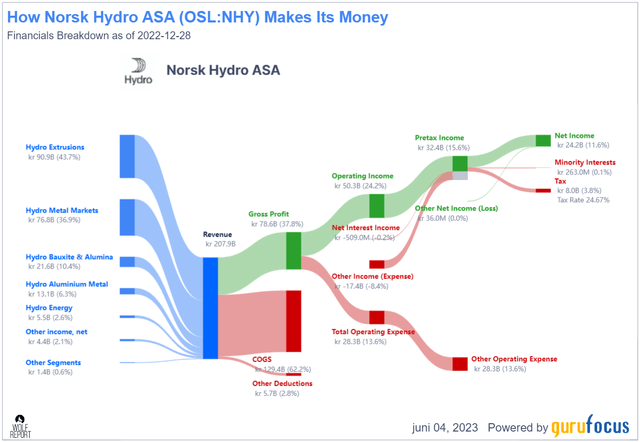

The mix is extrusions, metals, bauxite/alumina, Circal, Energy, and some smaller ones. It’s an appealing mix both on a company level, and also on an international one, and Hydro manages double-digit net income margins from a 35-40% gross margin, meaning COGS of below 63% and efficient OpEx of below 15%.

Hydro Revenue/net (GuruFocus)

It’s all in the numbers, dear readers – and these numbers are very, very basic. But they show us some good basic trends. Too many investors invest in companies that have sub-par or even negative margins, then are surprised why the “undervaluation” they perceived doesn’t change. You could have easily checked something like this – in any data service – where you could see that the company’s margins and business model are terrible.

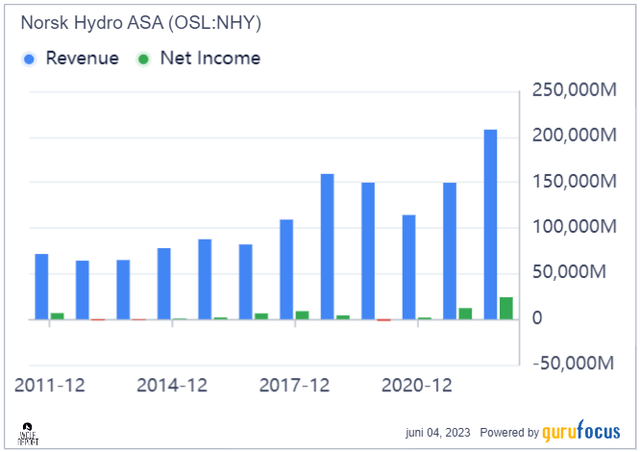

It’s to be said though, that Hydro is on a run. The company has rarely had such positive net income trends in context to its revenue. But this is the volatility that I am talking about, and why I know when I want to invest in this company, and when I do not.

Norsk Hydro revenue/net (GuruFocus)

Again, volatility. It’s the name of the game here. You want to buy the company cheap, to hold it until it outperforms, to then trim when the price gets too high, and investors forget that “Whoa, this is actually a cyclical business”. In case you need more proof, let me just say that the company has a more or less 50/50 miss/outperform ratio on the part of FactSet analysts. They do not know or are capable even with a margin of error to accurately forecast Hydro, which is completely natural. It’s too volatile.

That’s why we need to employ very basic valuation-oriented investment approaches to make a profit here.

The latest results we have are still 1Q, and these were reported about a month back, in late April.

Norsk Hydro has entered the beginnings of a downcycle, with volatile markets and characteristic weaker demands. The last 2 years have bolstered the company’s coffers and allowed it to prepare for this downcycle in good ways. This development is visible across the board, among other things:

- Agreement with Glencore to further develop Alunorte, aiming for its 2025E strategy. Alunorte has always been a difficult asset to have and was part of the reason for the crash in share price years back.

- Alumina prices remain relatively stable in spite of the current volatility – however, feedstock like coal, caustic soda, and bauxite are less stable, injecting further uncertainty.

- The aluminum market remains relatively stable and balanced ex-China. With China included, it’s characterized by disruptions, with further curtailment risks. China is a big question for much of the commodities market today, with its collapsing property/infrastructure market and economic situation, and requires a close look before investing.

- End markets are mixed – but good. Automotive is improving, but weaker in B&C and Industrial.

- The company is further pushing its CIRCAL and low-carbon aluminum. The fact that Aluminum is the “metal of the future” is not in dispute by any sector-specific analyst I know, nor by any generalist such as myself. Porsche’s recent push is a good example.

