I’ve said this multiple times: this volatile market is a stock trader’s dream. This is not the time to be sitting quietly in index funds and wait for a rising tide to lift all boats – this is a time when active evaluation of individual positions can lead to outsized gains versus market averages.

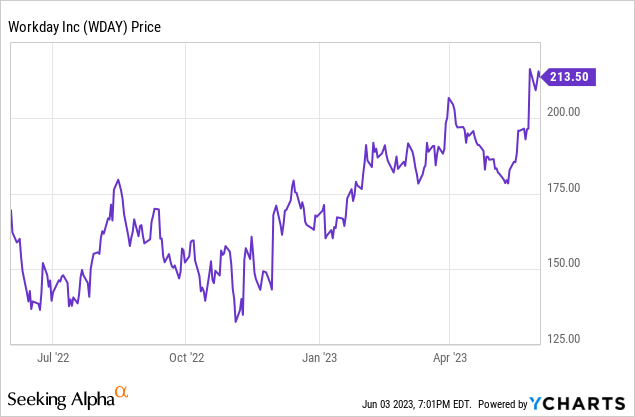

This means being willing to evaluate bull and bear theses as fundamentals change, and most importantly, as valuations change. In the case of Workday (NASDAQ:WDAY), which is up nearly 30% year to date, I think it’s time for a change in stance.

With stock price hitting my upper threshold, I’m moving to the sidelines

I’ve been bullish on Workday for over a year. In my last article on the stock, I laid out a price target of $220 on the name, then representing a 7.5x forward revenue multiple. Enthusiasm for Workday post-Q1 earnings (released in early May) plus the general resumption in risk-taking attitude as expectations of interest-rate pauses build has driven the stock sharply upward over the past month.

Accordingly, I’m now revising my opinion on Workday to neutral, as I believe the stock’s runway room has thinned with the recent rally. I now see the stock as a relatively balanced bag of positives and negatives.

On the bright side for Workday:

- Category leadership in two very large markets in enterprise software. For investors who don’t have the history, Workday was born out of ex-Oracle employees who eventually turned Workday into a premier cloud software solution for HR. The company has now extended that dominance into financial/ERP software, and together between these two markets, Workday now sits on a massive $125+ billion market opportunity.

- Growth/profitability balance. Workday is a “Rule of 40” software stock, which is a goal many fellow enterprise software companies strive to achieve and fail to do. With ~20% revenue growth on top of 20%+ pro forma operating margins, Workday has achieved a level of growth/profitability balance that should give investors some comfort in a choppy stock market.

At the same time, however, especially at the stock’s higher price, we should be wary of the following factors:

- Headcount compression and layoffs in the current environment may hurt Workday’s core HCM business, which is largely priced on a per-head basis. Overall corporate investment in HR and recruiting departments (both from a personnel and IT perspective) may also suffer.

- Leadership turnover. While founder Aneel Bhusri remains the company’s co-CEO (a model that hasn’t always worked in the software industry, by the way; looking at Salesforce.com’s (CRM) example), the company recently turned over its other co-CEO (Chano Fernandez) as well as its CFO.

A higher valuation, meanwhile, remains my biggest wedge to remaining invested in the stock. At current share prices near $214, Workday trades at a market cap of $55.60 billion. After we net off the $6.33 billion of cash and $2.97 billion of debt on Workday’s most recent balance sheet, the company’s resulting enterprise value is $52.24 billion.

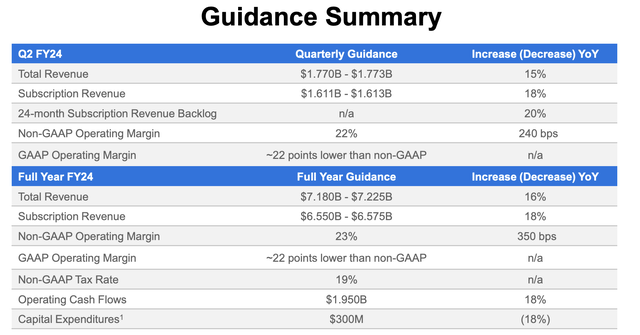

Meanwhile, for the current fiscal year, Workday is guiding to $7.18-$7.225 billion in revenue, representing 16% y/y growth (with subscription revenue growing faster at 18% y/y). It’s worth noting as well that Wall Street consensus is calling for FY24 pro forma EPS of $5.33 (data from Yahoo Finance; represents 46% y/y growth).

