Introduction

This article builds on prior signal event articles with more explanations on how to benefit from one of the most popular features of the Value & Momentum Breakouts investing group. As more data points are collected, more insights are gained. Usually I focus on publishing market topping signals, but this time I am sharing a very positive development that we have not seen since January.

This past February signaled the largest market topping signal since August 2022. Since then many sectors have declined with financials among the hardest hit sector this year. A banking crisis followed directly after the February negative signal, and we have been waiting through May for signs of a broad positive market signal. While the Technology sector has been led by a few mega caps in strong positive momentum, it has been a narrow trade that left both the DJIA and Russell 2000 indices in negative territory through May. This article serves to answer key questions about the current positive signal and prepare readers for the potential of more gains in the short term.

Momentum Gauges Dashboard

Market daily gauges, S&P 500, and sector gauges are highly positive in the first broad rally in months. All the sectors turned positive this week in the strongest broad market move since January. Money flows to oversold sectors like financials, energy, and basic materials may accelerate as long as the US dollar continues to decline from peak levels in May.

app.VMBreakouts.com

- Guide: Maximizing Market Returns With The Automated Momentum Gauges

Market Momentum

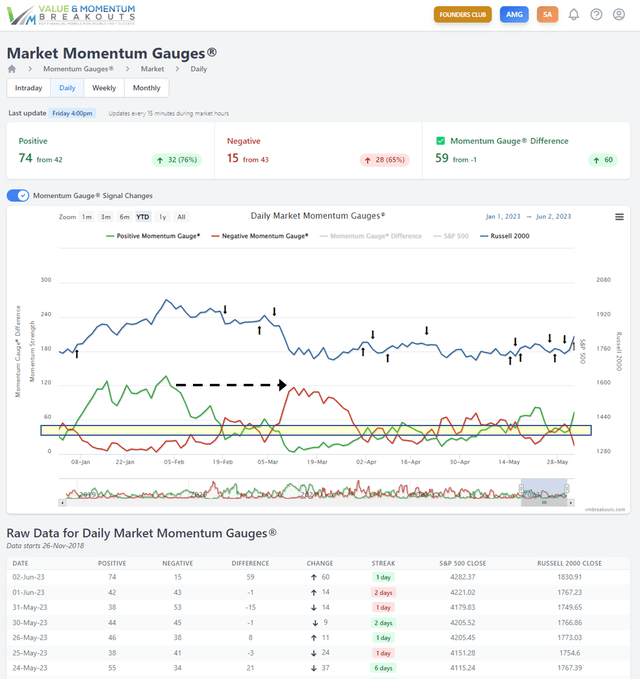

Momentum broke out above 70 on Friday after some of the choppiest weeks on the signals that we have seen in years. This was largely due to frequent sector rotation with concerns about a debt default. As I wrote about in my debt ceiling article linked below, this pattern is consistent with increased volatility ahead of all the prior debt ceiling standoffs followed by strong gains after each deal concludes. This time however we are in a continuing Fed tightening program with 10 consecutive rate hikes and the largest QT program in US history.

Daily Market Momentum Gauges YTD

Momentum cleared the choppy equilibrium range (yellow) this week, but unlike the mid-May jump, all the sectors this week were participating in the breakout. There is a better chance that this bounce will sustain for the oversold sectors.

