Last year, global commodity markets were in a dramatically different position than today. Most energy commodities were much more expensive until peaking roughly twelve months ago. The early 2022 price surge was triggered by the Russia-Ukraine conflict and the associated geopolitical actions that limited both countries’ export capabilities. Most of those issues have since been resolved as Europe has managed to increase energy imports from others, while Russia has shifted most of its exports toward Asia. The 2022-2023 winter season was also relatively mild, and the global economy has slowed, lowering the demand for oil, natural gas, and other key commodities. Accordingly, there has been a dramatic reversal in commodity prices over the past twelve months, altering the strains and creating significant issues in specific secondary markets.

One of the most natural gas-sensitive secondary markets is the fertilizer industry. Fertilizer companies are arguably more exposed to natural gas prices than many natural gas producers, as increased gas prices can dramatically drive fertilizer costs. Last year, amid soaring natural gas prices, Europe’s fertilizer production fell by ~70%, greatly aiding US producers such as CF Industries (NYSE:CF), which buy much cheaper US gas.

In May of 2022, amid peaking fertilizer prices, I was among the few analysts warning investors about a likely impending reversal in the sector in “CF Industries: The U.S. Fertilizer Boom May Soon Become A Bust.” The stock has declined by ~42% since then as fertilizer prices fell due to a convergence in US-EU natural gas prices, as expected. CF’s forward “P/E” is an attractive 7X, while its TTM “P/E” is extremely low at 4.2X. These measures are significantly (60-80%) below their five-year average and similarly below the current median valuations in the chemicals sector. In general, CF is trading around a 40-50% discount to its sector and its five-year average valuations, giving it the potential to be significantly undervalued. That said, the situation regarding natural gas prices remains precarious and could dramatically hamper the company’s profitability over the coming year. Further, its smaller size may make it more volatile and risky than some of its larger competitors, particularly in the current environment.

Will Fertilizer Prices Rebound Soon?

From my standpoint, CF’s core exposures have very little due to fertilizer demand and agriculture, with immense dependence on natural gas prices and gas price spreads abroad. Demand for fertilizer is relatively constant due to soil degradation, and most farmers will buy it as long as prices are not stupendously high. However, as we’ve experienced, supply is far less constant, particularly considering natural gas’s global supply and demand have become highly volatile.

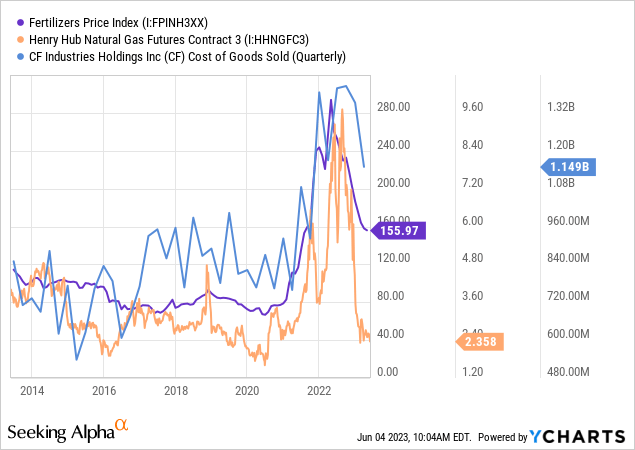

CF Industries’ cost of goods sold (usually around 50-70% of its sales) is primarily influenced by natural gas prices since that is the primary input, and fertilizers are extremely energy intensive. Accordingly, fertilizer prices are heavily influenced by natural gas. See below:

As you can see, there is a robust relationship between these three factors. CF’s COGS and the Fertilizers Price Index (influencing its revenue) are heavily lagged measures, whereas natural gas futures prices are somewhat leading. Accordingly, it is likely the case that both CF’s sales and COGS will decline over the coming quarters amid tremendously lower US natural gas prices.

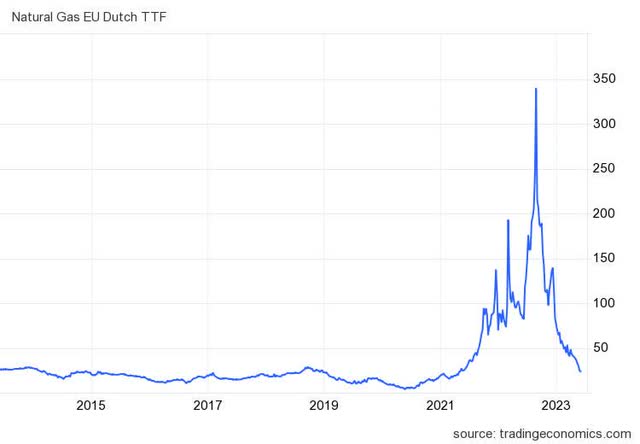

Crucially, fertilizer prices are much more global than natural gas because relatively little gas is sold via overseas shipping, whereas fertilizers are heavily traded globally. Thus, even if CF is not selling to Europe or Asia, it benefits tremendously from higher natural gas prices in those regions than the US. Problematically, European natural gas prices are much closer to US prices today. See below:

Europe Natural Gas Price (TradingEconomics.com)

The EU natural gas price is €23.7 per MWH, down from over €300 last summer. The current EU natural gas prices in US terms are ~$7.4/MMBTU, translating energy and currency units. While the US gas prices are lower, the spread is only around $5/MMBTU today, compared to over $50 throughout most of 2022. Accordingly, Europe is reopening most of its fertilizer plants; however, it may still be some time before its production returns to normal. China has also tried to protect its fertilizer production by telling its producers to increase output levels; however, it is always difficult to know precisely what is occurring in that significant economy.

