Recap

The most recent article with a rating for this name was published on January 23, 2023, and the previous one was on November 14, 2022. We see the above as one sign that retail investors are not interested in this name, even though investors on Seeking Alpha don’t necessarily represent the entire spectrum of American investors.

Rating (Seeking Alpha)

We attributed this to the deterioration of US-China relations. Retail investors have doubts about how this connection will develop. The news that Elon Musk and Jamie Dimon visited China on May 30 caught our attention. We interpreted this as an early sign that the US-China relationship was warming up.

This was easily connected to Buffet’s recent trip to Japan. Actions speak louder than words in this case.

We believe it’s time to start reviewing Chinese ADRs and looking for appealing equities in the midst of this uneasy and nerve-racking time.

KE Holdings Inc. (NYSE:BEKE) announced its Q1 2023 earnings on May 18. The company’s net revenue in the first quarter reached RMB 20.3 billion, representing a 61.6% increase year-over-year, beating both the high end of their guidance and the street consensus. Its stock traded sideways and was in a downtrend after the earnings.

Valuation

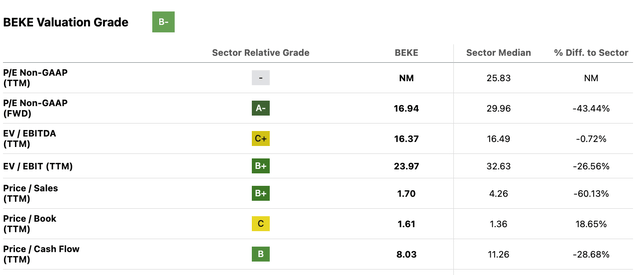

We start with the valuation analysis as follows:

Its forward P/E ratio was 16.9x. When compared to a 60% growth rate, this appeared to be appealing.

Valuation multiple (Seeking Alpha)

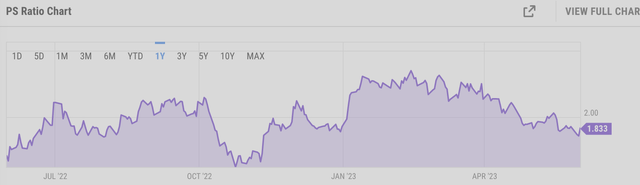

Its current P/S ratio, which is trading at 1.8x, is below the historical average.

P/S ratio (YCharts)

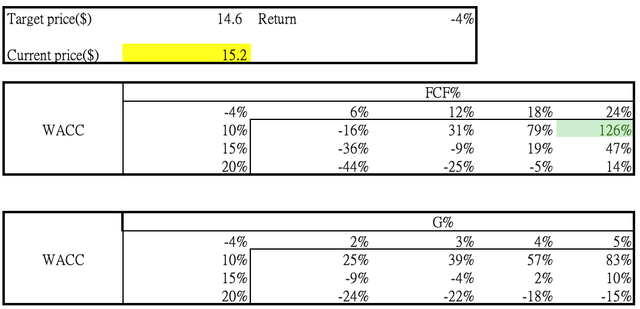

Since Chinese ADR requires a more thorough examination, we conducted the DCF analysis and used the following assumptions:

- WACC: 15% (cost of equity: 15.8%, cost of debt 7.4%)

- Free cash flow margin: 13% (2022 data)

- Terminal growth rate: 3%

- Net debt:-$6656 million (Q12023 data)

- Shares outstanding: 1217 million (Q12023 data)

Through the DCF model, we arrived at a $17.7 billion equity value ($14.6 per share), which is 4% below the current price.

Based on the sensitivity test below, the stock is likely undervalued if the company can improve its free cash flow margin to above 15%, its WACC falls below 13%, or its terminal growth rate is over 5%.

