Introduction

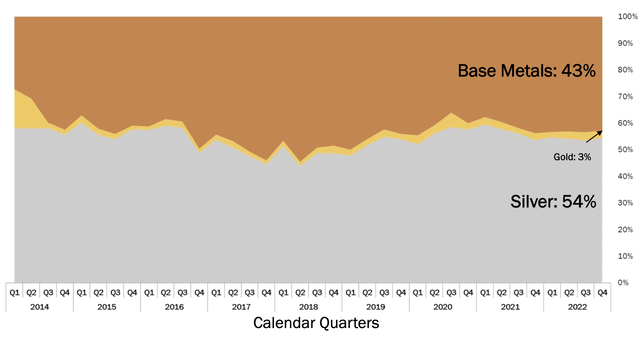

Silvercorp Metals Inc. (NYSE:SVM, TSX:SVM:CA) is a Canadian mining company primarily focused on silver. More than half of its revenues come from silver, with the remainder from lead and zinc. The company operates mainly in China, specifically in the Ying Mining District in the Henan Province and the GC Mining District in the Guangdong Province.

Revenue share by metal (Company’s Presentation)

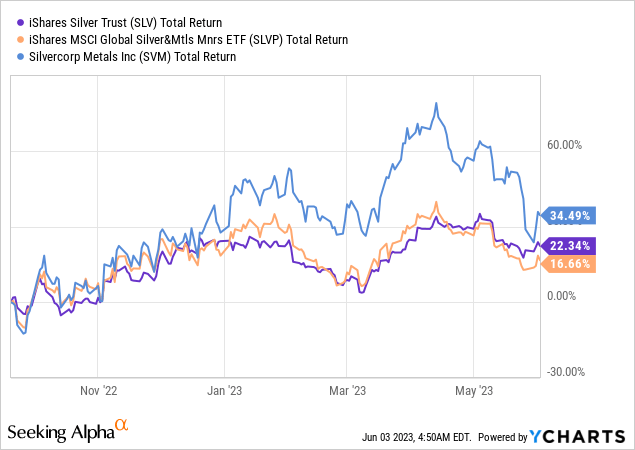

Since my initial coverage of Silvercorp back in September, the stock has delivered a return of approximately 35%, outperforming both silver (which is up 22%) and the Global Silver Miners ETF (which is up 17%). In April, the stock was up over 75%. However, the recent decline in silver prices, driven by a stronger US dollar and rising yields, has led to a sharp sell-off.

Despite the recent downturn, the investment thesis has been successful thus far. This can be attributed to the prevailing pessimism surrounding precious metals miners last fall and the discounted valuation at which Silvercorp was trading in relation to its peers. With 10-year bond yields likely having peaked in October, China reopening its economy, and a more bullish outlook for precious metals, Silvercorp has rebounded. The stock still offers significant potential, as it remains 65% below its all-time highs in 2020 and trades at an EV/FCF multiple below 5x. Moreover, the management is anticipating a much stronger year ahead from an operational point of view. The acquisition of Celsius Resources is also a potential game changer.

FY 2023 Results

Historically, Silvercorp has faced a significant valuation discount compared to its peers, primarily due to its operations being located in China and the ongoing US-China geopolitical tensions. Currently, the company is trading at an EV/trailing EBITDA multiple of around 5x, while the peer average stands at 15.6x. Similarly, the price/trailing cash flow per share multiple for Silvercorp is 7x, whereas the peer average is 51.5x. Other headwinds have included delays in the construction of the New Mill at Ying, disappointing performance at GC, and a decline in zinc production.

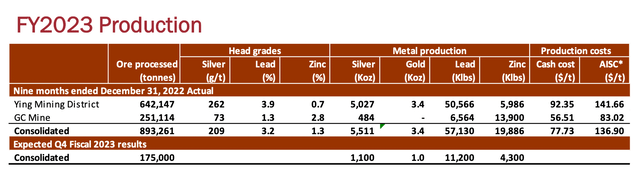

Reviewing the recently released FY 2023 Financial Statements, Silvercorp’s results were slightly below expectations. The company faced tough comparisons relative to the previous year when metal prices were higher. It was also impacted by rising costs and lower grades.