Overall, the global fertilizer market is not nearly in the crisis it was last year, and production and prices are steadily normalizing, although there is a way to go. Over the coming months, I expect we will continue to see fertilizers prices fall, while it is improbable that US costs (natural gas) will continue to decline since natural gas should not sustain its current levels indefinitely amid the collapsing natural gas rig count (a forward production indicator). I expect fertilizers to become cheaper primarily due to continued bearish trends in EU gas prices. Europe’s natural gas storage level is currently at the highest seasonal level in many years, despite losing access to its primary energy source. Accordingly, European natural gas prices are likely to trend lower, encouraging an increase in fertilizer output.

EU natural gas prices are much lower for a few factors, some of which will not last. For one, gas demand over winter was extremely low due to very warm winter weather in most of the Northern Hemisphere. Secondly, Europe slashed its demand by encouraging heavy users, such as fertilizer plants, to close down. Thirdly, the slowing global manufacturing economy (see manufacturing PMIs) has compressed demand.

Weakened economic outlooks should continue to compress gas demand, keeping CF’s domestic costs low while limiting global fertilizer prices. That said, I do not necessarily expect 2023 winter weather will be as warm as 2022’s, and Europe’s increased gas consumption as it reopens plants may not be met with increased production. Many global gas producers are slashing output due to low prices. Europe’s significant gas imports last year depended greatly on extremely high import prices from Norway, the US, and the Middle East – all of whom have little incentive to import to Europe at current prices. Even if the Russia-Ukraine war ends, Europe cannot return its natural gas imports to normal levels even if it wanted to due to the NS1 pipeline’s destruction.

Accordingly, while the immediate outlook for EU natural gas is bearish, today’s low prices could trigger a more significant supply cut that leads to even higher prices by the end of the year. In other words, fertilizer prices should continue to decline for a few months. Still, they could bottom and rebound even higher by the end of the year as global gas output falls even lower – particularly impacting Europe (due to its immense import dependence).

What are CF Industries Worth Today?

My base case view is that CF will continue to struggle in the short run as prices slip amid increased global production levels. All US fertilizer producers no longer have the edge over their international competitors, meaning their fundamental position differs slightly from before the 2020-2022 gas shortage crisis. Before 2020, CF traded in the $30-$60 range, which is currently just above that zone. That said, the company’s cash flow windfall over the 2020-2022 period caused its book value to rise by ~$15, encouraging improved financial stability and operational capacity. Further, current fertilizer prices remain above pre-2020 levels while natural gas is extremely cheap, so CF’s EPS should remain elevated over the coming quarter or two – likely around $6 to $9 annualized.

Considering these factors, I believe CF is fairly valued today, given the assumption of continued normalization in the market. In other words, CF appears fairly valued, given that its production costs and sales prices will return to normal levels. At the same time, le its output capacity and efficiency will be permanently aided due to reinvested 2020-2022 profits. Although CF is cheaper than many of its large peers, it is historically more volatile, so I would not necessarily buy the stock for that reason alone.

However, a resurgence in fertilizer prices could lift CF much higher over the coming year or two. In my view, while Europe’s natural gas situation appears much better today, that is mainly due to a mixture of rare weather abnormalities and, more importantly, excessively high prices last year that encouraged sufficient imports to offset lost Russian sources. Fundamentally, nothing has improved since 2022, and the falling gas rig counts suggest that global natural gas production will fall significantly over the coming months. Accordingly, I suspect Europe will not refill its gas storage sufficiently throughout the coming months, potentially creating a shortfall by ~2024 – potentially causing a prolonged fertilizer shutdown in Europe. Although that continent has restarted many fertilizer plants, they may curb production again if EU natural gas prices rise. Thus, there is reason to believe the long-term fertilizer shortage could be worse than in 2022.

Overall, I believe there is a growing speculative bullish opportunity in CF today. In my view, CF is likely not overvalued if we assume that its EPS will eventually return near pre-2020 levels, limiting its downside risk. Further, I suspect that the natural gas and fertilizer shortage may eventually return with greater force due to the ongoing production cuts in natural gas output. While higher gas prices push CF’s costs higher, it is most certainly the case that Europe and Asia’s fertilizer producers will be impacted more significantly due to their gas import dependence. As such, global natural gas prices rise is highly bullish for CF.

The greatest risk to this bullish thesis is a significant global recession that dramatically reduces natural gas demand. I believe a recession is likely; however, I do not believe gas demand will fall too much since it has become the dominant global power source over the past decade. Secondly, continued temperate winter weather in 2024 would hamper my thesis as it depends on natural gas prices; however, that is unpredictable from my standpoint.

At this point, it is unclear if gas prices will rise, so my bullish view on CF is speculative, and I would not be surprised to see CF continue to decline as its short-term EPS outlook continues to compress. That said, the precarious global energy situation, CF’s geographical position in a net gas exporter continent (North America), and its low valuation give it significant upside potential should the shortage return. I do not believe that will occur until ~2024 (or late this year), so CF may not see much upside for some time, but I am more willing to dip into the stock today.

Read the full article here