Introduction

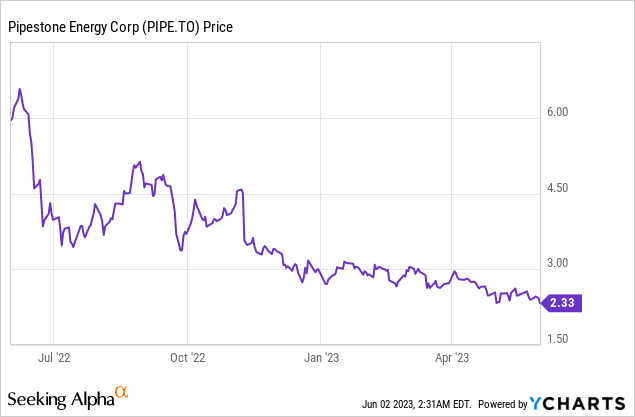

I have been keeping an eye on Pipestone Energy (TSX:PIPE:CA) (OTCPK:BKBEF) for a while now, but unfortunately the low natural gas price in Canada (which has dropped below the C$3 I used in my previous article) has definitely held the share price back. Q2 will likely be very soft as well as the company had to reduce its production rate by more than 50% for about two weeks, so the lower production rate in combination with a lower natural gas and condensate price indicates Q2 will likely be very soft. I can be patient but I obviously also want to keep a finger on the pulse.

As this article is meant as an update on older articles, I’d like to refer you to those articles to get a better understanding of Pipestone’s business and its exposure to the natural gas and condensate prices.

The Q1 results were very decent

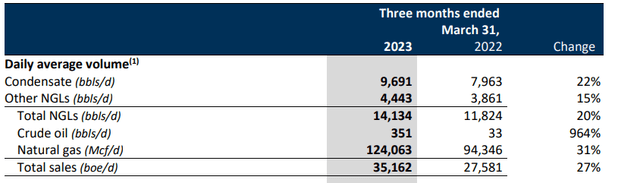

During the first quarter of the current financial year, Pipestone produced an average of 35,200 barrels of oil-equivalent per day. Approximately 14,100 barrels of oil-equivalent per day came from the production of NGLs where the condensate production played an important role. The remainder of the oil-equivalent production rate (about 59%) came from natural gas.

Pipestone Energy Investor Relations

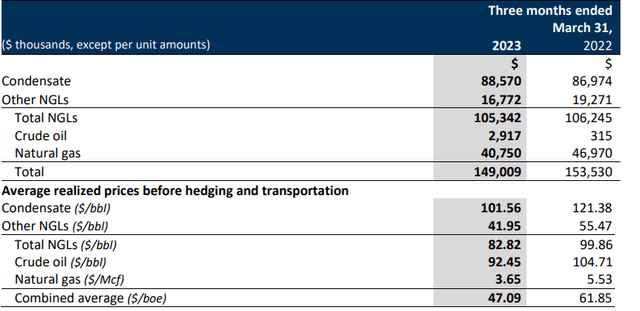

Thanks to the higher prices for condensate, not natural gas, which represented 59% of the production, but condensate generated the majority of the revenue for Pipestone. The NGLs were sold at just under C$42/barrel but the condensate was selling for about C$101.5 per barrel. So although condensate represented just 28% of the production, it represented almost 60% of the total revenue of approximately C$149M.

Pipestone Energy Investor Relations

In a way, the strong condensate pricing environment was a blessing in disguise for Pipestone Energy as the average realized price for its natural gas was just C$3.65 per mcf (that’s still higher than the benchmark price during the quarter).

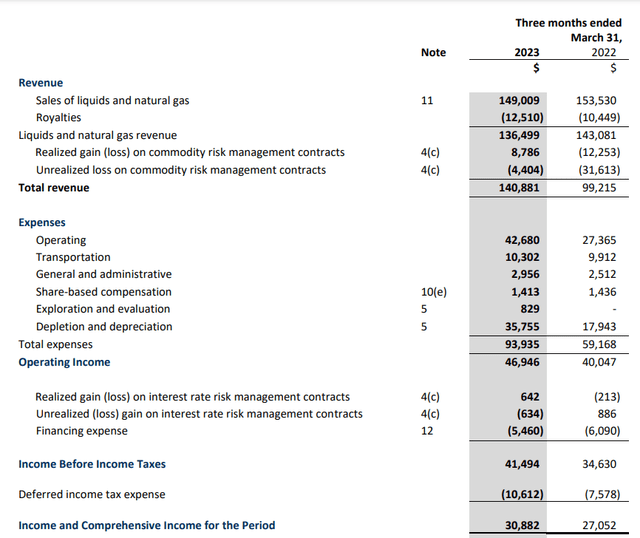

The total revenue indeed came in at about C$149M during the quarter, and the net revenue after deducting the royalty payments and adding the C$4.3M in net realized and unrealized hedging gains came in at C$141M. As you can see below, the total production costs are very reasonable and the (non-cash) depletion and depreciation expenses represented almost 40% of the total operating expenses.

Pipestone Energy Investor Relations

The company remained profitable with a pre-tax income of C$41.5M and a net profit of C$30.9M which represented an EPS of C$0.11/share. That’s great but I’m mainly interested in Pipestone’s cash flow performance.

