Investment Thesis

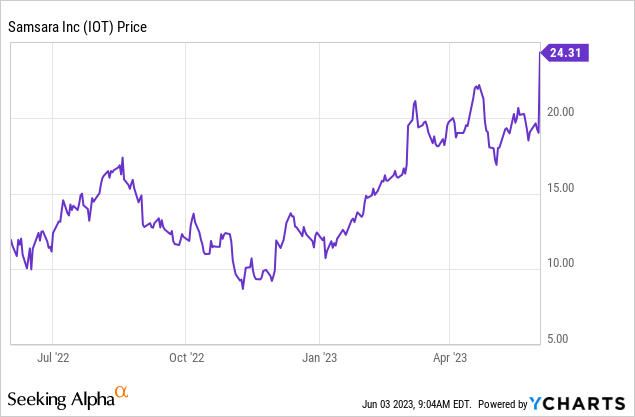

Samsara (NYSE:IOT) is up nearly 30% since my previous coverage in March as it continues to show impressive execution. While the economy is slowing, the company is benefiting from the unprecedented increase in construction spending, which should provide meaningful tailwinds moving forward.

During the latest earnings, the company once again reported a strong beat and raise with revenue up over 40%, making it one of the fastest-growing SaaS (subscription as a service) companies at the moment. However, the valuation continues to be my major concern as the lofty multiples will likely limit its upside potential. Therefore, I rate the company as a hold.

Favorable Backdrop

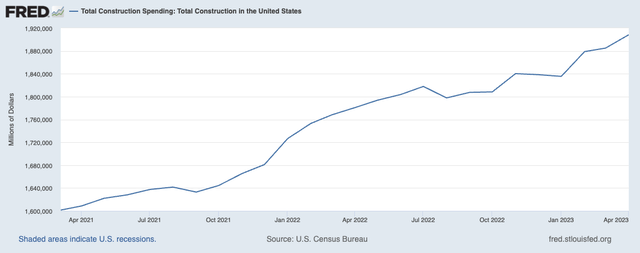

While the overall economy has slowed meaningfully in the past year amid rising interest rates, the construction industry has been thriving. According to the St. Louis Fed, the seasonally adjusted annual rate of total construction spending in the US reached a historical high of $1,908 billion in April, up 7.1% compared to $1,781 billion in the prior year.

Higher construction spending should provide solid tailwinds for Samsara as the company is heavily involved in physical operations with products such as operation cloud, equipment monitoring, site visibility, and more. As shown in the latest earnings, existing customers have been increasing their spending rapidly, with 60% of the net new ACV (annual contract value) coming from customer expansion. The favorable backdrop should be able to help the company better navigate the weakening economy.

St. Louis Fed

Impressive Q1 Earnings

Samsara announced its first-quarter earnings last week and the results are very impressive with extremely strong top-line growth.

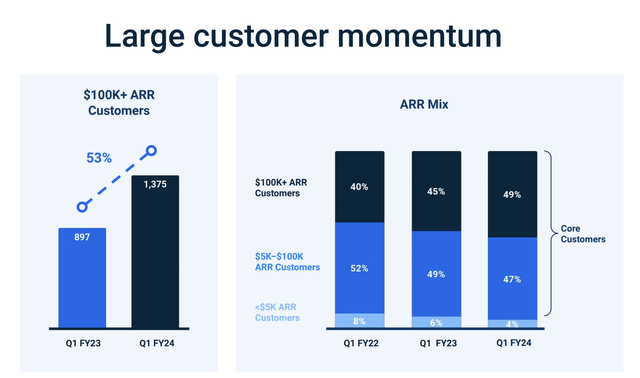

The company reported revenue of $204.3 million, up 43% YoY (year over year) compared to $142.6 million. ARR (annual recurring revenue) grew 41% YoY from $607.2 million to $856.2 million, with 61 million being net new ARR. The growth was driven by the increase in high-value customers and higher spending from existing customers. The number of customers with over $100k ARR increased 53% from 897 to 1375, as the company’s product continues to show great value propositions and high ROI (return on investment). New customers include blue-chip companies such as United Rentals (URI).

The bottom line also showed slight improvement. The net loss contracted 6% YoY from $(71) million to $(66.9) million, or (32.7)% of total revenue. The improvement largely came from slowing G&A (general and administrative) spending, which was flat at $43 million. This was partially offset by the increase in R&D (research and development) spending, which grew 47.3% from $41 million to $60.4 million. The net loss per share was $(0.13) compared to $(0.14). The balance sheet remains solid with $726 million in cash and only $105.4 million in debt, which provides ample financial flexibility.

Given the substantial momentum, the company also raised its guidance for FY24. It now expects revenue growth to be between 33% and 34%, up from the range of 28% to 30% previously announced. Non-GAAP net loss per share is now expected to be $(0.02) to $0.00, up from the range of ($0.05) to ($0.07) previously announced.

Samsara

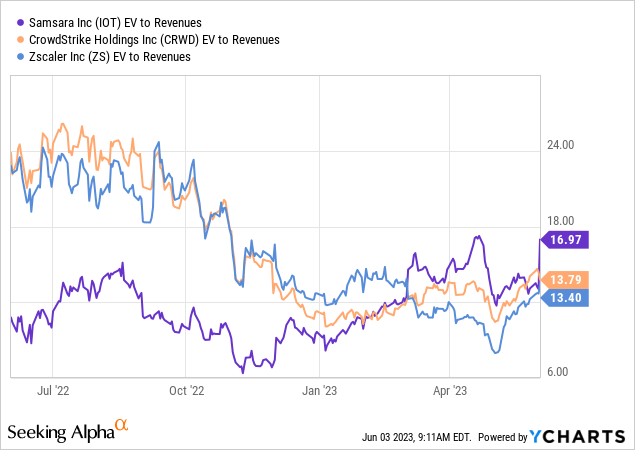

Lofty Valuation

After the recent spike in share price, Samsara’s valuation looks very lofty. The company is currently trading at an EV/sales ratio of 17.1x, which is pretty expensive even if we consider its upbeat revenue growth. The company has only been public for less than two years, therefore it is hard to make any meaningful historical comparisons. However, the current multiples are elevated compared to other SaaS companies with similar growth. For instance, Zscaler (ZS) and CrowdStrike (CRWD) both grew revenue by over 40% in the latest quarter, but their EV/sales ratio are only at roughly 13.6x, which represents a discount of 25.7% compared to Samsara.

Investors Takeaway

I believe Samsara is the perfect example of a great company trading at a bad price. The company has massive market opportunities, and the ongoing increase in construction spending should provide solid tailwinds moving forward. As shown in the latest earnings, revenue growth continues to be extremely strong while the bottom line also saw modest improvements. However, valuation is a notable issue. As mentioned above, the company’s current multiples are very elevated and its upside potential will likely be muted. Therefore, I believe investors should be patient and wait for a more favorable price point before diving in.

Read the full article here