The market is never dull, and 2023 is certainly no exception. The constantly moving parts are why I have such an affinity for investing (it’s fun and dynamic!).

We’re not quite halfway through the year, and we have seen:

- A banking crisis and failure of the mismanaged SVB Financial Group (OTCPK:SIVBQ);

- Interest rates rise precipitously, as expected;

- Positive developments on inflation (but not out of the woods); and now

- The debt ceiling grandstanding gave way to a snoozer of a compromise.

Luckily I don’t invest based on the macroeconomic headlines or try to be the Nostradamus of the market. I’m purchasing stakes in extremely well-managed companies in secular growth industries to keep for the long haul. Cash flow positive is a must; share buybacks or dividends are preferred (it sounds like a dating profile, doesn’t it?).

We don’t prognosticate macroeconomic factors; we’re looking at our companies from a bottom-up perspective on their long-run prospects of returning. – Mellody Hobson: CEO of Ariel Investments, Starbucks Board of Directors Chair.

At the end of 2022, I used this approach to pick 4 Top Techs Stock For 2023 and 4 Top Long-Term Stock For 2023.

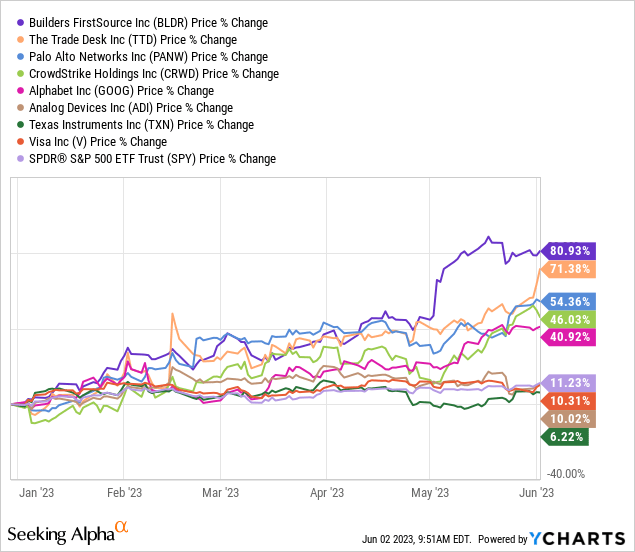

So far, so good, as shown below.

It’s way too early to celebrate. These are core holdings that will grow for years according to the plan. However, with Builders FirstSource (NYSE:BLDR) up nearly 80% year-to-date (YTD), it demands an early update.

Builders FirstSource: How did we get here?

I know it’s tempting to scroll past Builders FirstSource to get to The Trade Desk (NASDAQ:TTD) (caught ya!), but before you do, consider that the stock is up 160% since I first recommended it here in May 2021 vs. no return for the S&P 500.

Starting with its massive $3.7 billion merger with BMC, completed in January 2021, Builders FirstSource went on a buying bonanza and began focusing earnestly on value-added products. I spoke to then-CEO Dave Flitman at the time (talk about polished), and if you have a spare minute, it might be worth a look. The company is a terrific example of management having a detailed long-term plan and executing it near flawlessly.

There are three reasons that I love this company’s direction:

- Focus on value-added products;

- Creating efficiencies through mergers and acquisitions (M&A); and

- Secular housing trends.

Let’s look at them in order.

Valued-added products

Builders FirstSource fabricates and sells products like roof and floor trusses, wall panels, windows, doors, and millwork to contractors. The products cut down on construction site waste and other costs and are advantageous when skilled labor is in short supply.

The focus is transformational for Builders FirstSource because they carry higher margins and distinguish the company. In 2022, 53% of the $22.7 billion sales were value-added, increasing to 56% in Q1.

M&A efficiencies

The merger with BMC created a company with $11.7 billion in combined sales. Sales have doubled since then based on organic growth and many more tuck-in acquisitions. But the company was not swinging wildly. It focused on adding:

- In fast-growing geographies like Maricopa County, AZ ($400 million acquisition of Cornerstone Building) and similar; and

- Companies with millwork and building component capacity (see value-added products above).

The efficiencies created by scaling increase sales and margins, increasing cash flow and profits, and enabling a lucrative buyback program. It equals significant capital gains for us. In 2021 and 2022, $4.3 billion in shares (29% of the current market cap) were repurchased, and the company is on pace to repurchase another $2.5 billion this year.

Secular housing trends

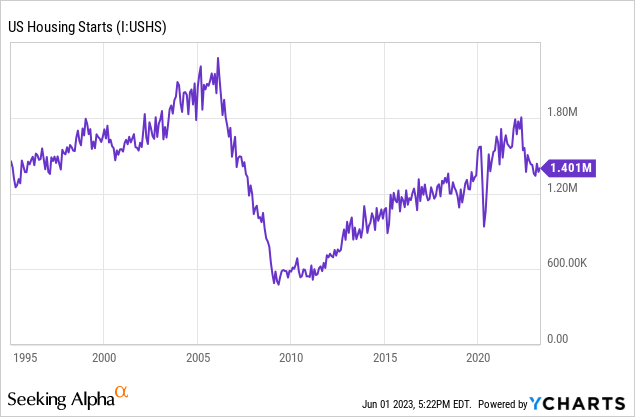

Home prices aren’t high today because of easy credit, as anyone who has purchased recently can attest. The days of “NINJA” loans (No Income, No Job, Approved) left with the 2008 financial crisis.

