Housing plays a significant role in the overall health of the economy, and it’s difficult to have a new bull market in stocks without a new bull market in housing. Despite current elevated prices, the housing market has yet to correct meaningfully, which raises concerns about its future performance. The collapse in lumber prices suggests that weakness in housing is still very much to come, further confirmed by the performance of small-cap stocks, consumer discretionary stocks, and retailers.

The Connection Between Housing and Stocks

Housing is often considered a leading indicator of the health of the economy, and as such, it has a direct impact on the stock market. A healthy housing market signals strong consumer confidence and economic growth, which in turn can lead to a bull market in stocks. Conversely, a weak housing market can be an early warning sign of economic troubles ahead, potentially leading to a bear market in stocks.

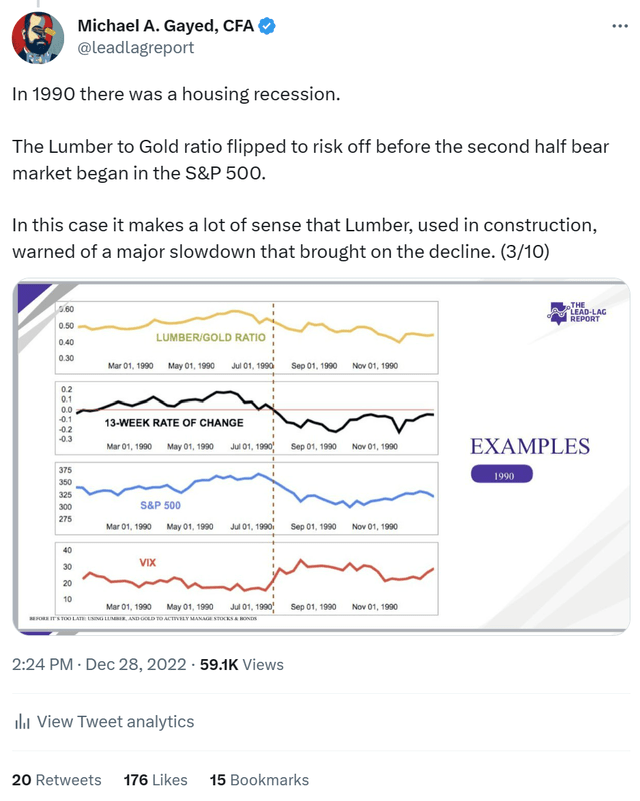

This happened in 1990, which had a nasty economic recession driven by housing, which Lumber relative to Gold warned of.

Twitter

The Role of Credit Creation

Housing is a significant driver of credit creation, with mortgage loans making up a substantial portion of total credit in the economy. When the housing market is booming, credit creation accelerates, providing a tailwind for economic growth and stock market performance. Conversely, when the housing market is weak, credit creation slows down, creating a headwind for the economy and potentially dragging down stock market performance.

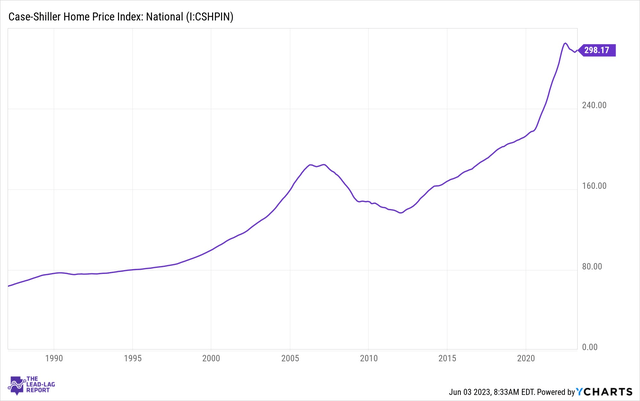

Elevated Housing Prices

Despite ongoing concerns about the state of the housing market, prices remain elevated. This lack of a meaningful correction in housing prices raises questions about the sustainability of the current bull market in stocks. If housing prices continue to stay high without a significant correction to begin a new housing bull market from, the potential for a new bull market in stocks may be limited.

YCharts

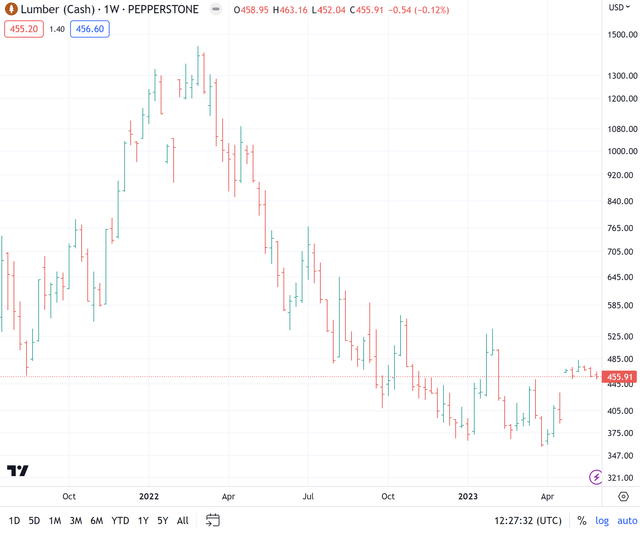

The Collapse in Lumber Prices

The recent collapse in lumber prices is a clear indication of anticipated weakness in the housing market. Lumber is a critical raw material used in construction, and falling prices suggest a slowdown in demand for new home construction. This weakness in the housing market could potentially lead to a downturn in the stock market, as economic growth may be negatively impacted by a struggling housing sector.

TradingView

Performance of Small-Cap Stocks, Consumer Discretionary Stocks, and Retailers

The performance of small-cap stocks, consumer discretionary stocks, and retailers further confirms the weakness in the housing market. These sectors are closely tied to the health of the housing market and are often considered leading indicators of its performance. If these sectors continue to struggle, it could be a sign that the housing market is facing headwinds, which could potentially impact the stock market’s performance.

Can the Housing Market Re-Accelerate?

While the current state of the housing market raises concerns, it’s not impossible for the market to re-accelerate. Several factors could contribute to a turnaround in the housing market, which would potentially create a more favorable environment for a new bull market in stocks.

Changes in Monetary Policy

If central banks were to adopt more accommodative monetary policies, it could help stimulate the housing market by making borrowing more affordable for potential homebuyers. This could, in turn, lead to increased demand for housing and potentially trigger a new bull market in stocks.

Improvement in Economic Conditions

An improvement in overall economic conditions could also help to re-ignite the housing market. A stronger job market, rising wages, and increased consumer confidence could all contribute to a more robust housing market, which would likely have a positive impact on the stock market. I have my doubts on this, though, given that we have yet to see the full impact of spiking rates.

Government Intervention

Government intervention, such as stimulus programs targeted at the housing market, could also play a role in turning the market around. By providing incentives for homebuyers and supporting the construction industry, the government could help to stabilize the housing market and potentially pave the way for a new bull market in stocks.

The Long Road Ahead for Housing

However, it’s essential to recognize that the housing market, much like the Titanic, takes a long time to turn around. This implies that the housing market could continue to act as a headwind for credit creation and economic growth for years. As a result, the path to a new bull market in stocks may be more challenging than some might hope.

Conclusion

The health of the housing market plays a critical role in determining the potential for a new bull market in stocks. The current elevated housing prices, collapse in lumber prices, and weak performance of small-cap stocks, consumer discretionary stocks, and retailers all suggest that the housing market remains under pressure. While it’s possible that the market could re-accelerate under the right conditions, the long road ahead for housing means that the stock market may face headwinds for some time to come.

Read the full article here