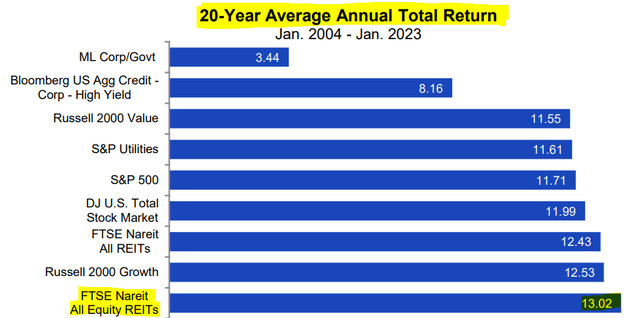

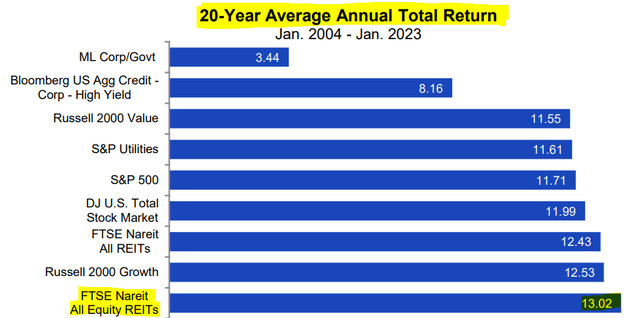

Over the long run, REITs, or Real Estate Investment Trusts (VNQ), have been some of the most rewarding investments in the world. They have even beat the returns of the S&P 500 (SP500) and tech stocks (QQQ) despite being a lot safer, offering higher income, and better inflation protection:

NAREIT

Today, I am especially bullish on REITs because they are priced at their lowest valuations in years. In the most extreme cases, some REITs are priced at just 50 cents on the dollar – allowing you to buy an interest in a real estate portfolio at a 50% discount to its fair value, net of debt.

I believe that valuations are so low because the market has overreacted to the surge in interest rates, and failed to recognize that REIT balance sheets are today the strongest they have ever been with low leverage and long debt maturities. Besides, interest rates only surged because of the high inflation, which also benefits REITs since it resulted in much faster rent growth, and this explains why REIT cash flows have kept on rising even as their share prices collapsed.

So, I am very bullish and I am putting a lot of my capital to work in this sector.

But that does not mean that I am bullish on every REIT.

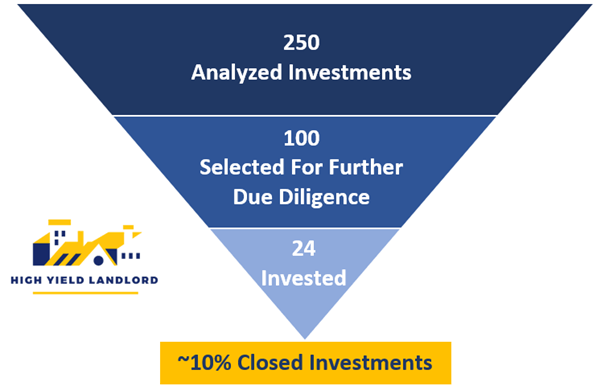

On the contrary, there are lots of REITs that I am staying away from as I only invest in 1 REIT out of 10 on average:

High Yield Landlord

In today’s article, I want to share some of the screening criteria that help me to sort out those REITs that should be avoided.

Here are 5 types of REITs to avoid:

#1 – Externally managed REITs

REITs can be managed in two ways: internally or externally.

Internally managed REITs will hire their management as employees of the REIT. This is the preferred management structure because it does a better job of aligning the interests between the shareholders and the managers. The manager is then fully focused on this one vehicle and its compensation is typically tied to some key performance indicators that are reflective of shareholder value creation. Moreover, if the results are disappointing, the manager can be fired and replaced.

Whitestone REIT (WSR) went through that recently.

Externally managed REITs, on the other hand, will outsource the management to an outside advisor that will take care of the management in exchange for fees. But this also means that the manager will not be solely focused on this one REIT since they will typically also manage other vehicles with competing interests. Moreover, the fees will typically be tied to things like the volume of assets under management, which will push the manager to grow the REIT as much as possible, often at the cost of shareholder dilution. Finally, even despite the disappointing performance, it may be very hard or even impossible to fire the manager because the management agreements will often make it very difficult to get rid of the manager.

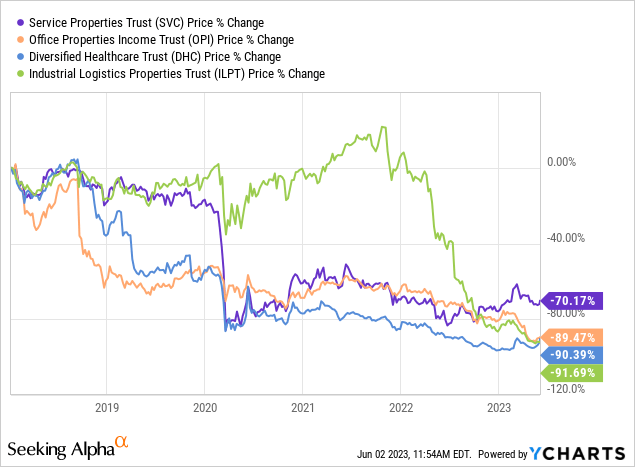

A good example of that would be REITs managed by The RMR Group Inc. (RMR), such as (SVC; OPI; DHC; ILPT). They have a horrendous track record, but continue to be managed by the same conflicted manager:

Some externally managed REITs may be good, but a simple rule is to just stay away from them because they have historically performed a lot worse than internally managed REITs due to higher management costs, greater conflicts of interest, and worse growth prospects due to poorer access to capital.

