Author’s Note: This article was published to iREIT on Alpha in Mid-May of 2023.

Dear subscribers,

Safehold (NYSE:SAFE) is an interesting REIT. We very recently had an update article by Brad Thomas about the company, which you can find here. He showcased his various returns over different periods of time – positive from 2018, negative since 2021, and somewhat positive, though underperforming, since April of 2023.

My own last piece on SAFE was published back in October of last year. I have a modest position in the business, and I’ll explain to you here why I’m buying more – some similar reasons to Brad, but also some other considerations.

Let’s get going.

SAFE remains superbly safe – here’s why and why I’m at a “BUY”

SAFE isn’t the easiest REIT to understand and requires some in-depth reading before you know what to expect and what the company does.

It’s a “Land lease REIT”. Not many of them out there, but this is what Safehold does and the business it’s in. SAFE is New York-based, it’s externally managed (more on that later), and comes with an interesting business idea. It’s the only public ground lease company available at this time, and it focuses strictly on investment-grade ground lease companies, in order to increase its safety and manage only an institutional quality-level portfolio.

So what exactly is a Land-lease REIT?

The company acquires, manages, and capitalizes on ground leases. In this business idea, the tenants own their buildings, but not the land that the building is built upon. The lease involves undeveloped commercial land that in turn is leased to tenants, given the right to develop the property for the duration of the lease.

A good example of a company that utilizes ground leases is Macy’s (M). The company’s buildings are owned by Macy’s, including things like parking, but the tenant still pays rent on the land.

Structurally and organizationally, a ground lease is very similar to any other sort of lease. The tenant makes monthly rent payments. With a ground lease REIT like Safehold, the leases are net leases, which means that tenants assume responsibility for taxes, insurance, and CapEx/OpEx for the duration of the lease.

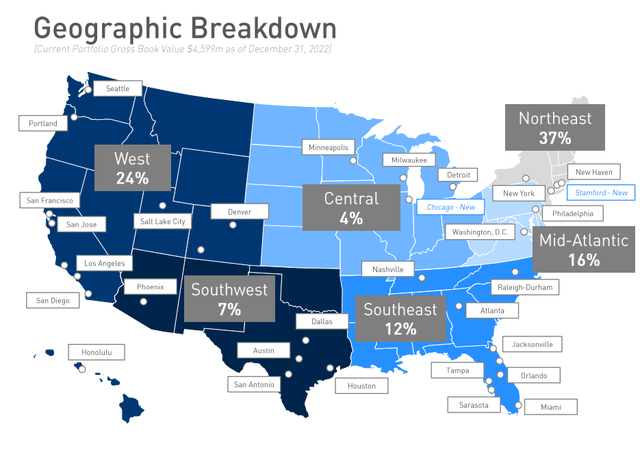

It doesn’t take much explaining beyond this as to why this is an attractive business model. The company, unlike many other REITs in offices, apartments, or other segments, also doesn’t hold any massive overexposure to any one area.

SAFE IR (SAFE IR)

The improvements that could be made involve more exposure to sunbelt and central – but other than that, this is an attractive model.

The appeal of the model for the tenant is that it doesn’t require the company leasing the land to put up massive amounts of capital for the land itself. Because these leases come with very long leasing terms – not uncommon to see over 50 years here – it enables companies to essentially optimize their capital mix by not having to use significant amounts of its own capital or debt to grow – while the owners of the lands, the REIT, get significant and long-term safety from recurring rent checks. They get decades’ worth of income security and can eventually, usually way off in the future, collect a lump sum payment for the property.

The tenant can also get access to land that they otherwise would have no access to. This is why the model is used by retail tenants such as Macy’s, but also McDonald’s (MCD) and Starbucks (SBUX).

I go more into the various lease types and why landlords want unsubordinated as opposed to subordinated leases from their tenants. But that is how ground leases work, and why they are attractive. And Safehold has been growing massively.

Over the past few quarters, Safehold has been managing pretty well. The quarterly results should be taken with a fair share of salt, due to the current costs of the incoming merger with iStar, inc.

There seem to be two ways to view this play. One side, the more bearish side, views SAFE as exposed to what are essentially Office-type properties in a real estate bubble/environment that is not conducive to offices, as we’ve seen from the valuations for Office REITs. They say despite the company declining significantly in price, this company is not going anywhere near an upside, and the company’s increased exposure to floating-rate debt in conjunction with its merger makes the entire play an unappetizing potential.