Sensitivity analysis (LEL Investment)

Fundamental

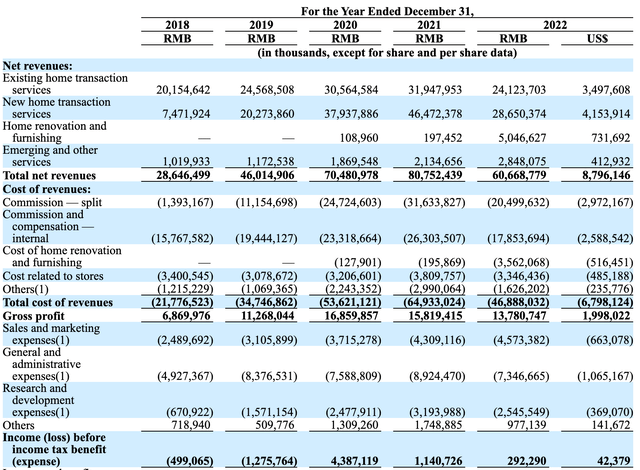

BEKE engages in the following four businesses: (1) existing home transaction services; (2) new home transaction services; (3) home renovation and furnishing services; and (4) home rental services.

BEKE experienced revenue growth in 2020 and increased earnings during the initial lockdown in China. However, the company faced a decline in both revenues and earnings during the second lockdown in China in 2022.

Financials (BEKE)

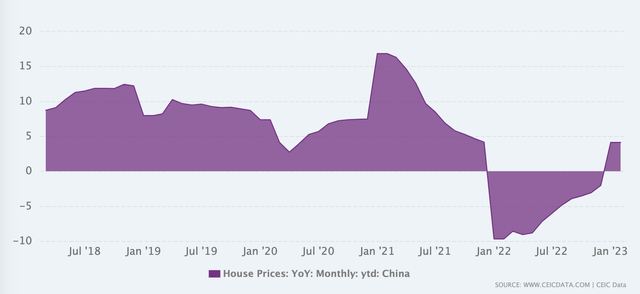

The decline in house prices in 2022 can be attributed to the more pessimistic behavior of businesses and individuals towards investments, primarily due to the escalating tensions between the United States and China. As housing is the primary investment target for individuals, the muted purchase activity had a significant impact on BEKE’s revenues.

China housing prices growth yoy (CEIC)

