Zalando (OTCPK:ZLDSF) kicked off 2023 with in-line Q1 revenue growth despite a challenging macro and consumer backdrop in Europe. The key positive was the improved bottom line result, with the company nearing breakeven (following years of P&L losses) supported by enhanced cost discipline in the face of high inventories and cost inflation throughout the industry. Yet, the implied guidance for more Q2 weakness (full-year unchanged despite a robust Q1) entails a muted near-term growth outlook and a likely shift in focus to profitability vs. growth; the stock sold off on the news.

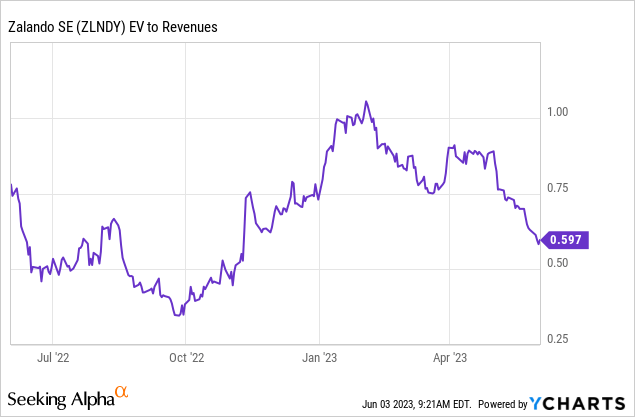

But with Zalando now de-rated well below its historical averages at 0.6x EV/Sales and holding EUR1.1bn of net cash on its balance sheet (mid-teens % of market cap), this isn’t priced like a ‘growth stock’ anymore. At these levels, the market has likely lost conviction in the company’s e-commerce growth runway despite its proposition remaining very competitive vs. omnichannel and pure-play online peers. And with its off-price business screening attractively in a difficult consumer environment (up 33% YoY), I don’t think the Zalando top-line growth/share gain story is done yet. Net, the stock remains one of the better EU retail plays on an eventual normalization of consumer demand, in my view.

In-line Q1 Trading Update as Profitability Takes Precedence Over Growth

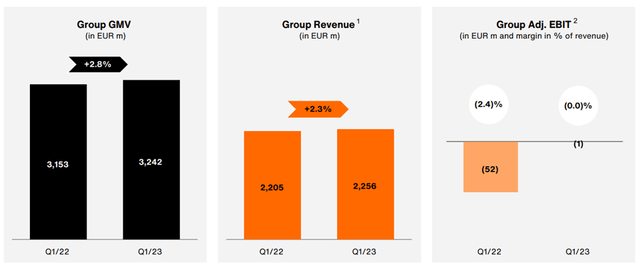

Expectations were low heading into Zalando’s Q1 print amid consumer sentiment weakness and high levels of promotional activity in its key markets. Thus, it came as no surprise that Q1 sales growth slowed to +2.3% YoY (group gross merchandise value +2.8% YoY). The positive surprise, though, was on margins, with adj EBIT improving to near breakeven at -EUR0.7m (narrowing from a EUR52m loss last year). The key cost driver was on the fulfillment side, where Zalando’s improved order economics and efficiency gains helped to unlock ~310bps of cost reduction YoY. Given the inflationary freight pressures throughout Q1 that had also plagued peers like boohoo (OTCPK:BHOOY) (“ongoing elevated air freight costs” cited as a margin headwind per their latest annual report), the company’s outsized gains were impressive. Also positive was the traction Zalando’s off-price business has gained in this environment – in Q1, off-price revenues were up 33% YoY to EUR416m (vs. low single digit % declines in its core’ fashion store’ segment), helped by the success of ‘Lounge by Zalando.’

