Introduction

Oil is in a tough spot. Economic growth fears are hurting cyclical commodities while pushing money into technology and growth stocks.

While oil stocks aren’t a fun place to be, I’m a buyer again, boosting my stake in preparation for the next inflation wave. In this article, we’ll discuss one of the best drillers on the market.

Houston-based EOG Resources (NYSE:EOG) has it all. The company produces both oil and natural gas. It has a deep, high-quality inventory, efficient operations, and a management team eager to let shareholders benefit from its success through regular and special dividends.

Now, the company is becoming more cautious and deferring certain projects. I believe we’ll see a lot more of this, which is set to hurt supply growth even more.

The moment economic growth bottoms, I expect oil to reach triple-digit dollar territory, causing EOG to boost its dividend, outperform its peers, and start a meaningful long-term uptrend.

Now, let’s dive into the details!

What Happened To Oil?

Oil prices aren’t falling off a cliff. However, prices have come down in recent months. NYMEX WTI is currently trading in the low $70s range, which is down from the low $80s range in prior months.

TradingView (NYMEX WTI)

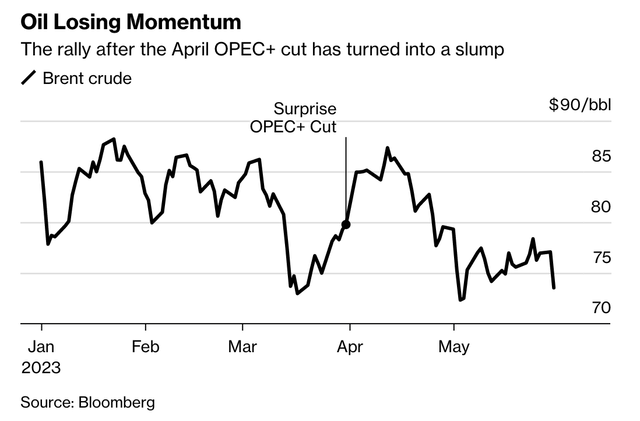

As reported by the Wall Street Journal, oil traders are continuing to bet on falling oil prices despite efforts by producing countries to boost them. Prices have been on a downward trend since October when the Organization of the Petroleum Exporting Countries (“OPEC”) and its allies, known as OPEC+, announced production cuts of 2 million barrels per day, as displayed in the chart below.

Bloomberg

Additional cuts by Russia and voluntary reductions by eight OPEC+ members have failed to halt the slide.

Brent crude oil futures, the international benchmark (even more important than WTI), have dropped about 20% since the October cuts. This is below the estimated $81 per barrel that Saudi Arabia, the de facto leader of OPEC, needs to balance its budget.

This is a very important thing to keep in mind, as this will almost certainly lead to more efforts to support the price of oil.

Several factors have contributed to the decline in prices, including:

- increased petroleum production from non-OPEC+ countries,

- concerns about an economic slowdown, and

- Russia’s robust oil exports despite Western sanctions.

Bullish analysts have repeatedly revised their forecasts downward, and bullish traders have faced losses.

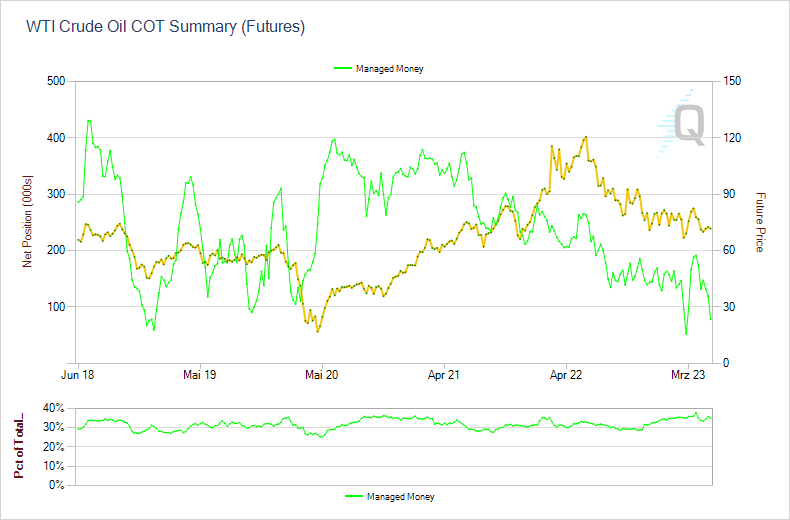

Also, looking at positioning, we see that money managers have reduced their net positions to the lowest levels in more than five years. However, they continue to be net long, which I do not expect to change, given stronger-than-average oil fundamentals – at least on the supply side.