app.VMBreakouts.com

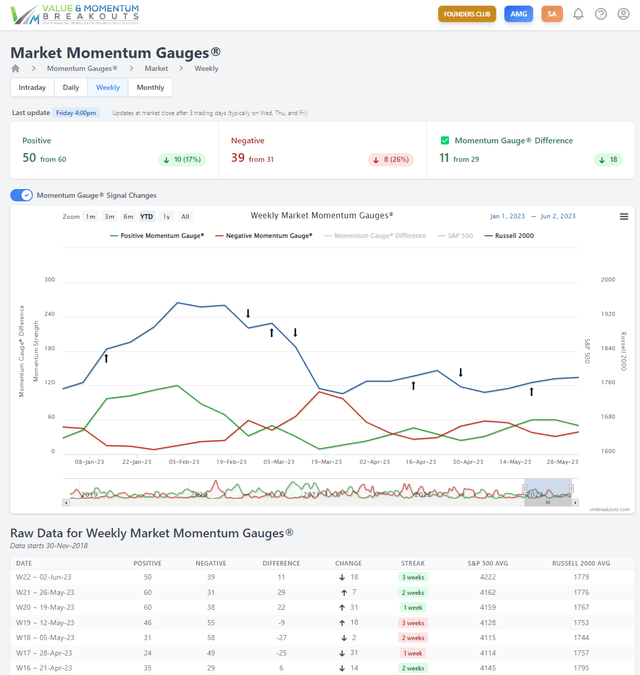

Weekly Momentum Gauges YTD are heading toward a 4th consecutive positive week with much less noise than the daily gauges. The weekly chart illustrates the unexpectedly strong momentum conditions in January that topped in February ahead of the recent banking crisis.

app.VMBreakouts.com

These weekly momentum moves also correspond strongly inverse to the movement of the Invesco DB US Dollar Index fund (UUP) shown below. As the dollar declined into January, we had a strong rally that peaked at the end of February. As May comes to a close with the dollar index at the highest levels since March, we might be headed toward another rebound off the lows of this cycle.

FinViz.com VMBreakouts.com

Why do finance companies admit that “timing is everything,” but when it comes to investing your money, the majority tell their clients to “just buy/hold and try to ignore the downturns?” I submit most investors would rely on timing signals, but without a model like the gauges they are forced to try to keep their clients in buy/hold positions for 24 months with no gains, or worse.

If timing helps you gain just 1% a week, you will significantly outperform all the long-term market averages.

Long time members know, we can consistently beat the markets by avoiding the most negative weeks and loading up during the most positive signals. Only the financial industry has incentives to make you to stay in the markets year round.

FinViz.com VMBreakouts.com

2023 Market Outlook

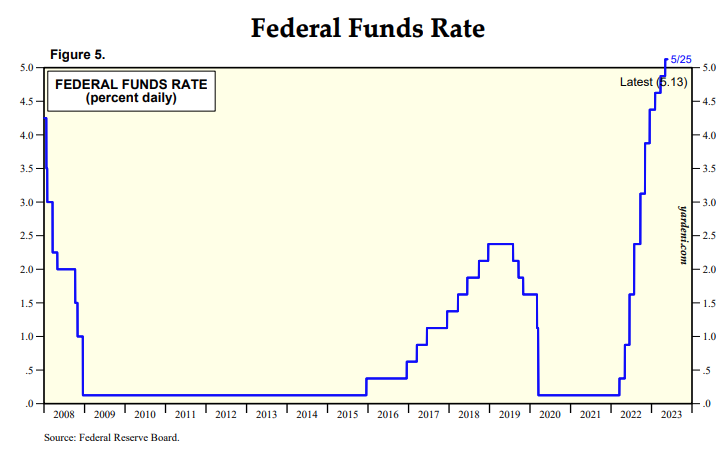

The Fed has delivered its 10th consecutive rate hike in the fastest series of increases since 1977. The S&P 500 (SPX) (SPY) are still negative since the Fed began its tightening program on March 9th, 2022 and began hiking rates early last year. After the latest PCE inflation unexpectedly increased again, the odds of an 11th hike in June jumped to 66.5% and have fallen back to 25% on the CME FedWatch Tool. Historically, such high rates have led to a market correction after every rate hiking cycle in US history. Although I am pleased to report current positive momentum, the largest QT program in history is still ongoing to reduce the Fed’s balance sheet at the fastest rate ever conducted, with target levels of -$95 billion per month.

Yardeni.com

My strategy for 2023 is to stay generally bearish while adjusting for large bear bounces in anticipation of strong similarities to the August topping pattern last year. Economic data, inflation, manufacturing productivity, home sales, and the latest banking crisis continue to show recessionary weakness into rising interest rate hikes at the highest levels since Sep 2007.

Mid-year 2023 is nearly here and things may get interesting with potential for a Fed pivot. Dip-buyers will continue to try to pull this anticipated pivot event forward in time, extending high market volatility while the Fed hikes rates.

The new June Russell Reconstitution anomaly report will be released again in June with the latest stocks for 2023 FTSE Russell Reconstitution Anomaly Study – Strong +22.7% Difference After 5 Months

Some of my forecast articles for 2023 are here for your benefit.

Sector Momentum

For this article, I want to highlight just two of the eleven sector gauges in particular. The differences between these two sectors also accounts for much of the extreme chop in the markets recently.