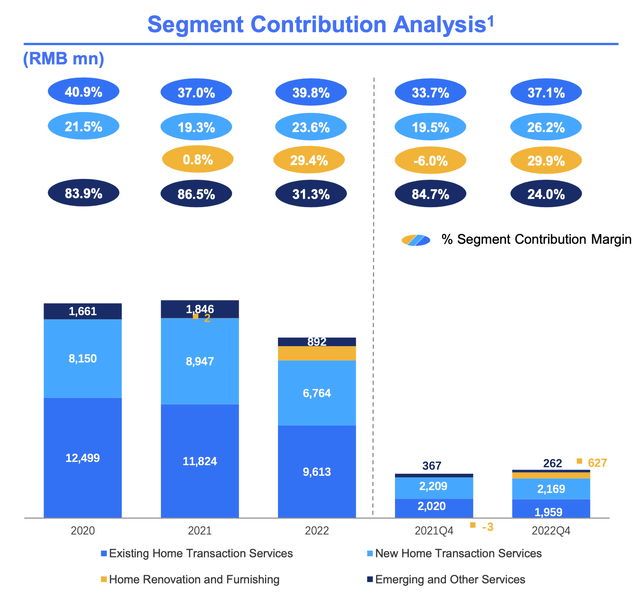

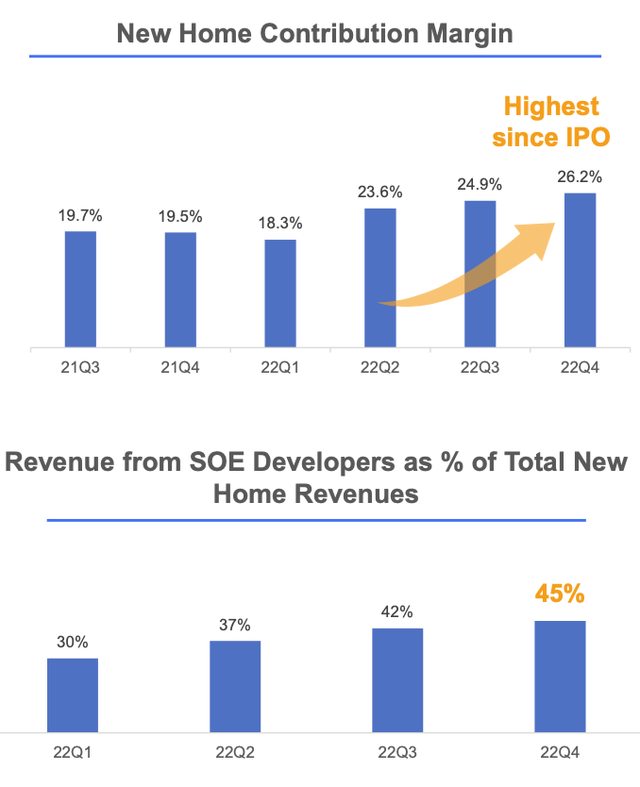

Despite the changing dynamics, BEKE showcased resilience in its operations. Over the past three years, the company has maintained a stable contribution margin. In 2022, both its new home transaction and renovation businesses achieved new highs in contribution margin. This margin expansion in new home transactions was attributed to BEKE’s adoption of commission in advance and its strengthened partnerships with state-owned developers. Notably, the percentage of revenues under commission in advance increased to 44% of the total commission in the fourth quarter of 2022, up from 20% in the first quarter of the same year.

Segment contribution margin (BEKE)

*The margin for emerging and other services experienced a decline in 2022 due to the acquisition of a lower-margin rental business.

Furthermore, BEKE witnessed a notable increase in the percentage of revenues from state-owned enterprise (SOE) developers, which rose from 30% in Q1 2022 to 45% in Q4 2022. The company actively pursued corporate-to-corporate collaborations with carefully chosen developers, including state-owned developers, aiming to enhance the quality of its sales projects and ensure the security of commission collection.

New home contribution margin, revenues from SOE (BEKE)

Valuation upside

We examine if there is potential for upside in the stock through the following factors: expansion of the free cash flow margin, decrease in the WACC, and increase in the long-term growth rate.

Free cash flow margin expansion

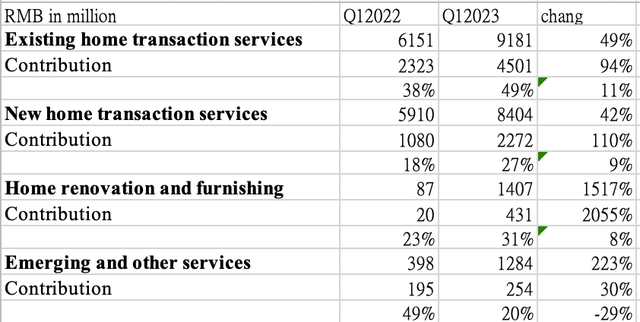

In Q1 2023, the company experienced high single-digit expansion in its existing home, new home, and renovation service margins. This was driven by improved growth in gross transaction value (“GTV”) and the resulting operating leverage.

However, we maintain a cautious outlook on the company’s long-term margin expansion despite its recent improvement driven by operating leverage.

Contribution margin by segment (BEKE)

WACC decrease

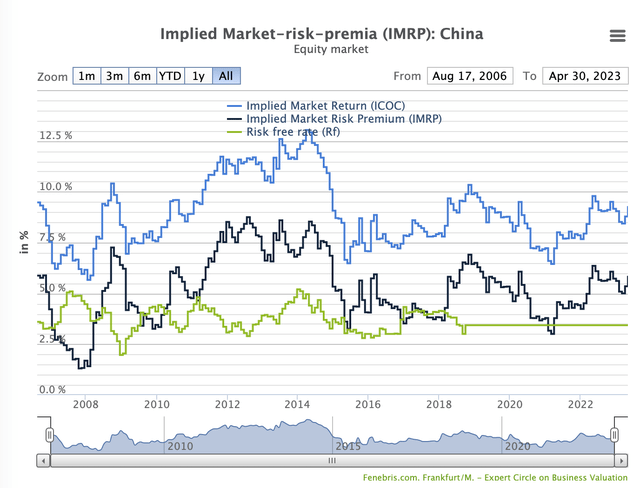

We considered various sources that assumed a China risk premium between 8% and 10%. Using a 10% China risk premium and considering the company’s capital structure, we arrived at a WACC of 15%.