CME Group

When it comes to the supply side, the WSJ makes the case that OPEC+ members may be more inclined to support prices with steeper cuts than in the past as market share concerns have diminished.

Non-OPEC+ production growth is unlikely to repeat this year’s surge, and US shale oil producers are no longer rapidly responding to price increases.

That’s where EOG Resources comes in.

Why I’m Betting On A Bright Future For EOG Resources

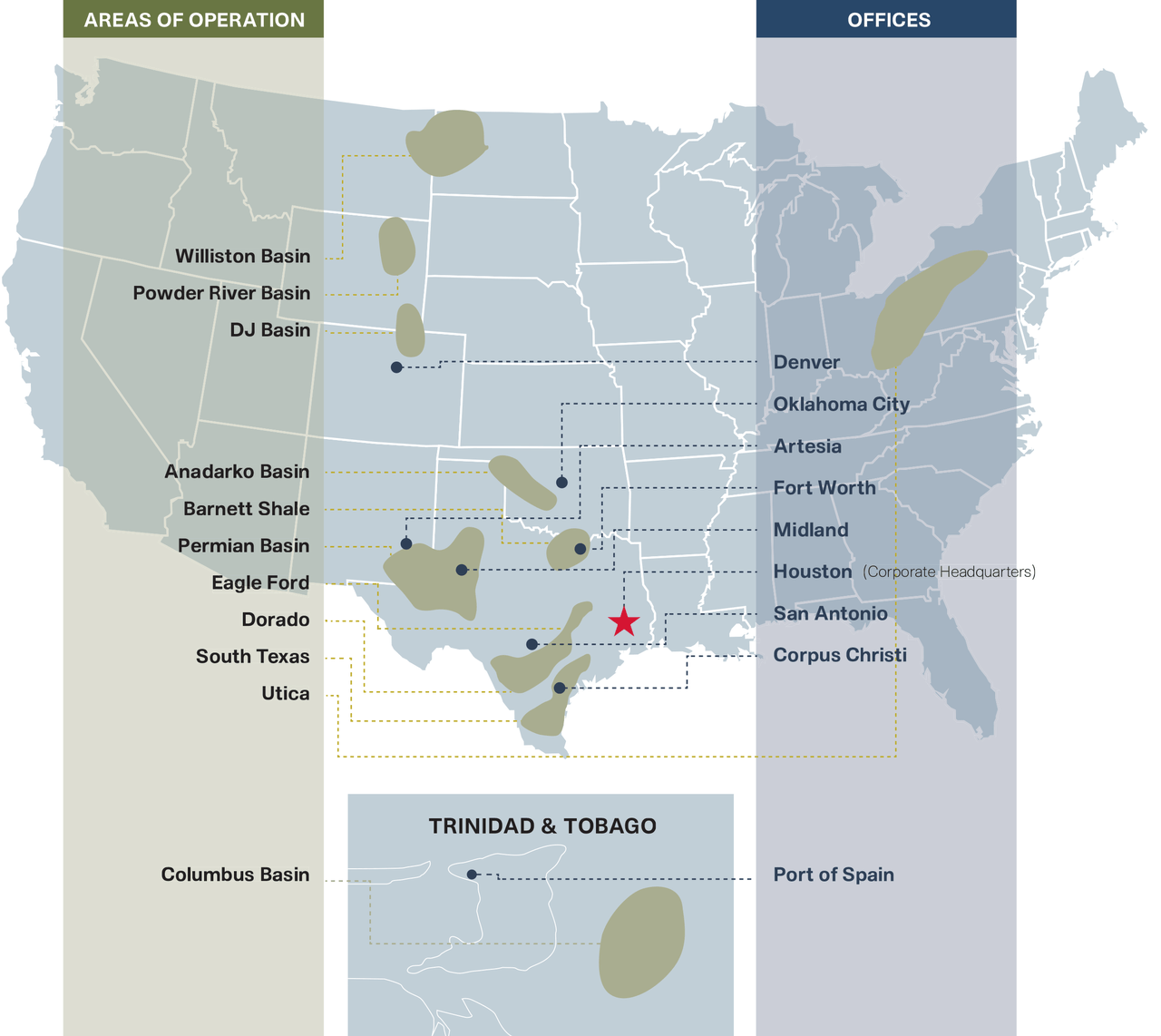

EOG Resources is one of the world’s largest onshore oil and gas producers, with a market cap of roughly $65.5 billion.