#2 – Capital Allocation Policies That Make No Sense

But just because a REIT is internally managed does not mean that the REIT enjoys good management.

This is particularly true for many of the smaller REITs.

They often suffer questionable capital raising and allocation policies because they are managed by people who are very knowledgeable about their real estate niches, but not so much about corporate finance.

To give you an example: UMH Properties, Inc. (UMH) is a manufactured housing REIT that made the decision to invest in a bunch of other REITs years ago. Many of these investments end up performing poorly, destroying a lot of shareholder value, and then on top of that, it also depressed the market sentiment of UMH, increasing its cost of capital and hurting its own growth prospects. In hindsight, it was a mistake to invest in these securities since the market would rather see a focused REIT with a clear specialization, not one that plays the role of a hedge fund manager.

And to be clear, I am not saying here that UMH is poorly managed, but this is just to highlight an example of a questionable capital allocation policy that ended up hurting shareholders.

There are many other such cases and typically, you would be better off avoiding a REIT when you discover such red flags.

#3 – Excessive Leverage

Most REIT balance sheets are today very conservative, but that’s not always the case.

From my past experience, it is typically better to stay away from the highly leveraged REITs. High leverage can, of course, lead to higher gains during the good years, but it can also then leads to catastrophic losses when things go south – and you can rapidly lose years’ worth of gains in just a few weeks when risk factors play out.

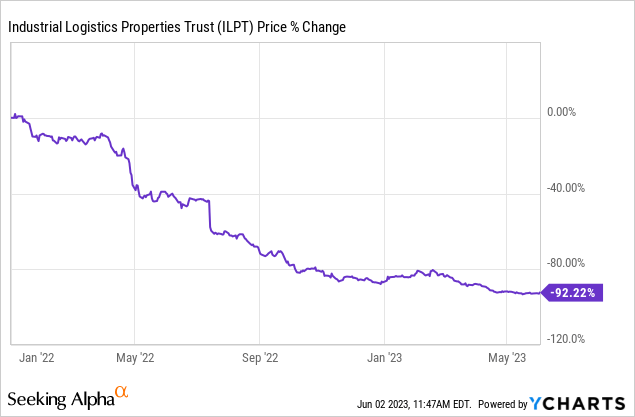

A good example of that would be Industrial Logistics Properties Trust (ILPT), which lost nearly all of its value due to excessive leverage, and that’s despite owning very desirable industrial properties:

A few studies have been conducted on this topic and to the surprise of many, they conclude that high leverage results in lower returns in most cases over full cycles.

That’s not just because of the losses suffered during the downcycles, but also because the REITs then aren’t able to take advantage of the opportunities when properties come for sale at distressed prices.

I tend to stay away from REITs with an LTV over 60%. I will make some exceptions, but typically, I have lost money when investing in REITs with higher leverage than that. I try to learn from these losses.

#4 – Specific Categories to Avoid

Then there are many property sectors that you may want to avoid.

The most obvious one today is probably the office sector which is facing a perfect storm, but there are many others that may not be as obvious.

Generally speaking, I tend to avoid property sectors that suffer high capex because the maintenance cost really eats into your returns. Some studies have shown that high capex properties tend to underperform over time. A good example would be hotels.

I also avoid property sectors that are too heavily reliant on unpredictable macro factors. A good example of that would be mortgage REITs that are at the mercy of interest rates and spreads, which I can’t accurately predict.

There are other such property sectors that I simply avoid, regardless of their valuations.

Some are challenged by technology. Others by high capex. And then a few are simply too unpredictable, resulting in poor risk-to-reward.

#5 – Overvaluation

Finally, I spend a lot of time analyzing the NAVs of REITs. NAV stands for net asset value. I try my best to come to an estimate of the NAV of REITs because this helps me to better understand how much I am really paying for the real estate.

Just like a traditional real estate investor, I try to buy real estate at a discount to its fair value because the money is really made at the time of the purchase if everything else checks out.

I find that many REIT investors make the mistake of relying solely on cash flow-based valuation metrics such as P/FFO or even dividend yield. The issue with this is that some REITs are priced at low FFO multiples and offer a high yield, but they are still overpriced relative to their NAV.

A good example of that would be Omega Healthcare Investors, Inc. (OHI). It may seem cheap based on its high dividend yield, but in reality, this is really just because it is investing in riskier, higher-cap-rate skilled nursing properties. That’s another property sector that I dislike because it is reliant on macro factors and the rent coverage of your tenants is very low, leaving little margin of safety.

Bottom Line

It takes a lot of work to be an active REIT investor.

If you don’t have the time, interest, or knowledge to closely follow REITs, you may be better off simply investing in a REIT ETF and accepting the average market returns:

NAREIT

But if you can sort out the good from the bad, your investment performance can improve materially.

Read the full article here