- Revenues for FY 2023 marginally declined by 4% to $208.1 million. This decrease was primarily driven by lower realized prices for silver, lead, and zinc, as well as reduced volumes of zinc sold due to a 12% decline in zinc production. However, there were increases in production for silver (+8%), gold (+29%), and lead (+6%), albeit slightly below the management’s initial guidance for the year. The lower zinc production resulted from decreased head grades. Silvercorp now expects a return to normal conditions. Zinc production is forecasted to be in the range of 27.7 million to 29.7 million pounds during 2024, representing an 18% to 26% increase compared to 2023.

- Costs saw a marginal increase. Cash costs per ounce, net of by-product credits, rose from negative $1.29 to negative $0.42. Around 40% of this increase can be attributed to lower by-product credits, while the remainder is a result of inflation. All-in sustaining costs (AISC) increased by approximately 11%, from $8.77 to $9.73 per ounce. This increase was due to higher cash costs and higher sustaining capital expenditures. Nevertheless, Silvercorp has been relatively less impacted by rising inflation compared to other miners and remains one of the lower-cost operators in the sector.

- Cash flow from operating activities declined by 20% to $85.6 million compared to $107.4 million in FY 2022, primarily due to lower revenues. Net income also decreased by 16% to $70.8 million.

- Looking at individual assets, most of the underperformance can be attributed to the lower head grades and curtailed production at the GC Mine.

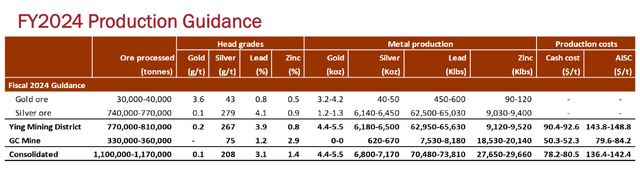

Looking ahead to 2024, Silvercorp’s management is guiding for a significantly stronger year.

- Head grades are expected to improve with the implementation of an X-Ray Transmission Ore Sorting System at the GC Mine, for which the company has invested approximately $1.0 million. This system utilizes X-ray sensors to measure the absorption of X-rays by different minerals. Minerals with higher atomic densities, such as metals, absorb more X-rays and can be easily separated from lower density minerals. Ore sorting enhances the efficiency of mineral processing operations by reducing the volume of material that needs to be processed, thereby improving overall productivity and reducing costs.

- Production is anticipated to increase across the board. The FY 2024 guidance is for 6.8 million to 7.2 million ounces of silver, 4,400 to 5,500 ounces of gold, 70.5 million to 73.8 million pounds of lead, and 27.7 million to 29.7 million pounds of zinc. These figures imply approximate growth rates of 3% to 8% for silver, 0% to 25% for gold, 4% to 8% for lead, and 18% to 26% for zinc.

- Costs are expected to experience a slight moderation. Cash costs are projected to decrease by 4% to 7%, and all-in sustaining costs (AISC) by around 4% (the difference can be attributed to higher planned capital expenditures in 2024). The reduction in production costs will be driven by improved mine planning and efficiency optimizations, particularly through the implementation of the new ore sorting system, which is currently undergoing testing.

FY 2023 actual production (Company’s Presentation) FY 2024 production guidance (Company’s Presentation)

Looking at potential drivers of Silvercorp’s share performance, it is important to consider certain factors. Firstly, the geopolitical discount associated with the company’s operations in China is likely to persist, although it should be noted that Silvercorp has a strong track record of operating without issues in China. Recently, the company obtained all the necessary permits for the construction of the New Mill and Tailing Storage Facility at the Ying Mining District, as well as a new mining license for the Kuanping silver-lead-zinc-gold project.

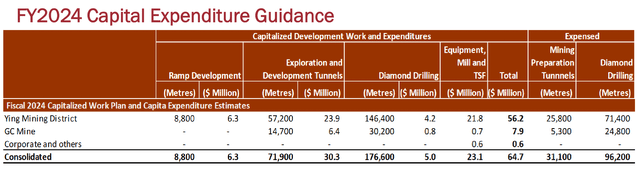

Another challenge the company faces is its ongoing efforts to extend the life of its assets through an aggressive drilling campaign and expand its production capacity via the new 3,000 tonnes per day mill at the Ying Mining District. These initiatives involve higher capital expenditures and will result in lower free cash flow in the short term. However, the positive aspect is that the approved new mill will nearly double the processing capacity from the current 3,200 tpd to over 5,500 tpd.

