MasTec, Inc. (NYSE:MTZ) has experienced significant share price growth and operational expansion. Considering the company’s effective utilization of free cash flow for growth, strategic acquisitions, and the overvaluation indicated by my discounted cash flow analysis, I recommend holding onto the stock at this time.

Business Overview

MasTec, Inc. is an infrastructure construction company that operates in the United States and Canada. The company offers a range of services, including engineering, building, installation, maintenance, and upgrades for various infrastructure sectors. MasTec operates through five segments: Communications, Clean Energy and Infrastructure, Oil and Gas, Power Delivery, and Other.

Its services encompass the construction of underground and overhead distribution systems for communications, power lines, and fiber optic cables. The company also specializes in clean energy infrastructure, such as renewable energy power generation, as well as natural gas and product transport systems.

MasTec’s expertise extends to electrical and gas transmission and distribution systems, industrial and heavy civil infrastructure, water pipelines, and home automation and energy management solutions. The company provides maintenance, upgrade support services, and service restoration in response to natural disasters and accidents. MasTec serves a diverse customer base that includes wireless and wireline/fiber service providers, broadband operators, energy providers, pipeline operators, infrastructure providers, and government entities.

MasTec

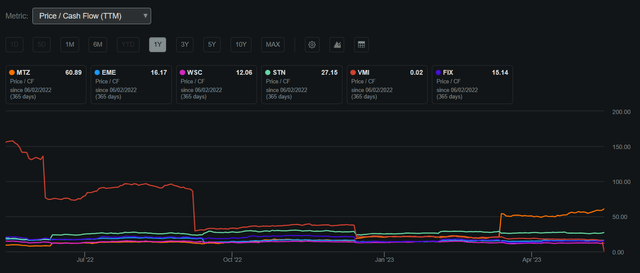

MasTec has a market capitalization of $8.18 billion and has shown a 5 year average return on invested capital of 7%. The stock’s 52-week high and low are $106.08 and $62.36 respectively, with a current price of $105.63. The price-to-earnings ratio for MasTec is 23.26 indicating slight overvaluation. The stock is trading close to its highs and is much higher on the price-to-cash flow ratio in comparison to its industry peers.

MasTec Price/Cash Flow Compared to Peers (Seeking Alpha )

Despite not paying a dividend, MasTec is capable of leveraging its free cash flow to drive long-term growth. This strategic approach positions MasTec to maintain a competitive advantage over its peers and facilitate seamless shareholder growth.

Seeking Alpha

MasTec delivered outstanding Q1 2023 results, surpassing expectations on both the top and bottom lines. The company exceeded earnings per share estimates by $0.03 at -$0.54 and outperformed revenue expectations by $210 million, achieving $2.58 billion in revenue and demonstrating an impressive 32.3% year-over-year growth. These achievements are especially noteworthy given the prevailing moderate economic headwinds. MasTec’s effective utilization of free cash flow in a high-rate environment contributed to these beats and showcased the company’s resilience. With a robust annual 2023 guidance, including a revenue range of $13.0 to $13.2 billion, GAAP net income of $165 to $200 million, adjusted EBITDA of $1.10 to $1.15 billion, and diluted EPS of $2.11 to $2.55, MasTec is strongly positioned for long-term growth. Additionally, the company’s record 18-month backlog as of March 31, 2023, amounting to $13.9 billion, reflects predictable and consistent cash flows in the future, enhancing MasTec’s resilience in macroeconomic downturns.

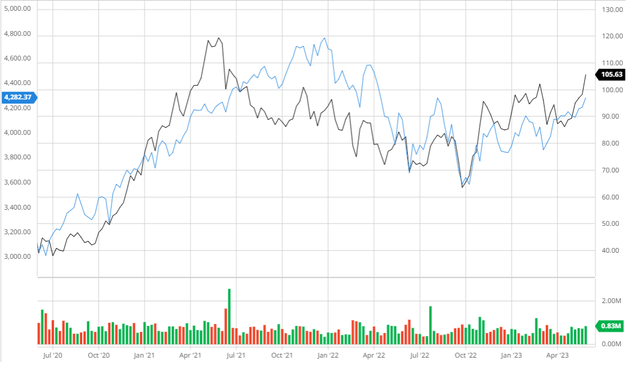

Outperforming the Broader Market

MasTec has demonstrated superior performance compared to the S&P 500 in the last three years, showcasing the company’s proficiency in scaling operations and utilizing cash flows to enhance its core business model.

MasTec Compared to the S&P 500 3Y (Created by author using Bar Charts)

Strategic Acquisitions Fostering Growth

MasTec Inc. uses a strategic acquisitions approach to grow over the long term, increase its capabilities, and enter new markets. The business discovers and assesses potential acquisition prospects that support its current operations and align with its strategic goals.