Headquartered in Houston, Texas, the company has major productions in the United States and minor exposure in Trinidad and Tobago.

EOG Resources

Going into this year, the company had more than 4.2 billion barrels of oil equivalent in reserves.

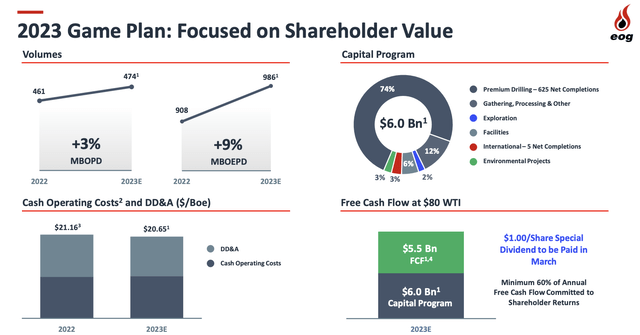

This year, the company aims to produce 986 thousand barrels of oil equivalent per day, an increase of 9% versus 2022. Roughly half of that (474 thousand barrels) consists of oil, which gives the company a good oil and gas mix.

EOG Resources

These numbers indicate that EOG has at least 12 years’ worth of high-quality reserves, which excludes new discoveries.

Needless to say, EOG is consistently increasing its reserves. For example, EOG has learned from its extensive experience in unconventional resource plays across North America. Through trial and error and data collection, the company has identified mechanical units in the reservoir, which help optimize drilling and completion operations.

Additionally, EOG benefits from its multi-basin portfolio, allowing the company to utilize data from different basins and geologic environments to enhance its understanding and modeling of various plays.

EOG Resources Adjusts To A Changing Environment

In the latest Bernstein Strategic Decisions Conference, the company elaborated on its outlook.

The company mentioned the global trend of inventory levels declining, China’s strong oil demand, and the anticipation of an under-supplied market in the back half of the year.

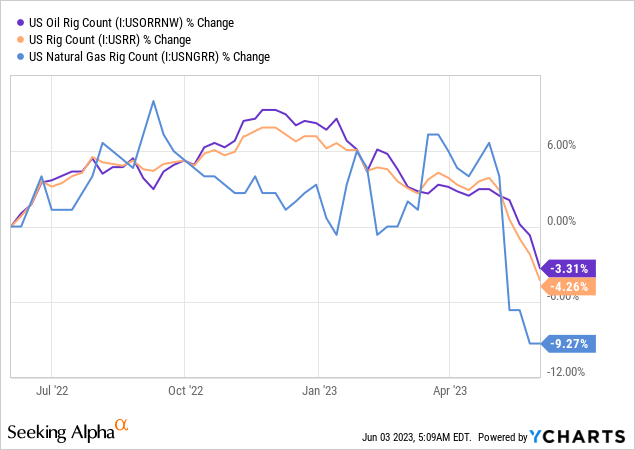

Furthermore, EOG discussed the impact of Russia’s oil production and the recent decline in rig count, both in oil and gas.

These rig count comments are important, as we’re now dealing with the steepest decline in the rig count since 2021. Especially the natural gas rig count has fallen off a cliff. Over the past 12 months, the natural gas rig count has fallen 9%. The entire decline came after the April peak.

EOG Resources is among the companies that have become more cautious. During the aforementioned conference, the company explained that it is evaluating options to defer certain gas-focused projects until the market is more in balance.

The company’s capital allocation decisions are primarily driven by the ability of each asset to absorb investment while improving year-over-year financial and development costs.

EOG Is A Great Place For Shareholders

On top of deep inventory, the company is a great source of dividends, supported by efficient operations.

Earlier in this article, I mentioned that EOG aims to hike full-year production (versus 2022). This is expected despite 13% to 14% inflationary pressures, as the company believes it can offset a big portion of this through efficiency gains.

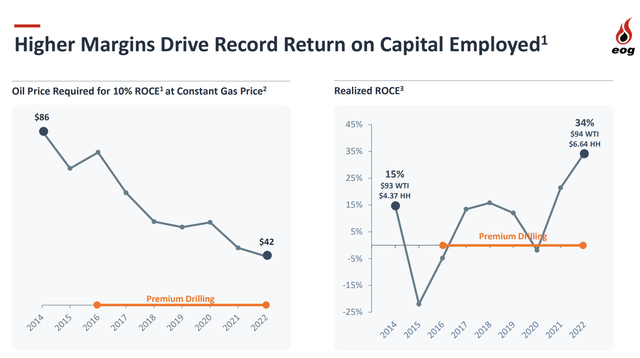

Looking at the numbers below, the company only requires a $42 oil price to generate a 10% return on capital. That number used to be $86 per barrel.