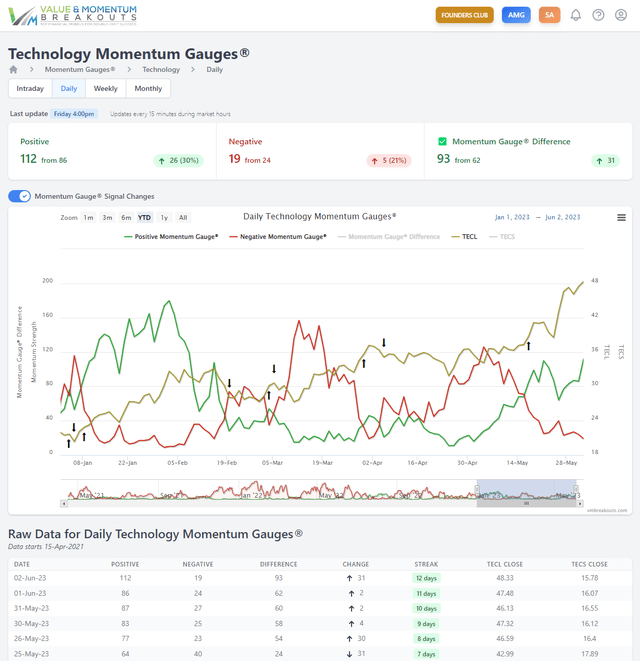

Technology Momentum Gauges continue for a third week to be the breakout sector. Negative gauges continue to drop sharply from the peak of negative momentum on May 4th. The (TECL) 3x Direxion Daily Technology bull fund has gained +41.7% from May 4th and could continue toward January peak positive momentum levels at 180. The technology sector is the highest weighted and largest sector on the major market indices, especially the Nasdaq and related index fund (QQQ). As long as technology momentum increases it will benefit technology funds like (SOXL) 3x Direxion Daily Semiconductor bull fund and the Mega cap bull funds comprised mostly in technology like MicroSectors FANG+ and FANG Innovation 3x funds (FNGU) (BULZ).

app.VMBreakouts.com

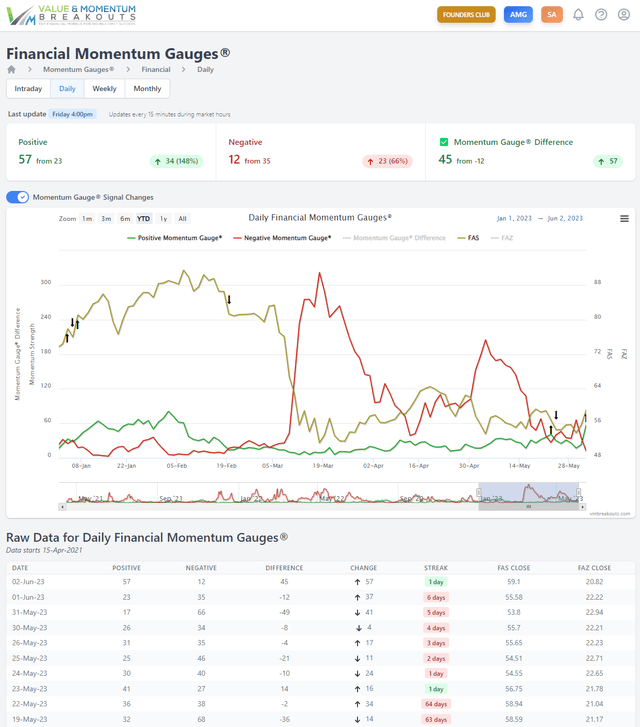

Financial Momentum Gauges have been the most negative sector this year from the February 21 signal in advance of the March banking crisis. This past Friday gave us only the 2nd and most positive signal in over 71 days. Since that negative market and sector gauge signal, the (FAZ) -3x Financial bear fund has gained +29.8%. This new positive sector signal could mark the start of a longer rebound in banks, with the (FAS) 3x Financial bull fund and related (BNKU) (DPST) for strong potential gains.