Prices are high now because we are short millions of single-family homes due to the underbuilding after 2009, as shown below.

Building has picked up, but the latest data shows households are being created faster than supply. The housing market may cool for a quarter or two along the way, but the secular trend is just getting started, and estimates continue to be too low.

Is Builders FirstSource stock a buy now?

This stock should provide excellent, market-beating gains over the long haul. But there is no denying that its success is finally noticed on Wall Street, and it isn’t trading at a discount anymore. However, as mentioned above, the company is on pace to repurchase another 15%+ of the market cap this year alone, and the company is in a terrific position.

We can also get creative. The recent momentum could mean the stock will take a breather. Selling covered calls makes sense here. For example, January 2024 $135 calls currently net ~$9 per share (or $900 for each lot).

The stock would need to rise 17% for this to be in the money and 25% for it to be a losing trade. If the stock continues its tear, we can buy the option back and sell another one at a higher strike price for a date further out.

The Trade Desk defies advertising slowdown

You wouldn’t know there was an advertising slowdown from The Trade Desk’s stock price this year, and the company’s results continue to outpace the industry. The stock is up more than 70%, and Q1 sales rose 21% year over year, while the industry is in a slowdown. The Trade Desk (“TTD”) is gaining market share by outpacing industry growth. When the industry recovers, TTD will benefit even more.

TTD is at the forefront of the changing advertising landscape. Advertising is moving from the old way (static contracted ads) to programmatic.

How does programmatic advertising work?

When an opportunity becomes available in programmatic advertising, it sends a bid request to demand-side platforms (DSPs), like The Trade Desk, where advertisers bid on the space based on preset parameters of interest. It happens in a fraction of a second and millions of times daily.

The advantages for advertisers are:

- Targeted and nimble campaigns;

- Omnichannel reach;

- Budget responsive; and

- The ability to track effectiveness and efficiency with quality data feedback.

When we talk about “omnichannel,” think connected television (CTV), web and mobile display, and online video. Connected television is a significant growth area as it takes market share from traditional television, and its viewers skew to prime demographics. CTV represents more than 40% of TTD’s revenue, while mobile and video make up more than 30%.

TTD also has a gigantic international opportunity. It generally receives 10% to 15% of revenue outside of the US, so room for expansion abound; however, management still needs to show the ability to gain traction here. This is something to watch.

Is The Trade Desk stock a buy now?

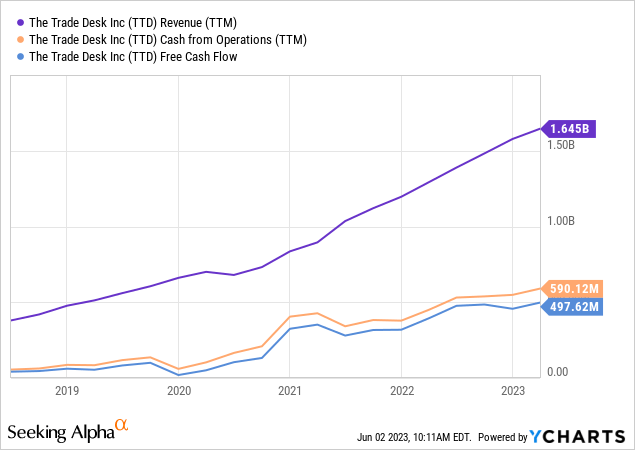

It’s tough to find a company that has excelled at cash flow and revenue growth more than TTD, as shown below:

At the current pace, it should reach $1.9 billion in revenue in fiscal 2023.

But there are risks.

First, the company is prolific at dispensing stock-based compensation (SBC), much going to founder and CEO Jeff Green. This is less of a threat to shareholder value now that the company has begun buybacks to offset dilution. In Q1, $292 million was repurchased vs. $113.5 million expensed. TTD has signaled it intends to keep this up and has a war chest of liquid assets of over $1.3 billion (plus the cash it produces each quarter).

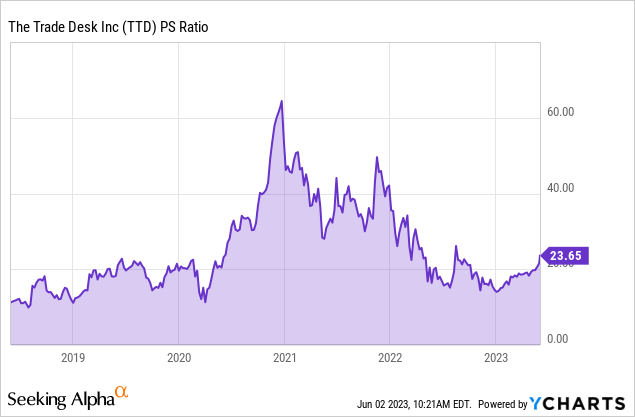

The price-to-sales (P/S) ratio sneaked over its pre-pandemic level recently, as shown below.

Options are a good play here. January 2024 $90 calls will net the seller more than $8 per share, or $800 for the lot. The stock would need to rise another 27% to $98 a share to lose on this trade, which (1) seems unlikely, and (2) would make the stock clearly overvalued.

The Trade Desk stock is a secular buy; however, it’s wise to accumulate shares slowly to mitigate the risk at this price.

Read the full article here