EOG Resources

Over the past eight years, the company has lowered finding and development costs per barrel from $12.93 to $5.13. Operating costs, excluding taxes and interest, have dropped from $32.66 to $22.59.

Not only that, thanks to higher oil prices and more efficient operations, EOG has reduced its debt. In 2017, EOG had $5.6 billion in net debt. In 1Q23, that number had dropped to $1.2 billion in net cash, meaning the company has more cash than gross debt. Now, the company has a negative leverage ratio, which sets it apart from most of its peers.

Its liquidity alone is close to 8% of its market cap.

In other words, EOG is much healthier than it was in the past, which is helpful because of (at least) two reasons.

- The company is better protected against oil price declines. While it will remain a volatile energy play, it is unlikely to suffer the way it did during downswings in the past.

- The company can now focus on shareholder distributions instead of debt reduction.

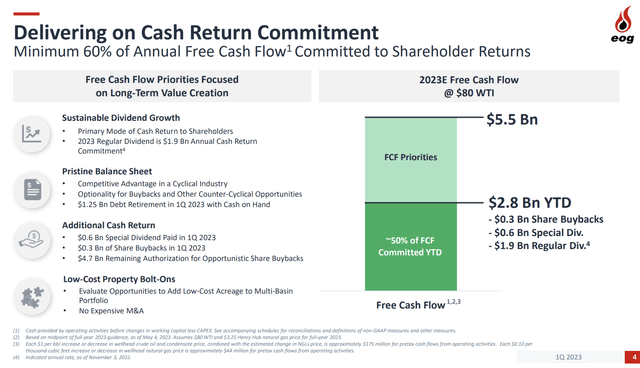

Thanks to its healthy balance sheet and efficient operations, the company aims to distribute at least 60% of its free cash flow to shareholders.

EOG Resources

If WTI were to average $80 this year, the company could generate $5.5 billion in free cash flow, which indicates a free cash flow yield of almost 9%.

So far, the company has committed $2.8 billion to distributions. $300 million of this consists of buybacks. The company has almost $5.0 billion remaining for opportunistic buybacks. In 1Q23, the company used banking woes to repurchase shares, as it believed that the decline in equity values was unwarranted. Given my view on oil, I agree with that and applaud the company’s method of opportunistic buybacks.

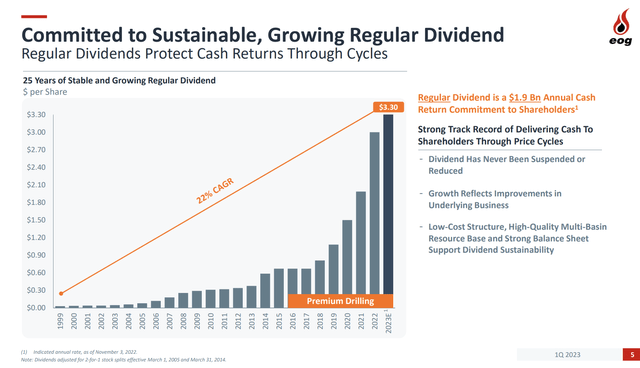

With regard to the company’s dividend, a big portion of its payout is its regular dividend, which has never been suspended or cut, despite various nasty oil downswings since 1999.

The regular dividend is based on breakeven considerations, inventory levels, exploration assets, and ongoing efforts to lower breakeven prices.

While the base dividend has grown quite rapidly in recent years, EOG Resources aims to avoid letting the regular dividend exceed its financial capacity.

The company currently offers a competitive regular dividend that sits at approximately 3.0% yield, which they consider manageable and compelling compared to the broader market.

EOG Resources

EOG aims to strike a balance between providing returns to shareholders and maintaining financial stability throughout industry cycles.

I agree with this strategy. The base dividend is what shareholders can rely on. The special dividend is used to get rid of excess cash without having to hike the base dividend to uncomfortable levels.

In February, the company announced a $1.0 special dividend on top of its regular $0.825 per share per quarter dividend. This translates to an annualized dividend yield of 6.5%.