app.VMBreakouts.com

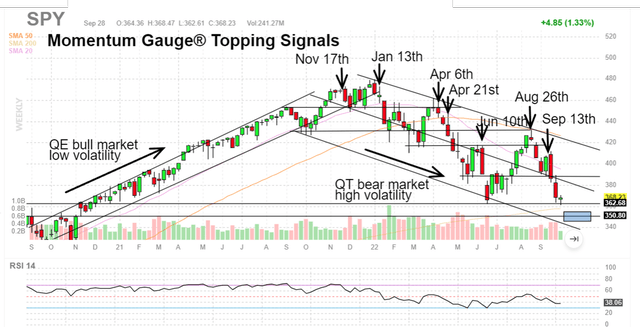

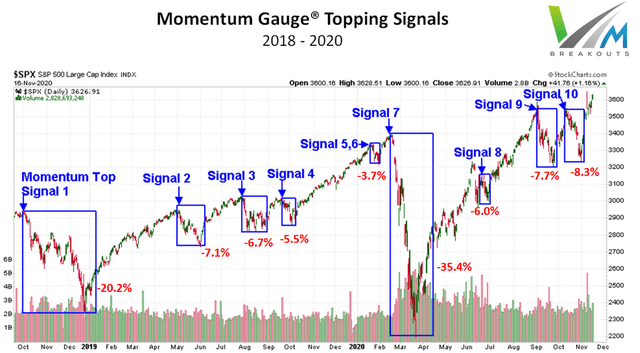

Prior Negative Signals In Advance Of Major Downturns

One of the most popular uses for the gauges is to get advanced warning signals ahead of major market downturns in order to protect your investments. Examples of prior major market topping signals including the 2018 quantitative tightening (QT) correction and the 2020 Covid correction are shown below.

VMBreakouts.com

The point of this illustration is that a majority of all the signals detected so far were events exceeding -5% S&P 500 declines to as much as -35%, including one of the worst one-month declines in history. I always publish many more current examples and signal articles throughout the year for anyone interested in following my market updates.

Review Of Prior Signals

-

Signal 19 (November 17th, 2021) Momentum Gauge Topping Signal: The Second Largest 2021 Negative Signal To Date

- Signal 16 (June 17th, 2021) Momentum Gauge Topping Signal June 17: The Largest Negative Signal In 2021

- Signal 11 (January 29, 2021): First Negative Momentum Gauge® Signal For 2021: Reviewing The Signals | Seeking Alpha Marketplace

- Signal 9-10 (September 13, 2020): An Election Year Correction Signal And Only The 3rd Negative Weekly MG Signal In 2020

- Signal 8 (June 24, 2020): Evaluating The 8th Market Correction Signal On June 24th That Has Preceded Every Recent Decline

- Signal 7 (March 23, 2020): Revisiting The Signals That Forecasted Every Recent Decline, In Search Of Early Recovery Indicators

- Signals 4-6 (Jan 28, 2020) : Revisiting The Signals That Forecasted Every Major Downturn Since “Volmageddon”: What’s Next

- Signals 1-3 (Aug 8, 2019): These 3 Measures Forecasted Every Major Downturn Since QT Started: What’s Next

Conclusion

The Momentum Gauges continue as part of an active research project that has delivered highly profitable results to many readers of my published financial articles. I continue to enhance the model as we gather more data over many more months and years. The current market conditions with increasing rate hikes and the largest Fed quantitative tightening program in history may contribute to weaker than average performance for 2023.

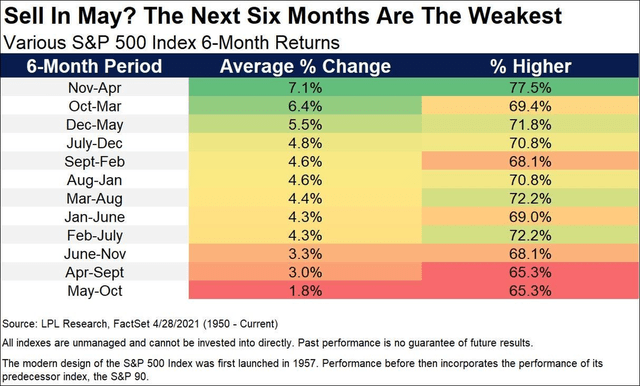

Historically, from 1950, the six-month period between May to October delivers the lowest average returns for the S&P 500 relative to all six-month periods. The current Fed tightening conditions and approach of a potential recession are not factored and may further increase the market risks this year.

LPL Research

I hope this analysis provides you with additional market insight that benefits your trading in the days ahead.

All the very best to you!

JD Henning, PhD, MBA, CFE, CAMS

Read the full article here