Zalando

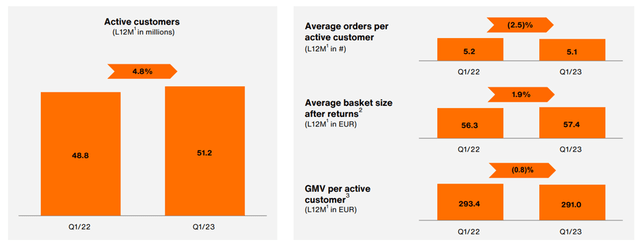

Yet, there were negatives too. The Q1 report also showed sluggish active customer growth at +4.8% YoY to 51.2m on a trailing-twelve-month basis, while average orders per active customer (-2.5% YoY) and GMV per active customer (-0.8% YoY) were down as well. But some growth slowdown was always on the cards, given the need to stabilize the P&L and preserve the cash runway in a challenging funding environment. And with Q1 already reaching breakeven EBIT (recall Zalando has mostly been loss-making in recent years), the modest decline in ‘Fashion Store’ segmental sales and profitability (-3.5% YoY revenue; -1.1% YoY adj EBIT) is an acceptable tradeoff, in my view.

Zalando

Near-Term Downside Risk to Guidance; Mid-Term Outlook Still Attractive

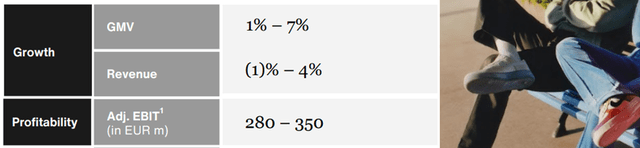

Despite the resilient Q1, management reiterated its full-year outlook (+1%-7% YoY GMV growth; -1% to +4% YoY sales growth) following a slow start to Q2. Some of the weakness is down to seasonality, for instance, wet weather in Germany vs. much warmer temperatures in Spain and Italy. The ECB’s extended tightening cycle is playing a role as well; hence, the muted near-term demand backdrop and deteriorating consumer sentiment could continue into the coming months, further weighing on growth. But there was little mention of its off-price business offering some much-needed strength through a retail downturn/recession scenario (recall the +33% YoY growth in Q1), likely indicating some conservatism in the top-line numbers. Management is also well-equipped on the cost side, supported by its recently initiated discipline and efficiency measures, so the EUR280m-350m adj EBIT target is likely well within reach.

Zalando

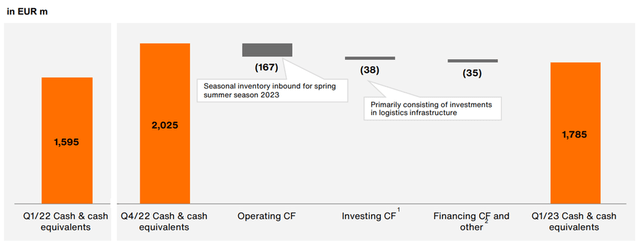

Perhaps more concerning for the market, though, is the risk to Zalando’s mid-term 3-6% EBIT margin target. While the current retail downturn is concerning, I don’t think this growth story is over just yet. As the leader in a growing market, Zalando still has a clear path to sustaining high-single-digits % growth once European retail recovers, in my view. Plus, there is a consolidation opportunity now that the market has been shaken up by consumer weakness, with elevated inventory levels accelerating department store chains’ descent into bankruptcy (see Galeria Karstadt Kaufhof’s recent decision to shut more branches after filing for insolvency in late 2022). Equipped with a EUR1.1bn net cash hoard as well (EUR1.8bn gross cash), Zalando is in a prime position to further enhance its status as Europe’s leading third-party brand distributor. With industry-wide valuations reset lower, expect more M&A in line with the recent addition of Highsnobiety on its retail side.

Zalando

No Longer Priced for Growth

The disconnect between risk-free yields and European internet stocks this year has offered a limited reprieve to Zalando, with the market’s focus on underlying growth concerns returning to the fore. As a result, the stock has been punished YTD, largely for factors outside of its control, including a challenging macro and retail industry environment in Europe. As Q1 showed, however, the company has made the best of the multi-pronged headwinds, outperforming on the bottom line (albeit at the expense of core growth).

But any good news from Q1 was more than offset by guidance for further Q2 top-line weakness, largely due to seasonal headwinds (e.g., wetter than usual April weather in Germany). And with Zalando increasingly focused on profitability over growth to ride the turbulence, the market appears to have discounted any reacceleration of the active customer base from here nor the positive contribution from its off-price business (+33% YoY in Q1). Yet, at ~0.8x fwd EV/Sales (including a ~EUR1.1bn net cash position), expectations have likely been reset too low, de-risking earnings and favorably skewing the return potential in an eventual demand normalization scenario.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here