A renowned firm that specializes in the building of renewable energy sources, IEA, was acquired by MasTec for $1.1 billion in 2022. MasTec was able to expand its footprint and experience in the field of renewable energy as a result of this acquisition, particularly in the development of solar and wind energy projects. IEA was a useful addition to MasTec’s portfolio because of its experience in the design, building, and delivery of utility-scale renewable energy plants.

Through the acquisition of IEA, MasTec got access to a knowledgeable team, solid client contacts, and a sizable project pipeline in the renewable energy sector. This tactical acquisition complemented MasTec’s efforts to broaden its service offerings and take advantage of the rising demand for clean energy solutions.

Along with increasing MasTec’s capabilities, the IEA acquisition opened up options for cross-selling and upselling services to both current and potential customers. MasTec could provide clients in the renewable energy industry with a full range of services, including engineering, procurement, development, and maintenance, thanks to its extended competence in heavy civil and sustainable energy construction.

MasTec’s reputation as a top provider of infrastructural building solutions across multiple sectors, notably energy, and utilities, was further cemented by this strategic acquisition. The company was able to benefit from the global shift to cleaner, more environmentally friendly energy sources and increase its share of the renewable energy sector as a result.

IEA

Analyst Consensus

MasTec is currently rated as a strong buy by analysts, highlighting its potential to deliver long-term results. With an average one-year price estimate of $117.45, the stock shows an upside of 11.19%.

Trading View

Valuation

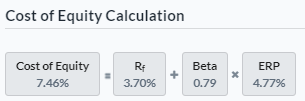

To prepare for my DCF analysis, I will first calculate MasTec’s Cost of Equity and WACC using the Capital Asset Pricing Model. Taking into account a risk-free rate of 3.7%, aligned with the 10-year treasury rate, I have determined that the Cost of Equity for MasTec is 7.46%.

Created by author using Alpha Spread

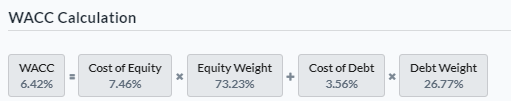

Based on the given Cost of Equity value, I have calculated the WACC to be 6.42%. This figure is lower than the industry average of 9.34%.

Created by author using Alpha Spread

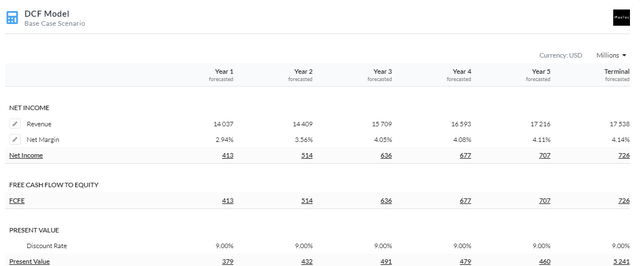

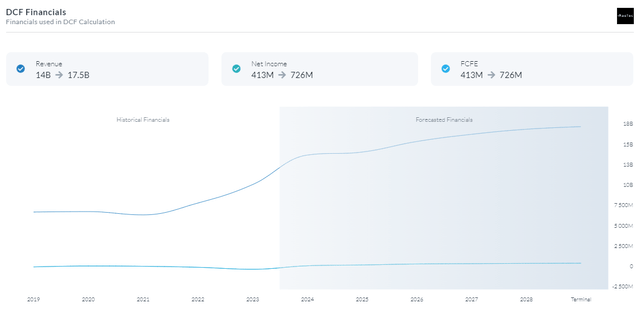

Based on my Equity Model DCF analysis using net income, I have determined that MasTec is currently overvalued by approximately 10%, indicating a fair value of approximately $94.88. This valuation is based on a discount rate of 9% over a 5-year period. To account for potential macroeconomic headwinds, such as high-interest rates, I incorporated a 1.54% risk premium into my assumptions. Additionally, I anticipate that MasTec will continue its focus on innovation and acquiring more efficient assets, leading to margin expansion in the long term.

5Y Equity Model DCF Using Net Income (Created by author using Alpha Spread) Created by author using Alpha Spread Created by author using Alpha Spread

Risks

Regulatory and Permitting: MasTec works in sectors with strict regulations, such as telecommunications and energy. Regulation modifications or delays in acquiring required approvals may affect project schedules and raise expenses for the company.

Raw Material and Supply Chain: For its initiatives, MasTec depends on a reliable supply of equipment and raw materials. Project deadlines and prices can be affected by supply chain disruptions, such as pricing changes, shortages, or delays in material delivery.

Conclusion

In conclusion, I recommend holding onto MasTec at the moment. The company demonstrates the capability to leverage free cash flow for expanding its operations, while strategic acquisitions contribute to its growth. However, considering my discounted cash flow analysis, the stock appears to be overvalued. Therefore, it is prudent to exercise caution in light of these factors.

Read the full article here