Workday guidance (Workday Q1 earnings release)

This puts Workday’s valuation multiples at:

- 7.2x EV/FY24 revenue based on guidance.

- 40x FY24 P/E based on consensus estimates.

There’s not enough of a comfortable valuation cushion here, in my view. Given the stock is fast approaching my original $220 price target, I’m content to lock in gains and move to the sidelines here and re-invest in other stocks (at the moment, picks I like include Box (BOX), Chewy (CHWY), DocuSign (DOCU), and Asana (ASAN)).

Q1 Download

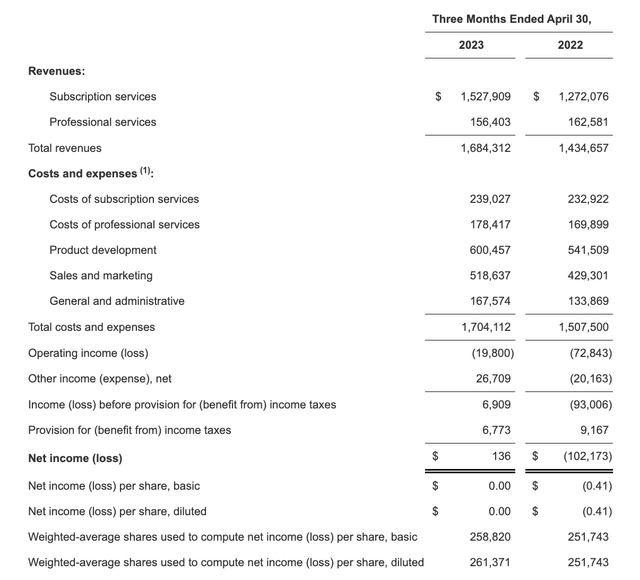

In spite of my valuation-related concerns, needless to say, Workday has continued to deliver excellent results, which stand out in an uncertain macro environment for most tech stocks. The latest Q1 earnings print is shown below:

Workday Q1 results (Workday Q1 earnings release)

Workday’s revenue grew 17% y/y to $1.68 billion, beating Wall Street’s expectations of $1.67 billion (+16% y/y) by a hair. Revenue growth also decelerated three points from Q4’s 20% y/y pace.

The company notes that in spite of macro headwinds, sales momentum remains high, and the company is benefiting from a healthy pipeline for the remainder of the year. Per co-CEO Carl Eschenbach’s remarks on the Q1 earnings call:

Ninety days ago at our global sales kickoff, we challenged our teams to deliver a strong start for FY ’24. I’m proud to say that our workmates met that goal driving growth across key geographies, industries and solutions, leading to strong new ACB growth in Q1. Because of their efforts, we are well positioned as we head into Q2, despite a challenging macro environment, which continues to cause customer uncertainty, increased scrutiny, and in some cases, lightning sales cycles […]

We rolled out our new partner referral program in May, which puts clear incentives in place for our ecosystem to drive lead generation. In addition, following our go-to-market partnership with AWS, we announced last quarter, I’m pleased to share that we had our first AWS private marketplace transaction during Q1. And as Aneel mentioned, the recently announced payroll partnership with Alight expands our global payroll coverage.

In closing, we’re off to a great start in FY ’24 with strong new business bookings, healthy pipelines and continued progress towards our strategic growth initiatives. And while the macro remains uncertain, we are positioning the business to return to 20%-plus subscription revenue growth when the environment improves and laying the foundation for driving durable growth and margin expansion for many years to come.”

Profitability also saw meaningful tailwinds. Workday managed to expand pro forma operating margins by 340bps y/y to 23.5%, up from 20.1% in the year-ago Q1. This was driven both by opex discipline as well as the company’s strategic shift to offload more professional services/implementation work to system integrator partners, increasing the company’s higher-margin subscription revenue mix.

We note that with 17% revenue growth and 23.5% pro forma operating margins, Workday is still managing to hold onto the psychologically important “Rule of 40” threshold. Note as well that Workday’s guidance calls for operating margins to remain at the ~23% level for the full year.

Key Takeaways

After this year’s generous rally, Workday has reverted to a “high price for high quality” stock that doesn’t make much sense in my portfolio right now, as I’m looking mainly for cheaper “growth at a reasonable price” stocks with a larger valuation runway to re-rate higher. Keep an eye out for price movements on Workday, but it’s appropriate to start locking in gains here.

Read the full article here