However, we have observed early signs of easing tensions between the US and China, as evidenced by public endorsements and visits from business leaders. While we remain cautious about the duration of this easing, we believe it is important to consider the potential impact on WACC assumptions. Furthermore, we have seen the US regain its leadership position by strengthening relationships with EU countries and APAC countries such as Japan and Korea. Additionally, US companies have diversified their supply chains away from China to countries like Vietnam and India, reducing China’s dominance as the world’s factory. Therefore, there is reason to believe that the US economy may no longer be threatened by China.

On the other hand, we do not view the ideological conflict between the US and China as a major issue, as the US has maintained good relationships with countries like Saudi Arabia despite differences in ideology. Considering these factors, if the US-China relationship continues to ease, there is a chance that the market will recognize it and respond by reducing the risk premium on Chinese stock, which, according to historical statistics, might decline by 2.5% to 5%.

China equity risk premium (Fenebris.com)

In addition, given the company’s leadership position in the industry and its strong relationship with government entities, we believe the company’s risk is low, providing further justification for a potential decrease in the risk premium. This decrease in risk premium (2–5%) could result in a stock upside of 12%–39% from its current level based on our DCF model.

Terminal growth rate increase

The company has expanded its product offering by entering the renovation and rental business through acquisitions, demonstrating its ability to extend its platform.

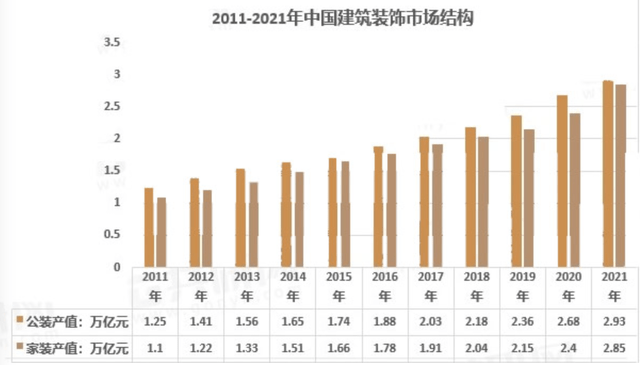

Home decoration market grew at high-teens

The home decoration market in China is expected to continue growing at a CAGR of 8% until 2030, according to Beke research. In addition, according to data from the China Building Decoration Association, the market size of the home decoration industry was approximately 2.85 trillion yuan in 2021, with a year-on-year growth rate of about 18.89%. The CAGR from 2019 to 2021 was 15%.

China home decoration market (China building decoration association)

In addition, the home furnishing industry is fragmented. Top companies in the industry, such as Shengdu and Dongyi Risheng, have a market share of less than 5%, indicating low concentration. The acquisition of Shengdu by Beke gave Beke the opportunity to expand in this market.

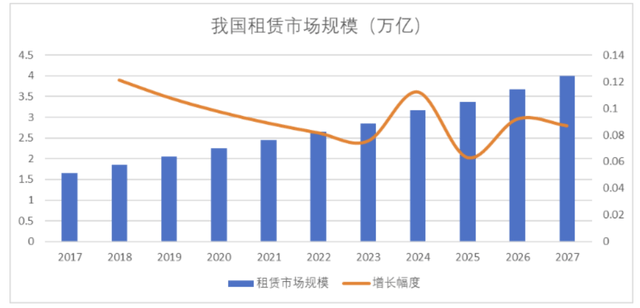

Rental housing market grew at high single digits

Furthermore, the rental housing market shows significant potential due to a severe supply shortage and increasing demand, especially in urban areas. According to E-house research, the rental market’s compound growth rate is currently estimated to be between 8% and 10%. This expansion in the home decoration and rental markets presents a positive outlook for the company’s long-term growth.