On the other side, more a positive note, say (and point out) that SAFE lacks the equity risk of managing real estate – it’s a capital provider without any actual property obligations, making the comparison to an Office-type company or REIT completely moot. While the leases it holds could be said to be previously specific to offices, it doesn’t dictate that offices have to be constructed there.

Furthermore, any debt risk needs to be put in the context of its maturities – and these are some of the longest in the industry, at a debt-to-book equity of below 2x and a total debt to Equity market cap of below 2.5x. The average maturities here are over 22 years, and no maturities coming due until 2026.

So, as is somewhat typical with me, I say that the pessimist is too pessimistic, and the unbridled optimism is too optimistic. The truth is, as I see it, somewhere in between.

Over the last few quarters, SAFE earnings have been below the forecasted rate. 1Q came in at ~80% lower YoY, but of course, this was mostly due to merger costs, which we can net out. Aside from those, the earnings decline was mostly a product of increasing exposure to floating rates and debt load.

Anyone investing in SAFE needs to be aware of what happens when financing costs change due to interest rate changes, regardless of long maturities, either due to float exposure or due to refis. This is bound to provide some downward pressure in earnings, both GAAP and FFO, that could see the company go even lower here.

While I won’t claim that I foresaw the exact nature of this back 1-2 years ago when I got my eyes opened to SAFE, I did see the risk in interest rates, and this caused me to stay out of the stock until it fell below $26/share. The bubble we saw in 2020-2022, which ended when SAFE fell from grace and from a share price of over $60/share was never something I saw as sustainable.

However, claiming in the same vein that the company’s current debt mix/composition is untenable and will cause a downfall is going too far. The argument is being made due to the near-billion in debt that SAFE has put on an unsecured revolver – not typically the facility you’d want to use for that amount due to the interest rate cost of such a solution. These recent moves have left the company a bit cash-strapped and with interest rates going up. We’re seeing notes at over 5%, and yet another $100M revolver at LIBOR + 1.5%, which is significant in this environment. LIBOR was well below 3% a year ago, and the company’s interest payments are now over 6% on average for that slightly north of $1B.

If a criticism can be levied at the analysts following SAFE and their forecasts from march-April 2022, is that they expected interest rates to stay the same, and completely failed to forecast this massive delta in debt-related payments.

The current interest rate environment also means that anything the company tries to do on the debt mix/finance side is going to be influenced by current market circumstances. There are no “good” or “easy” hedges to get out of this situation, such as floating to fixed swaps or some refinancings. The risks financiers take will come at a cost, and that leaves me with the following expectation for earnings for the next few years – that they won’t be massively growing.

At the same time, the bearish side takes far too negative a view and often forgets what the company has actually achieved – and how it operates – such as the crucial differences in its principal safety.

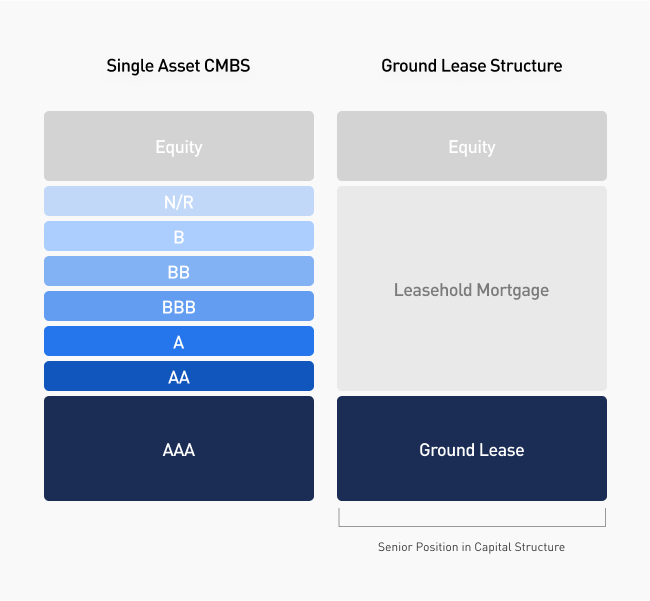

Safehold IR (Safehold IR)

The company’s operating model entails an AAA-like position in the capital structure, virtually immune from the types of risks you see in single-asset CMBS. Even with contractual inflation captures, the company’s inflation-adjusted yield is over 6% at 3% long-term inflation.

Bears also forget, or underestimate (in our opinion) the value of the CARET structure and the value it offers – both in terms of monetization and other concerns. For those unfamiliar with it, the CARET program is an innovation in terms of trying to value future cap appreciation, with CARET unit reflecting unrealized capital appreciation the company expects to receive once leases terminate or expire.