FY 2024 capital expenditures guidance (Company’s Presentation)

There are, however, compelling reasons to invest in Silvercorp. The company stands out as one of the few reputable miners with a primary focus on silver. It possesses long-lived and low-cost assets with significant exploration potential, robust margins (trailing EBITDA margin of 41% compared to a peer average of 21%), a solid balance sheet, and an exciting growth pipeline.

Looking at the balance sheet, Silvercorp reported at the end of FY 2023 $203.3 million in cash and cash equivalents, excluding investments in other companies with a total market value of $141.9 million. In particular, the company holds a significant stake in New Pacific Metals (NEWP) worth $120 million. With a market capitalization of approximately $550 million and no debt, the enterprise value stands at around $210 million. This valuation appears attractive in relation to its target annual free cash flow of over $50 million.

The question arises, however, regarding how the company will allocate its cash reserves. Overall, the current management appears aligned with shareholder interests and unlikely to destroy value. In fact, since its inception, Silvercorp has returned over $175 million to shareholders through dividends and buybacks, demonstrating its commitment to capital returns. However, the current returns are relatively modest. The dividend yield is insignificant (the recently announced semi-annual dividend of $0.0125 per share equates to a 0.8% yield), while buybacks, considering the company’s undervaluation, hold more potential. Under the current NCIB program, which expires on August 28, 2023, Silvercorp is authorized to repurchase approximately 4% of its outstanding shares. However, to date, only minimal amounts have been bought back, leaving investors curious about the company’s capital deployment plans.

Growth is undoubtedly a priority for Silvercorp. In addition to investments in the New Mill at the Ying Mining District and the advancement of the Kuanping project toward construction, there is also the possibility of restarting the BYP gold project, which is currently under care and maintenance. Furthermore, management has expressed its intention to pursue acquisition opportunities. While I believe that management may have been excessively cautious in the past in this regard, it appears that an exciting target has now emerged.

Celsius Resources Acquisition

On May 15, Silvercorp announced a non-binding term sheet for the acquisition of Celsius Resources (ASX/AIM: CLA), an Australian copper-gold exploration and development company, for total considerations of AUD$56 million. The deal is structured to comprise 90% Silvercorp shares and 10% cash. Silvercorp could have acquired the company without any dilution, but likely chose to preserve its cash for the project’s development.

This acquisition is in my opinion a solid move for Silvercorp. It allows the company to diversify its operations away from China and gain exposure to copper, another strategically important metal for the green energy transition, alongside silver. Celsius Resources’ flagship project is the MCB copper-gold project, located on the main island of Luzon in the Philippines. The project boasts measured and indicated resources of 296 million tonnes grading 0.46% copper and 0.12 grams per tonne of gold, as well as an inferred resource of 42 million tonnes grading 0.52% copper and 0.11 grams per tonne of gold, according to the recent JORC-compliant mineral resource estimate of December 2022.

Celsius has also released a scoping study on the MCB project. The study estimates an initial capital expenditure of $253 million, a post-tax 8% NPV of $464 million, an IRR of 31%, and a payback period of approximately 2.7 years. It assumes metal prices of $4 per pound of copper and $1,695 per ounce of gold, which are quite conservative long-term. Furthermore, it outlines production of 22,000 tonnes of copper and 27,000 ounces of gold annually for the first 10 years, at a cost of $0.73 per pound of copper net of gold credits. These metrics position the MCB project in the lowest quartile of global copper projects.

It is important to note that the MCB project is not yet fully permitted, as Celsius is in the final stage of obtaining the mining permit from the Philippine government. Additionally, the transaction between Silvercorp and Celsius has not yet been finalized, although Silvercorp expects a definitive agreement to be negotiated within one month of the term sheet.

Conclusion

In conclusion, Silvercorp is a top name within the silver mining sector, with low-cost assets and a substantial organic growth pipeline. While its exposure to China is a drawback, the current discounted price appears to compensate investors for this risk. If the Celsius acquisition is successfully completed, it has the potential to be a game-changer for Silvercorp, providing an ambitious project with significant exploration upside at a reasonable price.

Read the full article here