China rental market (E-house)

Our DCF model assumes BEKE will grow flat in 2023 and will grow thereafter at a terminal growth rate of 3%. This assumption is very conservative because we did not factor in growth projections for its rental and home-decorating businesses. Considering Beke’s acquisition to position itself in the high-growth renovation and rental business, there is growth acceleration potential for the company.

Overall, considering the potential for free cash flow margin expansion, a decrease in WACC, and an increase in long-term growth rate, we see potential upside for the stock. Our DCF model predicts an upside of 83% in the stock return if the risk premium decreases by 2% and the terminal growth rate rises by 2%.

Risk

China real estate market slowdown again

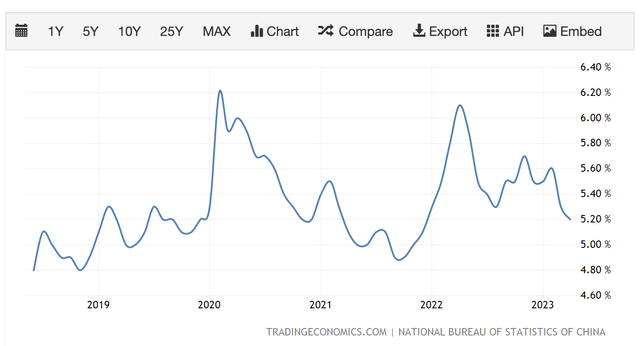

There is a potential risk of deceleration in China’s real estate market in the second half of the year due to underperformance in the economy.

According to a report by Nomura’s chief China economist, Ting Lu, new home sales for the week ended May 28 showed a significant slowdown in growth. The year-on-year growth rate dropped to 11.8%, compared to the 24.8% growth recorded the previous week.

In the secondary housing market, Fitch Ratings has noted a cooling trend since April. This is evidenced by a decrease in the number of homes listed for sale, lower asking prices, and a reduction in transaction volume.

These observations suggest a potential slowdown and weakening in the real estate market in China, which poses a risk to the stock.

On the other hand, there is a potential positive factor that could provide support for residential spending in the Chinese real estate market. The decline in the unemployment rate from a record high level is expected to contribute to this.

China unemployment rate (National Bureau of Statistics of China)

Furthermore, management has highlighted that the market’s recent recovery and its future growth are primarily driven by home upgrade demand. We believe that this group of buyers is expected to be more resilient to potential downturns in the market.

The demand for home upgrades primarily comes from individuals who already own at least one property and are seeking to enhance their living arrangements. According to the management, in Q1 2023, the proportion of home upgrade demand exceeded 70%, marking a 7% increase compared to 2019. Notably, over 45% of this demand is attributed to first-time upgrades.

Chinese ADR De-Listing Risk

The China-U.S. relationship is still intense at the moment. However, as noted in the above analysis, there are early signs to support the idea that tension has eased between the two nations.

However, there is still a potential risk, such as when DiDi Global Inc. (OTCPK:DIDIY) was forced to delist by the Chinese government from the U.S. stock exchange due to a violation of national information security. If the Chinese government thinks BEKE plays the same important role as DiDi, there is a risk that the stock will be delisted and is likely to be traded in the OTC market as DiDi.

Even though DiDi’s stock was traded on the OTC market, there was still a sizable amount of activity (5.7 million shares traded today). Delisting risk is not deadly to US investors, in our opinion.

Summary

Despite the fact that some investors might lose interest in Chinese ADR, we view this as an opportunity to add extra momentum if things turn around. Beke’s stock appears to be fairly valued under our DCF model with conservative growth assumptions.

We identify two potential reasons for the stock to rise: (1) a decline in equity risk premium as a result of easing US-China tensions; and (2) growth possibilities in the rental and home furnishing industries. Although there are risks, such as the potential for the Chinese real estate market to further contract or the delisting of Chinese ADRs, we believe that given BEKE’s leadership position and expansion into the high-growth industries of home decoration and rental, the stock’s risk and reward profile is still favorable. We rate the BEKE stock as “Buy”.

Read the full article here