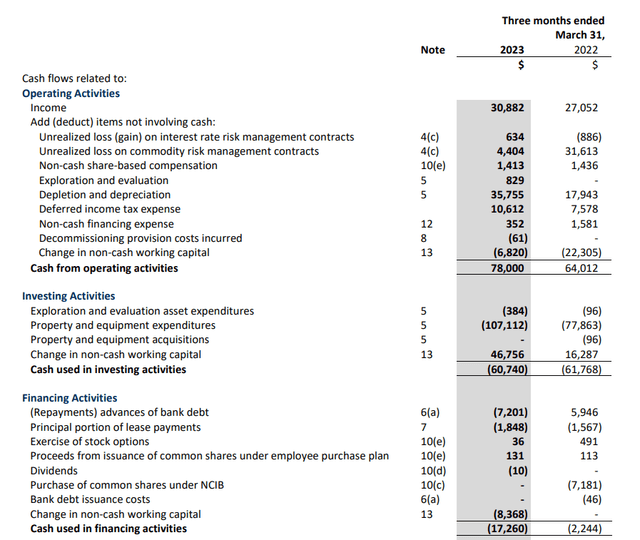

The total operating cash flow was C$78M in the first quarter, and after making some adjustments like adding back the C$6.8M investment in the working capital position and deducting the C$1.8M in lease payments, the adjusted operating cash flow was approximately C$83M.

Pipestone Energy Investor Relations

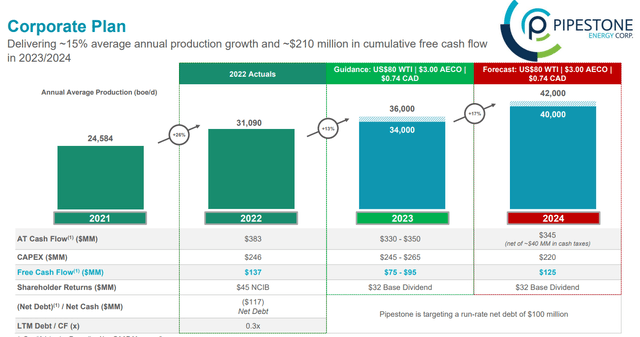

That’s excellent, but it wasn’t sufficient to cover the C$107M in capital expenditures and Pipestone Energy was essentially free cash flow negative in the first quarter of this year. While that does sound worrisome, let’s not forget Pipestone’s first quarter was very capex-heavy. The company has reiterated its full-year guidance which calls for a total capex commitment of C$245-265M. Using the midpoint of that, at C$255M, in excess of 40% of the full-year capex has already been spent in the first quarter. This means the average quarterly capex in the next few quarters will be reduced to less than C$40M, which is just a fraction of the Q1 capex.

Pipestone Energy Investor Relations

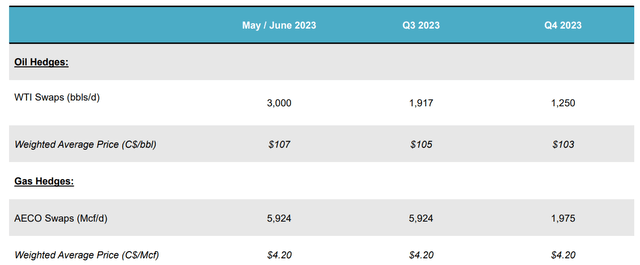

Looking at the guidance for next year, which uses US$80 WTI (perhaps a little bit optimistic) and a natural gas price of C$3 on an AECO basis, the company expects to generate a net free cash flow result of C$125M. As Pipestone currently has approximately 280M shares outstanding, the 2024 free cash flow guidance implies a free cash flow result of C$0.45 per share. That’s just a provisional expectation as Pipestone has had to refine its guidance in the past as well. But as the current share price has fallen to just over C$2.30, the stock is trading at about 5 times the anticipated 2024 free cash flow result – based on C$3 AECO. Fortunately the company has some hedges in place which will help to mitigate (but not offset as the natgas hedges represent a single digit percentage of the total production) the impact of the lower natural gas price on the spot market.

Pipestone Energy Investor Relations

Investment thesis

I expect the company’s second quarter to be pretty weak as the natural gas price isn’t cooperating and as the wildfires in Alberta resulted in Pipestone having to curtail some of its production for a few weeks. This will for sure have a very noticeable impact on the Q2 results and investors should mentally prepare for a weak result.

The condensate production is definitely helping Pipestone Energy, but a higher natural gas price will be needed for the company to start performing well. At the current share price, Pipestone is trading at approximately the PV20 of its 1P reserves (although the PV values are calculated based on a C$4+ natural gas price which I think is very reasonable).

And if you are a believer in natural gas trading back up to C$4-4.5/mcf and if you expect the condensate price to remain stable around C$100/barrel, the after-tax PV10 value of the current reserves is estimated at almost C$1.6B which would indicate a net value of C$5/share after deducting the net debt and working capital deficit.

I have a long position in Pipestone stock and am willing to add to this position, but I definitely realize the natural gas price will have to increase before the Pipestone share price starts to increase again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here