Who would want to buy these, you may ask?

Obviously, plenty of knowledgeable investors, given that 3% have been sold to institutional investors, such as sovereign wealth funds and family offices which are known to invest in long-term solid growth and safety potential. These holders are entitled to participate in any proceeds above the cost basis once assets are sold.

The perhaps biggest “problem” I see in terms of risk is the concentration of its land portfolio to Manhattan, which still makes up around 24% of the company’s gross book value or GBV. SAFE has been diversifying here, but it still has a lot of work to do in order to find value in areas that I would consider to be “attractive” relative to somewhat riskier west and east-coast areas.

Bears also characterize the company as an office landholder – this is false. 44% is Office, but multifamily is over 35%. This makes the company a diversified holder with a tilt toward Office.

The company’s strong fundamentals, including its BBB+, give a completely different picture than some of the bears telling us not to invest in the company would like to convey. They’re also rated differently than a REIT, which is also not covered in some of the bearish reports.

Let’s look at valuation.

Safehold – The valuation is very tricky

Whenever someone says “Well, this company can’t be measured traditionally“, I tend to take about nineteen steps back.

Typically, I really don’t trust any business that claims that in order to value it “properly”, you have to do X and Y.

Why? Because there are a hundred attractive investment opportunities that do not require us to take unique approaches to something as simple as a valuation for a business.

So, understand that when I say this company is attractive and can be bought, it comes with a certain risk profile that can be considered differently than your traditional companies – and by different, I mean higher in some ways.

When it comes to SAFE, there is some sound reasoning behind why it might need some variations in terms of its metrics – and some of the ones are mentioned above. The company’s debt is sky-high – over 12.5x net debt/EBITDA. But at the same time, SAFE has no obligations to its properties in the form of CapEx. The assumption is that once that extremely long-maturity debt comes due in over 25-30 years, the compounding nature of its cash flows will have done wonders. It’s not a wrong assumption to have either.

In order to see the safety, you need only look at what the company has done already to improve its metric. Back 5 years ago, the payout was 90%+ of net. That is now less than 35% of net at a yield of almost 5%.

Post the merger, and given its complicated peer situation (no other direct peers exist), evaluating this company is perhaps the hardest part of this article and of looking at the company.

We can look at some analyst estimates. When it comes to S&P Global, estimates here put the company at around $24-$25/share on average, but given the low coverage, I tend to ascribe this to a lack of understanding of the company’s income potential and upside.

That is not to say that I expect SAFE to go back to $60/share or anywhere close to it, at least not in the near term. With the recent internalization of its management and the process is currently in, coupled with the near-zero years of actual publicly-traded history, I tend to say that SAFE is hard to conservatively forecast expectations from – but a 13-16x P/FFO rate, coming to a 2025E of around $29-$33/share seems the baseline minimum of what I would expect from the company here.

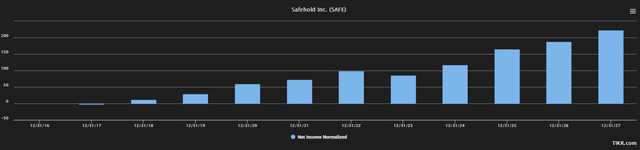

When I last wrote about the company, we were at less than $26/share, which I viewed as quite attractive with a potential long-term upside in the triple digits. I still view this as being entirely possible. And I am far from alone in this. Here is the expected net income growth beyond the 2023E dip.

TIKR.com SAFE forecast (TIKR.com)

And you can see the same trends in other measures – be it revenue, EBITDA, EBIT, EBT – dealer’s choice, it’s forecasted to rise. The interest expense I mentioned, that’s expected to stay at or about the level it currently is, expecting management to sort it out at or slightly above the levels we’re currently at, with growing expenses as the company grows. (Source: S&P Global)

If this turns out to be the case, then I believe this to be a catalyst for further upside. Many analysts have very positive targets for the business – upwards of $50/share. If certain optimistic views materialize, this is entirely possible. But I tend to view this with a healthy dose of skepticism and would average it out to a PT of around $32/share, which would still be a double-digit upside from current levels.

Another argument, and one well-covered in Brad’s recent article, is insider information and CEO knowledge.

Coupling all of this, I see a bit of risk and perhaps not as unerringly a strong buy as for some other qualitative REITs out there – but I definitely see an upside to the company.

My position in SAFE isn’t massive – but it’s in the green, and I’m open to expanding it here.

I’m at a “BUY”, and I give it a current PT of $32/share.

Questions? Let me know!

Read the full article here