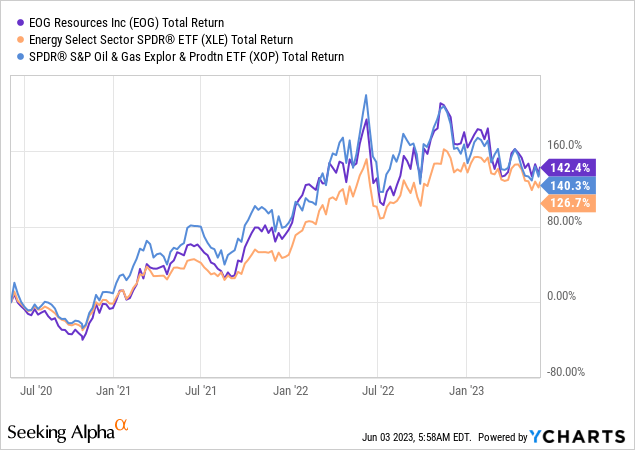

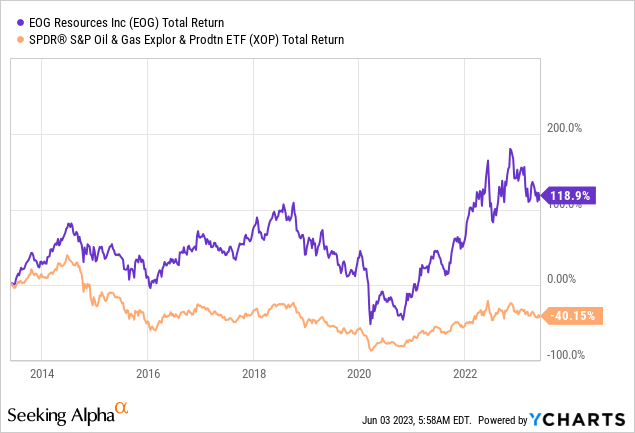

With that said, EOG is also outperforming its peers, albeit by a slim margin. Over the past three years, EOG has returned 142%, which is 200 basis points above the SPDR Oil & Gas ETF (XOP).

Over the past ten years, EOG has outperformed its peers by a much wider margin.

Based on everything so far, I expect EOG to outperform its peers.

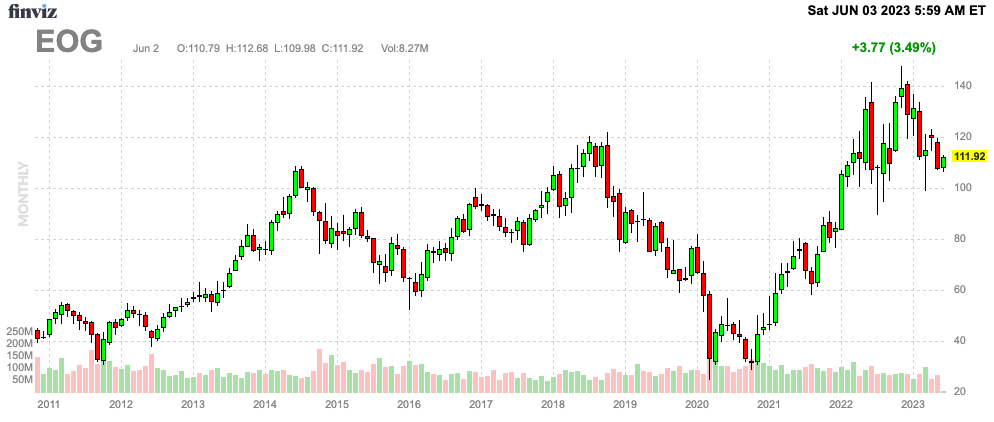

I also expect EOG shares to bottom above $100 per share. While I’m not yet expecting an oil breakout, I expect oil equities to outperform the market for many more years to come based on favorable supply and demand fundamentals.

FINVIZ

Hence, I consider EOG to be a buy at current levels.

However, investors need to be aware of the cyclical risks and above-average volatility that come with investing in oil and gas stocks.

I currently hold roughly 16% oil and gas exposure. I’m looking to further expand my exposure in the months ahead.

Takeaway

Despite the challenging position of the oil industry, Houston-based EOG Resources stands out as a promising investment opportunity. With its diversified portfolio, efficient operations, and commitment to rewarding shareholders, EOG is well-positioned to capitalize on the next potential wave of inflation.

While oil prices have experienced a decline due to various factors, including increased production from non-OPEC+ countries and concerns about an economic slowdown, EOG has adjusted its strategies to adapt to the changing environment. The company’s focus on optimizing drilling operations and its multi-basin portfolio provide a solid foundation for long-term success.

Moreover, EOG’s strong financial health, declining debt, and commitment to shareholder distributions make it an attractive choice for investors.

Read the full article here