NHYDY IR (NHYDY IR)

- There is also an ongoing process to work with Alumetal S.A, which would add significant capacity to the company with 275,000 tonnes, adding significant recycling capacity and post-customer scrap capacity.

The company is on track for an ambitious 8BNOK AEBITDA for Extrusions alone, and its energy growth strategies are on track.

NHYDY IR (NHYDY IR)

On the high level of it, adjusted company EBITDA is up due to strong pricing for aluminum/alumina, extrusion volumes, recycling volumes, and favorable FX (which will turn down, resulting in negatives). At the same time, upstream pricing and energy continue to impact the company. However, for the time being, the company realized positive EBITDA growth sequentially. Without the favorable FX though, it would be slightly negative – so it’s no longer as clear a growth thesis.

Energy pricing contracts are also starting to turn down, normalizing some of the massive gains that Hydro has seen during insane energy pricing in 2022, which in 1Q was over 2.2B NOK. All in all, the results are very good for what the company is in terms of its environment. It’s holding the line quite well, and while I expect to market and commodity normalization trends will come to continue to push this company’s results down, I also expect that the downturn won’t be as severe as we saw in previous down cycles. This is obviously a positive.

Really, the things you want to keep an eye on with Hydro aside from valuation are the commodity markets and macro, while also keeping your ear to the ground in terms of its various projects to make sure that these come off without too much of a hitch. For now, that’s going well.

The problem lies in the share price, as we’re now clearly normalizing macro-wise, and as a result of it, I’m somewhat lowering my share price.

Norsk Hydro – The valuation is really borderline

If Hydro hadn’t dropped below 68 NOK/share a few days back, it would now be a “HOLD”. With reversion clear, a 70 NOK/share price is too exuberant. I’m lowering it by 2 NOK to account for the impact of lower results, China, and forward risk.

Why only 2 NOK?

Because the company’s plans and projects meaningfully improve the company’s profit potential. We could see a 5-6 NOK/share EPS as high a few years back – but with Alumetal and other operations working, a high single-digit EPS will be the norm even in a downcycle. At least, that is how I see it.

As you can see, my new PT really doesn’t call the company “cheap”, because it isn’t. Hydro, at this time, with the massive quality that it does have, is fairly valued, or slightly below fair value. The company does have outperformance potential. If we normalize the future EPS at around 7.5 NOK for the native, then the company isn’t at 10x P/E at this time – and it should be. 10x P/E for Hydro implies an 11.9% annualized upside until 2025E at this time, and I consider that to be likely – though the dividend will most definitely go down as a result of lower earnings.

DCF and other valuation models that rely on the stability of earnings are useless with Hydro. Instead, focus on fundamentals. NHY is BBB rated, it has less than 21% debt/cap, and it has a market cap of native ~140B NOK. It’s one of the largest aluminum companies on the planet, and it’s also one of the most profitable. At the right price, this is a company you want to “BUY”, and want to own until it no longer makes sense to do so.

S&P Global analyst’s target are too exuberant, as I see it. 14 analysts follow Hydro, and the average comes from a 55-115 NOK range to an 85 NOK/share. However, only 4 analysts are at a “BUY” with as many at “SELL” or underperform here, underscoring the uncertainty analysts have with the company at this price.

I’m able to provide more clarity in my valuation targets and my thinking here.

At anything below 68 NOK, this company is where I would consider it a “BUY”. But at anything above 68 NOK, the thesis becomes muddled, and you could just as easily see underperformance if the market decides to go with volatility here. The initial drop several years ago was not justified based on long-term earnings potential – but the company still dropped. That’s how the market works.

Other analysts and data analytics also point to this company at this time, based on future earnings potential and specifically the drop-off from the cyclical downturn followed by “flat” earnings potential, being fairly valued. This has nothing to do with the company not being good or its projects not realizing a profit. It has to do with the fact that the company is meaningfully changing its minimum EPS, and the share price already reflects this new reality.

That’s why I don’t see the company going much higher, and that’s why I am lowering my PT to 68 NOK/share.

Thesis

My current stance on Norsk Hydro is the following:

- Norsk Hydro is currently close to fairly valued to normalized future earnings and my new improved price target going into 1Q23.

- The potential returns from today’s levels are now acceptable compared to what other investment alternatives in the market offer us.

- At its current valuation, Norsk Hydro is a bare-bones “BUY” with at least the beginnings of what I consider to be an attractive upside. The price target is 68 NOK.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I can’t call Hydro “cheap”, but I am calling it “attractive”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here